Powerful Calculations Made Simple

The human life value calculator provides a fast and simple estimate for life insurance coverage. This calculation produces a benefit amount that is designed to replace income, through retirement, for clients who pass away this year. Determining the right coverage amount is an important aspect in every client's financial planning strategy.

Accessing the human life value calculator

To access the human life value calculator, open the desired client plan, click the "more" (three dots) icon in the upper right corner, and select "Calculator" in the secondary menu.

Human life value calculator overview

This tool allows advisors to quickly determine the benefit amount needed to replace future income from a deceased client. This calculator uses tax adjusted income and discount rates to estimate the present value of future income. For a more comprehensive life insurance evaluation based on the client's detailed cash flow analysis please visit the Life Insurance Analysis Tool article.

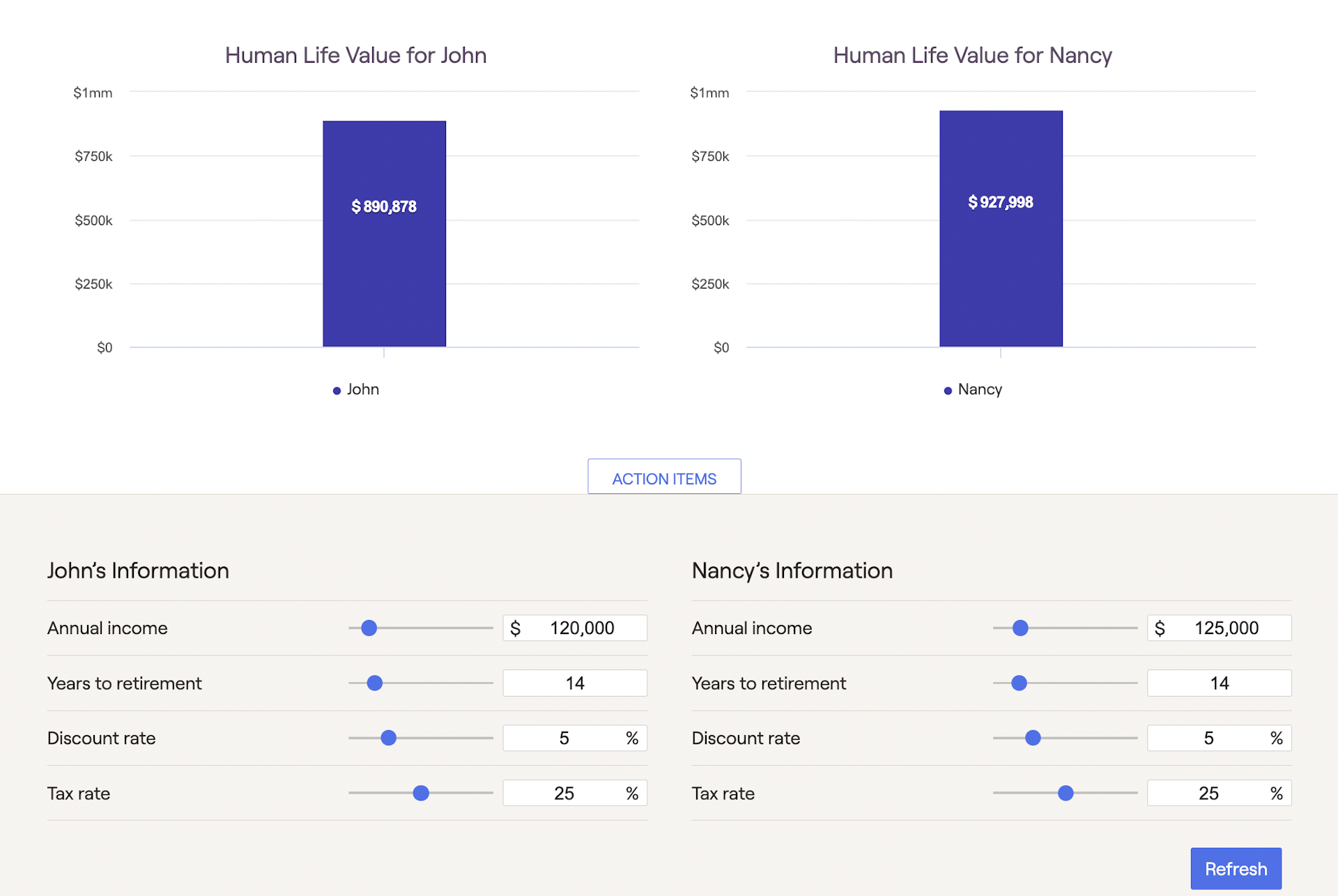

To begin, use the action items at the bottom of the screen to enter annual income and years until retirement for each client. The default values for these fields are pulled from the client's Profile information but can be customized to demonstrate alternative scenarios. The other variables needed to run this calculation are as follows:

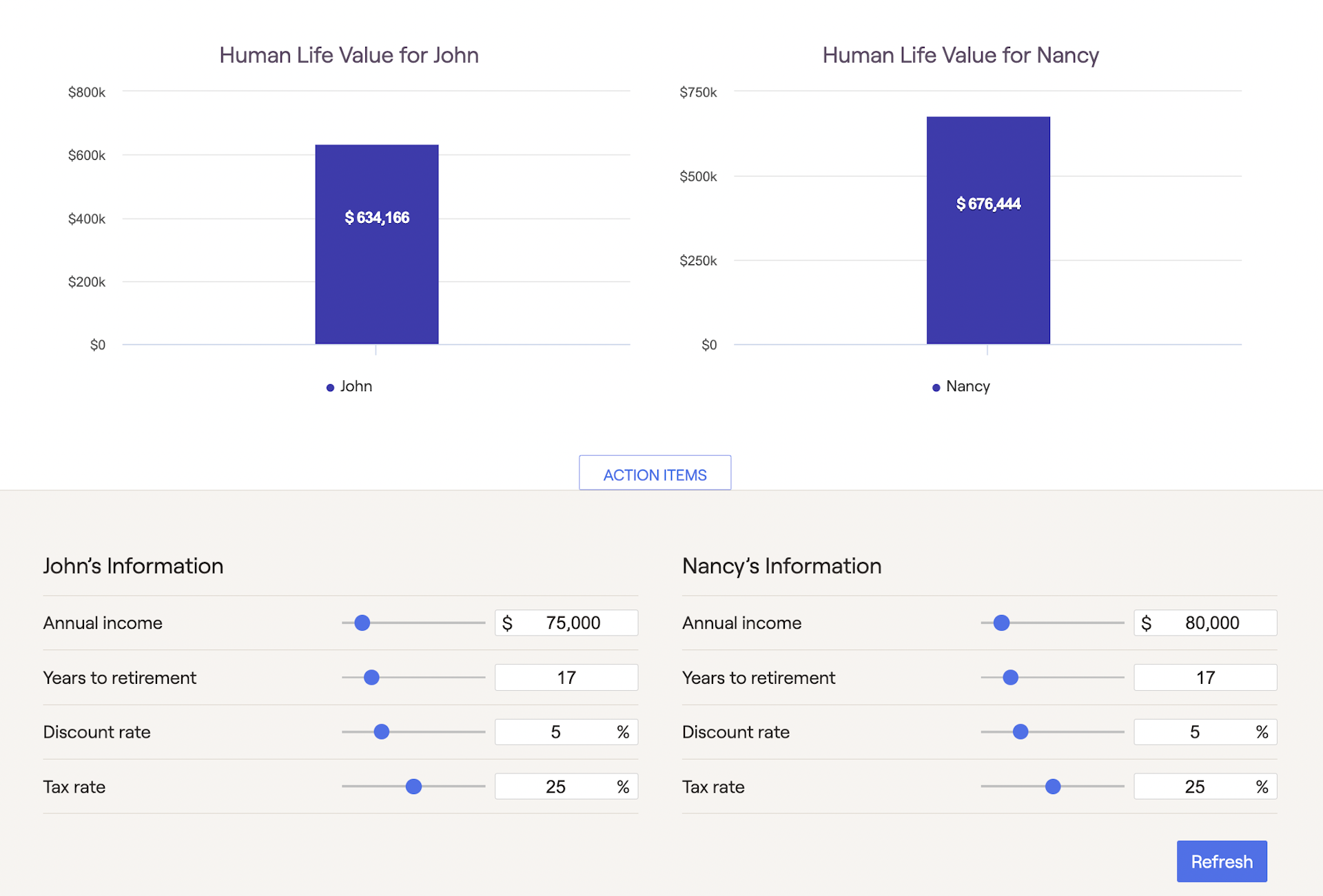

Example of human life value calculation

Consider a client, John, who is 50-year-old and makes $75,000 per year. If John passed away this year, his family will need a life insurance benefit to replace the 17 years of tax adjusted income until retirement. After assuming a 5% discount rate, the present value of John's net income over 17 years is $634,166. Therefore the life insurance benefit needed to replace John's earnings through retirement would be $634,166.