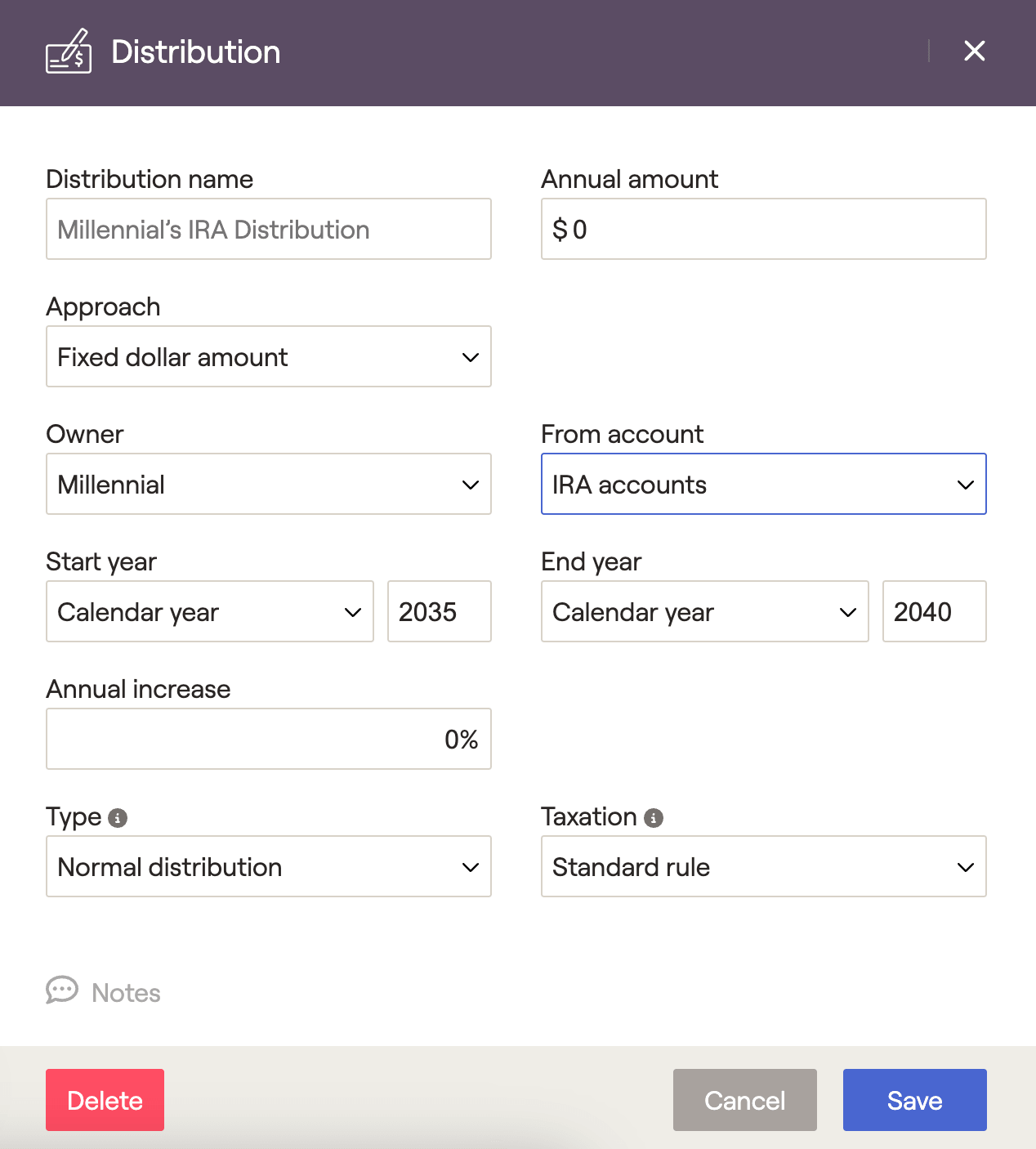

Adding Income Distributions & RMDs

One of the options on the Profile > Income > Add Income screen is to enter specific distributions from client accounts. This article dives into that particular feature in detail.

Additionally, income distributions can be added directly to a proposed plan within the Retirement > Analysis module. This allows for an easy comparison of scenarios with different distribution strategies. For more information on adding income distributions into the Retirement > Analysis module, click here.

By default, RightCapital will take money from taxable accounts first and tax-advantaged accounts later when funding a cash flow deficit.

To illustrate a specific distribution from different types of accounts, use income distribution cards. When a distribution is created, RightCapital will automatically take money from the accounts specified and distribute them to the client's cash flow.

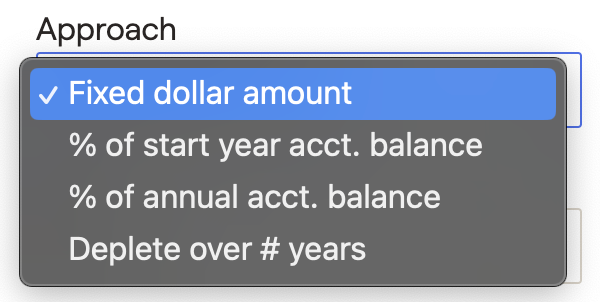

Distribution Approach

Users can specify the distribution method with four different approaches when adding income distributions.

- Fixed dollar amount: This allows the user to enter a fixed dollar amount that can be distributed over the designated start and stop years.

- "% of start year acct. balance": This allows the user to enter a percentage of the start year account balance. We will calculate that percentage of the ending account value in the year the distribution starts and distribute the same amount every year.

For example, if a 10% distribution from IRA accounts starting in 2030 is specified, and the 2030 IRA balance is $300,000, we will distribute $30,000/yr beginning in 2030. An annual increase can be added to increase that amount by a flat % each year.

- "% of annual acct. balance": The user can enter the annual account balance percentage. We will calculate that percentage of the ending account value in each year of the distribution. This amount distributed each year can change based on the account balance.

For example, if a 10% distribution is specified from 2030-2032, we will distribute 10% of the 2030 ending balance in 2030, 10% of the 2031 ending balance in 2031, and 10% of the 2032 ending balance in 2032.

- "Deplete over # years": This allows the user to enter a number of years over which the entire account will be depleted. We will calculate a distribution beginning in the start year such that the total balance is depleted in the number of years specified. Each year, the distribution will be based on the number of years remaining until depletion.

For example, if there are ten years left, 1/10 of the value will be distributed; if there are four years left, 1/4 of the value will be distributed.

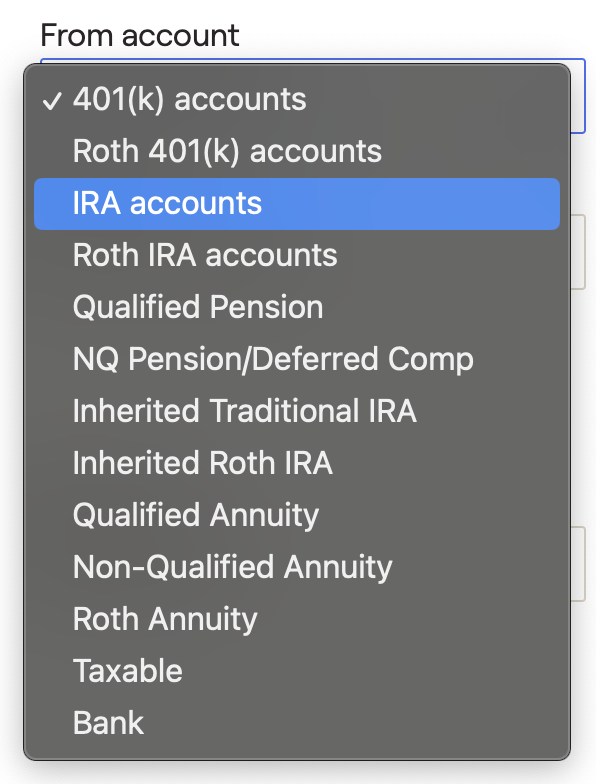

Identifying the type of account

To successfully distribute the assets, the owner and type of account must match the investment account set up on Profile > Net Worth.

Use the drop-down boxes to select the Owner and type of account:

Distributions are funded from buckets of assets owned by each client rather than specific accounts.

Distributions from bank accounts will only display when utilizing on of the 'treat bank account as cash' options within the Client Settings area.

Deferred Compensation distributions will distribute from the non-qualified pension accounts.

- Distributions from annuities are only allowed if the distribution type on the annuity is Regular withdrawals. For more information, see the Annuities article.

Certain account types cannot be distributed such as 529s and HSAs.

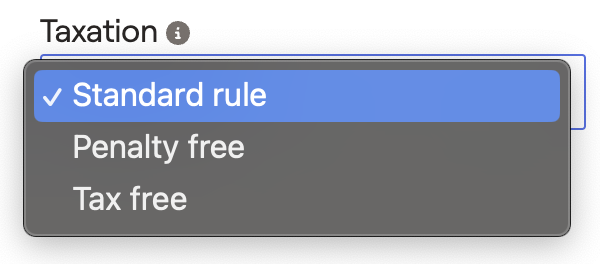

- When distributing from a taxable account you have the option to specify cost basis within the Taxation dropdown menu:

Enter the percentage of the distribution that should be treated as cost basis, the rest will be treated as gains. Percentage of gains treated as long term vs short term can be adjusted in the Gear Icon > Settings > Tax Assumptions tab.

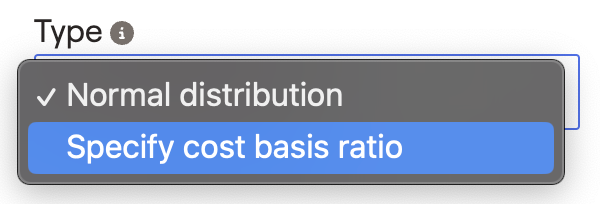

Conversion/Rollovers and Taxation

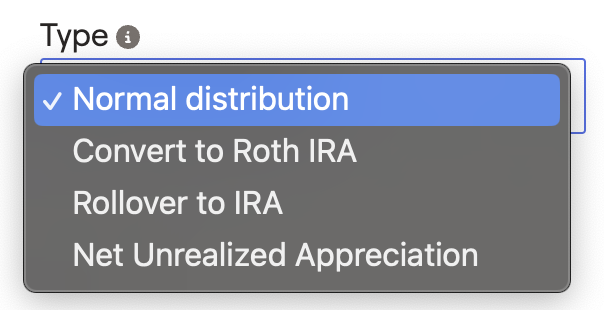

- Normal distribution will distribute the assets from the specified type of account and apply standard Taxation (subject to the selection in the 'Taxation' drop-down box.) The amount will be distributed into cash flows, and any positive net cash flow due to the distribution will be saved into the taxable account.

- Use the Convert to Roth IRA option to illustrate Roth conversions from IRA / 401(k) / Roth 401(k) accounts. Assets will be converted to a Roth IRA account. For more information, see the article on tax distribution and conversion.

- Use the Rollover to IRA option to illustrate rolling money from a 401(k), Qualified Pension, or Qualified Annuity (regular withdrawals only) to an IRA account. This option has no tax ramifications.

- Net Unrealized Appreciation allows you to illustrate the impact of selling appreciated company stock in clients' 401(k) or other defined contribution plans via a rule referred to as "Net Unrealized Appreciation" (NUA). The NUA strategy cannot be spread over multiple years as it require the entire account to be distributed. If advisors split distributions between an NUA and Rollover IRA, two distribution cards should be entered for the same account type and owner during the specified calendar year.

To create an NUA strategy, use the following steps.

When entering an Income Distribution card on the Profile / Income screen, you can select "Net Unrealized Appreciation" under the 'Type' drop-down box.

You can then enter the 'NUA cost basis', which is the original basis of the shares to be sold, along with the amount.

The amount entered as 'NUA cost basis' will be taxed as ordinary income, while the gain (difference between the amount and the cost basis) will be taxed as long-term capital gains.

The total amount will be distributed into cash flows, and any positive net cash flow due to the distribution will be saved into the taxable account.

Only the distribution from company stock should be entered as an NUA distribution; if the client is liquidating a 401(k) account that includes stock and other assets, they should enter two distribution cards.

You can only illustrate NUA distributions if the 'From account' type is "401(k) accounts"

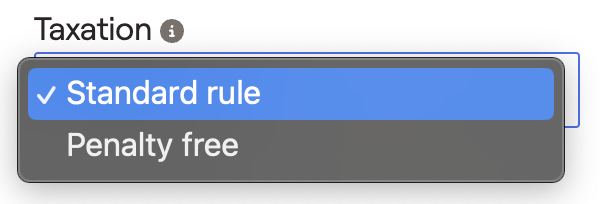

When illustrating an NUA distribution, you will have two available options for Taxation: "Standard rule or Penalty free"

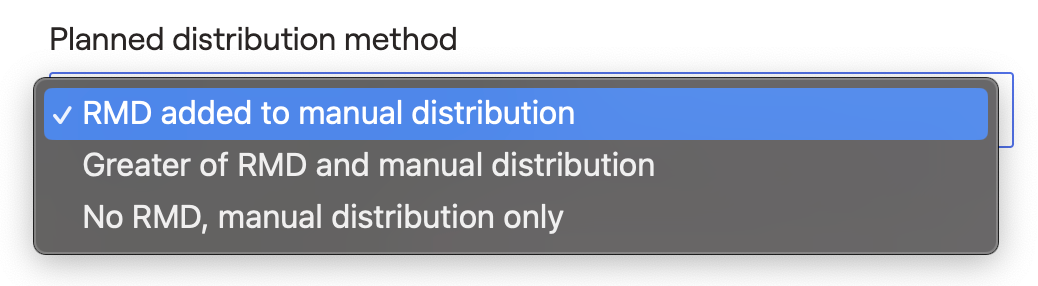

Distributions and RMDs

For distributions from IRA, 401(k), Roth 401(k), Qualified Pensions, and Inherited IRA accounts, control how the distributions interact with the required distributions that RightCapital automatically calculates. To update the setting for a specific client, in the main advisor portal, select their name in the client list and click on the 'Settings' tab.

For more information, see the article on how to change planning settings on a client-by-client basis: planned distribution settings.