Learn More about Student Loans in RightCapital

Need additional information for clients with student loans? RightCapital is here to help! This article is designed to provide you with facts and information that will help you understand the nuances of your client's student loan debt. If you're looking for something specific, you can use the table of contents on the right side of this page to skip ahead to a certain section.

If you're looking for more details on entering student loans into RightCapital or using the dedicated Student Loan module, you can visit the links below:

Federal Loans vs. Private Loans

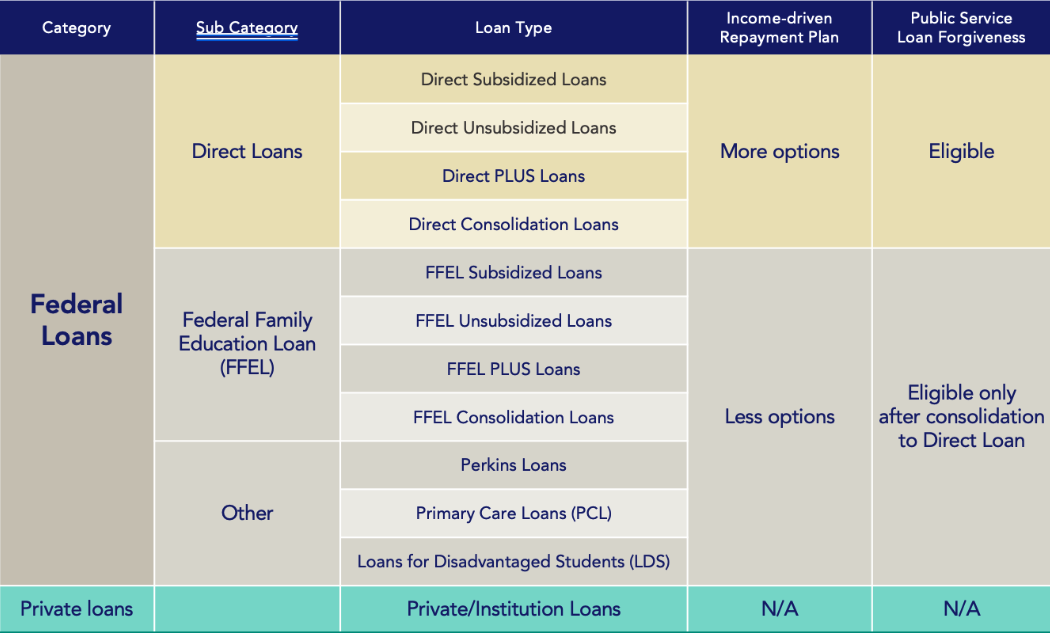

When entering student loans into RightCapital, you can designate the student loan type to evaluate the eligibility for income-driven repayment plans and loan forgiveness options.

See the chart below for a breakdown of student loan types and their impact on income-driven repayment options and Public Service Loan Forgiveness (PSLF) eligibility:

Income-Driven Repayment Plans (IDR)

The plans may seem similar, but each has distinct pros and cons. If the client didn't choose a repayment plan, the loan servicer will have automatically placed them on the Standard repayment plan. Below you can find more details on each student loan repayment plan available in RightCapital:

Standard Repayment Plan

Repayment Plan | Eligible Loans | Monthly Payment and Time Frame | Eligibility and Other Information |

|---|---|---|---|

Standard Repayment Plan | • Direct Subsidized and Unsubsidized Loans • Subsidized and Unsubsidized Federal Stafford Loans • All PLUS loans • All Consolidation Loans (Direct or FFEL) | Payments are fixed amounts that ensure your loans are paid off within 10 years (within 10 to 30 years for Consolidation Loans). | All borrowers are eligible for the plan. You'll usually pay less over time than under other plans. Standard Repayment Plan with a 10-year repayment period is not a good option for those seeking Public Service Loan Forgiveness (PSLF). Standard Repayment Plan for Consolidation Loans is not a qualifying repayment plan for PSLF. |

Income-Based Repayment Plan (IBR)

Repayment Plan | Eligible Loans | Monthly Payment and Time Frame | Eligibility and Other Information |

|---|---|---|---|

Income-Based Repayment Plan (IBR) | • Direct Subsidized and Unsubsidized Loans • Subsidized and Unsubsidized Federal Stafford Loans • All PLUS loans made to students • Consolidation Loans (Direct or FFEL) that do not include Direct or FFEL PLUS loans made to parents | • Your monthly payments will be either 10 or 15 percent of discretionary income (depending on when you received your first loans), but never more than you would have paid under the 10-year Standard Repayment Plan. • Payments are recalculated yearly based on your updated income and family size. • You must update your income and family size each year, even if they haven't changed. • If you're married, your spouse's income or loan debt will be considered only if you file a joint tax return. • Any outstanding balance on your loan will be forgiven if you hadn't repaid your loan in full after 20 years or 25 years, depending on when you received your first loans. • You may have to pay income tax on any forgiven amount. | • You must have a high debt relative to your income. • Your monthly payment will never exceed the Standard 10-year Plan amount. • You'll usually pay more over time under the 10-year Standard plan. • You may have to pay income tax on any forgiven amount. • Good option for those seeking PSLF. |

Pay As You Earn Repayment Plan (PAYE)

Repayment Plan | Eligible Loans | Monthly Payment and Time Frame | Eligibility and Other Information |

|---|---|---|---|

Pay As You Earn Repayment Plan (PAYE) | • Direct Subsidized and Unsubsidized Loans • Direct PLUS loans made to students • Direct Consolidation Loans that do not include PLUS loans (Direct or FFEL made to parents) | • Your monthly payments will be 10% of your discretionary income, but never more than you would have paid under the 10-year Standard Repayment Plan. • Payments are recalculated yearly based on your updated income and family size. • You must update your income and family size each year, even if they haven't changed. • If you're married, your spouse's income or loan debt will be considered only if you file a joint tax return. • Any outstanding balance on your loan will be forgiven if you haven't repaid your loan in full after 20 years. | • You must be a new borrower on or after Oct. 1, 2007, and must have received a disbursement of a Direct Loan on or after Oct. 1, 2011. • You must have high debt relative to your income. • Your monthly payment will never exceed the Standard 10-year Plan amount. • You'll usually pay more over time than under the 10-year Standard Plan. • You may have to pay income tax on any amount that is forgiven. • Good option for those seeking PSLF. |

Saving On A Valuable Education (SAVE)

Repayment Plan | Eligible Loans | Monthly Payment and Time Frame | Eligibility and Other Information |

|---|---|---|---|

Saving On A Valuable Education (SAVE) | • Direct Subsidized and Unsubsidized Loans • Direct PLUS loans made to students • Direct Consolidation Loans that do not include PLUS loans (Direct or FFEL made to parents) | • Your monthly payments will be 5% of discretionary income for undergraduate loans, 10% for graduate loans, and a weighted average for borrowers with both. • For SAVE, the income exemption (used to calculate discretionary income) is increased to 225% of the poverty line, compared to the 150% used for IBR and PAYE. • Payments are recalculated yearly based on your updated income and family size. • You must update your income and family size each year, even if they haven't changed. • Any outstanding balance on your loan will be forgiven if you haven't repaid your loan in full after 20 years (if all loans were taken out for undergraduate study) or 25 years (if any loans were taken out for graduate or professional study). | • Any Direct Loan borrower with an eligible loan type may choose this plan. • You'll usually pay more over time than under the 10-year Standard Plan. • You may have to pay income tax on any amount that is forgiven • Good option for those seeking PSLF. |

IDR Payment Calculation

The following table illustrates how income-driven student loan payments are generated within RightCapital. The client's discretionary income is calculated by taking their previous year's AGI from their 1040 Taxes and Fees card and subtracting 225% of the poverty guideline amount based on their family size and residence state.

Public Service Loan Forgiveness (PSLF)

The PSLF Program forgives the remaining balance on clients' Direct Loans after they've made 120 qualifying monthly payments under a qualifying repayment plan while working full-time for a qualifying employer. The amount forgiven will not be taxable income within the financial plan. You can find out more about PSLF by clicking this link.

Within RightCapital, you can use the student loan planning module to identify opportunities for PSLF while illustrating the benefits within a proposed plan. The Loans tab will highlight which loans are PSLF eligible, and the Action Items can be used to model clients working in public service toward PSLF:

Taxation on Loan Forgiveness

Loan Type | Taxation |

|---|---|

IBR | Any outstanding balance on your loan will be forgiven if you haven't repaid your loan in full after 20 years when using IBR. RightCapital will include ordinary income tax for any amount that is forgiven within the financial plan. |

PAYE | Any outstanding balance on your loan will be forgiven if you haven't repaid your loan in full after 20 years when using PAYE. RightCapital will include ordinary income tax for any amount that is forgiven within the financial plan. |

SAVE | Any outstanding balance on the client's loan will be forgiven if it hasn't been repaid fully after 20 years (undergraduate) or 25 years (graduate) when using SAVE. RightCapital will include ordinary income tax for any amount that is forgiven within the financial plan. |

Loan Servicers for Federal Loans

When modeling student loan planning opportunities in RightCapital, specific data is needed to evaluate future strategies. These data points include loan type, payment plan, loan origination date, and the standard ten-year payment. Clients can contact the loan servicer to obtain the relevant details if this data is unavailable on the loan statement.

A loan servicer is a company assigned to handle federal student loan debt on the government's behalf. The loan servicer will assist your client with tasks related to their federal student loans. If the client's circumstances change at any time during their repayment period, the loan servicer will be able to help. If the client is unsure of their loan servicer, look for the most recent communication from the entity sending bills for the client's loan payments.

Loan Servicer Contacting Information

Federal Student Aid Information Center (FSAIC) at 1-800-433-3243.

Below is a list of Federal loan servicers and their contact information. These contacts can be used to gather additional details needed for an in-depth student loan analysis.

Loan Servicer | Contact |

|---|---|

1-855-337-6884 | |

1-833-355-4311 | |

Default Resolution Group (also known as Maximus Federal Services,Inc.) | 1-800-621-3115 (TTY: 1-877-825-9923 for the deaf or hard of hearing) |

1-866-313-3797 | |

1-855-337-6884 | |

1-800-699-2908 | |

1-888-538-7378 | |

1-800-366-4372 | |

1-888-866-4352 | |

1-888-486-4722 |