Existing reverse mortgages in RightCapital can be added in the Net Worth section of the Profile (or the Net Worth step of the initial data entry process), by clicking Add Account > Loan:

Please note that future reverse mortgages should be modeled using the Reverse Mortgage income card in the Profile > Income section.

Reverse mortgages are only available if the owner of the reverse mortgage is age 62 or older.

Reverse Mortgage Data Entry

After adding the loan, you will first want to change the Loan Type selection to 'Reverse Mortgage'. This option allows you to reflect a HECM mortgage, including tax-free income, interest rates, and annual fees.

Specify the Interest rate and Annual Income associated with the reverse mortgage. You can also input an Annual fee, representing any additional servicing fees paid into the reverse mortgage balance, above and beyond the mortgage insurance premium. Choose an Income ends date, which is the last year the income will be included in the plan. Lastly, be sure to also specify the current Balance.

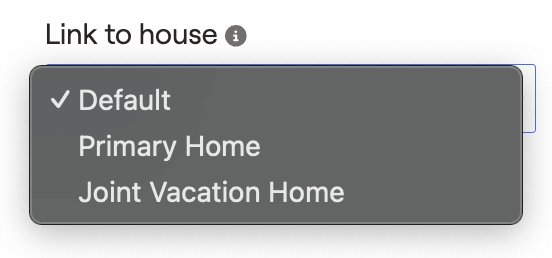

In the lower right, you can use the Link to house field to select the property this reverse mortgage is associated with. The 'Default' option will link the reverse mortgage to the client's Primary Home. In plans with multiple property entries, like investment and vacation properties, you can link each loan to its corresponding property:

Additional Information

Reverse Mortgage Cash Flows Location

Reverse mortgage income can be tracked within the Retirement > Cash Flows > Summary page, by clicking into the Income Inflows > Other Income column:

Reverse mortgage balances can be tracked as they accrue within the Cash Flows > Net Worth page, by clicking into the Mortgages column.

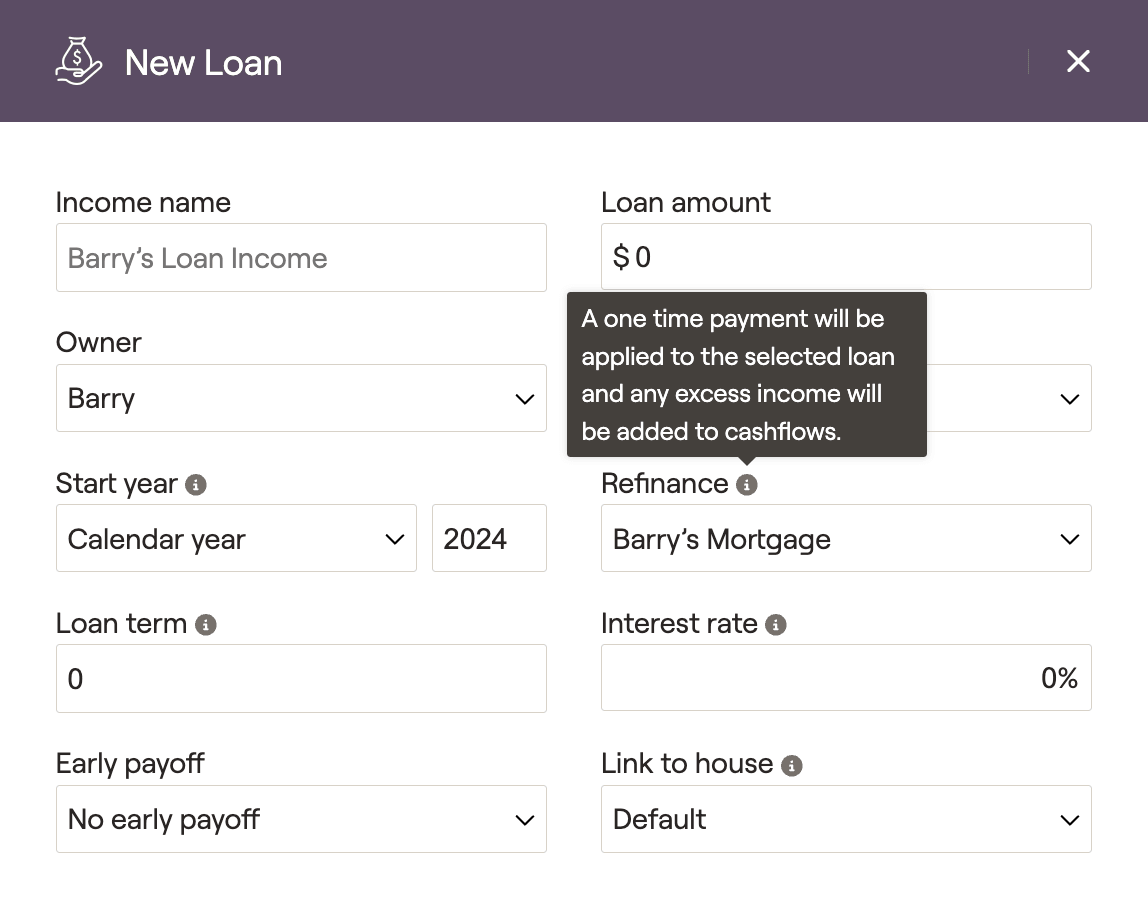

Refinance a Reverse Mortgage

You can model a refinance within a client plan using a New Loan income card. Within this card you will find a 'Refinance' field, in which you can choose the loan you would like to refinance. This will apply a one-time payment to the selected loan, and any excess income will be added to cashflows:

New loan cards can be added to the current plan within the Profile > Income section. You can also propose a refinance using the same card in the Retirement Analysis module, using the Action Items.