RightCapital enables you to capture every element of a client's financial landscape — including student loans and repayment options.

You can add information about a client's student loan debt in the Net Worth section of a client's Profile (or the Net Worth step of the initial data entry process).

For advisors with access to Account Aggregation, student loans are often able to be linked directly to the Net Worth. This can be a helpful time saver during the data entry process!

Adding Student Loans Overview

With this in place, the data entry fields will adapt to become specific to student loans. See below for an overview of the data entry process for both private and federal student loans.

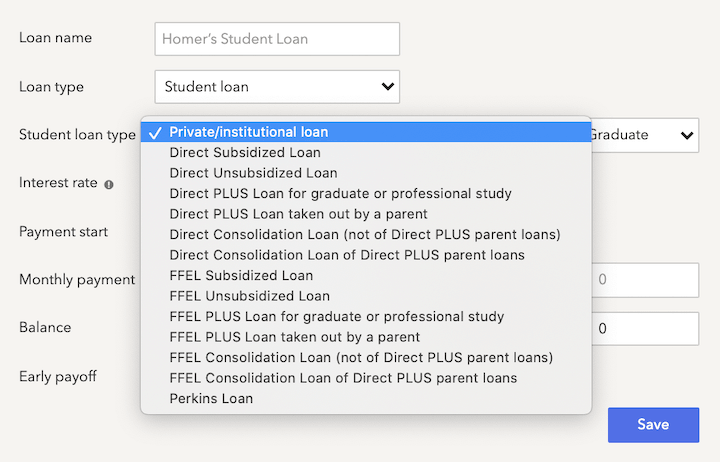

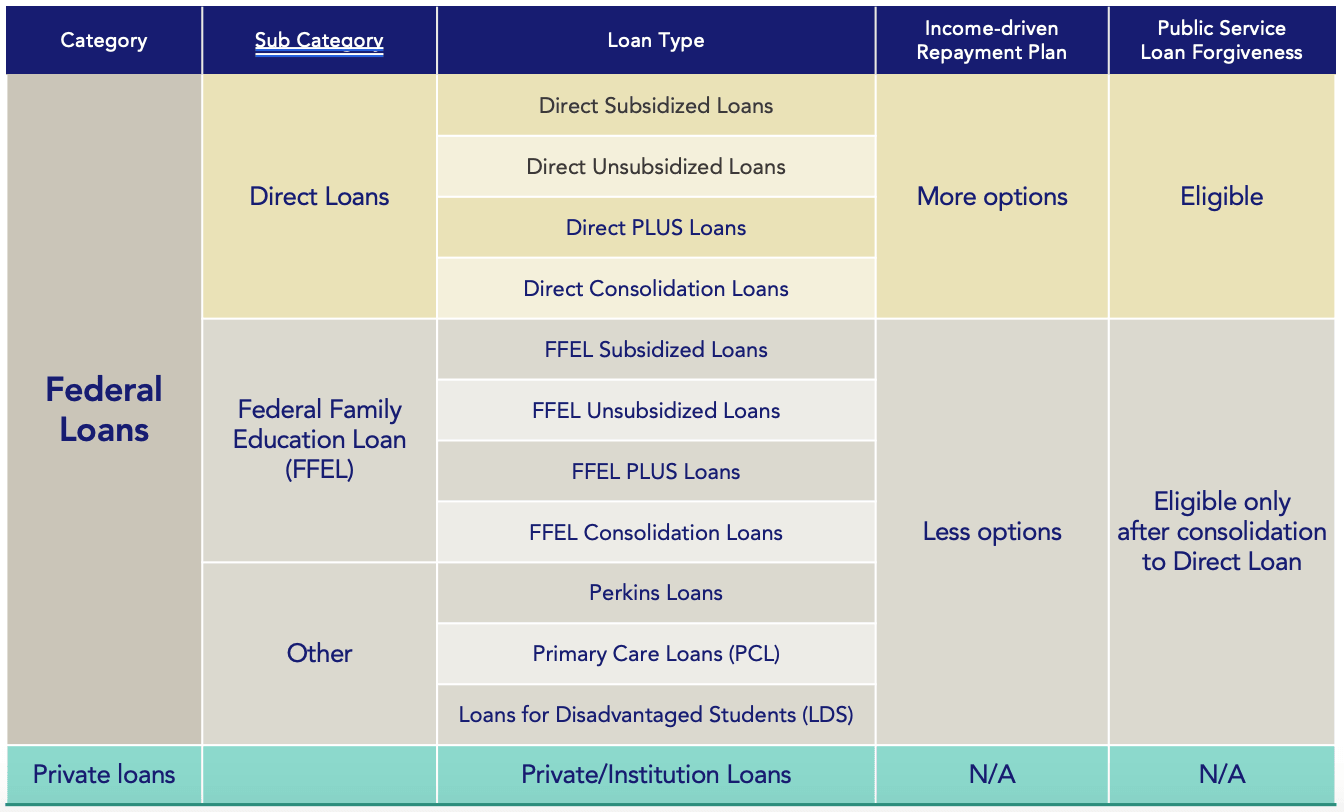

Student Loan Type

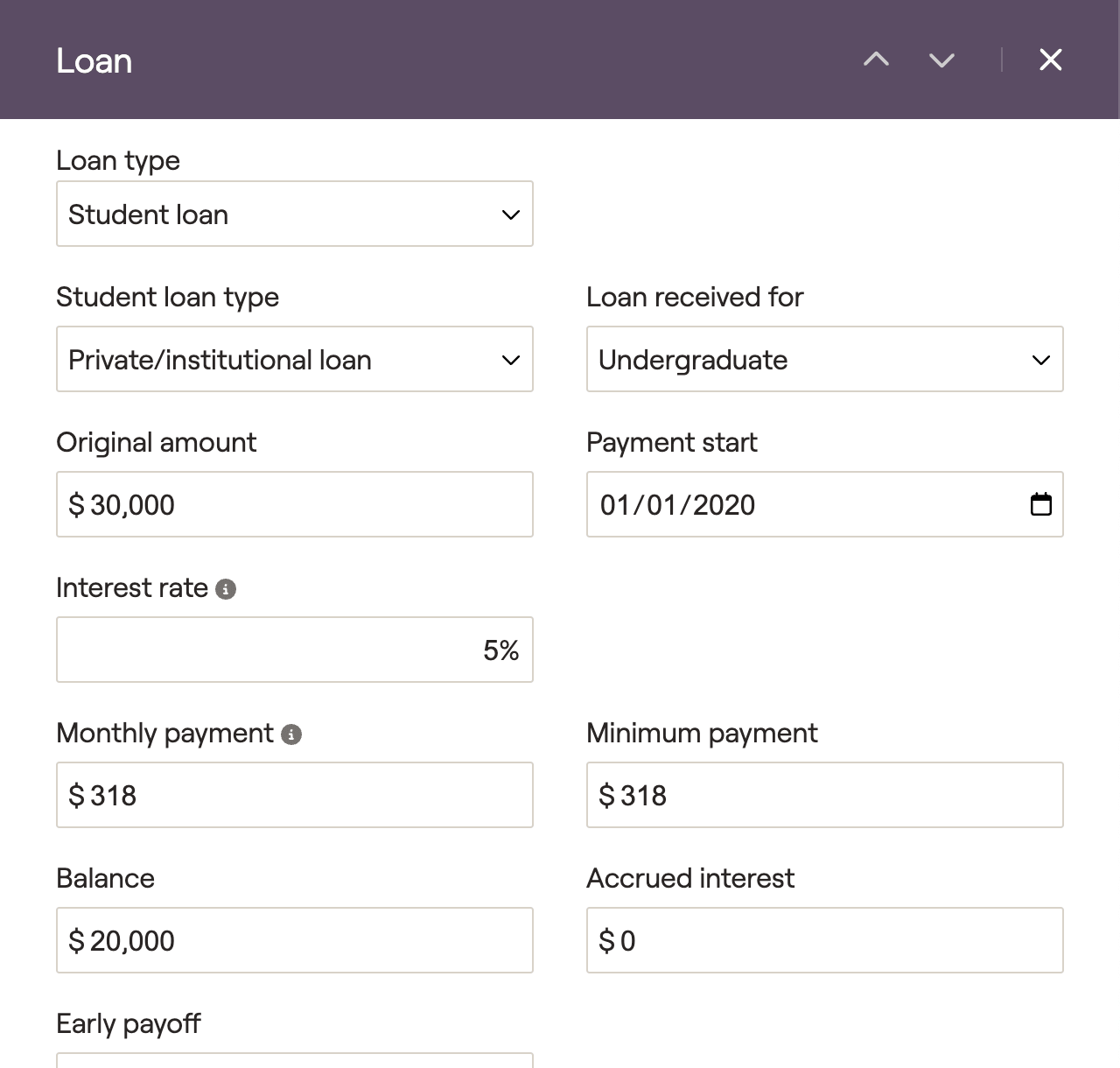

Private / Institutional Loans

Entering Private/institutional loans is the most similar to entering other types of loans in RightCapital. You'll be asked to enter details like the Original amount, Interest rate, Monthly / minimum payment amounts, and Current balance:

RightCapital will automatically calculate an amortization schedule for the loan, based on your inputs. You can track the payments within the Cash Flows > Summary > Expenses > Debt column, and you can track the balance as it's paid down within the Net Worth > Other Loans column:

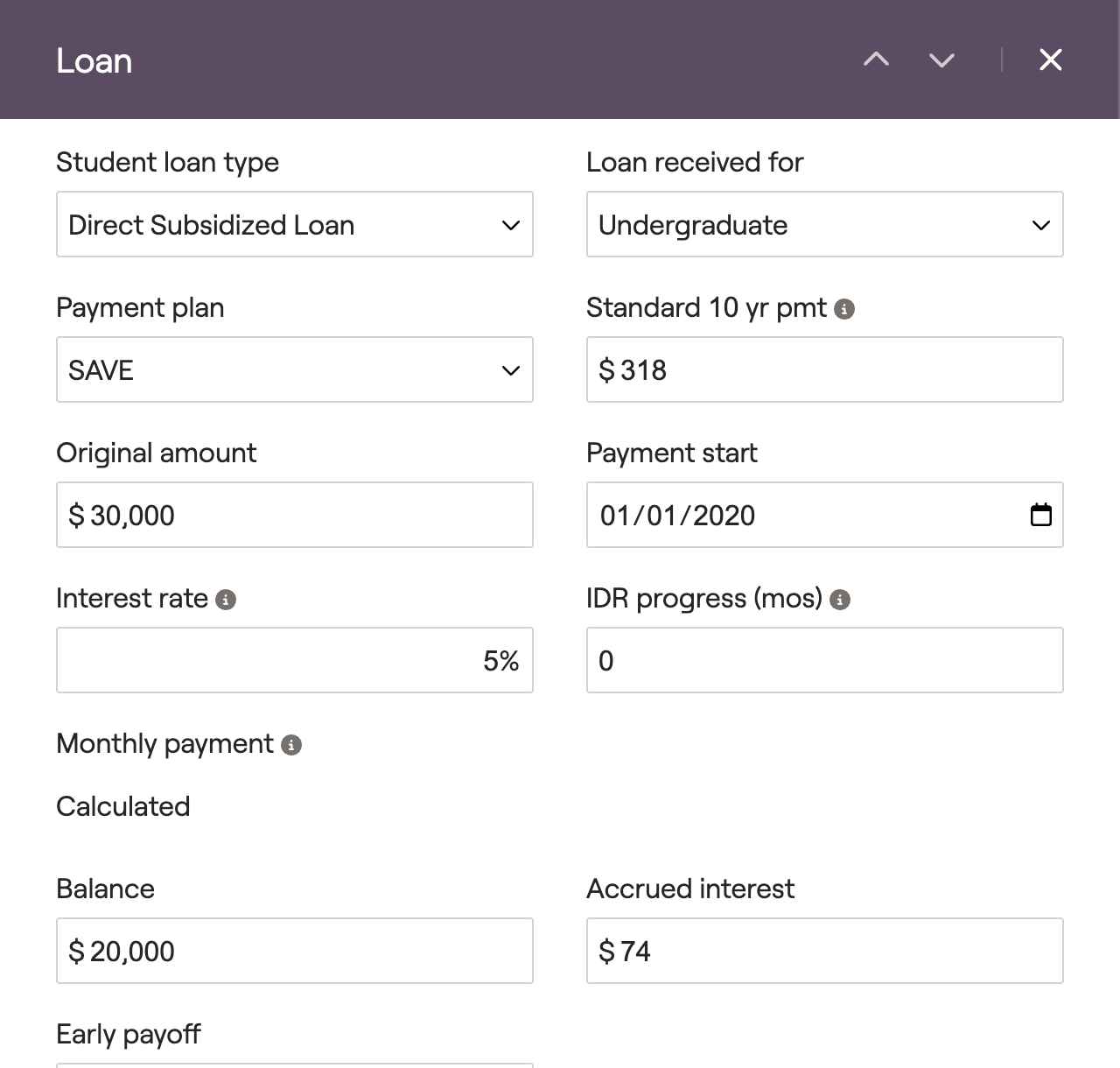

Federal Loans

When entering federal loans, the data entry will change to provide you with additional options. Data entry for federal loans requires information like the client's current payment plan, standard 10-year payment amount, and more:

Payment Plans

Standard

Income Based Repayment (IBR)

Pay As You Earn (PAYE)

Saving On A Valuable Education (SAVE)

The standard option reflects the standard repayment plan to pay off loans in 10 years. Meanwhile, IBR, PAYE & SAVE will calculate the monthly student loan payment based on the client's income and family size. RightCapital will calculate payments automatically using the client's projected Modified Adjusted Gross Income (MAGI) within the projections.

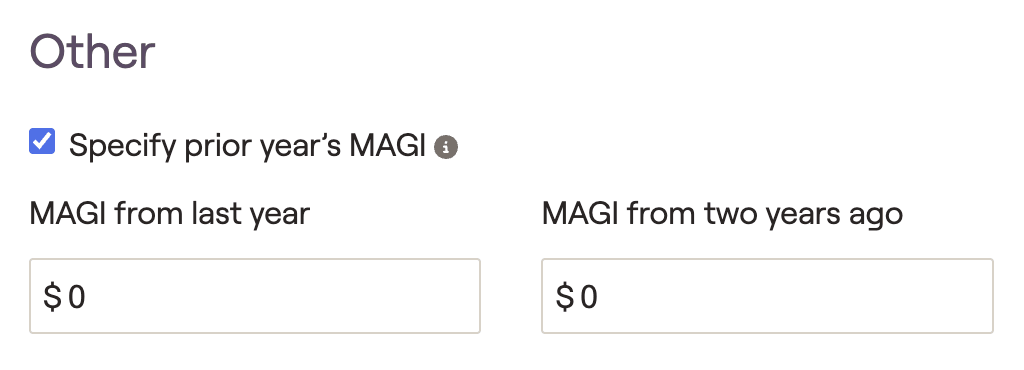

Listing the previous year's MAGI will allow RightCapital to calculate a more accurate IDR amount in year one of the plan. To do this, visit the Gear Icon > Settings > Tax Assumptions > "Specify prior year's MAGI":

The chart below demonstrates how payments are calculated in each income-driven repayment plan (IBR, PAYE, SAVE). To arrive at a client's discretionary income, 150% of the state poverty guideline amount is subtracted from the client's AGI.

Income Driven Repayment Plan | Payment Amount |

|---|---|

IBR | Generally 10% of discretionary income if you're a new borrower on or after 7/1/2014, but never more than the 10-year Standard repayment plan amount |

PAYE | Generally 10% of discretionary income |

SAVE | 5% of discretionary income for undergraduate loans, 10% for graduate loans, and a weighted average for borrowers with both. |

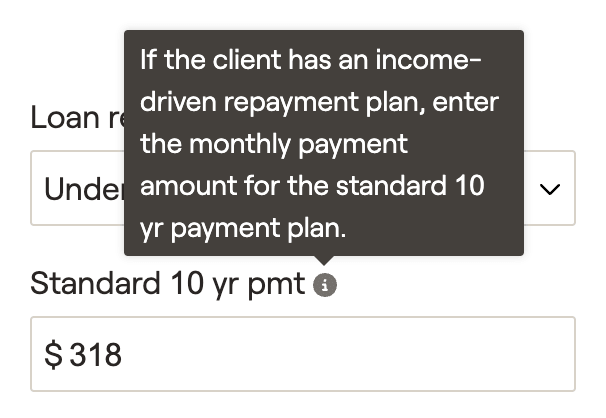

Standard 10 year payment

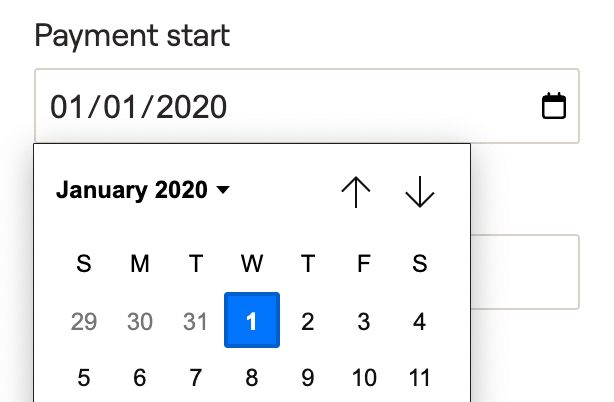

Payment start

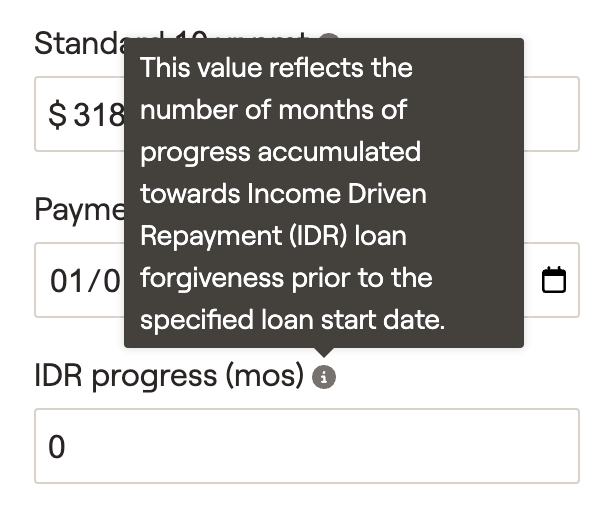

IDR progress (mos)

Monthly payment

If the client is on the Standard repayment plan, you will be able to enter their monthly payment amount within this field. Just like other loans in RightCapital, the plan projections will use the greater of the monthly or minimum payment amounts (for federal loans, the minimum payment is the 'Standard 10 yr pmt'). If the client is on an IDR plan, RightCapital will automatically calculate the monthly payment within the projections.

Accrued interest

Accrued interest is the total amount of interest that has accrued up through the current year. This amount will be capitalized and added to the loan balance if the client leaves their income-driven payment plan.

Early payoff

If an early payoff is selected, enter the calendar year when the client expects to pay off the remaining loan balance. Choosing an option here will generate a lump sum within the projections to fully pay off the loan in the year indicated.

Analyzing Student Loan Data

Once the financial parameters of the student loan have been completed, click "Save" to finish entering the loan into the client's Profile > Net Worth. You can track the payments within the Cash Flows > Summary > Expenses > Debt column, and you can track the balance as it's paid down within the Net Worth > Other Loans column: