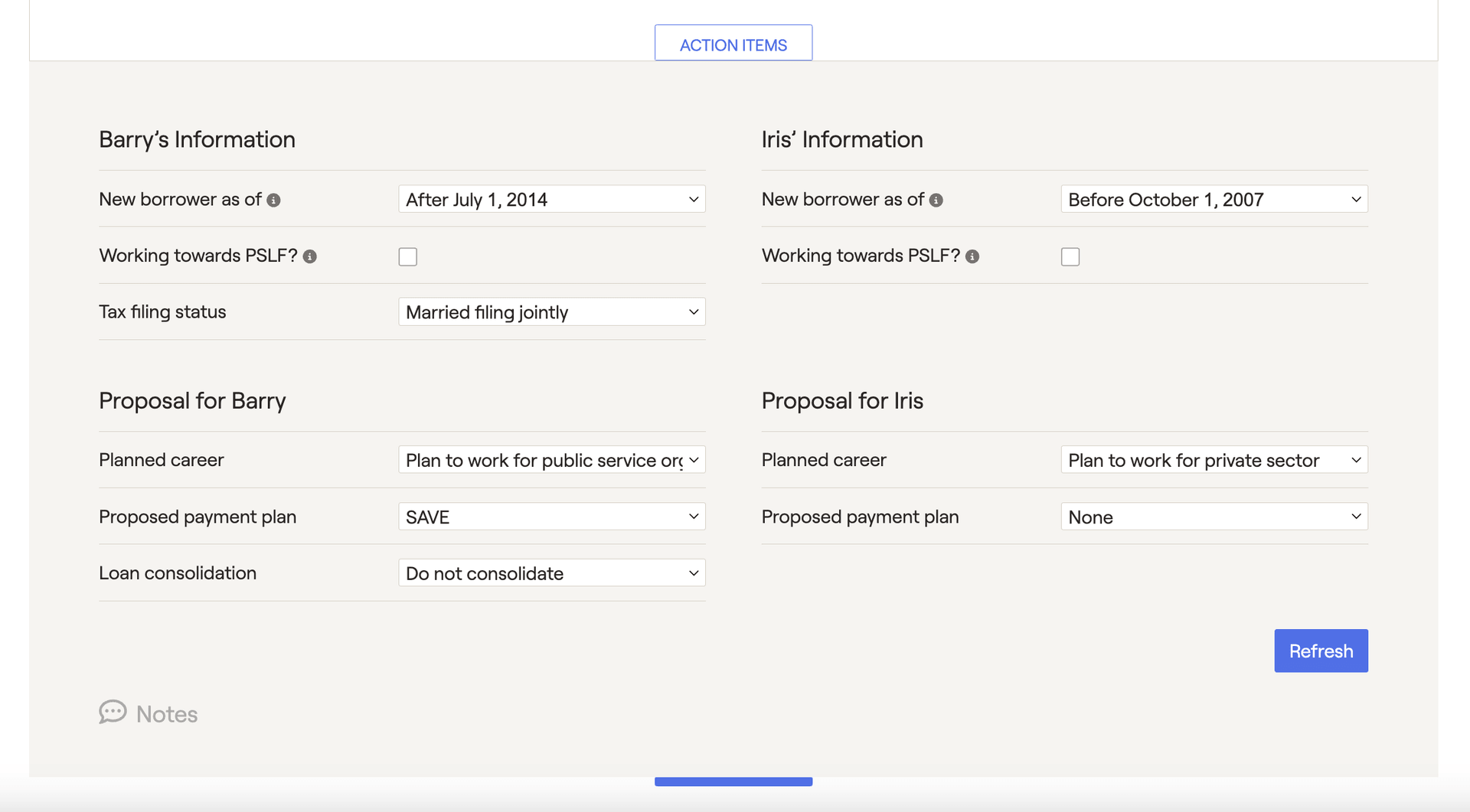

The action items at the bottom of the page are where you can model various student loan repayment strategies for clients. This includes income-driven repayment (IDR) plans, Public Service Loan Forgiveness (PSLF), consolidation, refinancing, and more:

[Client's] information

The first step of this process is clarifying each client's information using the first few action items listed:

- New borrower as of - Indicates the period during which the client was last a new borrower (meaning that they obtained a loan and had no outstanding student loans). This date influences eligibility for and calculation of payments under IBR and PAYE plans.

- Working towards PSLF? - Indicates if the client is already working for an eligible public sector employer. With this box checked, an additional field will allow you to specify the total months they have worked there while making student loan payments.

- Tax filing status - Indicates the client's planned tax filing status. This can impact the payment amounts calculated under IBR and PAYE plans.

Planned career

Proposed payment plan

- None: Student loans will reflect whatever payment plans are entered during the data entry process.

- Standard: This will reflect the standard 10-year payment plan.

- IBR / PAYE / SAVE: These three income-driven repayment plans calculate the payment amount based on the client's income, and offer loan forgiveness after 20/25 years. RightCapital will calculate payments using the client's projected Adjusted Gross Income (AGI) within the projections. To arrive at a client's discretionary income, 150% of the state poverty guideline amount is subtracted from the client's AGI (225% for SAVE).

- Refinance: Set an interest rate and duration to show the impact of refinancing all loans.

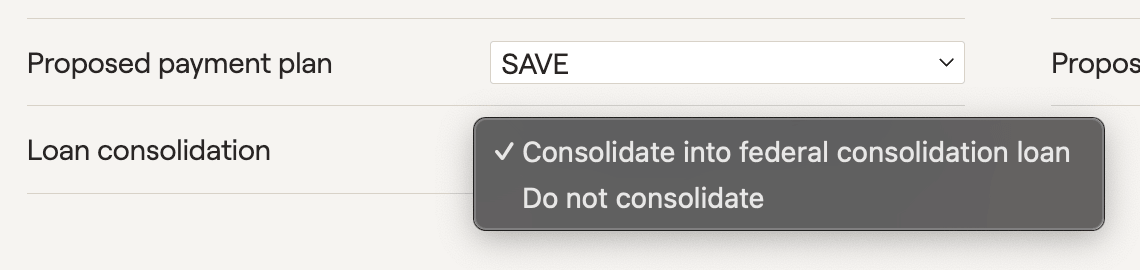

Loan consolidation

If an income-driven repayment plan is chosen, loan consolidation becomes available in a drop-down menu underneath the repayment plan. This will consolidate all loans into one at a weighted average interest rate: