In RightCapital, you are always in control of the underlying assumptions that drive your plan output. You have complete control over the tax assumptions within each and every client plan, providing a platform for world-class, personally tailored advising.

The Tax Assumptions page allows you to:

- Adjust your Ordinary Income Tax Rate Adjustment, Portfolio Turnover, and other important tax assumptions

- Enter capital loss carryover and other carryover values from previous years

- Specify prior year's MAGI for more accurate Medicare and student loan calculations

Taxes

Additional Tax Assumptions

Use this field to enter the percentage of dividends assumed to be tax-qualified.

This field indicates the percentage of capital gains that are assumed to be long-term capital gains.

Use this area to adjust the average annual turnover in taxable accounts. This value represents annual portfolio balancing and will produce capital gains in the plan.

Enter a percentage of AGI to be treated as a misc. itemized deductible when applicable.

Carryover Values from Previous Years

Enter the long-term capital loss carryover amount that will impact the client plan. It can be seen by adjusting taxes in the Tax module > Tax Estimate > Details > Schedule 1 Line 7.

The charitable giving carryover amount- cash will be capped at 60% of the client's AGI. It can be seen impacting the plan within the Tax module > Tax Estimate > Details > Schedule A, under 'Gifts to Charity'.

The charitable giving carryover amount- appreciated assets will be capped at 30% of the client's AGI. It can be seen impacting the plan within the Tax module > Tax Estimate > Details > Schedule A, under 'Gifts to Charity'.

Enter the AMT credit carryforward amount from prior year's exercise of ISO grants. This can be seen impacting taxes in the Tax module > Tax Estimate > Details > Alternative Minimum Tax form.

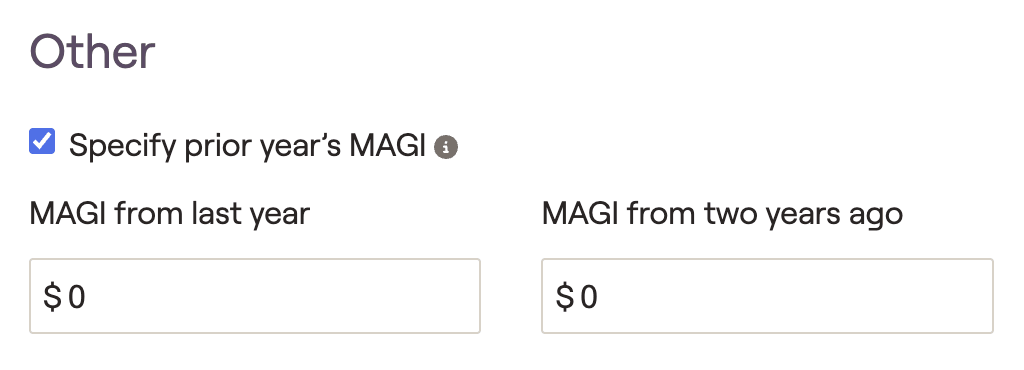

Specify Prior Year’s MAGI

After checking the box, you'll be able to enter the household's MAGI values from the two years prior to the start of your cash flow projections. This will allow for more accurate calculations that rely on a MAGI lookback, such as Medicare premiums (two-year lookback) and Student Loan IDR plans (one-year lookback).

Impact of Tax Filing Status

Within joint plans that are set to Married Filing Separately or Non-Married Filing Single within the Profile > Expenses > Taxes and Fees card, certain tax assumptions will be split between the client and the co-client. This allows you to enter separate values for each client: