Existing home equity loans in RightCapital can be added in the Net Worth section of the Profile (or the Net Worth step of the initial data entry process), by clicking Add Account > Loan:

Please note that future home equity loans can be modeled using the New Loan card in the Profile > Income section.

Home Equity Loan Data Entry

After adding the loan, you will first want to change the Loan Type selection to 'Home Equity Loan'. This option works similarly to a traditional mortgage with an interest rate and amortized payments.

If you enter the Original amount, Interest rate, and Loan term, RightCapital will automatically calculate the Minimum payment for the loan. If you choose to also enter a Monthly payment amount, the greater of the two will be utilized within the projections.

If you'd prefer, you can also just enter the existing current Balance and Monthly payment, and that amount will be paid until the Balance is fully depleted.

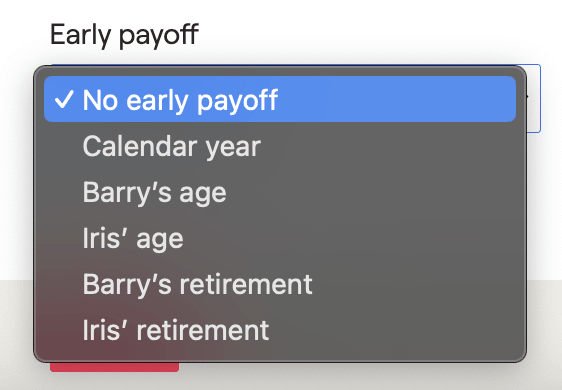

At the bottom of the data entry drawer, you will find an option for an Early payoff. Choosing an option here will generate a lump sum within the projections to fully pay off the home equity loan in the year indicated:

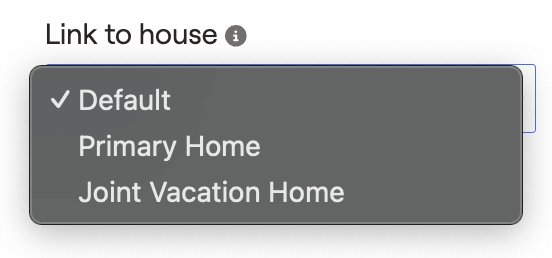

In the lower right, you can use the Link to house field to select the property this home equity loan is associated with. The 'Default' option will link the loan to the client's Primary Home. In plans with multiple property entries, like investment and vacation properties, you can link each loan to its corresponding property:

Additional Information

Home Equity Loan Cash Flows Location

Home Equity Loan payments can be tracked within the Retirement > Cash Flows > Summary page, by clicking into the Expenses > Debt column:

Home Equity Loan balances can be tracked as they are paid down within the Cash Flows > Net Worth page, by clicking into the Other Loans column.

Refinance a Home Equity Loan

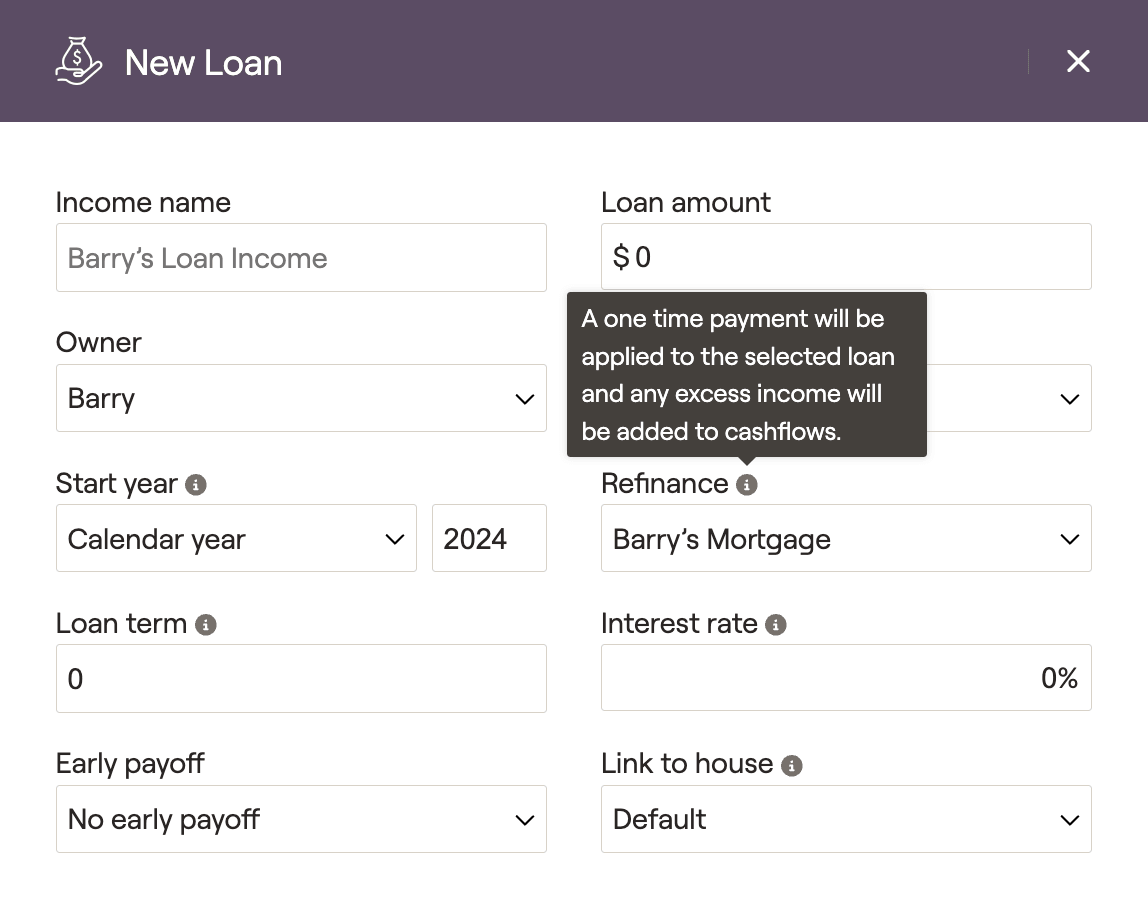

You can model a refinance within a client plan using a New Loan income card. Within this card you will find a 'Refinance' field, in which you can choose the loan you would like to refinance. This will apply a one-time payment to the selected loan, and any excess income will be added to cashflows:

New loan cards can be added to the current plan within the Profile > Income section. You can also propose a refinance using the same card in the Retirement Analysis module, using the Action Items.