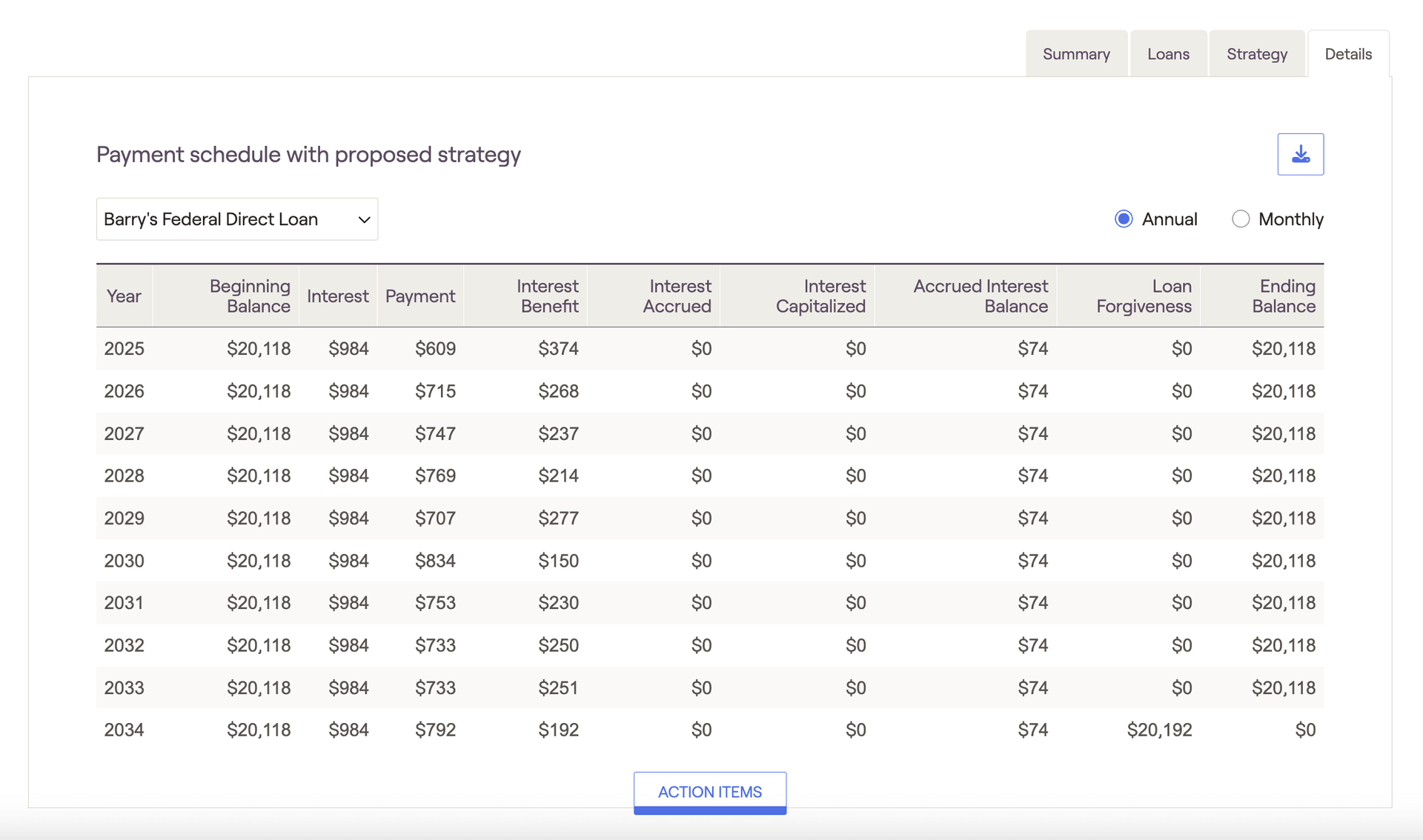

This page allows you to see the full details behind the projected loans, including annual and monthly payment amounts, ending balances, and loan forgiveness. You can use the dropdown menu in the upper left to choose which loan you would like to view the payment schedule for. If you've modeled loan consolidation within the Action Items, you will see an option to view the client's consolidated subsidized or unsubsidized loans.

Using the radio buttons in the upper right, you can choose whether you want to view annual or monthly payments. The start date for the annual and monthly schedules will align with your 'Cash flow in simulation starts' setting.

See below for a description of each cash flow column within the Details tab:

- Beginning Balance: Loan balance at the beginning of each monthly / yearly period. The start date will align with your 'Cash flow in simulation starts' setting.

- Interest: Total interest calculated for that year

- Payment: Total payments made for that year

- Interest Benefit: Any net interest (Interest minus Payment amount) that is forgiven each year/month as a result of an IDR plan.

- Interest Accrued: Interest accrued under an income-driven payment plan in a given month / year (not added to the loan balance).

- Interest Capitalized: Interest that is capitalized and added to the loan balance.

- Accrued Interest Balance: Total interest accrued at a given point in time (cumulative). This is the amount would be capitalized and added to the loan balance if the client left their IDR plan.

- Loan Forgiveness: The amount of loan forgiveness that will occur for a given loan, if any. Typically displayed in the final month/year of the schedule.

- Ending Balance: Loan balance at the end of each monthly / yearly period.