Client Specific Assumptions

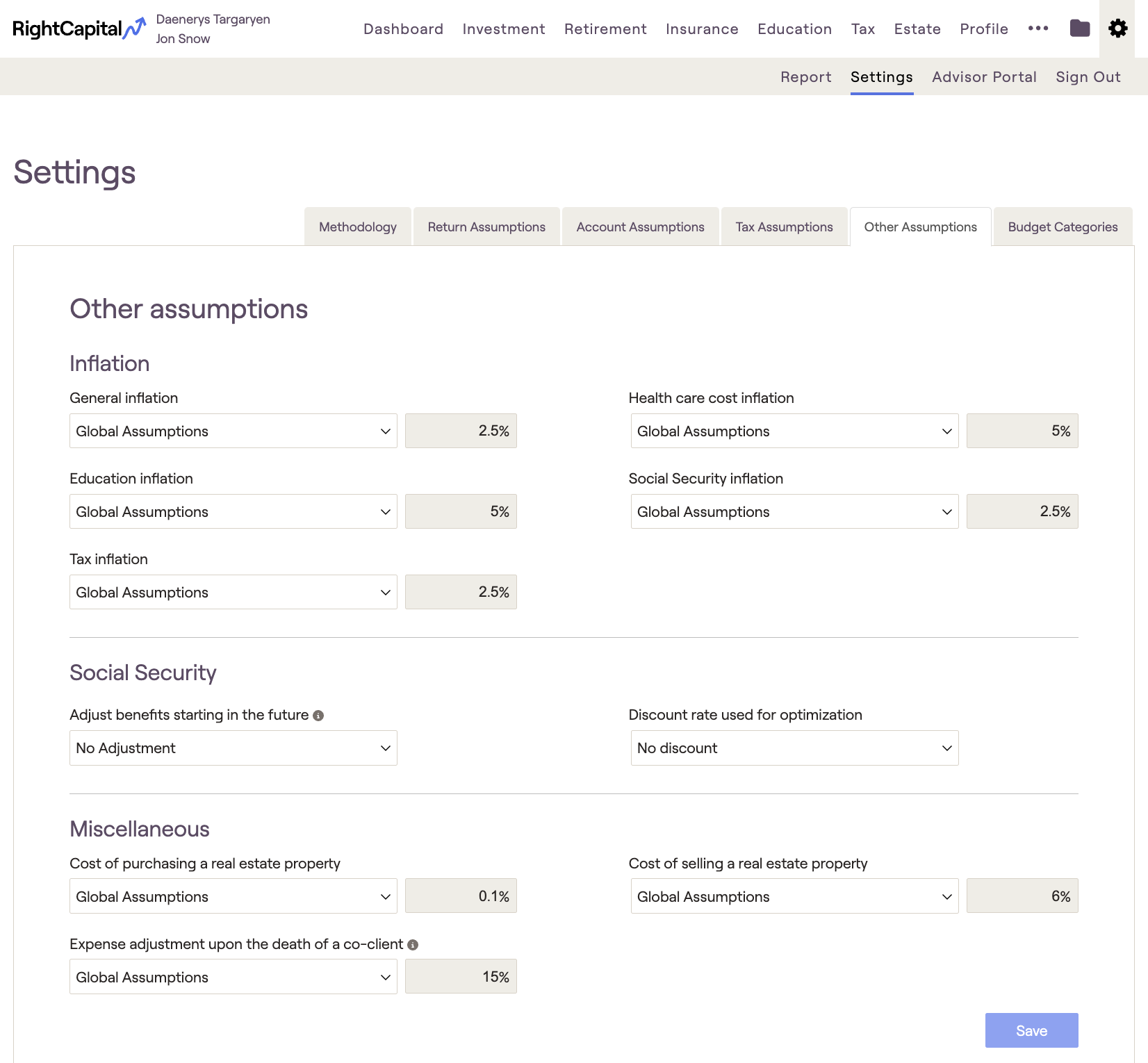

Inflation

RightCapital uses five different inflation assumptions to project goals and expenses. The inflation assumptions can be assigned globally or customized at the individual client level.

Default Inflation Assumptions

Default inflation settings are derived from studies and planning tools used by leading financial institutions and industry experts. The default assumptions are as follows:

General Inflation: 2.5%

Health Care Cost Inflation: 5%

Education Cost Inflation: 5%

Social Security Inflation: 2.5%

Tax Inflation: 2.5%

Custom Inflation Assumptions

Advisors can set customized inflation rates in the Client Assumptions section of the Advisor Portal. To edit inflation values, use the dropdown menu to switch "global assumptions" to "customized assumptions". When adjusting the inflation settings, a financial plan is impacted in the following ways:

Adjusts expenses and general goals.

Adjusts the health care expenses and LTC costs.

Adjusts the education goals.

Adjusts the social security payment every year for those who have started taking benefits.

Adjusts PIA Bend point and other variables needed to calculate social security benefits.

Adjusts the Social Security salary base every year for the purpose of calculating maximum social security benefit.

Adjusts the max contributions on employer-sponsored plans and IRAs.

Adjusts taxable income brackets.

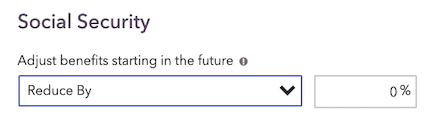

Social Security

Advisors can choose to adjust Social Security benefits starting in the future by changing the dropdown menu from "No Adjustment" to "Reduce by" and entering a percentage into the new data field.

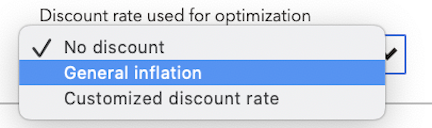

Advisors will also have the option to apply a discount rate that will impact the optimal Social Security strategy. Users can select a specific discount rate or use the general inflation rate. If a discount rate is chosen, that rate will be used to discount all future Social Security benefits for each strategy back to the current year. For additional information on using the Social Security Optimizer please click here.

Miscellaneous

RightCapital uses three different miscellaneous assumptions to alter cash flow details. These assumptions can be assigned globally or customized at the individual client level. Miscellaneous assumptions include:

- Cost of purchasing a real estate property: The default of .1% represents costs associated with purchasing a property.

- Cost of selling a real estate property: The default of 6% represents typical real estate agent fees associated with selling a property.

- Expense adjustment upon the death of a co-client: The default 15% figure represents the reduction in living expenses associated with the death of a client or co-client.