Explore Stock Plans in RightCapital

RightCapital enables advisors to capture every element of a client's financial landscape — even nebulous elements like vesting stock plans, private stock, and unqualified stock options.

This article is designed to provide an overview of stock plans and their necessary components. To review entering stock plans into a client's profile, please click here.

Stock Plans Overview

RightCapital allows users to enter stock plans and grants into the client's current Net Worth. Individual grants entered into the stock plan will vest, exercise and liquidate according to the details provided in the data card. Employers use stock plans as a form of equity compensation to encourage loyalty and company stake. Once vested, the employee can exercise or take ownership of the options or stock until the grant expires. Users can track individual grants as they vest, exercise and liquidate within the Retirement Cash Flows > Options Tab. Income from liquidated grants can be seen in the Retirement Cash Flows > Summary > Other Inflows column.

Only the net value of vested but unexercised stock will be reflected in the client's current Net Worth.

Shares that vest before the first year in the cash flows will not be reflected since they are previously exercised and included in the client's net worth.

Grant Type Overview

RightCapital includes the four most common grants types within the stock plans. The following details will describe each grant type and the taxation that users can expect within a RightCapital financial plan.

Incentive Stock Options (ISO)

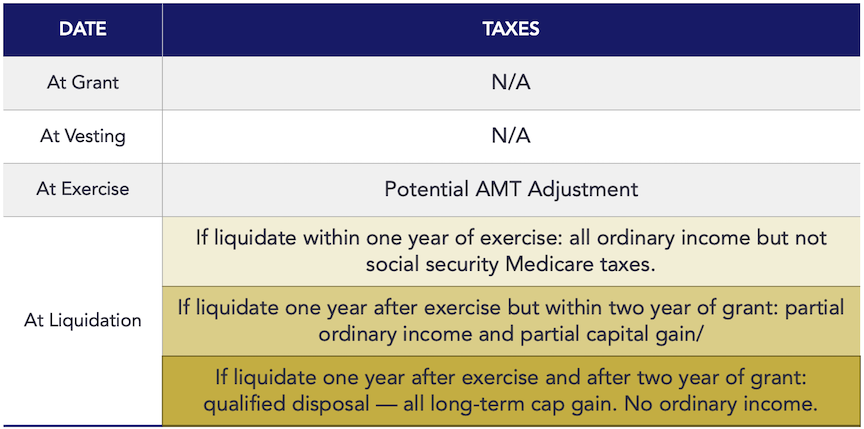

ISO's represent a corporate benefit that allows an employee to buy stock shares at a strike price. To achieve a qualified disposal, which produces long term capital gain taxation incentive stock options require a minimum two year vesting schedule and a holding period of more than one year before liquidation. If they are exercised and liquidated earlier different tax scenarios apply. This grant type also includes an option for cashless exercise which will automatically sell a specific number of shares to cover the cost of exercise associated with the strike price and number of shares.

Tax

The profits on incentive stock options are taxed at capital gain rates with a qualified disposal.

Possible alternative minimum tax adjustment can be viewed in the Tax > Tax Estimate > AMT form. See details for alternative minimum tax below.

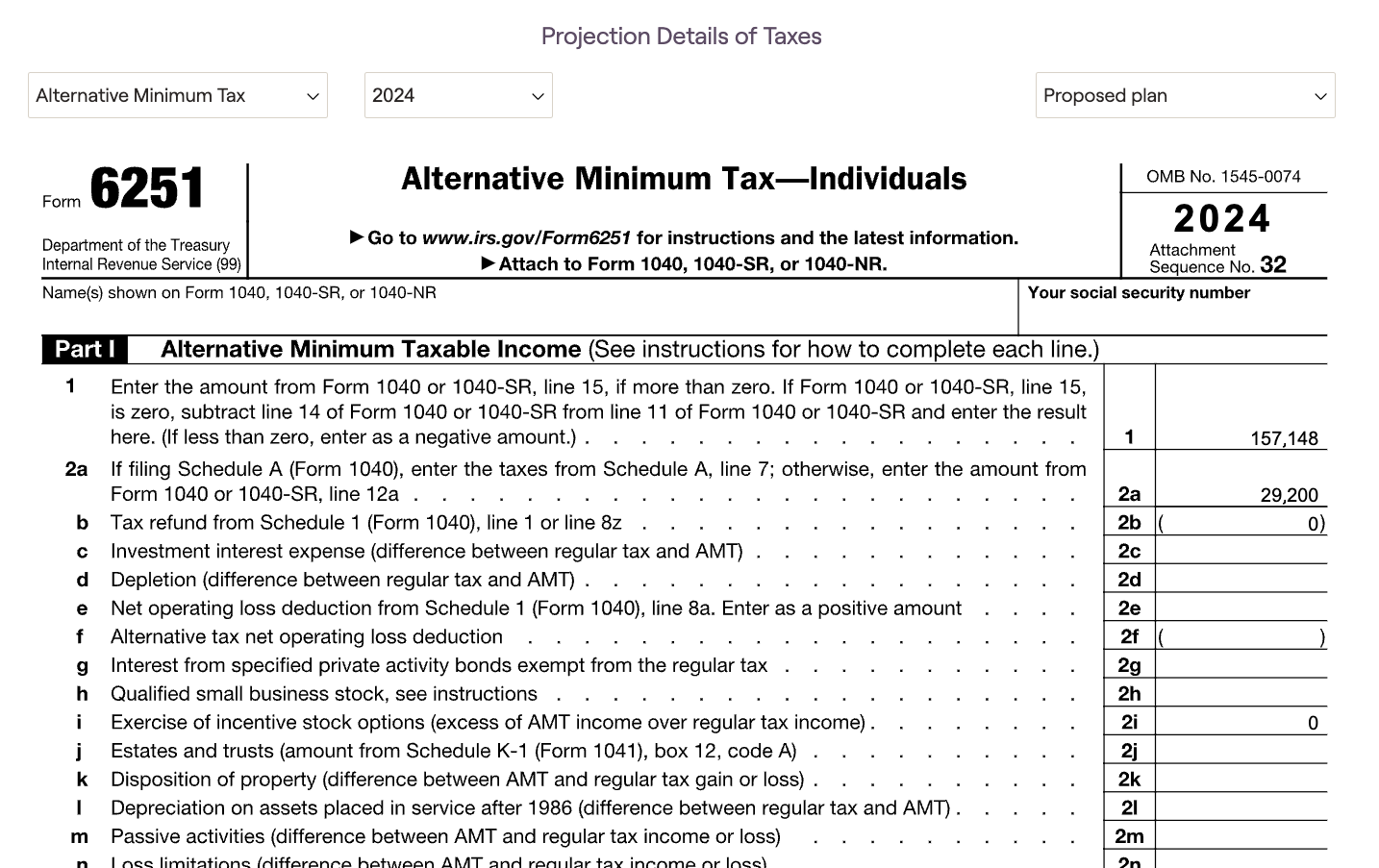

Alternative Minimum Tax

Alternative minimum tax is automatically factored into financial plans that include stock options like ISO's. AMT ensures that individuals pay, a least, the minimum amount of tax in a given year. AMT uses a different set of rules to calculate taxable income after possible deductions.

AMT can be viewed within the Tax > Tax Estimate > Details Tab, by choosing the dropdown menu on the left and selecting the Alternative Minimum Tax form.

Example: You have 1,000 ISOs with an exercise price of $10. You exercise and hold them when the market price is $50. You then hold the ISO stock through the calendar year of exercise. This results in an AMT adjustment of $40,000 ($40 spread x 1,000 options) that is part of your AMTI on Line 2i of Form 6251.

AMT will not be listed separately in the Retirement > Cash Flows > Options tab as it is coupled into the Federal income tax projection.

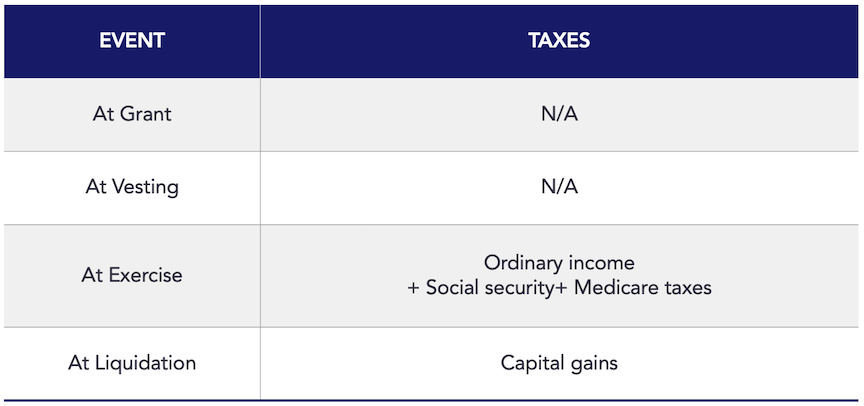

Non-Qualified stock options (NQO)

NQO's are an alternative type of compensation offered to employees that encourages loyalty through stock ownership. NQO's allow employees to buy a set number of shares from their company at strike price, within a designated timeframe. Typically the purchase price is similar to fair market value of shares at grant date. This grant type also includes an option for cashless exercise which will automatically sell a specific number of shares to cover the cost of exercise associated with the strike price and number of shares.

Tax

Non-qualified stock options are taxed as ordinary income at exercise and capital gain at liquidation.

Liquidate 1 year after exercise for long term cap gain.

Stockholder has option to make a 83(b) election within 30 days of grant.

If elected the stockholder can use the price on the grant date for the purposes of calculating ordinary income tax. Tax is calculated on the difference between current value and strike price.

If elected the client is taxed on grant date vs at exercised.

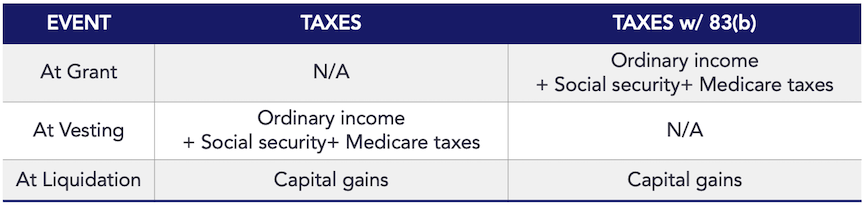

Restricted Stock (RS)

Restricted Stock is a type of executive compensation that is designed to motivates employees with an equity stake. RS represents actual ownership of shares but comes with conditions on the timing of their sale. RightCapital will exercise restricted stock grants as soon as they vest regardless of the listed exercise strategy.

Taxation

Restricted stock owners pay capital gain tax on the difference between the stock’s price on the date it vests and the date it is sold.

Liquidate 1 year after vesting without 83(b) for long term cap gain.

Liquidate 1 year after grant with 83(b) for long term cap gain.

83 (b) Election

Stockholder has option to make a 83(b) election within 30 days of grant.

If elected the stockholder can use the price on the grant date, not the vesting date, for the purposes of calculating ordinary income tax.

Taxed on grant date vs at vested.

Restricted Stock Unit (RSU)

Restricted stock units are a form of compensation issued to employees in the form of company stock. RSU's are typically issued to employees after a milestone event on a distribution plan. There is no expiration date on the grant but RSU's are withheld during a vesting period, during which time they cannot be sold. RightCapital will exercise restricted stock unit grants as soon as they vest regardless of the listed exercise strategy.

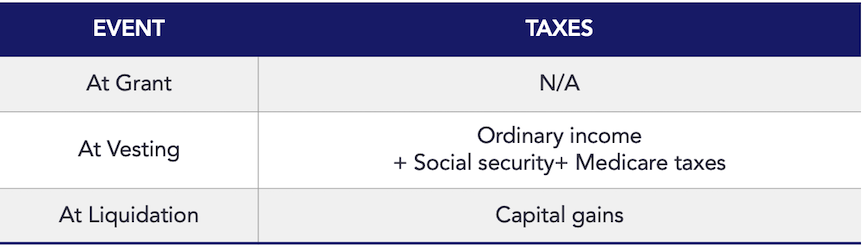

Taxation

The entire value of vested RSUs must be included as ordinary income at vesting.

Restricted stock unit owners pay capital gain tax on the difference between the stock’s price on the date it vests and the date it is sold.

Liquidate 1 year after vesting date for long-term cap gain taxation.