Vesting schedules within RightCapital are a crucial component of Stock Plan data entry. When clients receive equity compensation in the form of a grant, there is typically a specified term of employment that needs to be contractually fulfilled before taking ownership of the equity. This is referred to as the vesting schedule. Simply put, vesting represents a client's ability to earn rights to equity shares over a period of time.

Default Vesting Schedules

RightCapital includes three "default" vesting schedules, which are pre-built into every advisor account. The default vesting schedules reflect 3, 4 and 5 year vesting schedules, with equal amounts of equity vesting on an annual basis. For example, in the '4 years vesting annually' schedule, 25% of equity shares will vest each year. Equity shares can only be purchased after they have vested.

Adding New Vesting Schedules

When using Monthly as your Vesting Type, the Vesting Period will have a maximum of 5 years, rather than 10.

Re-order Vesting Schedules

When viewing the list of your vesting schedules, RightCapital allows you to change the order they are displayed. Within the list of schedules on the left, you can click on the title of one of the schedules and then drag it to the desired location.

Delete Vesting Schedules

Custom schedules can be deleted by hovering your mouse over a particular schedule, and then clicking the 'x' icon that appears to the right:

Where to Apply Vesting Schedules

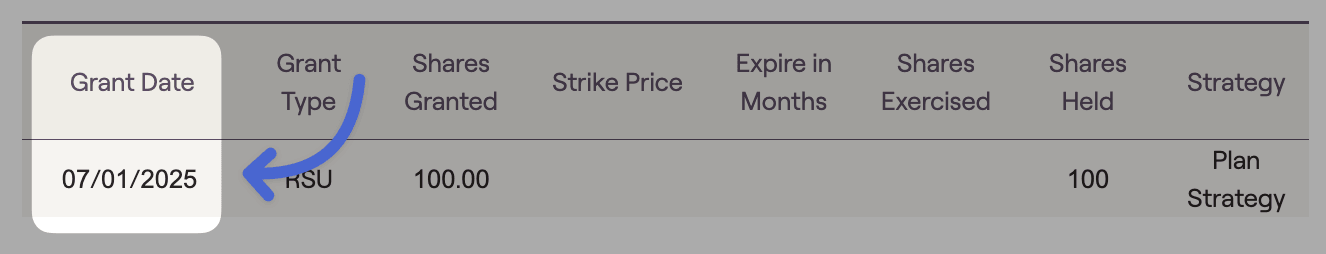

Only one vesting schedule can be applied per stock plan in the client's Net Worth. If clients have equity grants with different vesting schedules, they must be entered in separate stock plan entries within the Net Worth. For more information on entering stock plans in RightCapital, please click here.

Once applied, you can track stock grants as they vest in two areas:

- The Options tab within Retirement > Cash Flows

- The Stock Plans module within "..." More Menu > Stock Plans