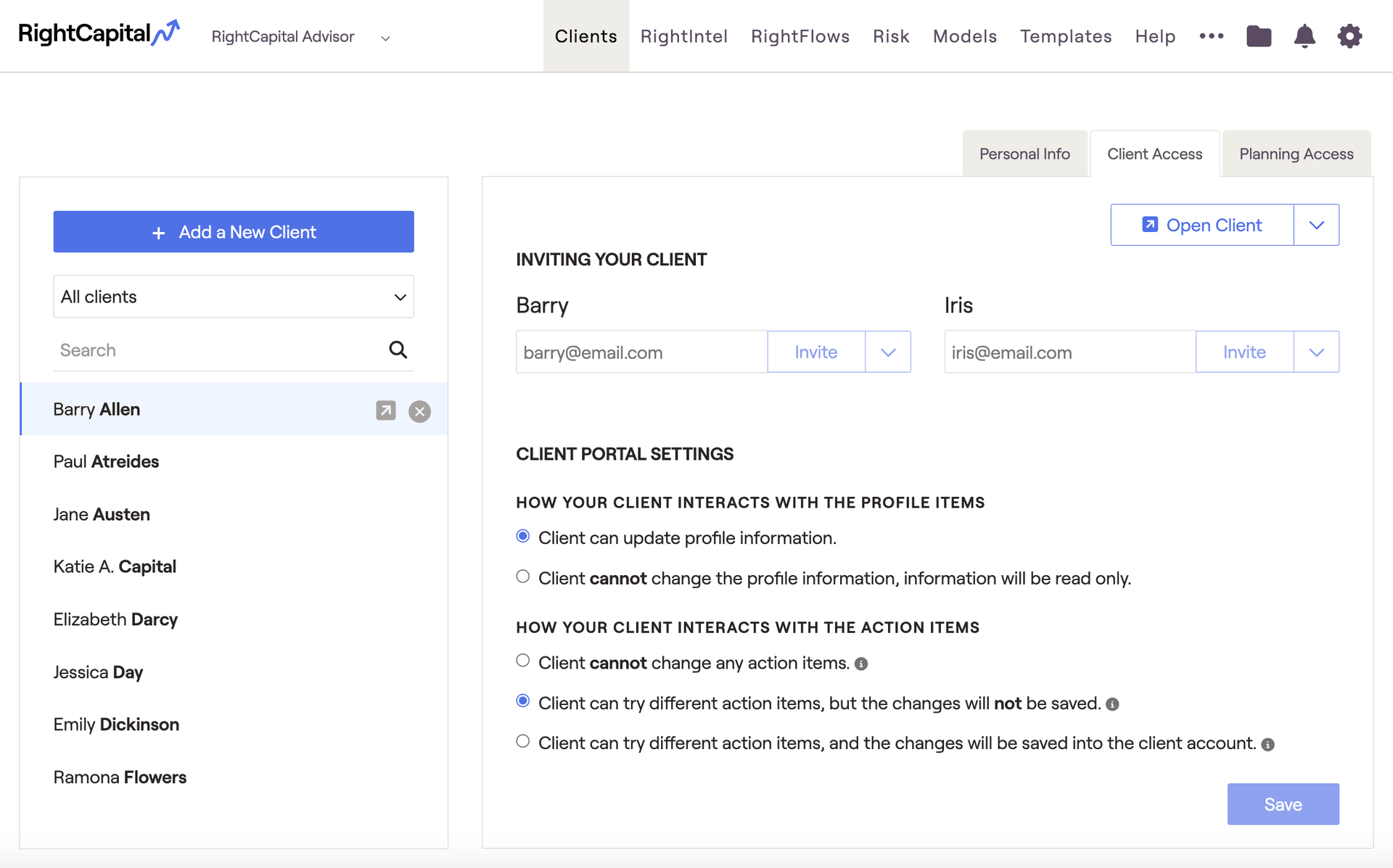

Curious how your invited clients will be impacted by the Client Portal Settings you select? We've got you covered! Below is an overview of the Client Portal Settings, and the impact they have on your clients' access.

Learn how to Invite a Client to access their portal, as well as how to Customize their Planning Access.

Please note that the client portal settings do not determine a client's ability to add/edit tasks, and budget categories. These selections are both made within the Client Settings > Permissions tab of the Advisor Portal.

How Your Client Interacts With The Profile Items

- "Client can update profile information" will allow the client to update their Net Worth, Goals, Income, Savings, Expenses, and Family Profile.

- "Client cannot change the profile information; information will be read only" will prevent clients from entering any data themselves.

When you prevent a client from changing profile information, clients will be unable to add new accounts or profile cards, and will not be able to edit existing items. They can still open items to view details, but all editable fields will be grayed out:

For advisors with Account Aggregation enabled, your clients will always be able to Link Accounts in the Profile > Net Worth section, regardless of the option you select for this setting.

How Your Client Interacts With The Action Items

- "Client cannot change any action items" will prevent clients from making changes to the Action Items. The Action Items will be visible, but editable fields and sliders will be grayed out:

- "Client can try different action items, but the changes will not be saved" will allow clients to use the Action Items, but will prevent them from being able to Save any changes. All changes made by clients will be reverted upon signing out:

- "Client can try different action items, and the changes will be saved into the client account" will allow clients to use the Action Items, as well as Save their changes.

Please be aware that this third option will cause differences between the Action Items on the advisor side, and on the client side. Your client will initially see the action item values you have entered. When they make any changes, the new values will be saved in the client’s account. They will no longer see any updates you make to items they have changed, and you will not see the changes they have made. This setting only applies to action item values, not to values entered in the Profile section.

Clients will not have the ability to Add New Proposals to the Retirement Analysis, regardless of the option you select for this setting. They will also not have access to the Action Items > Edit or Reset buttons.