Explore Advisor Analytics With RightIntel

RightIntel is a centralized business intelligence dashboard that consolidates client data into powerful visuals that help you deliver more value to each client. The goal of this article is to empower you to meet your financial planning objectives and review areas of opportunity associated with clients in RightCapital.

RightIntel can be found in the upper menu bar of the RightCapital Advisor Portal, to the right of the Clients tab:

RightIntel is available to Premium and Platinum subscribers at no additional charge. Basic subscribers will only have access to the RightIntel > Client Overview > Activities tab.

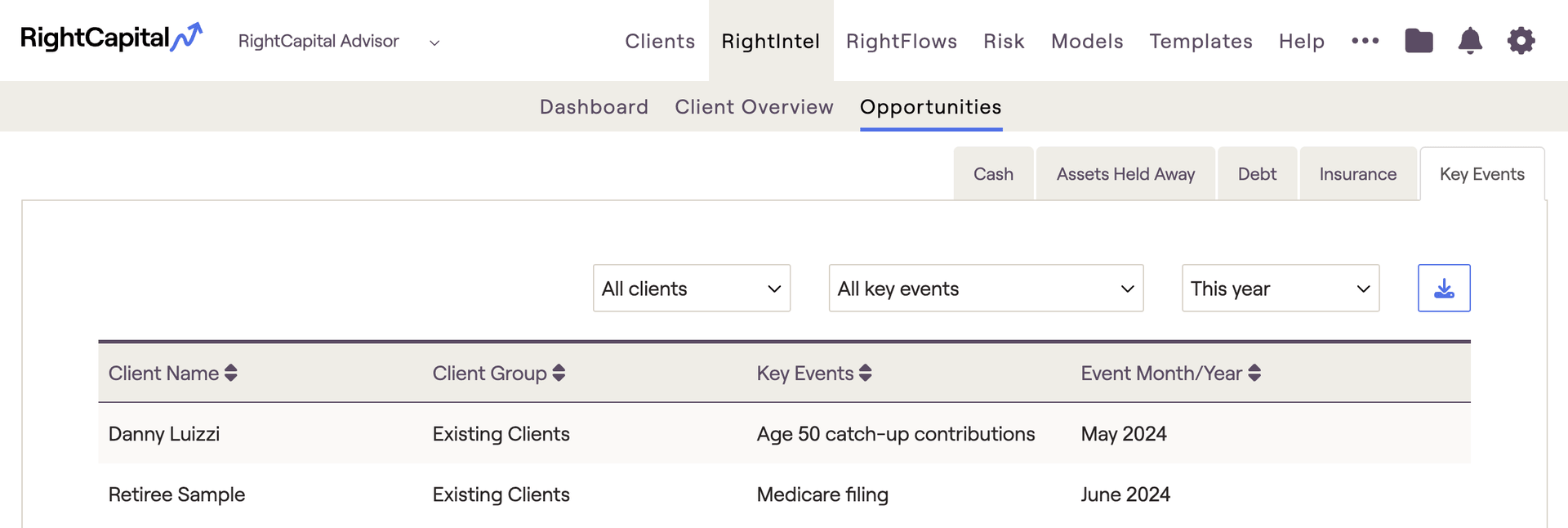

Dashboard

Accessible from the Advisor Portal, the RightIntel Dashboard allows Advisors to view key metrics about clients entered in RightCapital. Values will be updated each day.

Add, Remove, & Reorder

The top three widgets (Total number of clients, Total Invested assets, & Managed asset percentage) are static and cannot be removed or reordered. The remaining charts and tables can be removed, added or re-ordered through the drag and drop feature:

To remove additional widgets, hover your mouse over the tile until the "x" icon appears in the upper right corner. Then click "x" followed by "Delete". Widgets that have been removed, can be re-added by clicking the blue "add" button in the upper right corner of the RightIntel dashboard:

Available Widgets

Exclude Client Groups

Client Overview

The Client Overview section consolidates client data into sortable tables that help you deliver more value to each client.

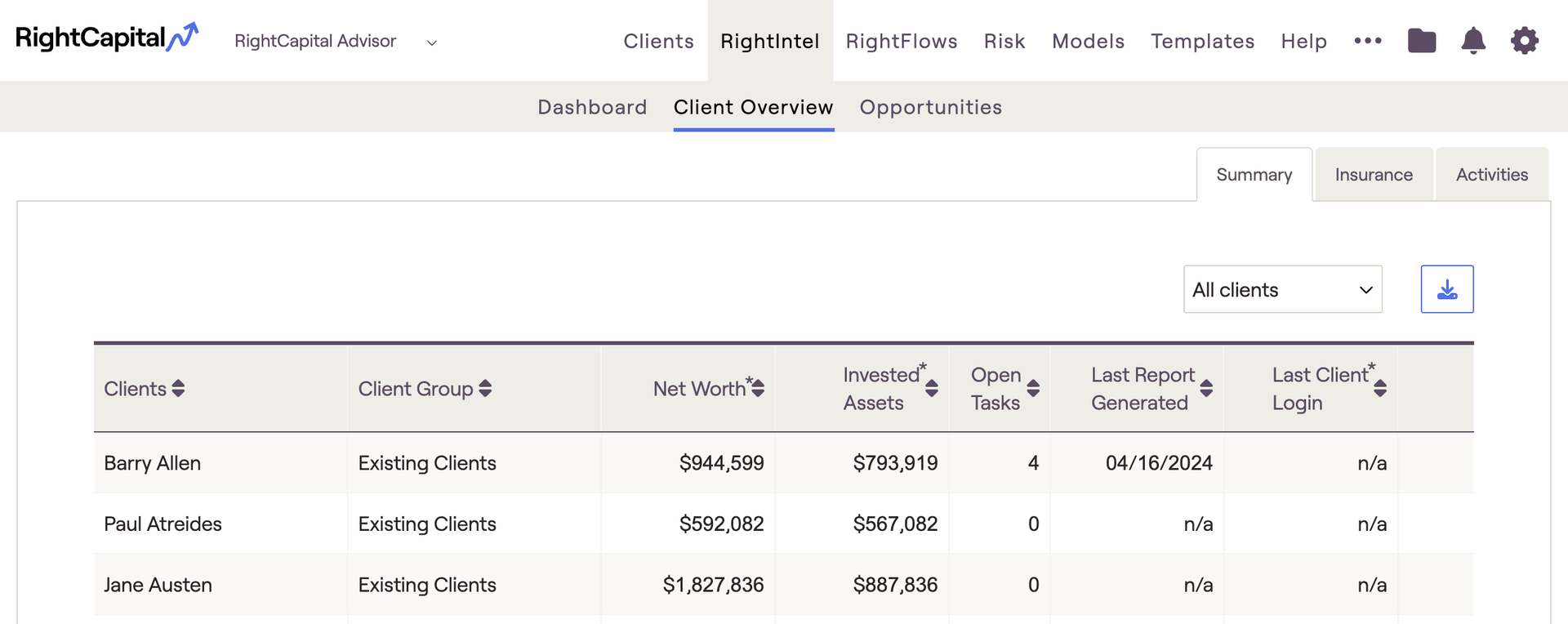

Summary

The summary page enables advisors to view key statistics for all of their clients in one place. This includes items such as the net worth, invested assets, number of outstanding tasks, date a report was last generated, and the client's last login:

Insurance

The Insurance tab will display a summary of client Insurance accounts. We can see data such as Client Age, Life Insurance death benefit amount and number of policies, LTC insurance benefit amount and number of policies, Disability insurance number of policies, and Property & Casualty Insurance number of policies.

Advisors will be able to click on each type of policy to see additional details such as Policy owner, Policy type, Insured, and Premium information:

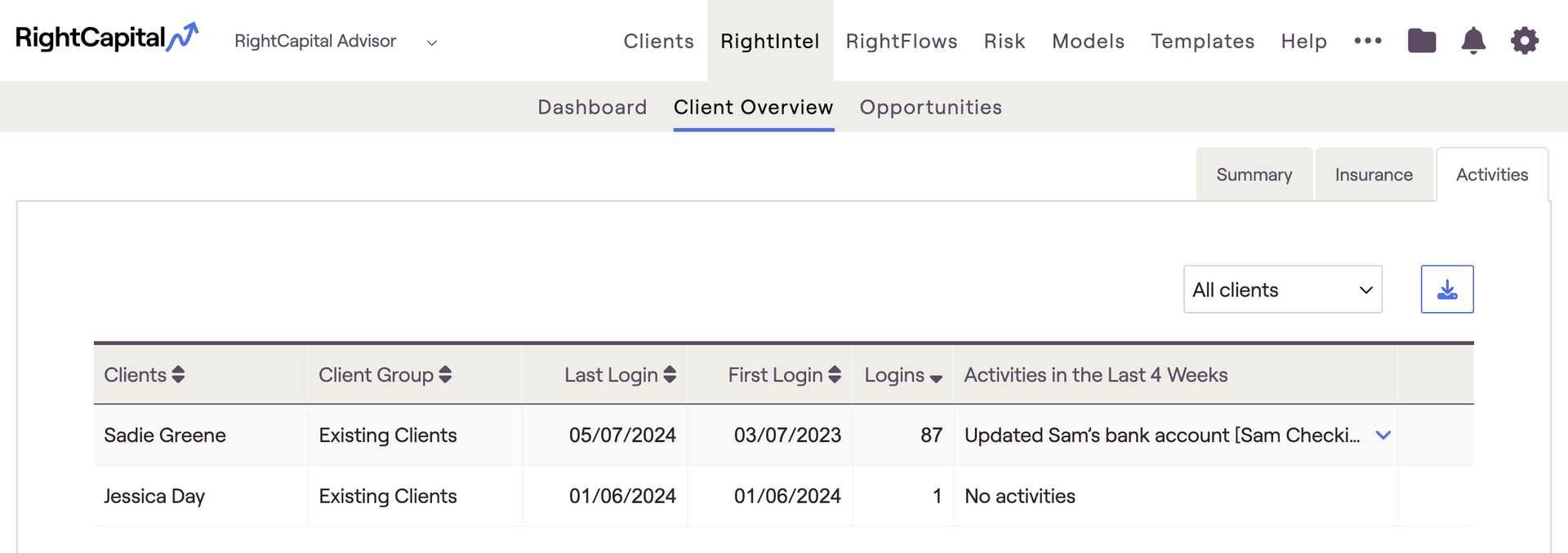

Activities

You can immediately locate a particular client within the Activities section by pressing (Control + F) for PC users, or (Command + F) for Mac users, and typing in the client's name.

The Activities section will display your invited client's login activity, such as when they first logged in, when they last logged in, and how many total times they've logged into their portal. It will also display specific activities they've performed within the last four weeks, such as updates to Profile cards, and changes they've made to particular accounts.

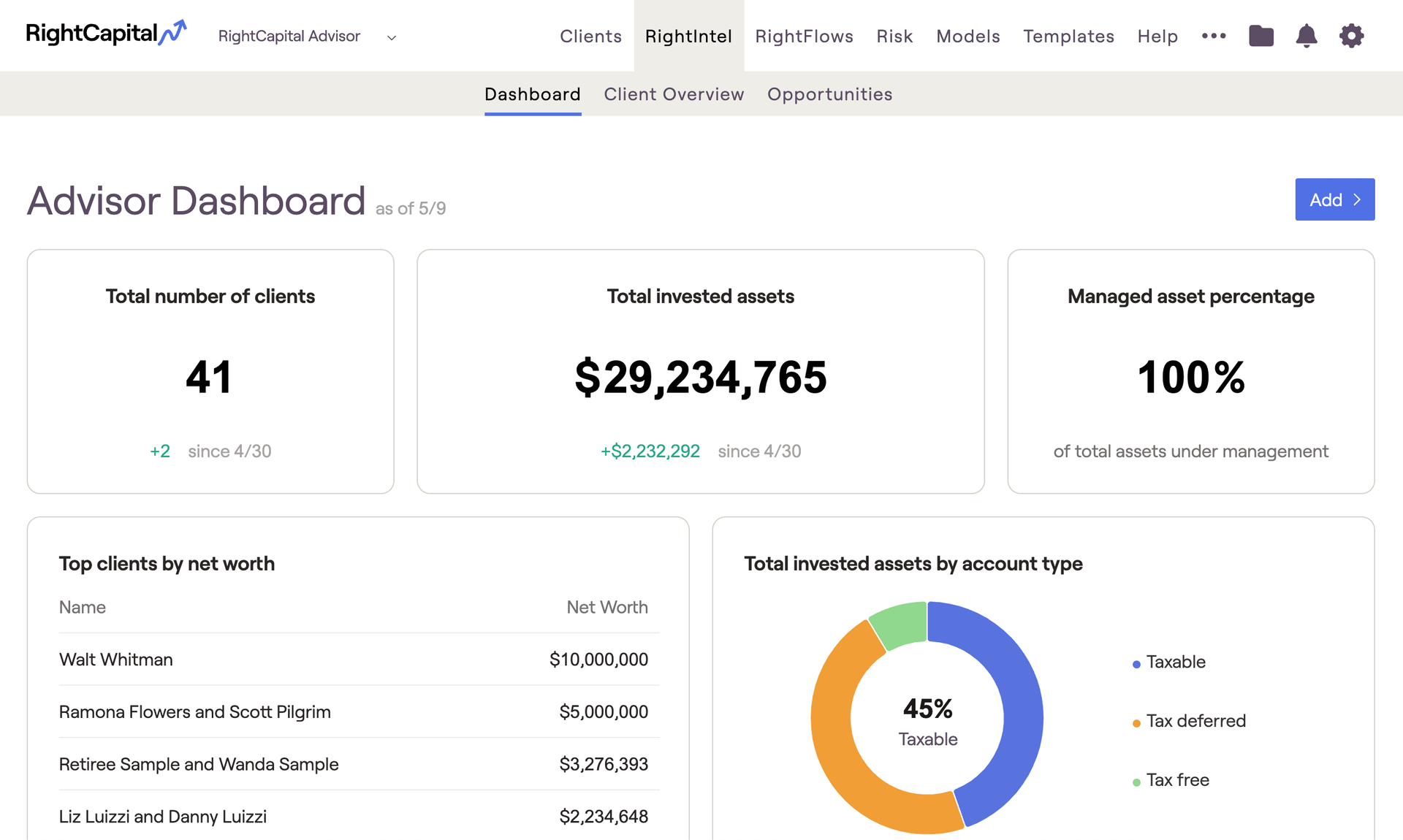

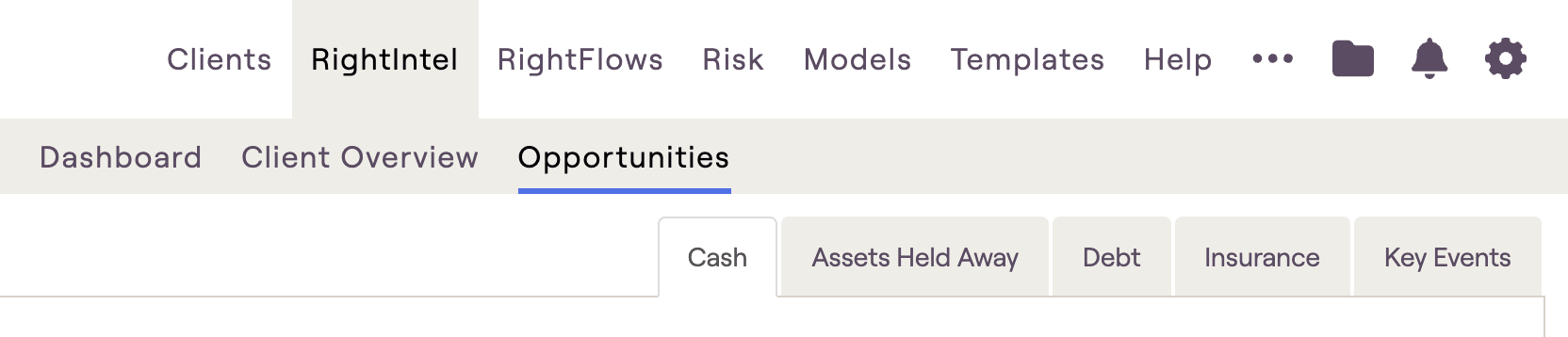

Opportunities

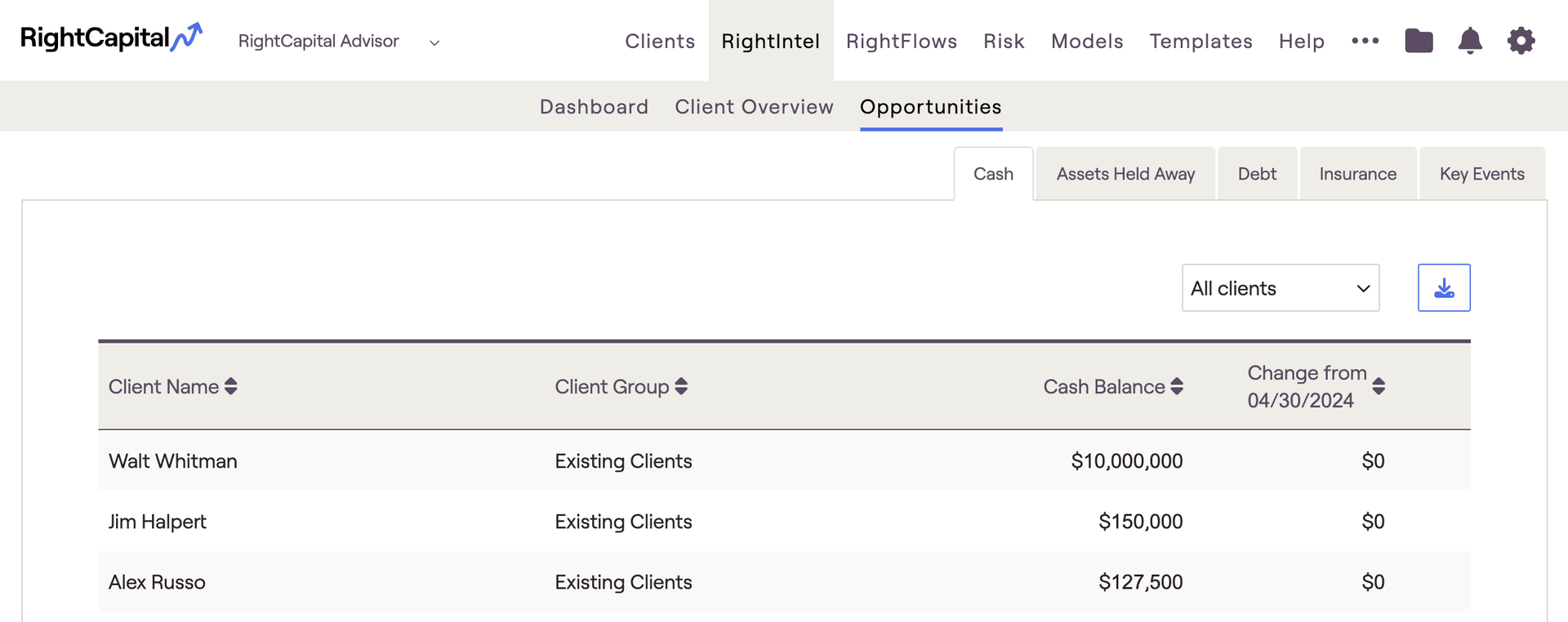

The Opportunities tab includes various tables with client data that advisors can utilize to look for opportunities within their business. There are individual tabs for Cash, Assets Held Away, Debt, Insurance, and Key Events:

This section includes items such as a list of cash balances and any changes to cash balances, the # of accounts and $ value of accounts that are not managed by the advisor, a list of debts and their balances/interest rates, and key events such as term insurance expiration or upcoming retirement dates for all clients within RightCapital.

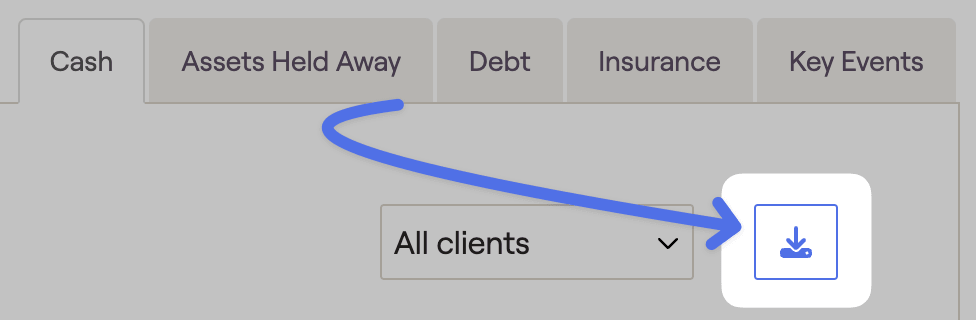

All Opportunities sub-tabs have the ability to be exported to CSV file:

Cash

The cash tab allows you to easily identify clients who have cash on hand to reinvest with you, or clients who would benefit from bolstering their cash savings. The cash tab will display the amount of money each client holds in cash and daily changes to those balances:

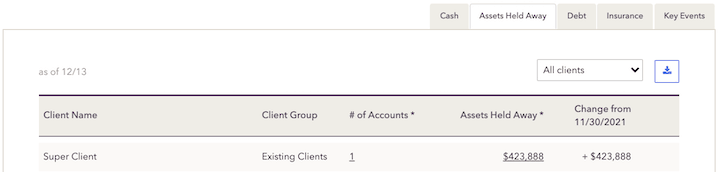

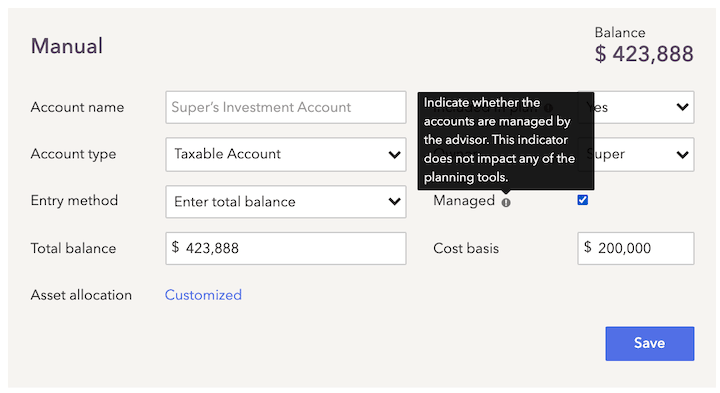

Assets Held Away

The Assets Held Away tab allows you to quickly see accounts your clients have invested elsewhere, providing you an opportunity to convert these assets to your management. The assets held away tab will display the total amount of investments the client holds outside of your management as well as their account type and balances:

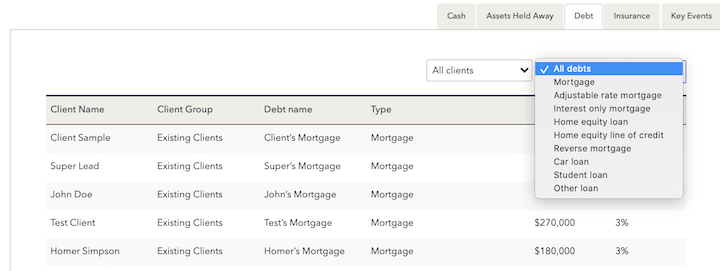

Debt

The debt tab houses all client loan data, allowing you to quickly identify which clients could benefit from consolidation or a refinance. The debt tab will display all client loans, their balances as well as their interest rates:

Credit card debt will not be displayed in this tab.

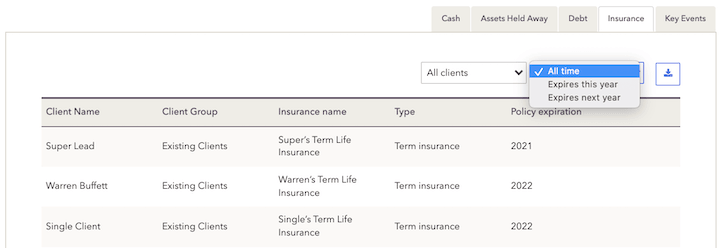

Insurance

The insurance tab will display active term and disability insurance policies across clients, including the expiration date, allowing you to step in to avoid a lapse in coverage. You can further sort the list by policies that will expire this year, or next:

Key Events

The key events tab will display key client events such as retirement age, Social Security filing age, Medicare filing age, RMD age, when they have reached age 59 1/2 (penalty-free withdrawals) or age 50 (contribution catch-up provision) as well as the month/calendar year in which they occur, allowing you to identify milestones and tailor your conversations accordingly: