Existing HELOC loans in RightCapital can be added in the Net Worth section of the Profile (or the Net Worth step of the initial data entry process), by clicking Add Account > Loan:

Please note that future HELOCs can be modeled using the New Loan card in the Profile > Income section.

HELOC Data Entry

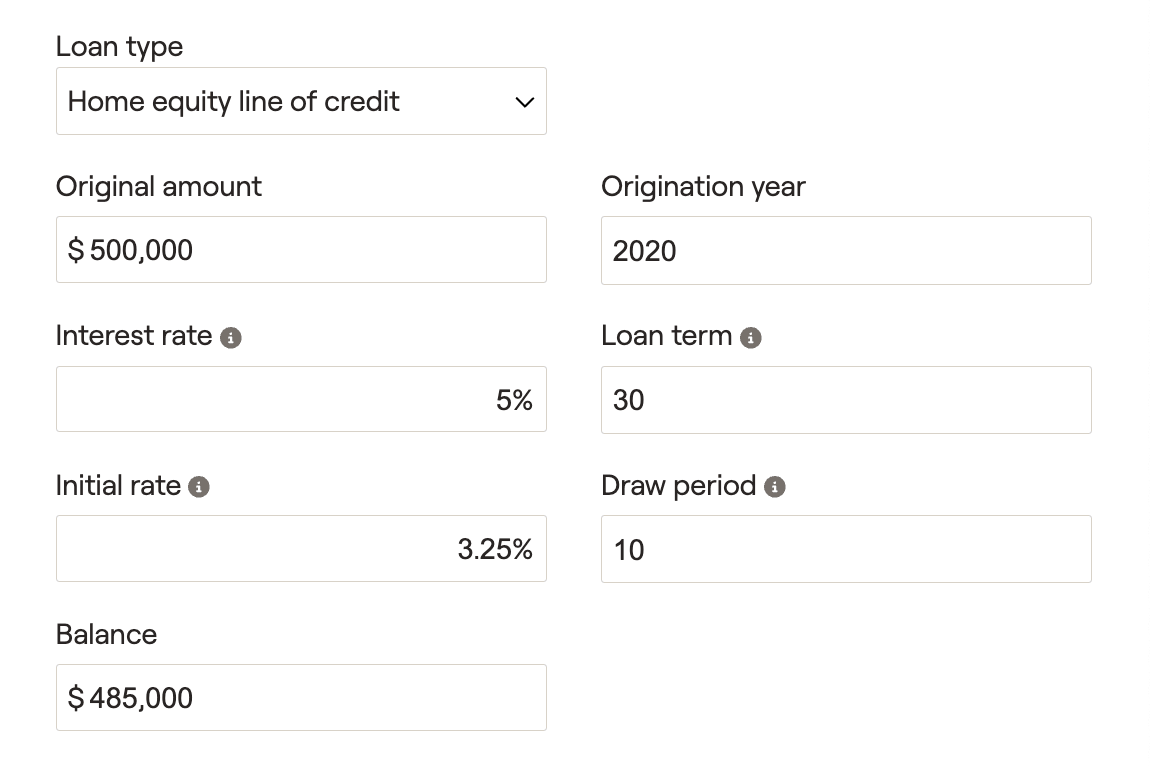

After adding the loan, you will first want to change the Loan Type selection to 'Home Equity Line of Credit'. This option allows you to reflect the interest and payments associated with an existing HELOC where you have drawn money from the line of credit.

Please note that only the money that has been drawn from the line of credit should be entered as a HELOC loan. HELOC entries will only show the payback of the loan.

You can then specify the Initial rate that will be applied for the duration of the Draw period (in years) that you enter. Only interest payments will be reflected during this time. Once the initial period has passed, the repayment period will begin and the Interest rate that you enter will be applied for the remainder of the Loan term.

To ensure accurate payment amounts each year, you will also need to enter the Original amount of the HELOC loan, as well as the Origination year. Be sure to also specify the current Balance.

Just like interest only mortgages, HELOC loans do not ask for a monthly payment amount. RightCapital will automatically calculate the amortized monthly payment amounts based on all of the inputs described above.

To model a client making extra payments during their draw period, you can add an Extra Debt Payment card in the Profile > Expenses tab.

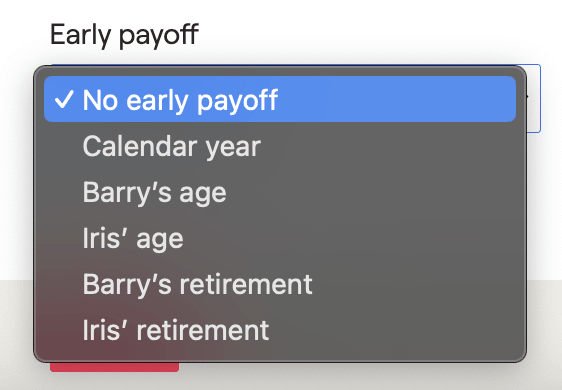

At the bottom of the data entry drawer, you will find an option for an Early payoff. Choosing an option here will generate a lump sum within the projections to fully pay off the loan in the year indicated:

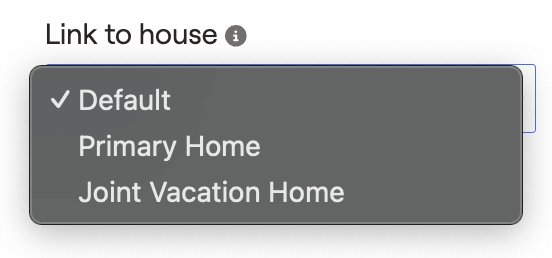

In the lower right, you can use the Link to house field to select the property this HELOC is associated with. The 'Default' option will link the HELOC to the client's Primary Home. In plans with multiple property entries, like investment and vacation properties, you can link each loan to its corresponding property:

Additional Information

HELOC Cash Flows Location

HELOC loan payments can be tracked within the Retirement > Cash Flows > Summary page, by clicking into the Expenses > Debt column:

HELOC loan balances can be tracked as they are paid down within the Cash Flows > Net Worth page, by clicking into the Other Loans column.

Refinance a HELOC

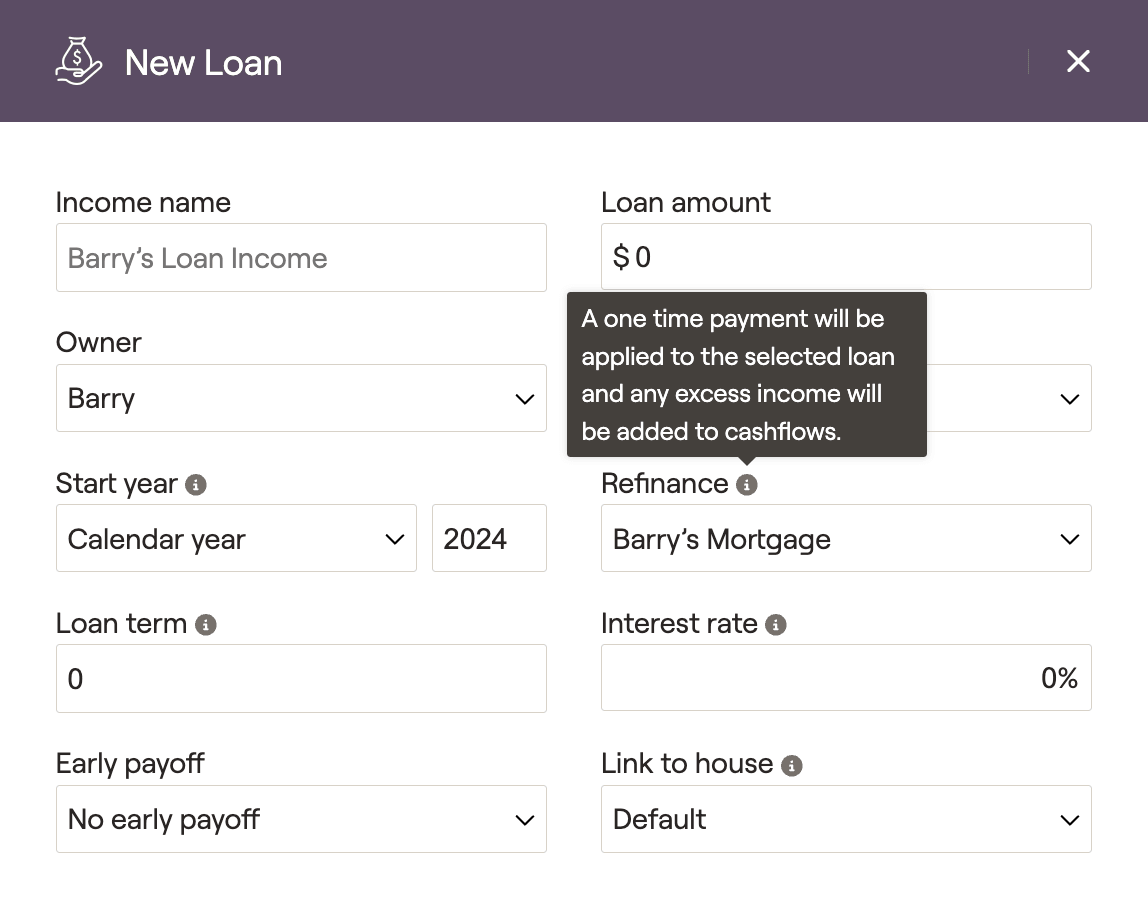

You can model a refinance within a client plan using a New Loan income card. Within this card you will find a 'Refinance' field, in which you can choose the loan you would like to refinance. This will apply a one-time payment to the selected loan, and any excess income will be added to cashflows:

New loan cards can be added to the current plan within the Profile > Income section. You can also propose a refinance using the same card in the Retirement Analysis module, using the Action Items.