As of 2024, it is estimated that 20% of all American adults with undergraduate degrees have outstanding student debt. With both private and federal student borrowing on the rise, it is more important than ever to be able to help clients navigate the often murky waters of student loan repayment.

With RightCapital's dedicated Student Loan Analysis tool, you can help clients better understand their student loans, model a number of student loan-specific repayment strategies, and implement these strategies within the broader context of a client's retirement projections. Ultimately, this allows you to provide clients with increased clarity, confidence, and peace of mind when it comes to repaying their student loans.

Student Loan Data Entry

Before you can utilize the student loan module for a client, one or more student loans must be entered into the Net Worth section of a client's Profile. To review the data entry process for student loans, you can visit the link below:

Student Loan Module Overview

The Student Loan module provides you with four subtabs to better visualize the details of a client's loans, as well as Action Items to model possible strategies for dealing with those loans. Below you will find an overview of each of the four subtabs, followed by a deeper dive into the Action Items and the various strategies that can be modeled.

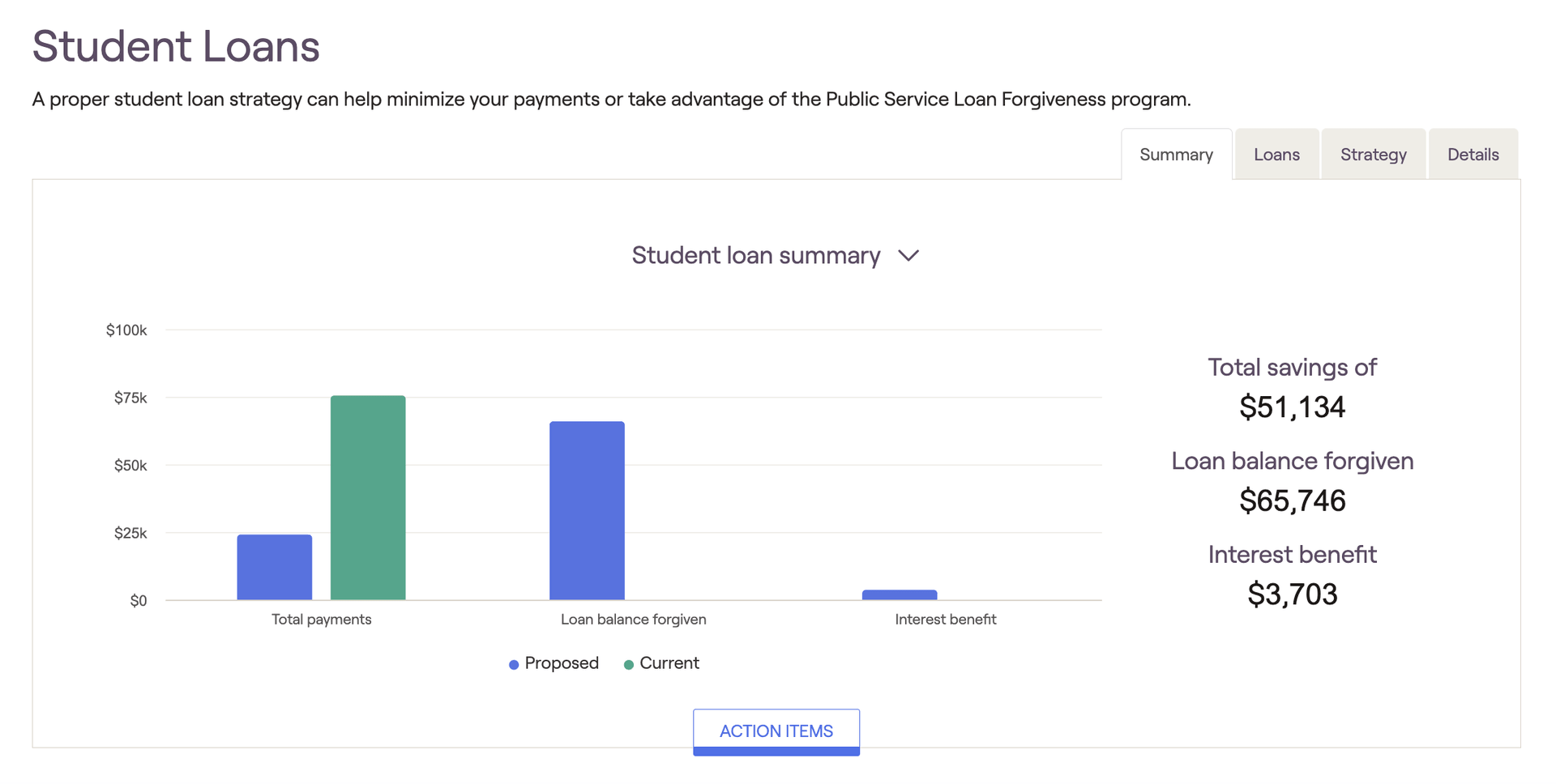

- Summary Tab: Shows the result of an applied strategy compared to the "current" scenario. Though it is the first tab, it is often most helpful to view after having completed the loans and strategy tabs. The Summary tab is fantastic for beginning a client conversation as it summarizes all your hard work.

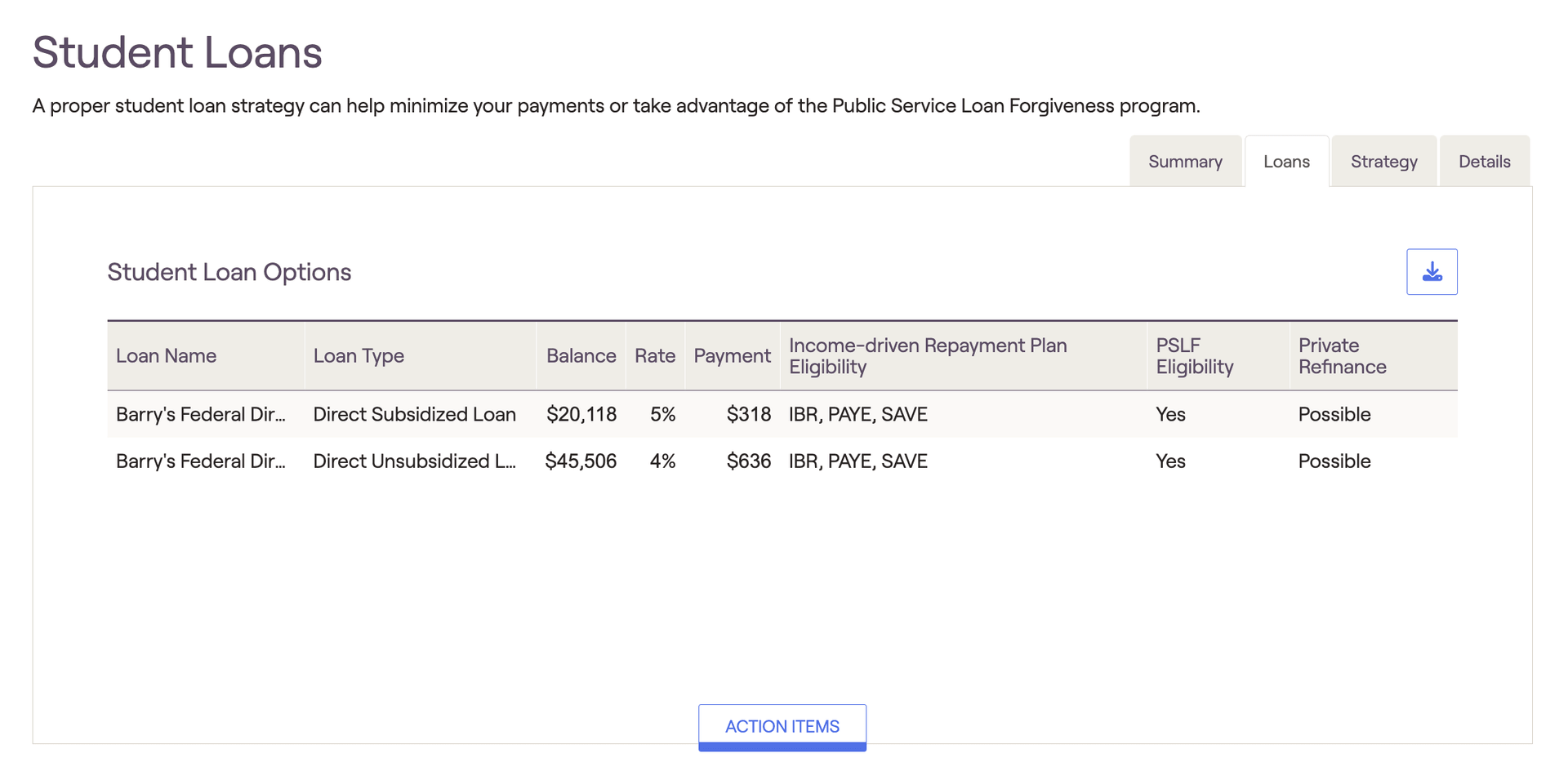

- Loans Tab: Shows the list of student loans included in the client's Profile, indicating what (if any) repayment strategy the loan may be qualified to receive. This is often an excellent place to begin thinking about a strategy - it helps you, the advisor, get your head around the multiple loans involved with a particular client and the potential repayment strategies available to each.

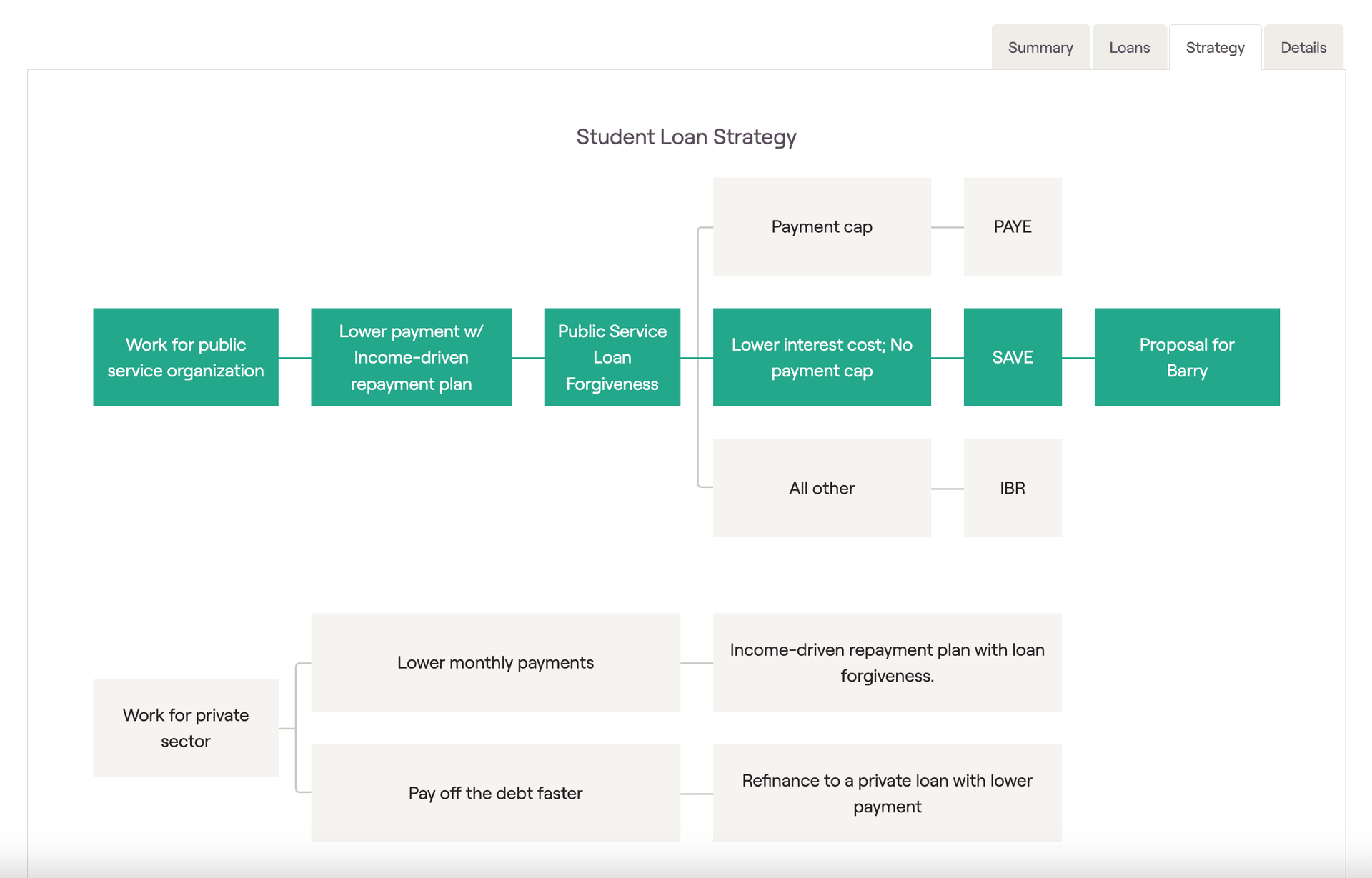

- Strategy Tab: Shows a visual path to advanced repayment or loan forgiveness. This is a great place to begin exploring the Action Items and the impact that various adjustments may make to the overall student loan repayment plan. From the Strategy tab, toggle over to the Summary tab to see how big of a difference various Action Item adjustments make on the repayment horizon for the client.

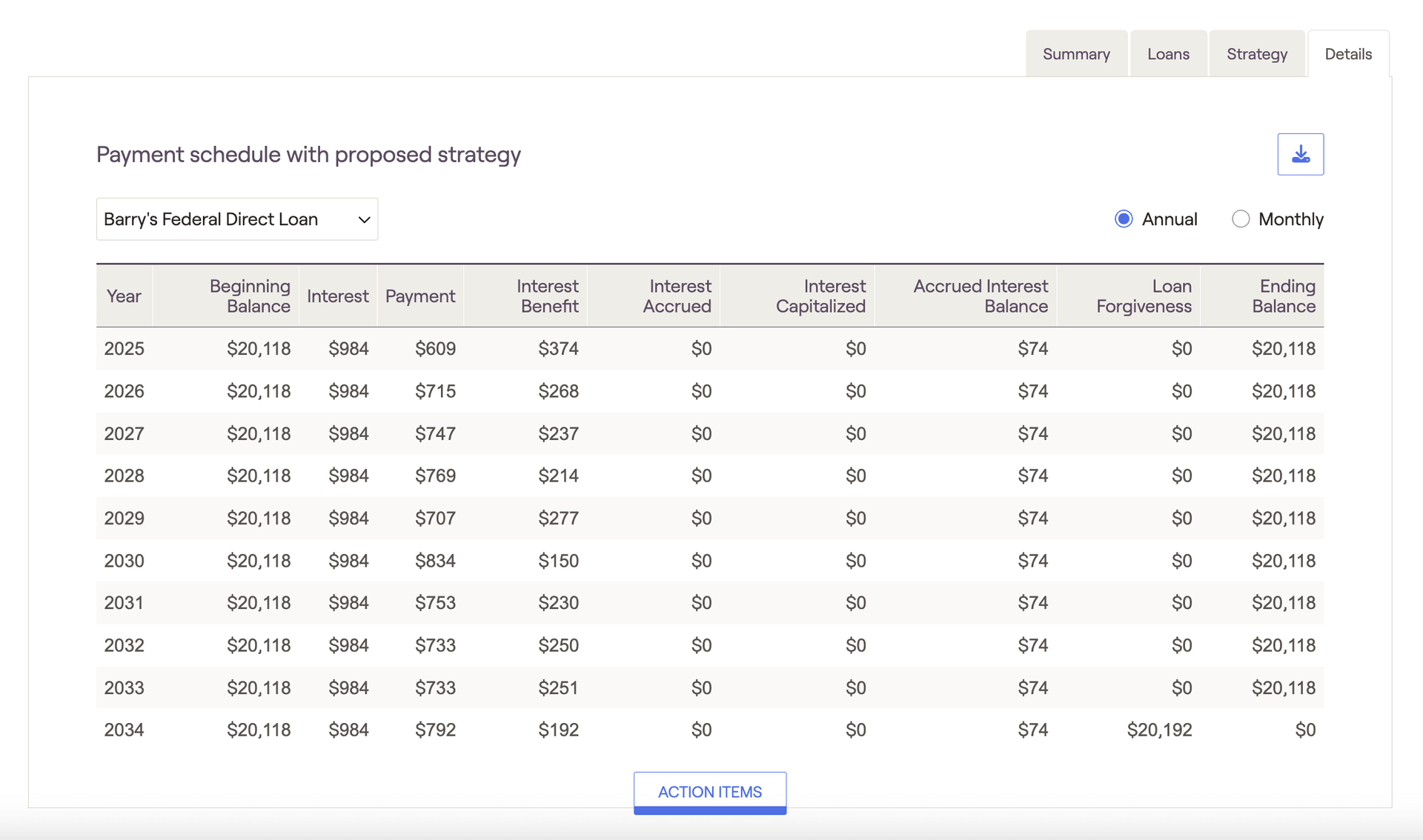

- Details Tab: Shows the annual (or monthly) loan details, including repayment amounts, loan forgiveness, etc. The Details tab displays one loan at a time, which can be selected from a drop-down list. This is helpful for clients concerned with specific cash flow or time-sensitive goals that may impact the repayment schedule.

Summary Tab

The charts here will compare the client's current payment plan in green, to your proposed payment plan in blue. On the right side of the page, you can find the total savings, loan balance forgiven, and interest benefit that your proposed strategy would yield for the client. Total savings indicates the difference in total payments between the two strategies, and the interest saved in the first three years of income-driven repayment plans will be listed under interest benefit.

Loans Tab

Make sure to indicate the client's "new borrower as of..." in the Action Items. This indicates the period during which the client first took out a student loan (exception: if the client took out and paid off a loan and then took out another loan, indicate the later date). This timing influences eligibility for and calculation of specific income-driven repayment plans.

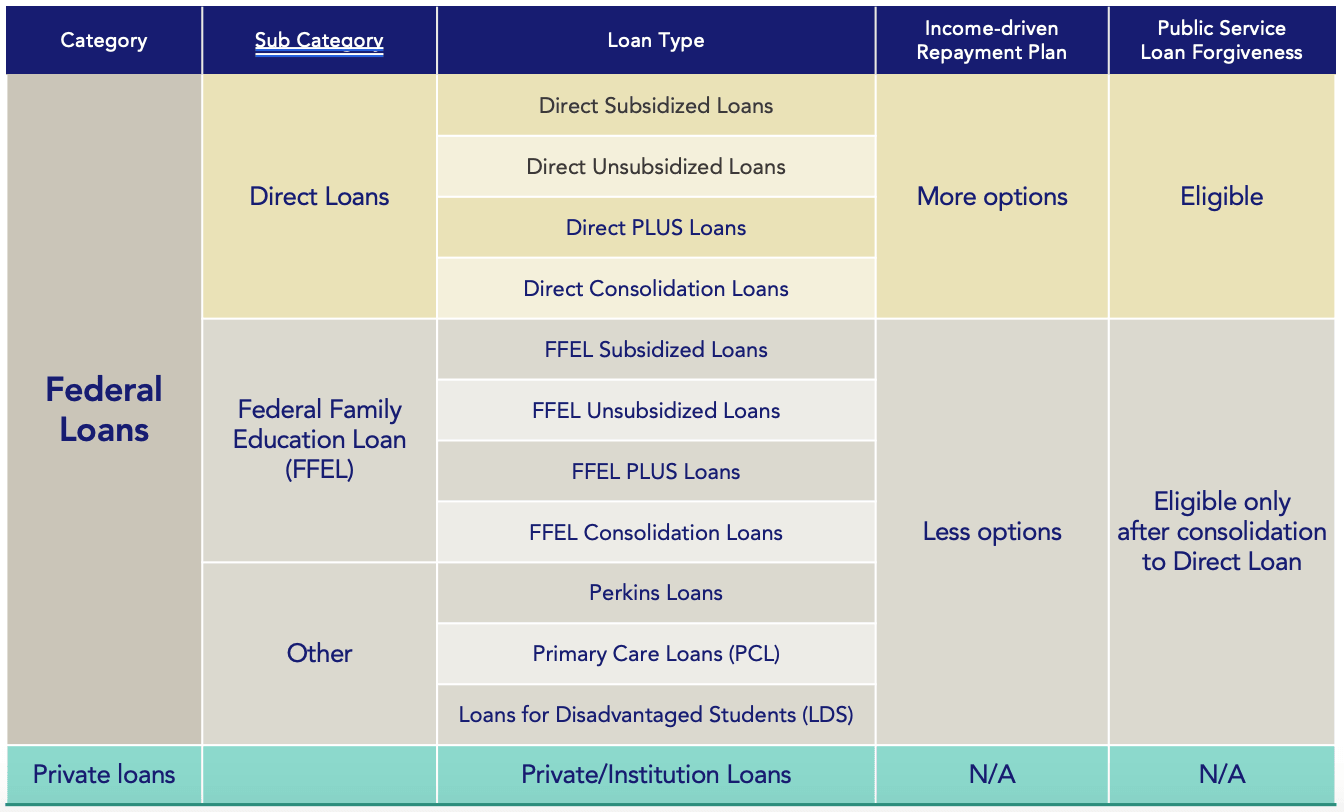

See the chart below for a breakdown of loan types and their impact on income-driven repayment options and Public Service Loan Forgiveness (PSLF) eligibility:

Strategy Tab

Details Tab

You can use the dropdown menu in the upper left to choose which loan you would like to view the payment schedule for. If you've modeled loan consolidation within the Action Items, you will see an option to view the client's consolidated subsidized or unsubsidized loans.

Using the radio buttons in the upper right, you can choose whether you want to view annual or monthly payments. The start date for the annual and monthly schedules will align with your 'Cash flow in simulation starts' setting.

See below for a description of each cash flow column within the Details tab:

- Beginning Balance: Loan balance at the beginning of each monthly / yearly period. The start date will align with your 'Cash flow in simulation starts' setting.

- Interest: Total interest calculated for that year

- Payment: Total payments made for that year

- Interest Benefit: Any net interest (Interest minus Payment amount) that is forgiven each year/month as a result of an IDR plan.

- Interest Accrued: Interest accrued under an income-driven payment plan in a given month / year (not added to the loan balance).

- Interest Capitalized: Interest that is capitalized and added to the loan balance.

- Accrued Interest Balance: Total interest accrued at a given point in time (cumulative). This is the amount would be capitalized and added to the loan balance if the client left their IDR plan.

- Loan Forgiveness: The amount of loan forgiveness that will occur for a given loan, if any. Typically displayed in the final month/year of the schedule.

- Ending Balance: Loan balance at the end of each monthly / yearly period.

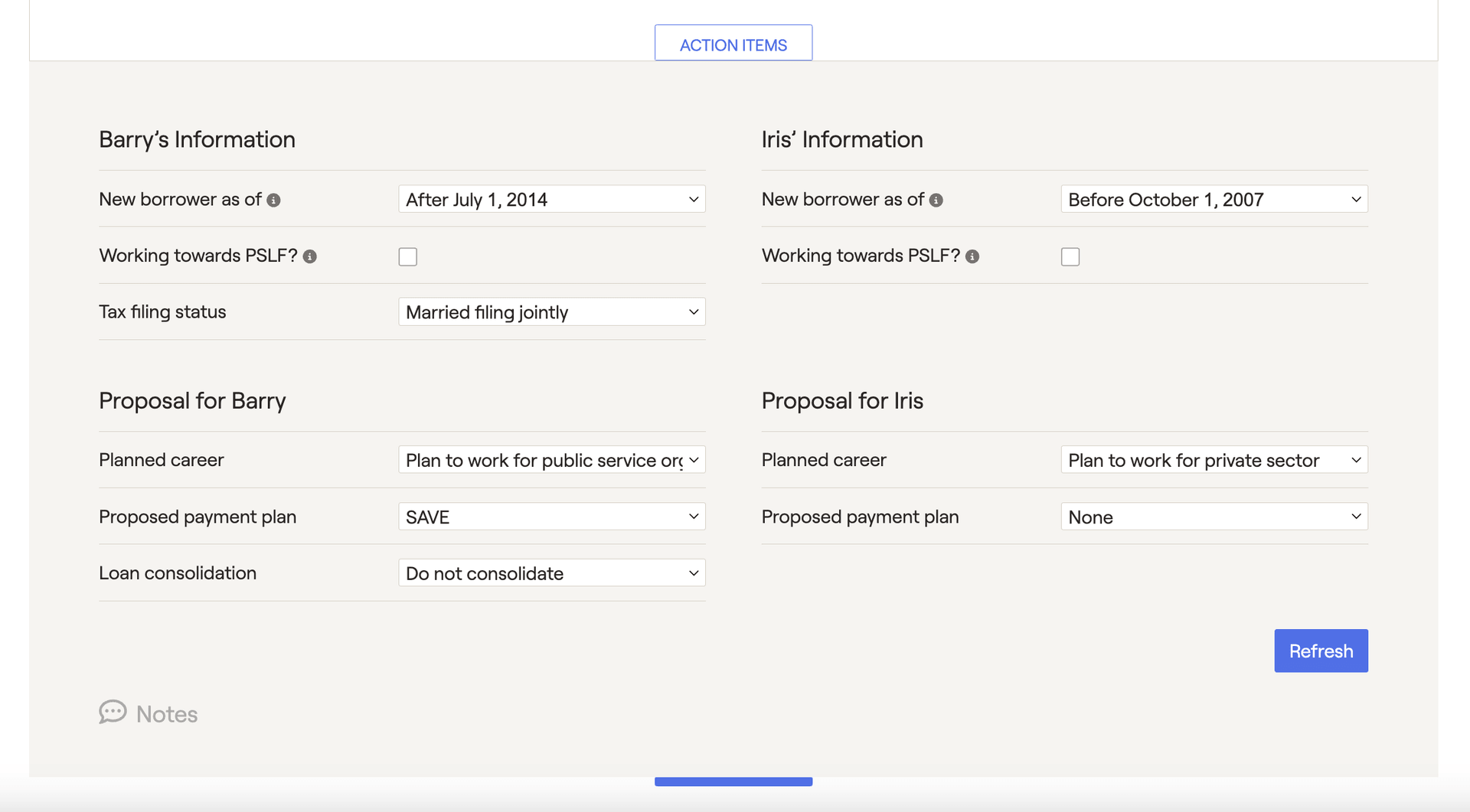

Action Items

[Client's] information

The first step of this process is clarifying each client's information using the first few action items listed:

- New borrower as of - Indicates the period during which the client was last a new borrower (meaning that they obtained a loan and had no outstanding student loans). This date influences eligibility for and calculation of payments under IBR and PAYE plans.

- Working towards PSLF? - Indicates if the client is already working for an eligible public sector employer. With this box checked, an additional field will allow you to specify the total months they have worked there while making student loan payments.

- Tax filing status - Indicates the client's planned tax filing status. This can impact the payment amounts calculated under IBR and PAYE plans.

Planned career

Proposed payment plan

- None: Student loans will reflect whatever payment plans are entered during the data entry process.

- Standard: This will reflect the standard 10-year payment plan.

- IBR / PAYE / SAVE: These three income-driven repayment plans calculate the payment amount based on the client's income, and offer loan forgiveness after 20/25 years. RightCapital will calculate payments using the client's projected Adjusted Gross Income (AGI) within the projections. To arrive at a client's discretionary income, 150% of the state poverty guideline amount is subtracted from the client's AGI (225% for SAVE).

- Refinance: Set an interest rate and duration to show the impact of refinancing all loans.

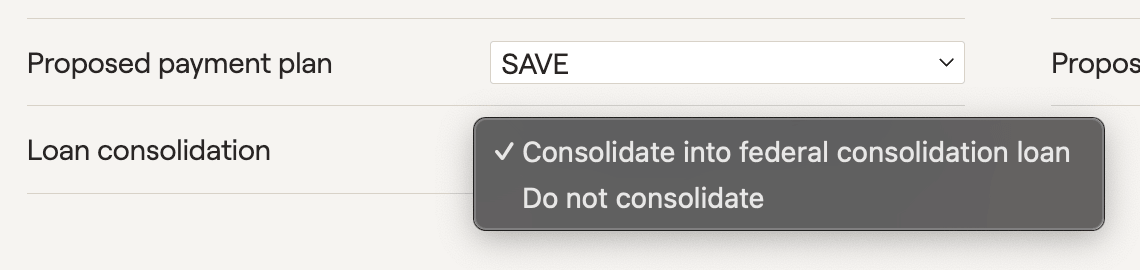

Loan consolidation

If an income-driven repayment plan is chosen, loan consolidation becomes available in a drop-down menu underneath the repayment plan. This will consolidate all loans into one at a weighted average interest rate:

Applying your Proposal in the Retirement Analysis

In a nutshell, the Student Loan tool is a powerful way to make your client's financial future stronger. The repayment strategies mentioned above take incredibly complex calculations, and present them in a simple and comprehensive format. While it can be helpful to see the benefits of your strategy within the Student Loan module itself, you also have the ability to illustrate the impact of your strategy within the broader context of a client's future-looking retirement projections.

To apply a student loan proposal, visit the Retirement Analysis module and access the action items at the bottom of the screen. On the right side of the action items, isolate the 'Student Loan Strategy' dropdown, and choose the 'Student Loan Proposal' option. Once you click Refresh in the lower right, details from the Student Loan module will flow into the Proposed plan:

Interaction with the Debt module

In addition, no changes on the Student Loan screen will impact what is reflected on the Debt screen or vice versa.