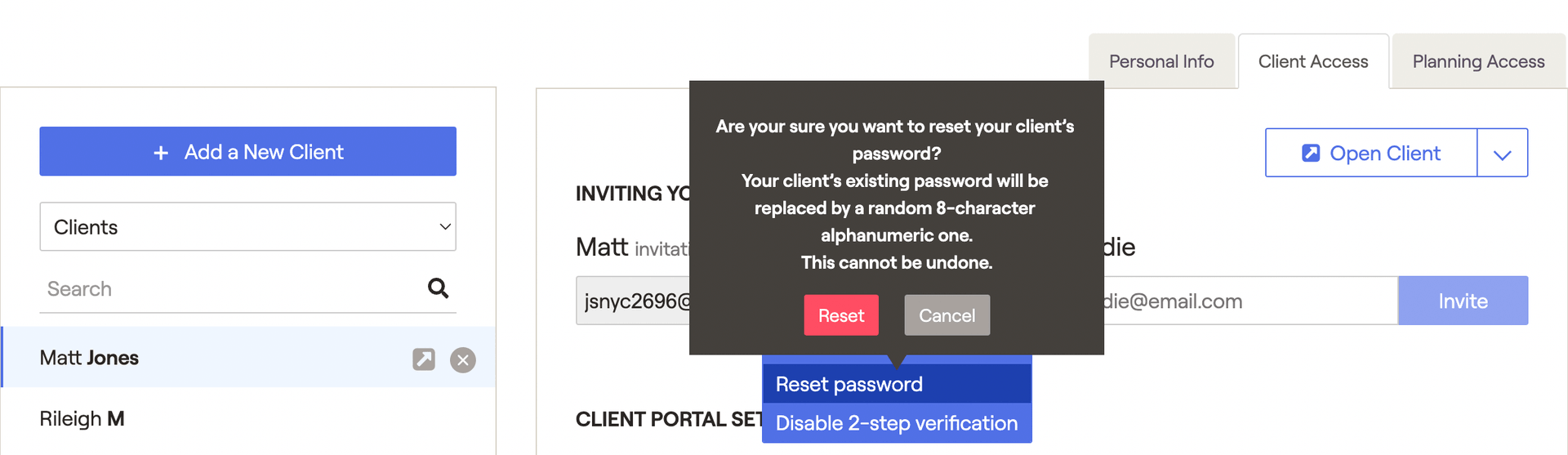

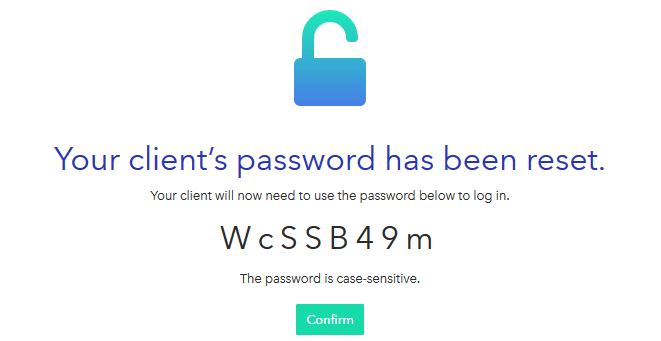

Change a client’s password

If you do not record the randomly generated password to send to your client, the process of resetting the password will need to be repeated to generate another code which can then be saved and used by the client.

Removing access to the Client Portal

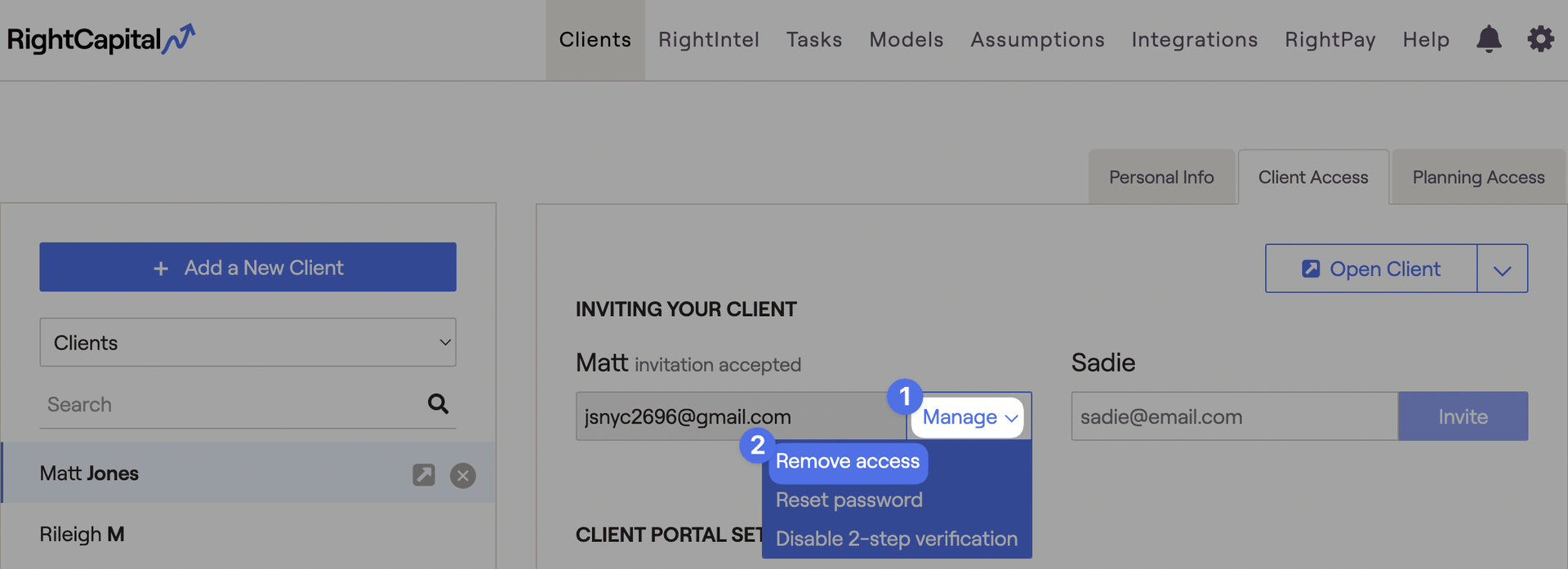

To remove a client’s access (typically because they are no longer a client):

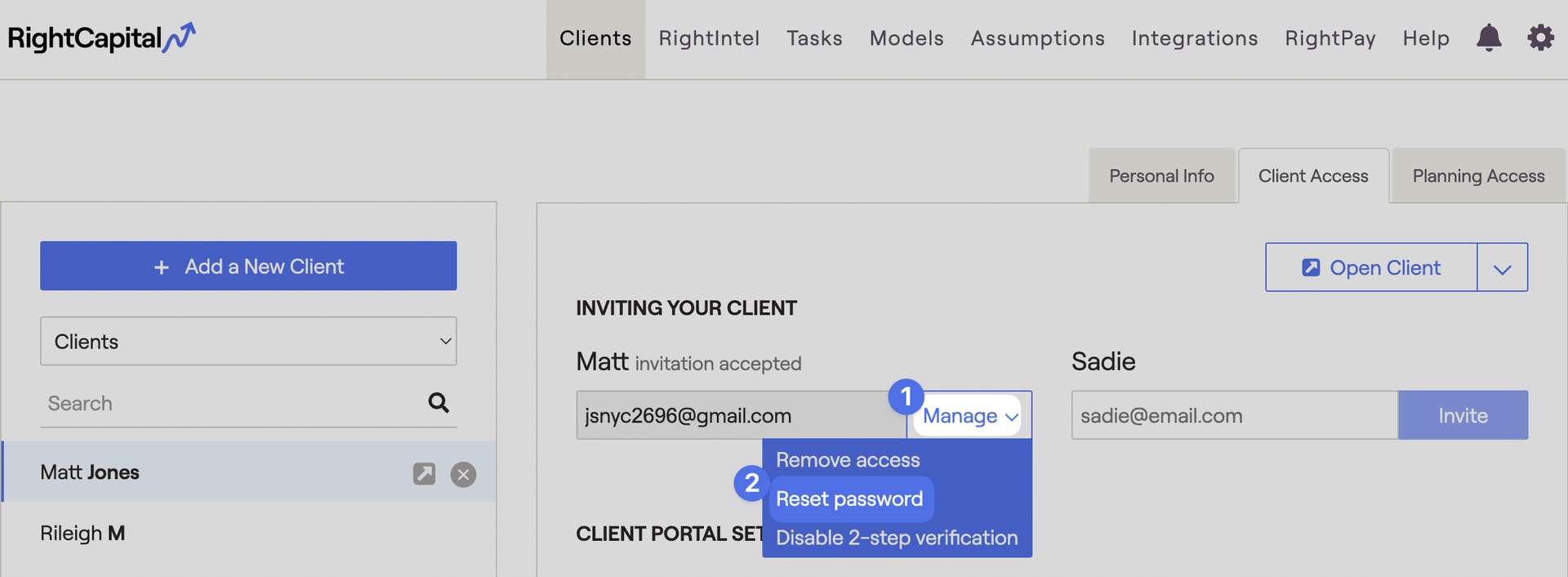

- Navigate to the Advisor Portal > Clients tab

- Choose that client from your client list, and click into their Client Access tab

- Click Manage next to their email address, followed by Remove access:

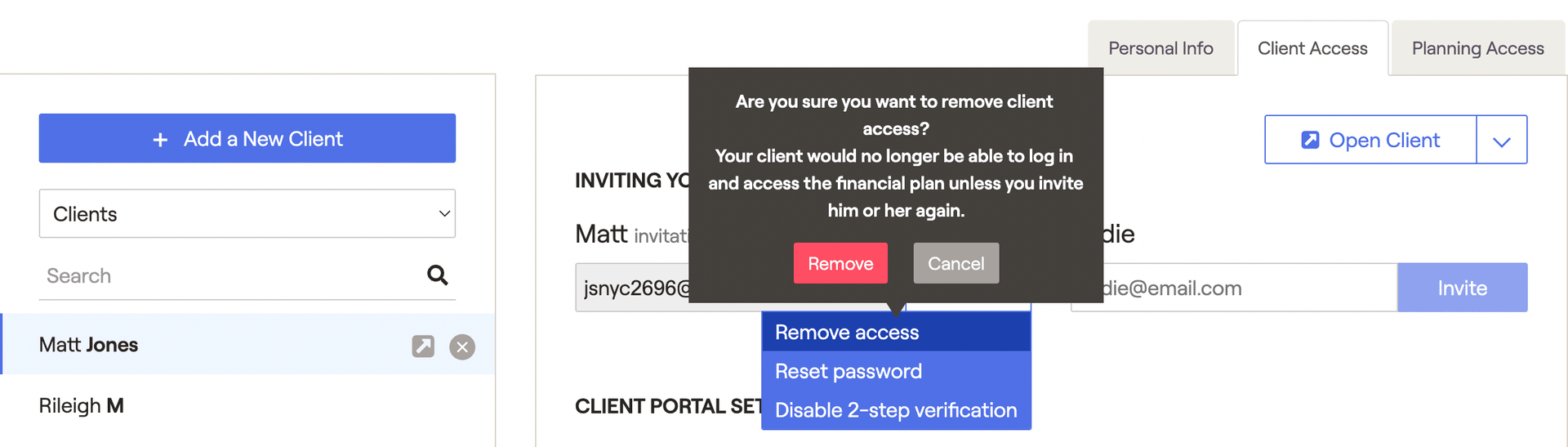

A display box will appear, asking you to confirm that you want to remove this client's access:

- If you remove the invitation before your client accepts it, your client will not be able to sign up with the invitation email they have already received.

- If you remove the invitation after your client accepts it, your client will see a message the next time they try to log in that their advisor has removed their access.

To re-invite a client after removing their access, click the link to read about inviting a client to the Client Portal.

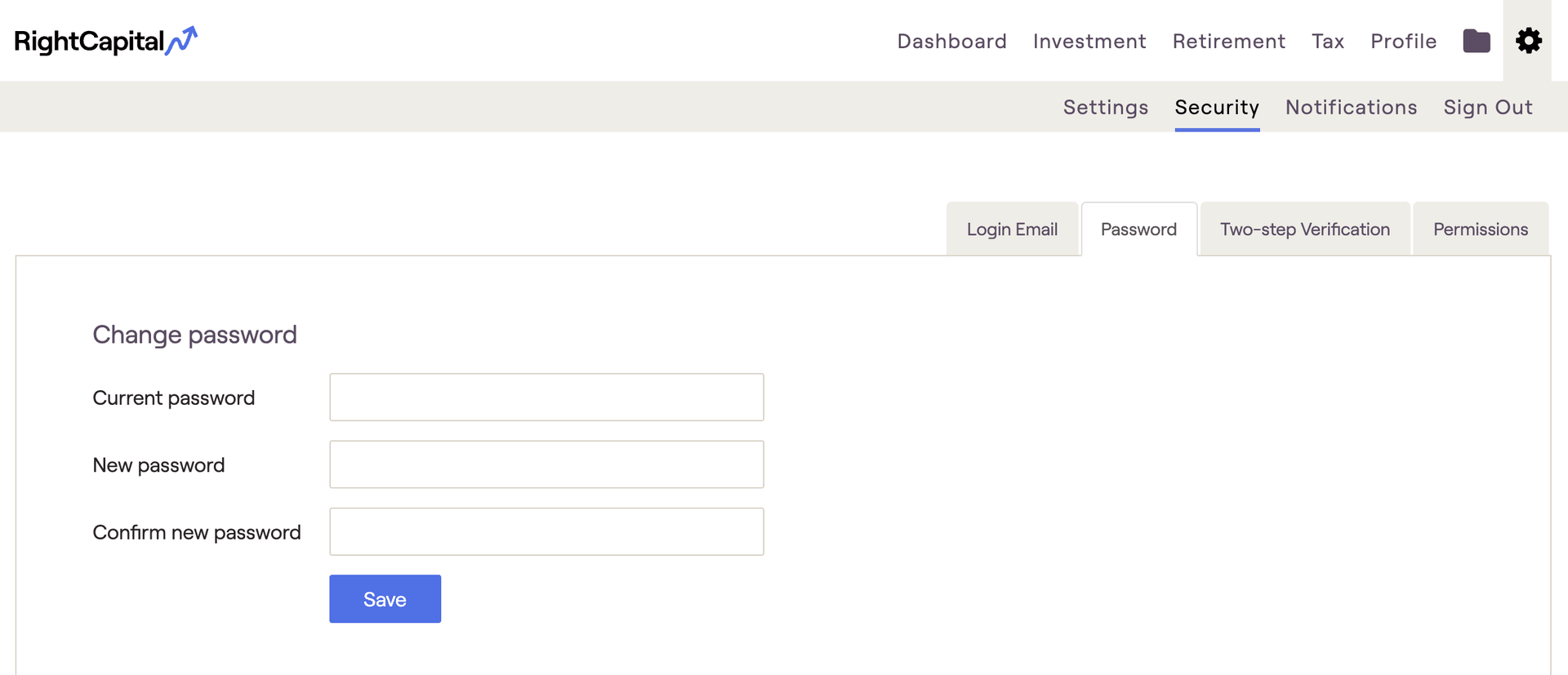

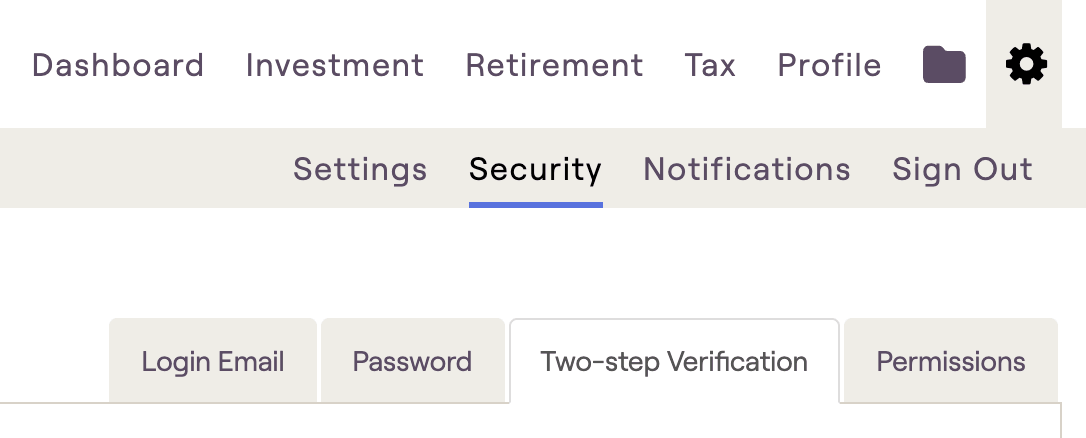

Disabling Two-Step Verification

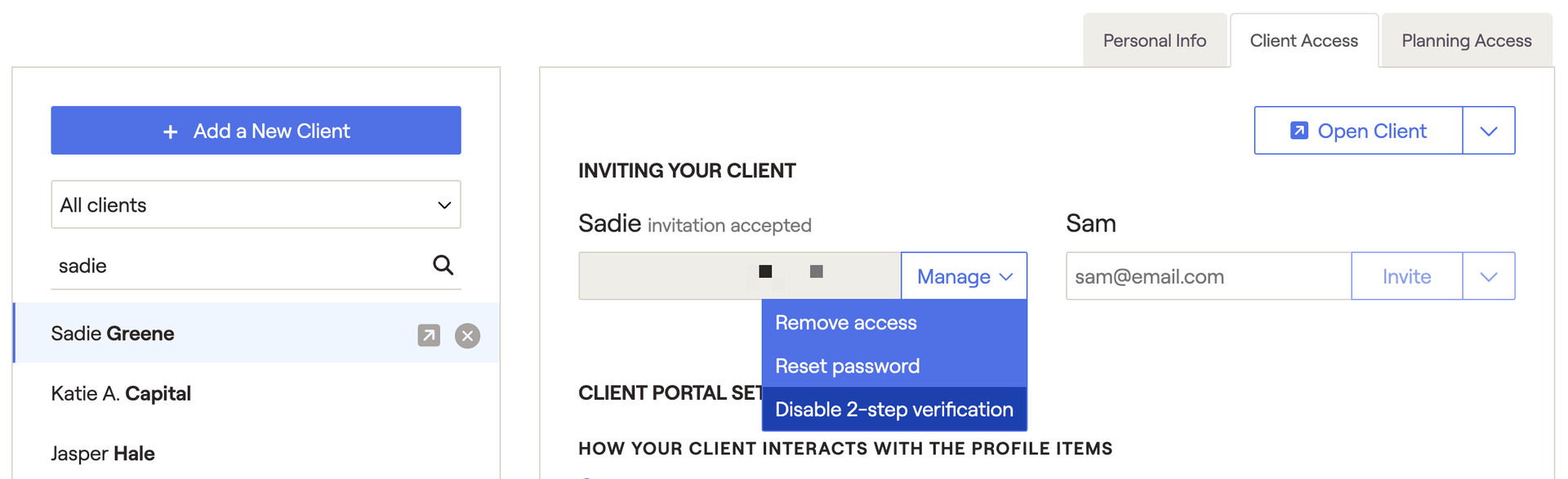

Sometimes a client will get a new cell phone and need you to disable their previous device and reconnect a new one. To accomplish this:

- Navigate to the Advisor Portal > Clients tab

- Choose that client from your client list, and click into their Client Access tab

- Click Manage next to their email address, followed by Disable 2-step verification:

After disabling a client's two-step verification, this will allow the client to reconnect two-step using their new phone. For questions on establishing two-step verification for the advisors OR client, please click here.