Explore Risk Tolerance & Assessment in RightCapital

- See Household Risk Scores, Current Portfolio Risk, and Risk Assessments for all of your client households in the Advisor Portal > Risk > Summary tab.

- View and create personalized Risk Assessment Questionnaires for your clients in the Advisor Portal > Risk > Questionnaires tab.

- Enable, create, and customize your own Risk Tolerance Categories in the Advisor Portal > Risk > Categories tab.

Risk Module Availability

Risk is available on both the Premium and Platinum subscription tiers. If you are interested in upgrading your account, please reach out to sales@rightcapital.com.

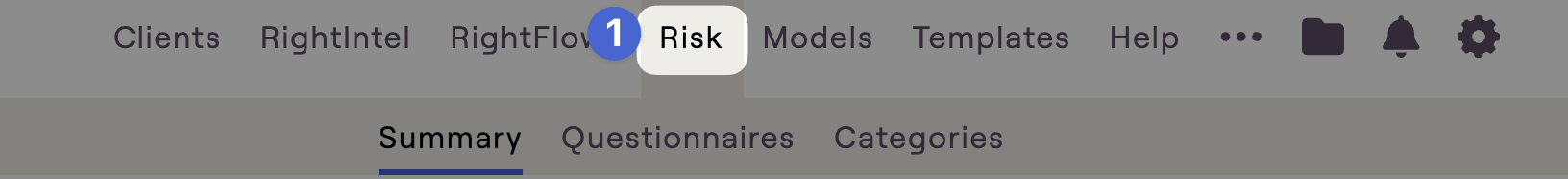

For premium and platinum subscribers, the Risk module can be found in the top menu bar of your Advisor Portal. This is where you can view a summary of your clients' risk metrics, create risk tolerance questionnaires, and customize your risk categories:

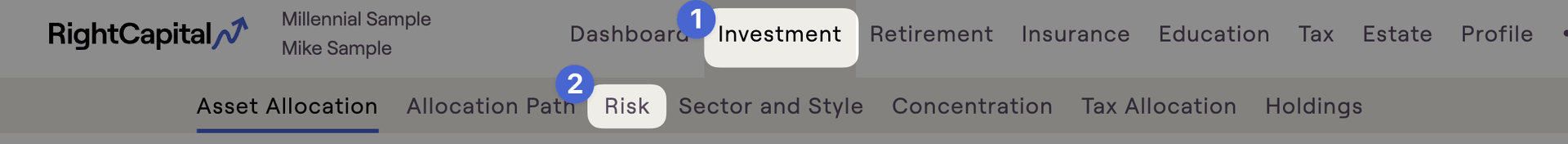

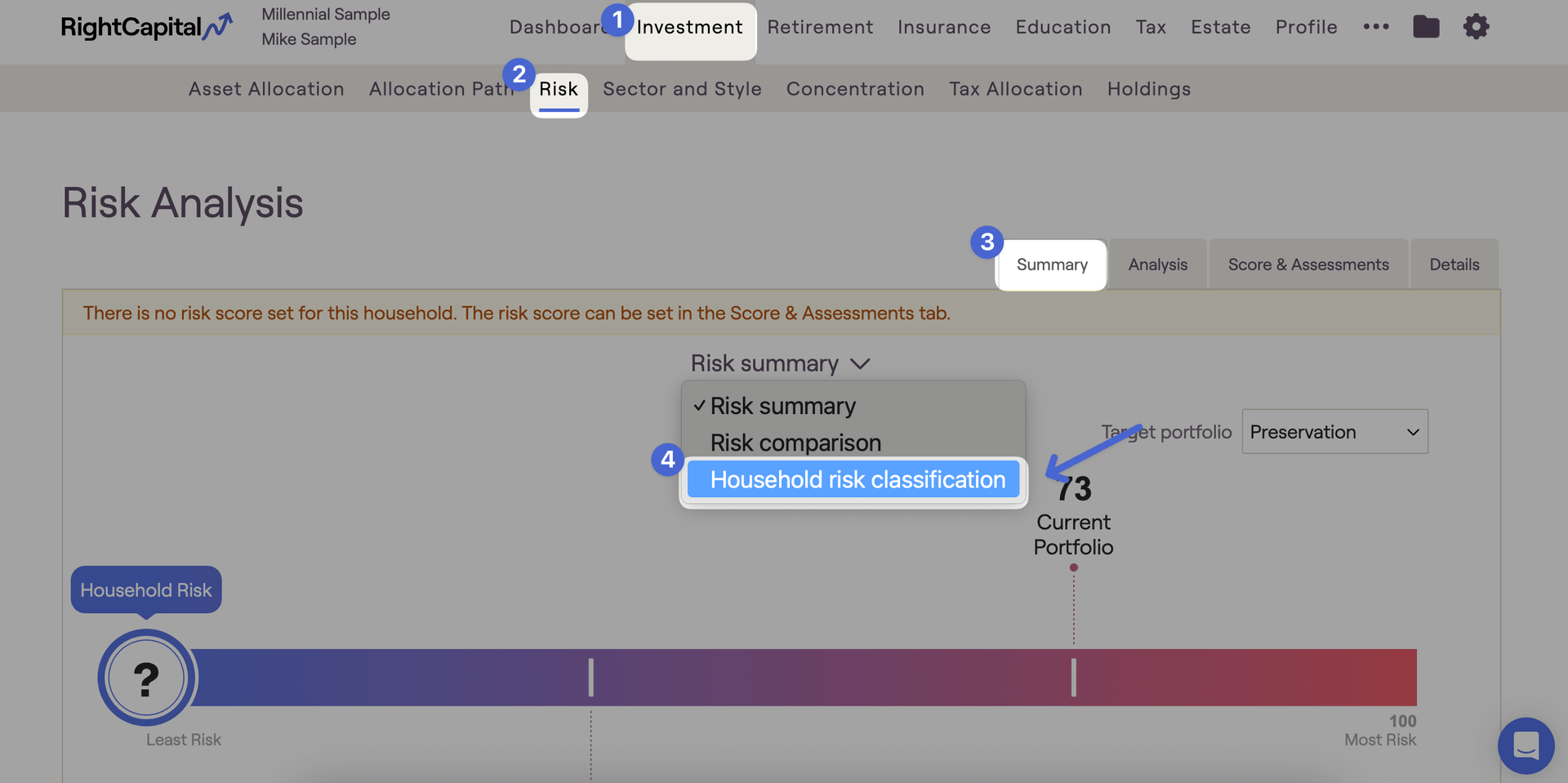

A client-specific Risk tab can also be found in the Investment module within each of your client plans. This is where you can assign that client a questionnaire to complete, set the personalized risk score for that household, and analyze the risk of their current portfolio:

This article will provide an overview of the Risk module in the Advisor Portal. For more information on the Client-Specific Risk Tab, click here.

Summary Tab

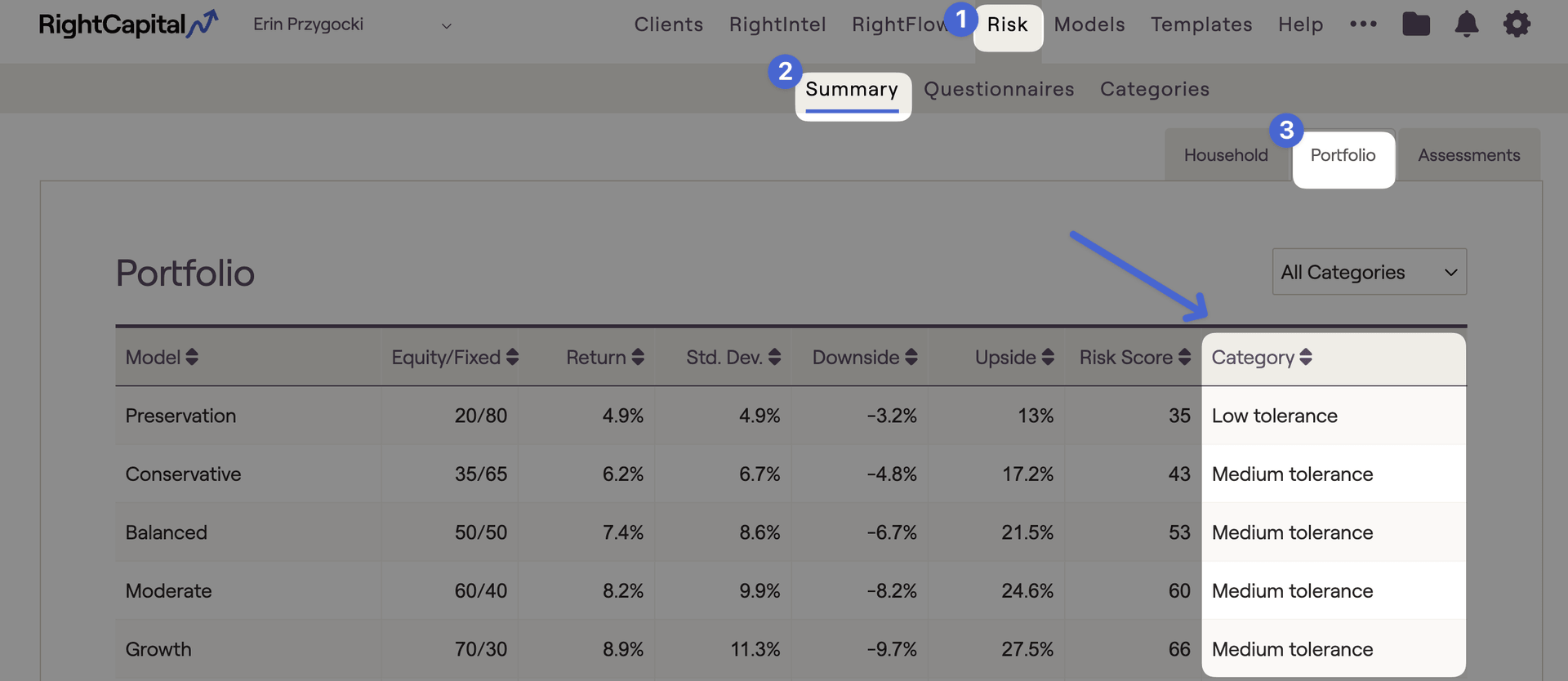

The first page of the Risk module is the Summary tab. This is divided into three separate sub-tabs: Household, Portfolio, and Assessments:

Household

From left to right you will see the client's name and group, followed by:

For more details on how Risk Scores are calculated for a client's portfolio, click here.

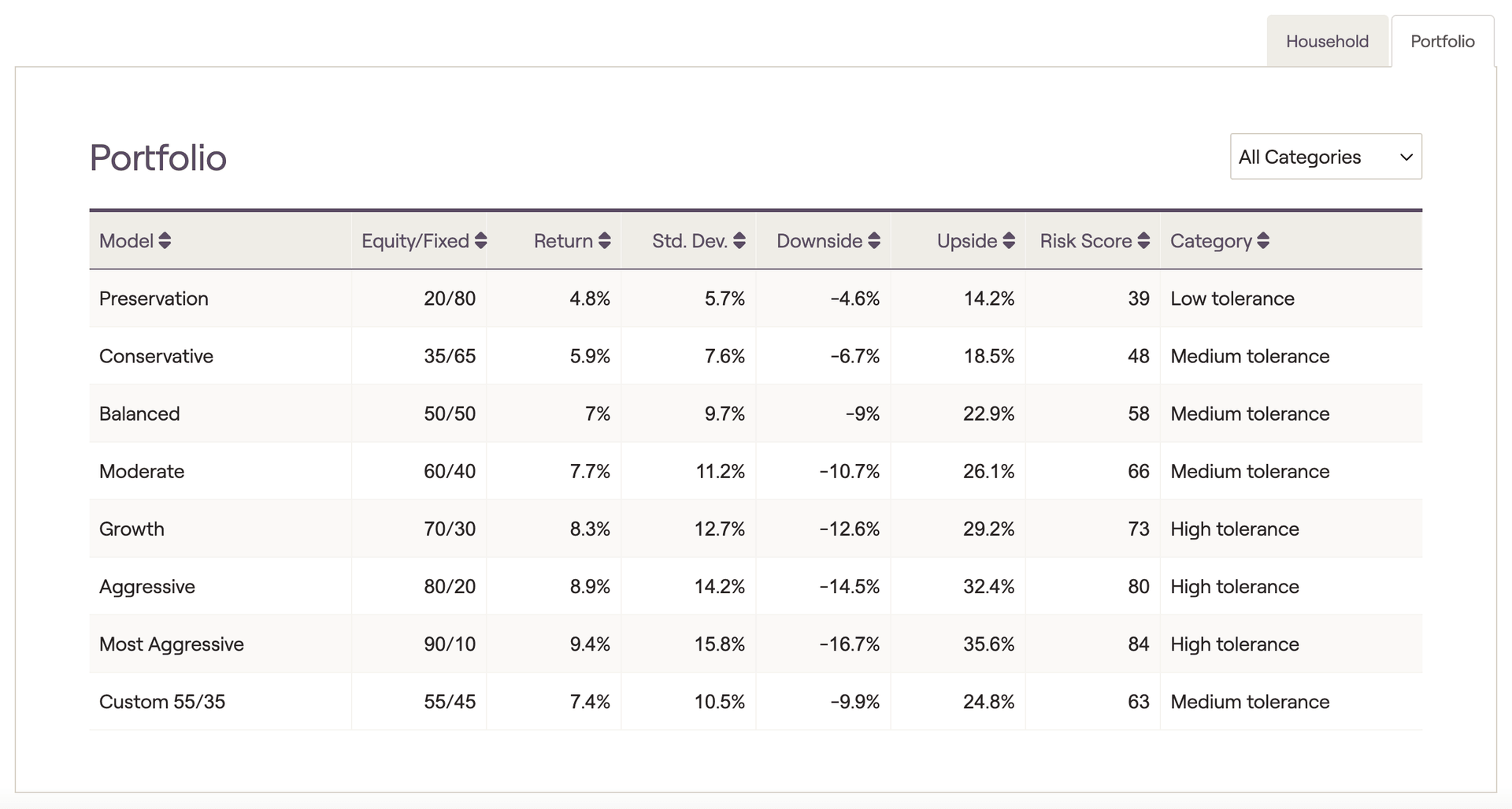

Portfolio

The upside and downside percentages are based on a 90% confidence interval, and are calculated using the total return and standard deviation of each portfolio.

Assessments

Using the dropdown menus above the table, you can sort by client household, by questionnaire, or by assessment status. You can also use the toggle arrows next to each column header to re-order the results. Launch directly into the Score and Assessments tab of a client plan by hovering over a client household, and clicking the 'Open Client' button to the far right:

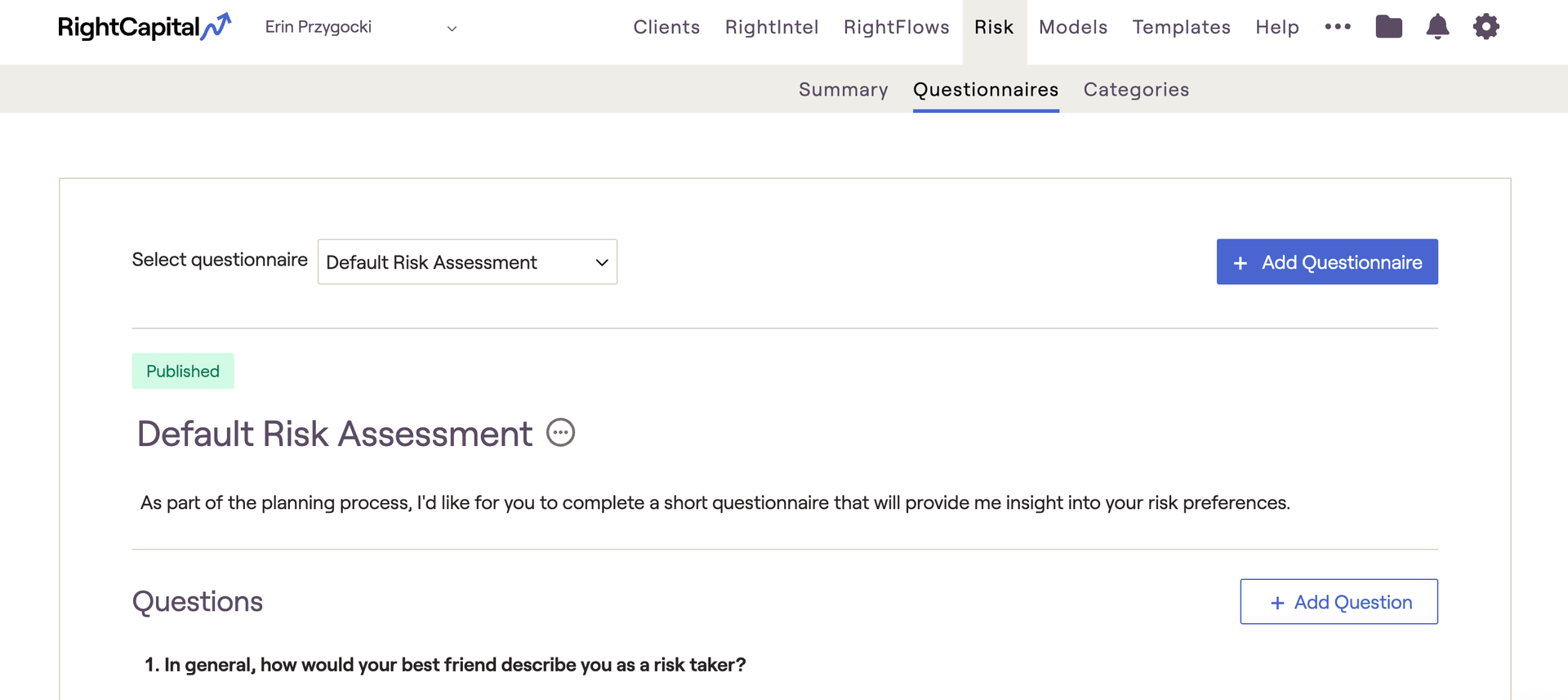

Questionnaires Tab

Default Risk Assessment

Every RightCapital account will already have a 'Default Risk Assessment' questionnaire that is available for use. This is sourced from the 13-Item Risk Tolerance Scale, developed by Dr. John Grable & Dr. Ruth Lytton. The Risk Values for each response have been adjusted to fit RightCapital's 1-100 risk scale.

Add a New Questionnaire

Rename your questionnaire by clicking the "..." icon to the right of the questionnaire name. An optional introduction can be added within the text box below the title. Remember to click the Blue Checkmark icon to the far right of each text box to save your changes.

You can also choose to incorporate rich text and images into your questionnaires. To add an image to a question, click the "Upload image" button. To use rich text features (bold, italics, etc.), simply highlight one or more words in your question or any of the responses:

After completing your questionnaire, click Publish in the lower right to move that questionnaire from the 'Draft' stage, to the 'Published' stage. You will then be able to use that questionnaire within each of your client plans.

Feel free to take a look at our other resources, which provide deeper dives on:

Categories Tab

After enabling Risk Tolerance Categories, you will be able to see the risk category for each portfolio in the Risk > Summary > Portfolio tab of the Advisor Portal:

You will also be able to see an additional "Household Risk Classification" chart within the Investment > Risk > Summary tab of each client plan:

Keeping the Categories tab disabled will hide the elements shown above. Risk categories are an entirely optional classification, and can be toggled on or off at any time.

Default Categories

By default, there will be three risk tolerance categories:

Add and Customize Categories

Categories can be renamed via the 'Category Name' column beneath the chart. To delete a category, hover your mouse over that category and click the 'x' icon that appears to the far right: