SSO Integrations

RightCapital's advisor-level integrations help to streamline the data entry process with technology, so you can focus more time on advising your clients. Integrations connect technology platforms, allowing for the reliable and secure transfer of data into RightCapital. This can significantly reduce the time it takes to create and update your client plans.

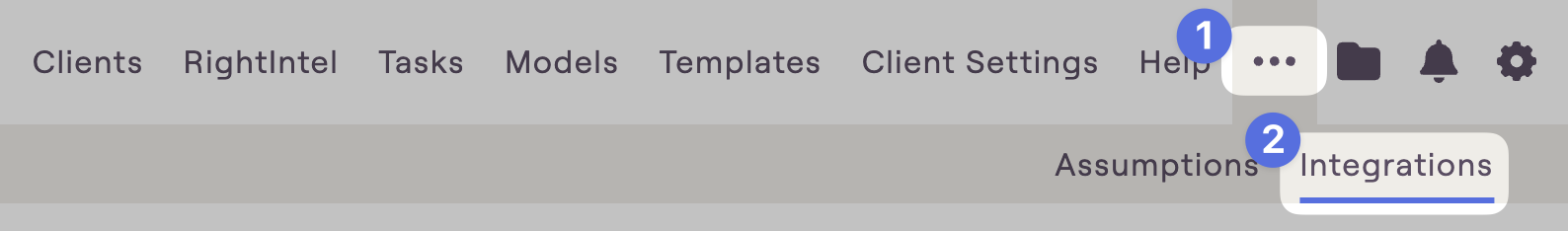

How to set up an Integration

Each integration also has a corresponding help center article. These articles can be found beneath the setup instructions for an integration, and will include additional details on how that integration can be used once it is set up.

Single Sign-On (SSO)

A Single Sign-on, commonly called an SSO, is an authentication method that allows users to securely access multiple applications with a single set of credentials. Use the hyperlinks below to learn more about the SSO options available in RightCapital.

Asset Custodians

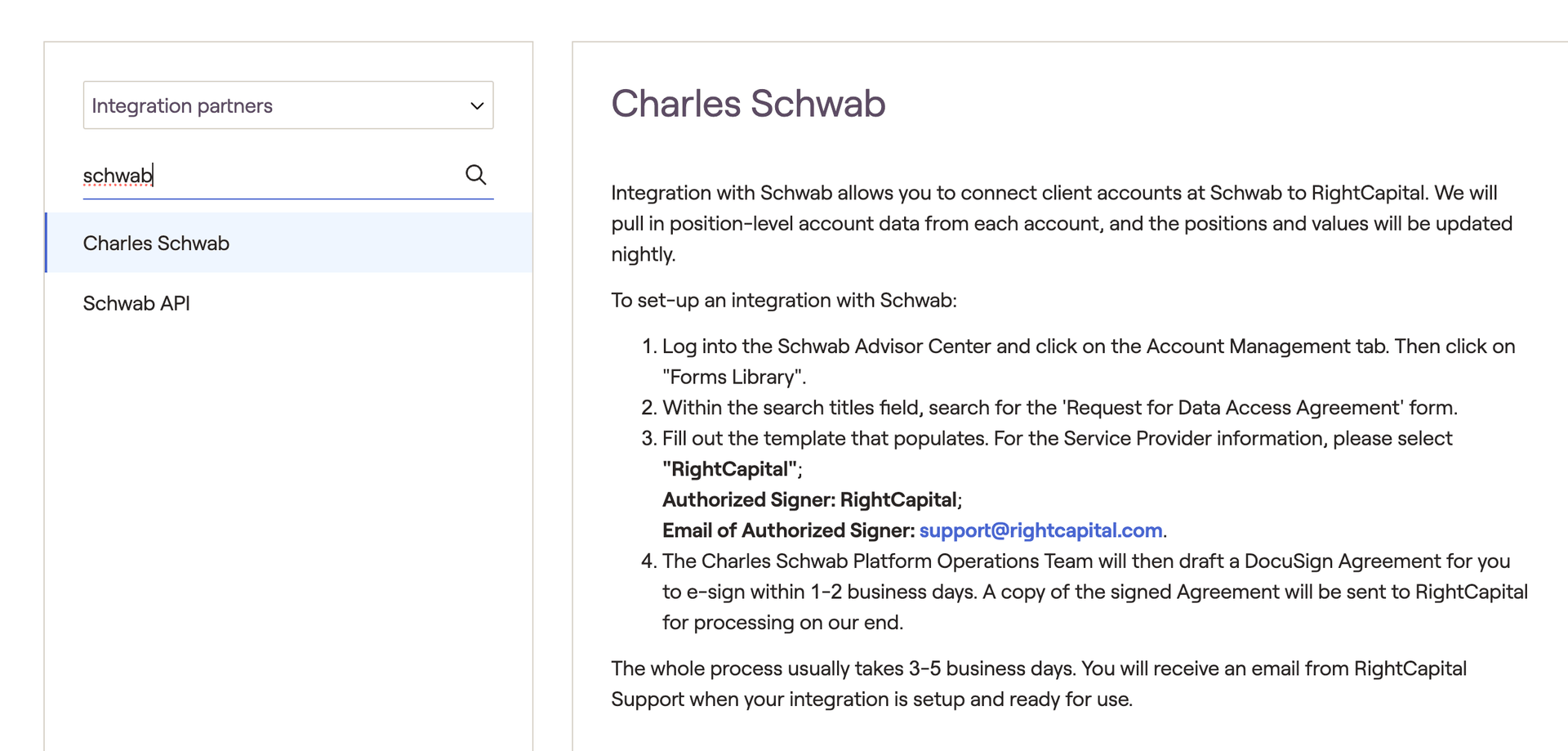

Connect and sync asset custodians to keep client data up-to-date automatically. This is perhaps the most effective way to buy extra time in your day. For asset custodians, RightCapital pulls in individual accounts for each client. RightCapital will pull over holdings-level data for each account, updating the information daily. Custodians RightCapital currently integrates with the following:

Aggregators

Some include CRM-like tools, allowing client data to be stored in the exact location as client account aggregation. The aggregation providers that RightCapital currently integrates with are:

Risk Management Solution

CRMs

Data Management

Portfolio Analytics

Portfolio Analytics integration partners benefit RightCapital users beyond accessing household information, position-level account data, and model portfolios. These integrations supply reporting data that help advisors analyze client investment data.