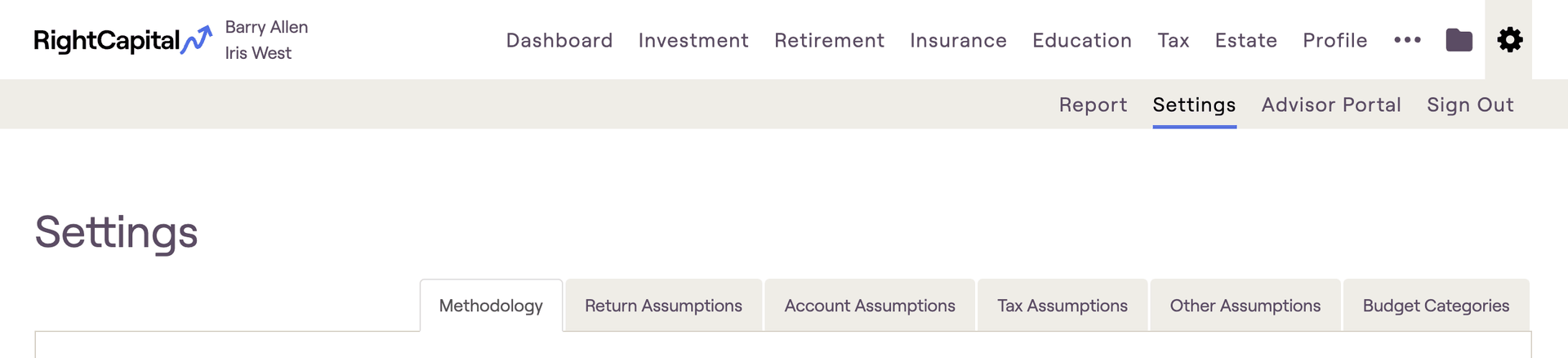

This article will provide you with a brief overview of each subtab, followed by links to more detailed resources. Always remember that if you have any questions, you can reach out to the RightCapital Support Team for assistance!

Methodology

The Gear Icon > Settings > Methodology tab enables you to adjust settings on a client-by-client basis, impacting only the household you are currently working on. You can adjust the global presets for these same settings within your Advisor Portal, by navigating to the Client Settings > Client Presets tab.

For a detailed description of each methodology setting and its impact on your client plans, please reference the resources below:

Return Assumptions

The Gear Icon > Settings > Methodology tab enables you to adjust return assumptions on a client-by-client basis, impacting only the household you are currently working on. The 'Global Assumptions' that each plan will use as a starting point are set within your Advisor Portal, via the Assumptions > Asset Return tab.

For a detailed overview of asset return assumptions at the global level, please reference the resources below:

Account Assumptions

Tax Assumptions

The tax assumptions play an important role in the tax framework used within the plan projections. Capital loss carryover and other carryover values will flow through and impact a client's tax calculations. Entering prior year's MAGI will allow for more accurate calculations that rely on a MAGI lookback, such as Medicare premiums and Student Loan IDR plans.

Most of these inputs are plan-specific, but you can adjust the global presets for some of the tax assumptions within your Advisor Portal by navigating to the Client Settings > Client Presets tab.

Other Assumptions

The inflation assumptions are used to project different types of goals and expenses out into the future. The social security assumptions can be used to reduce future social security benefits within the projections, or to set a discount rate for the social security optimizer. Misc. assumptions impact the cost of purchasing and selling real estate, as well as the reduction in living expenses associated with the death of a client.

Both the inflation assumptions and miscellaneous assumptions can be adjusted on a client-by-client basis within this area, impacting only the household you are currently working on. The 'Global Assumptions' that each plan will use as a starting point are set within your Advisor Portal, via the Assumptions > Inflation tab, and Misc. tab, respectively.

For more information on Other Assumptions, as well as an overview of inflation assumptions at the global level, please reference the resources below:

Budget Categories

Expense categories are used when filling out a detailed worksheet in the pre-retirement living expense or retirement living expense data cards. Expense, income and other categories are all used within RightCapital's Budget Analysis tool for advisors with premium or platinum subscriptions.

To learn more about budget categories and RightCapital Budget Analysis tool, please reference the links below: