Experience More Planning in Less Time

Welcome and thank you for using RightCapital financial planning software. As an administrative assistant, you work hard to make sure financial planning is done just right. The goal of this article is to empower you to meet your financial planning objectives and create more efficiency through our software.

Since the best way to learn RightCapital is to use it, let's jump in!

Reach out to our Support team or your sales associate today to get more information!

Learn About Assistant Resources

Many new subscribers require a helping hand while getting started. Understanding where to go for guidance is an essential first step in achieving your goals. From the first time you log in to RightCapital, you will have full access to our resources. Whether you need help creating a financial plan or accessing billing information we are here to help! Review the resources below and connect with our product experts to make the most out of your RightCapital experience. Click the links below for additional information:

RightCapital Support: Chat us, Call us, Email us or schedule 15-30-minute case reviews with resident software experts, we're here to help!

Help Center: Use this area to watch training videos, review how-to guides, data entry best practices, marketing materials, and more!

Recurring Training Webinars: Each week, product experts hold recurring training webinars to ensure that you have the tools you need to be successful. Sign up for a session that includes live Q & A with our experts or watch a pre-recorded session by clicking this link.

Assistant License Overview

As someone set up with a RightCapital "Assistant" login, you can work with clients for any advisor you are affiliated with.

Create new clients for an advisor

Review and update information for any client for the advisor

Change asset allocation assumptions for the advisor

Create models for the advisor, including allocation models and scenarios

Add clients under your own personal account

Update advisor’s personal information or branding

Getting Started

When first logging in you will notice three client samples listed within your client list. These premade financial plans provide the ability to analyze different case studies and comprehend appropriate outcomes.

Although you cannot create new plans, many assistants will begin the process of understanding RightCapital by overwriting the sample plan's profile information with their own data to review a completed financial plan that includes familiar details. Sign up for the weekly webinars below to learn everything you'll need to create a financial plan within RightCapital.

Recurring Training Webinars | Date | Time | Registration |

|---|---|---|---|

Creating your First Plan | Every Tuesday | 2:00PM ET |

Gathering & Inputting Client Data

There are multiple ways to gather data when entering clients into RightCapital. When working with a new client, leverage RightCapital's customizable data collection template to uncover important details about the client's financial picture. Alternatively, virtually onboarding clients is a great way to save time and increase efficiency.

Whether you are entering a new client or updating an existing client's plan there are important steps needed to access areas that you can edit. Use the steps below to update or create new financial plans:

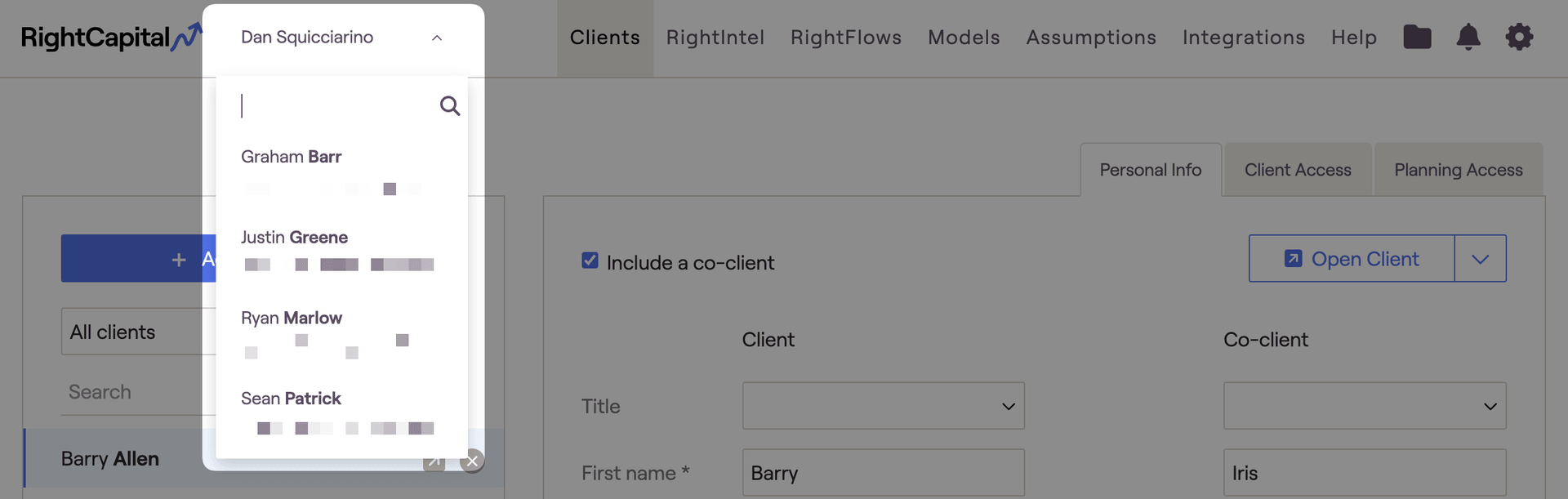

Use the dropdown menu on the upper left corner of the screen to select the advisor license the client is associated with.

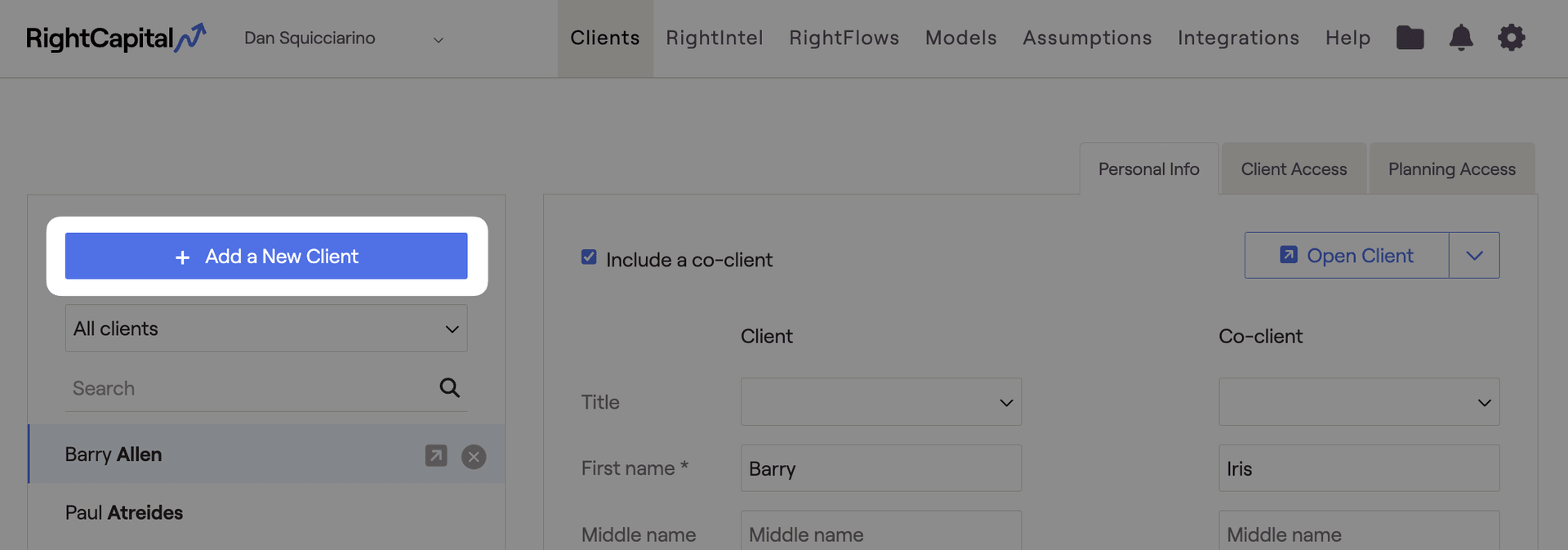

Once you have accessed the advisor's portal, use the client list to search for clients that need to be updated, or select "Add a new client" to create a new plan.

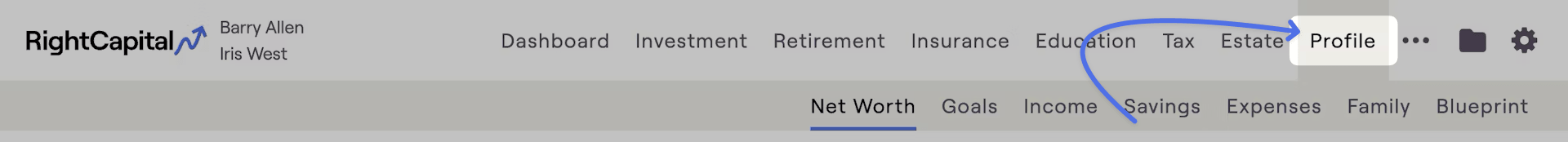

Use the six steps of initial data entry, when creating a new plan, or the profile tab, in an existing plan, to update the clients' family profile, income, savings, net worth, expenses, and goals.

Client Settings

Client settings are used to tailor the financial planning approach to your advisor's unique philosophy. Take time initially to review the available settings and align your favorites choices with each new client you create. For an informative article that describes global client settings click the link.

Additionally, click this link to watch a short training video on global client settings within RightCapital.

Client-specific settings, client-specific return assumptions and client-specific inflation/tax assumptions can also be customized for each client within their financial plan. Click the associated links for additional information.

Report Generation

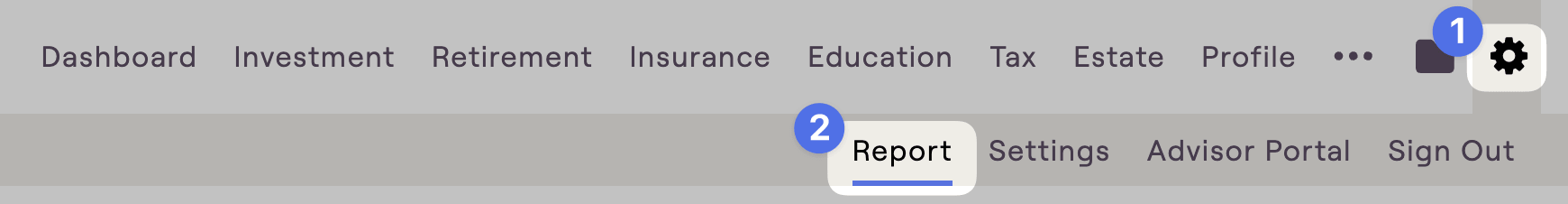

Once a financial plan has been updated or created, leverage the Gear Icon > Reports tab to produce reports that are high quality and easy to print on demand. Use this article to learn more about customizing report generation.

After the report has been generated the PDF file can be printed, emailed, or stored in the vault, a secure cloud storage area found in each financial plan.