Overview

The following updates to the system have been made to reflect the SECURE Act 2.0 changes.

Increased Age for Required Minimum Distributions

The SECURE Act 2.0 extended the age at which RMDs begin for specific individuals. The age at which RMDs begin is as follows:

Birth Year | Age RMDs Begin |

|---|---|

1950 or earlier | 72 |

1951 - 1959 | 73 |

1960 or later | 75 (Effective 2033) |

Roth 401(k) Required Minimum Distributions

Starting in 2024, there will be no Required Minimum Distributions for Roth 401(k) accounts.

Qualified Charitable Distributions (QCD)

Beginning in 2024, the maximum annual QCD limit will be indexed to tax inflation. The 2024 limit is $105,000 (up $5,000 from 2023).

For more information on Qualified Charitable Distributions (QCD), please reference this article.

For more information on inflation assumptions, please reference this article.

Changes to Employer-Sponsored Retirement Plans

There are increases in employer-sponsored retirement plan catch-up contributions for specific individuals.

Starting in 2025, for 401(k), Roth 401(k), 403(b), Roth 403(b), 457(b), and Roth 457(b) accounts, individuals aged 60, 61, 62, and 63 will have their catch-up contribution limit increased to $10,000.

Starting in 2025, individuals aged 60, 61, 62, and 63 will have their Simple IRA catch-up contribution limit increased to $5,000.

RightCapital will make further adjustments to the catch-up contribution limits as more details become available.

New Roth Savings Options

We have added three new savings types. This includes Roth Solo 401(k), Roth SEP IRA, and Roth SIMPLE IRA.

Roth Solo 401(k) contributions are for self-employed clients with their own 401(k) plan. Total contributions to all defined contribution plans (employee plus employer) will be capped at the IRS maximum value ($69,000 for 2024, plus an additional $7,500 'catch up' for those 50 and over).

All contributions are employer contributions. Total contributions to defined contribution plans will be capped at the lesser of 25% of compensation or $69,000 for 2024.

Employee contributions are capped at the IRS limit ($16,000 for 2024 + $3,500 catch up for those 50 and over).

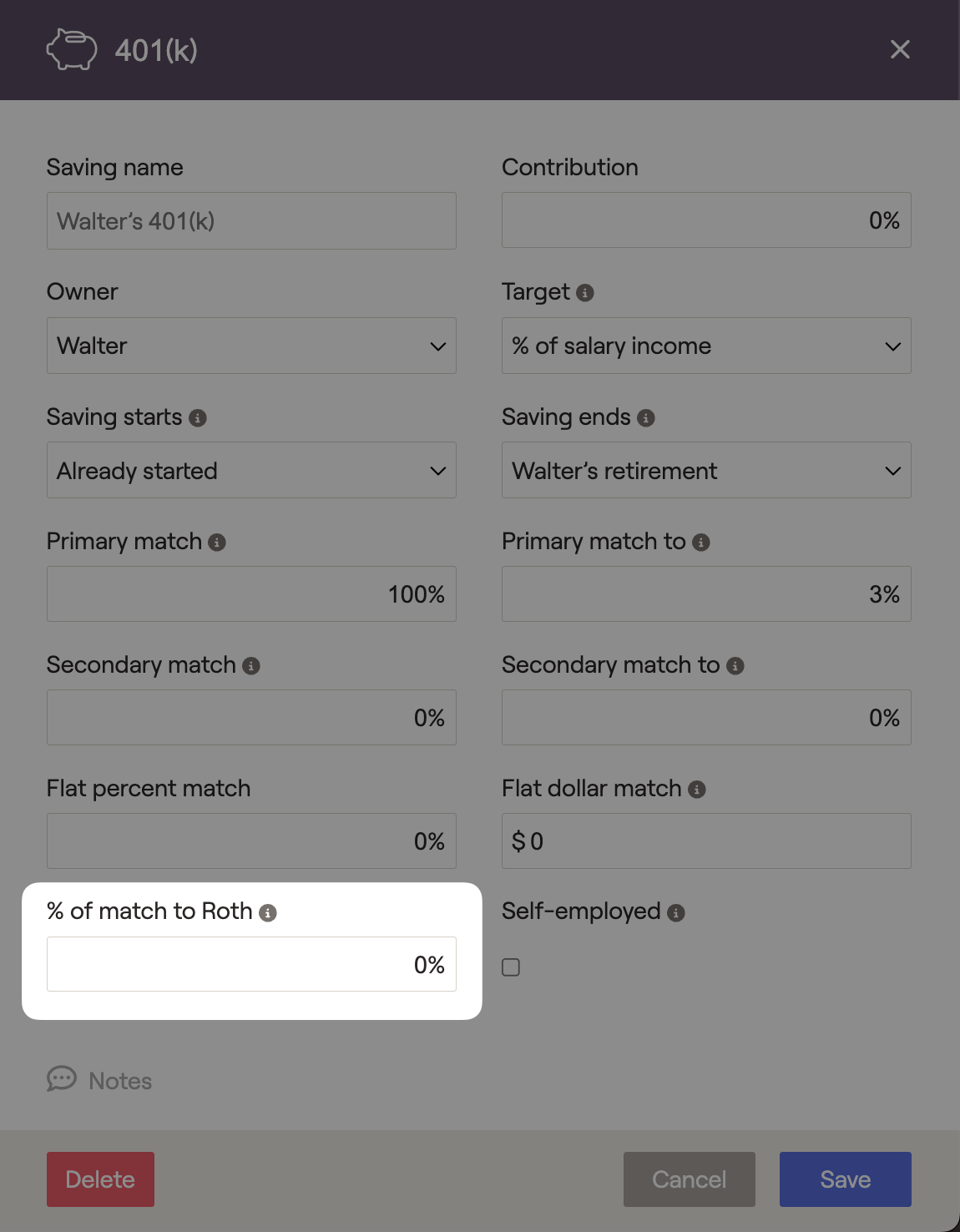

A new % of match to Roth field has been added to the savings card to allow you to reflect the percentage of the employer contribution that will be deposited into the designed Roth account.