How to add a Business to a client’s Profile

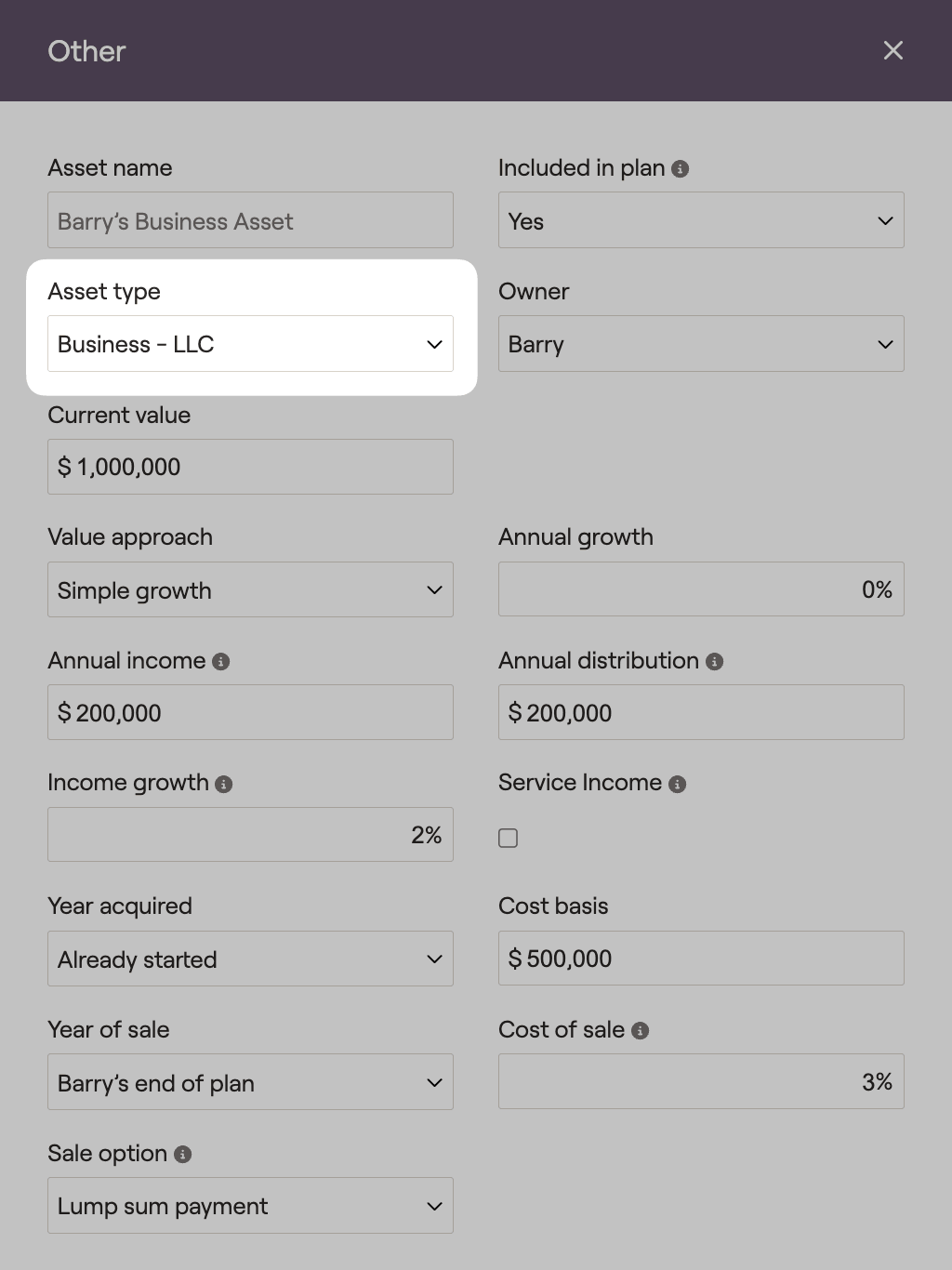

Within the Profile > Net Worth tab, click the green ‘Add Account’ button and choose ‘Other’ from the drop down.

The card that populates will have the option to adjust ‘Asset Type.’ Use the drop-down to choose the appropriate business type (LLC, Partnership, S Corp, or C Corp).

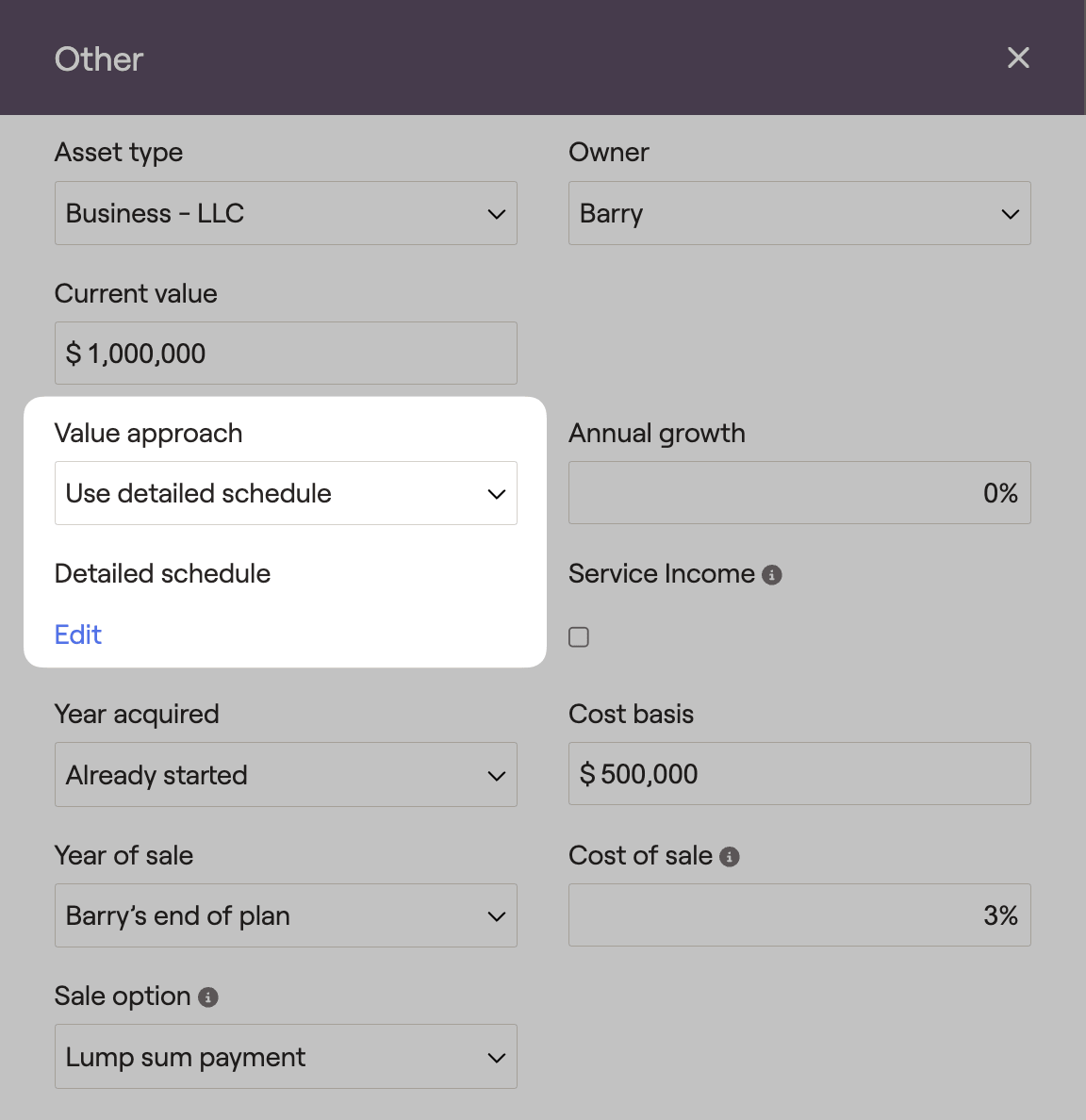

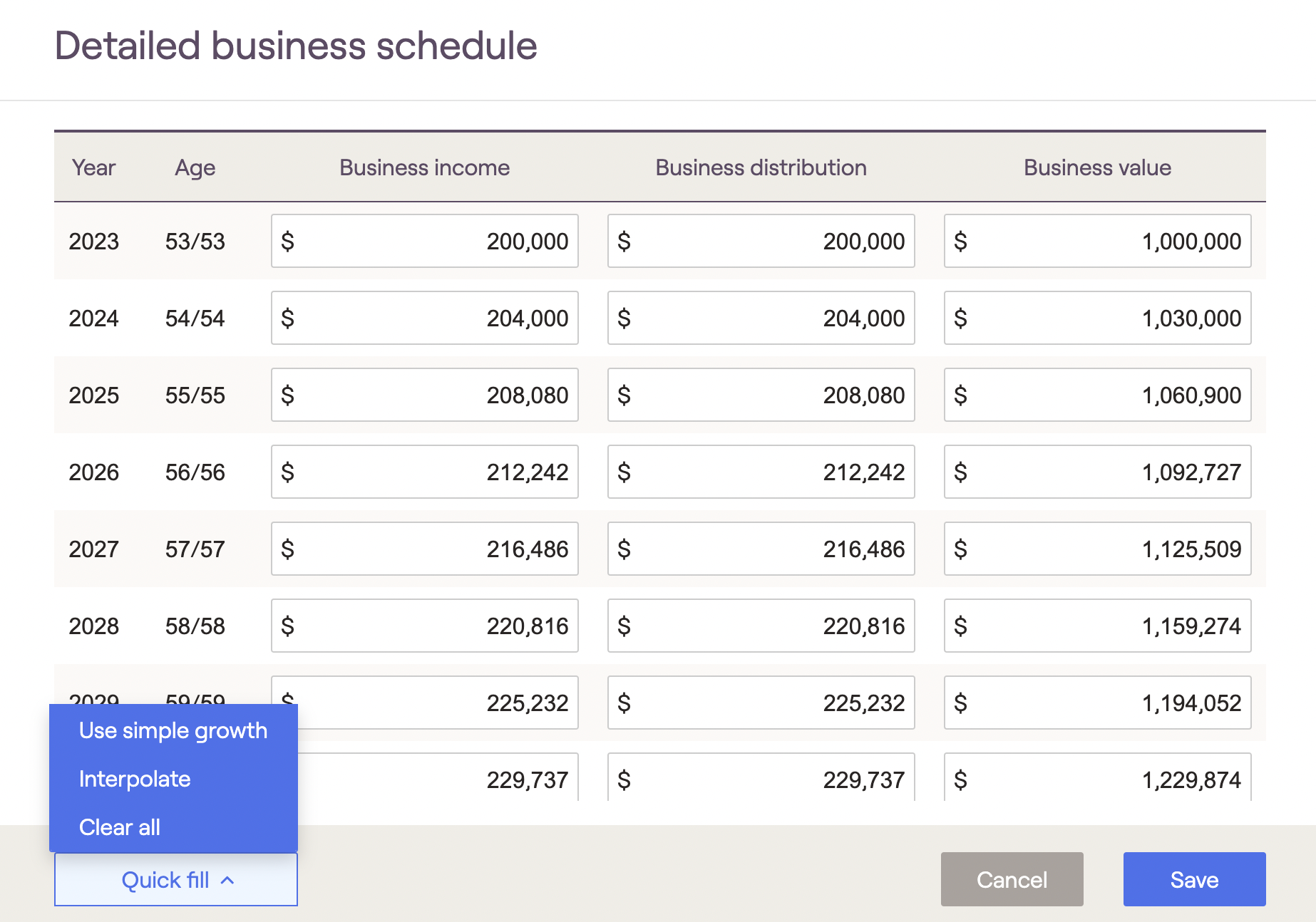

When using the detailed schedule, click the edit button to customize business income, business distributions, and business value for each year of the financial plan. The quick fill button allows you to populate information with one of three options easily.

- Use simple growth will populate the cash value with a simple growth projection based on the current value, annual growth, annual income, annual distribution, and income growth entered when using the ‘Simple growth’ value approach.

- Interpolate will automatically populate all $0 inputs between beginning and ending values listed in the detailed schedule. This feature saves time and helps to populate business income, distributions and value.

- Clear all will reset all detailed schedule values to $0.

Be sure to click the blue ‘Save’ button when you have completed entering information.

How to add Business Income to a client’s plan

Business Type | Business Income |

|---|---|

C Corp | Within the 'Other’ Business card, add the income within the ‘Annual Distribution’ field. You will then see this amount as an inflow within the Income Inflows tab of the Cash Flows. |

LLC | Within the ‘Other’ Business card, add the income within the ‘Annual Distribution’ field. You will then see this amount as an inflow within the Income Inflows tab of the Cash Flows. |

Partnership | Within the ‘Other’ Business card, add the income within the ‘Annual Distribution’ field. You will then see this amount as an inflow within the Income Inflows tab of the Cash Flows. |

Self-employment | Within the Profile > Income tab, use the green ‘Add Income’ button and choose ‘Self-employment’ from the drop down. You will then see this amount as an inflow within the Income Inflows tab of the Cash Flows. Please note, our Self-employment Income card accounts for both the employees and employers FICA tax. The figure is displayed on line 27 of Schedule 1, which can be found within the Tax > Tax Estimate > Details tab. |

S Corp | Within the ‘Other’ Business card, add the income within the ‘Annual Distribution’ field. You will then see this amount as an inflow within the Income Inflows tab of the Cash Flows. This income will not be subject to FICA tax. Within the Profile > Income tab, use the green ‘Add Income’ button and choose ‘Salary’ from the drop down. You will also see this amount as an inflow within the Income Inflows tab of the Cash Flows. This income will be subject to FICA tax. |

Business Definitions

Entry | Description |

|---|---|

Current Value | What the Business is currently worth. |

Annual Growth | The percentage that the Business’ value will grow by each year. |

Annual Income | Income from the Business (net of expenses) that the client will be taxed on. This figure will be displayed within Schedule (within the Tax > Tax Estimate tab). Please note, this amount will not be reflected as income within the client’s Cash Flows; it is only used to calculate a Business’ tax liability. |

Annual Distribution | Income from the Business that the client will see as an inflow within their Cash Flows. |

Income Growth | The percentage that the Annual Income and Annual Distribution will grow by each year. |

Service Income | By default, we assume that any Business is a ‘Specified Services Business,’ meaning that income generated within the business is subject to the QBI deduction phaseout. By deselecting this option, the QBI deduction for business income will not be subject to this phaseout. |

Year Acquired | When the Business was (or will be) purchased. |

Cost Basis | The original value of the Business. This value will impact the taxation of the Business if it is sold. |

Year of Sale | When the Business will be sold. The sale price is based upon the value of the Business (at the time of sale), less the cost of sale. Proceeds from the sale will be reflected within the Other Inflows tab of the Cash Flows. |

Cost of Sale | The percentage that will be used to reduce sale proceeds within the Cash Flows |

Sale Option | Indicate whether proceeds will be received in a lump sum or via installment plan (see below for more details) |

Taxation of Business Income

LLC | Partnership | S Corp | C Corp | |

|---|---|---|---|---|

Business Income taxed as | Ordinary Income | Ordinary Income | Ordinary Income | Dividend Income |

Income shown on Schedule 1 | Line 12 (from Schedule C) | Line 17 (from Schedule E) | Line 17 (from Schedule E) | N/A |

Business income subject to FICA Tax, shown on Schedule 1 | Yes, line 57 | Yes, line 57 | No | No |

Taxation of Business Sale

If selling the Business within two years of the year of purchase, any gains are taxed at short term capital gains rates. If the sale occurs after two or more years, any gains are taxed at long term capital gains rates.

Capital gains are calculated by reducing the Sale Proceeds (as reflected within the Other Inflows tab of the Cash Flows) by the Cost Basis of the Business (as entered within the Profile > Net Worth > Other section).

Installment Sale

If the business is being sold through an installment plan, you can set the Sale Option to 'Installment Years' to indicate the number of years over which the business is being sold. We will assume that the sale proceeds are split evenly across the number of years indicated. Gains will be split evenly in each year as well.

If you enter an interest rate for the installment sale, we will calculate an amortized equal payment amount for each year.

Qualified Business Income Deduction

Under TCJA tax laws, a 20% deduction of Business Income applies for LLC, Partnership, S Corporation or Self-employment income. RightCapital automatically accounts for this deduction for these types of Businesses that are added to your client’s plan.

The deduction is 20% of Business Income, capped at 20% of Taxable Income. The deduction is phased out based on income limits for a ‘Specified Services Business.’ By default, we assume that any Business is a ‘Specified Services Business,’ meaning it is subject to the QBI deduction phase out. If the Business is not subject to this phase out, the ‘Service Income’ box should be deselected within the Business card on the Profile > Net Worth tab or within the Self-employment Income card on the Profile > Income tab.

The Qualified Business Income deduction is shown on line 13 of the 1040 form.

Single Filers | Joint Filers |

|---|---|

$191,950 - $241,950 | $383,900 - $483,900 |

A couple’s pre-QBI deduction Taxable Income is $419,700

This $419,700 is in excess of the $383,900 threshold by $35,800

This means the couple’s applicable percentage would be 64.2% (100% - $35,800 / $100,000)

Accordingly, in computing the QBI deduction, the couple would only be allowed to take into account 64.2% of the QBI