Social Security Overview

This is a knowledge base article, designed to give advisors an overview of Social Security income and how certain calculations are generated within RightCapital. For additional information on entering Social Security income or using the Social Security Optimization tool, please review the linked help center articles.

Social Security benefits are intended to replace a percentage of a worker’s pre-retirement income based on their lifetime earnings. The portion of pre-retirement wages that Social Security replaces is based on your highest 35 years of earnings and varies depending on how much you earn and when you choose to start benefits. The amount issued as monthly income replacement at full retirement age is referred to as the Primary Insurance Amount (PIA). The PIA value is issued to every eligible client by the Social Security Administration (SSA).

Eligibility for Social Security

Clients must qualify for Social Security benefits by earning at least 40 Social Security credits. Clients earn up to four Social Security credits per year when they work and pay Social Security taxes.

Credits are based on their total wages and self-employment income for the year. The number of earnings it takes to earn credits may change each year. In 2024, clients earn one Social Security or Medicare credit for every $1,730 in covered earnings. You must earn $6,920 to get the maximum four credits for the year.

Primary Insurance Amount (PIA)

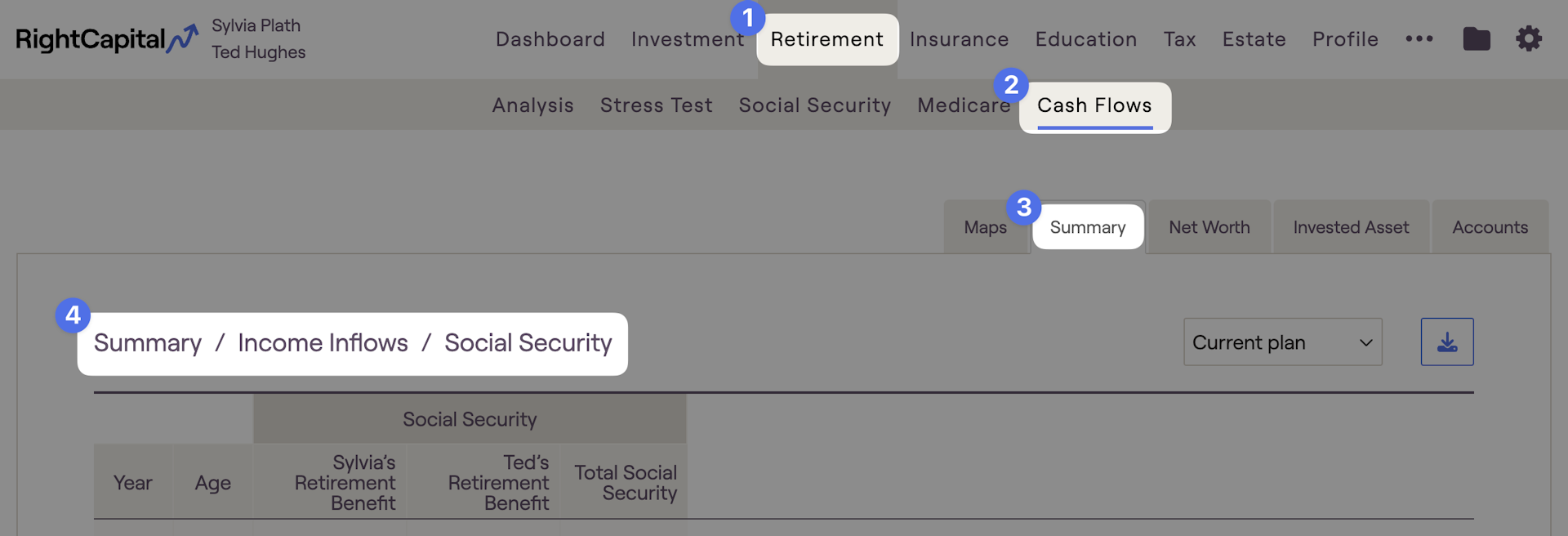

RightCapital allows advisors to estimate or supply the Social Security PIA value within the Profile > Income area of each financial plan. In the estimated benefit amount dropdown menu, advisors can select ‘Based on SS Statement Value’ and input the full retirement age benefit PIA value. This will be increased or reduced based on the filing age.

The PIA value is the monthly Social Security benefit a client will receive if they file for income at their full retirement age. At full retirement age, the benefit is neither reduced by an early withdrawal penalty nor is it increased with a delay credit. The Social Security Administration will calculate and supply this amount for eligible clients.

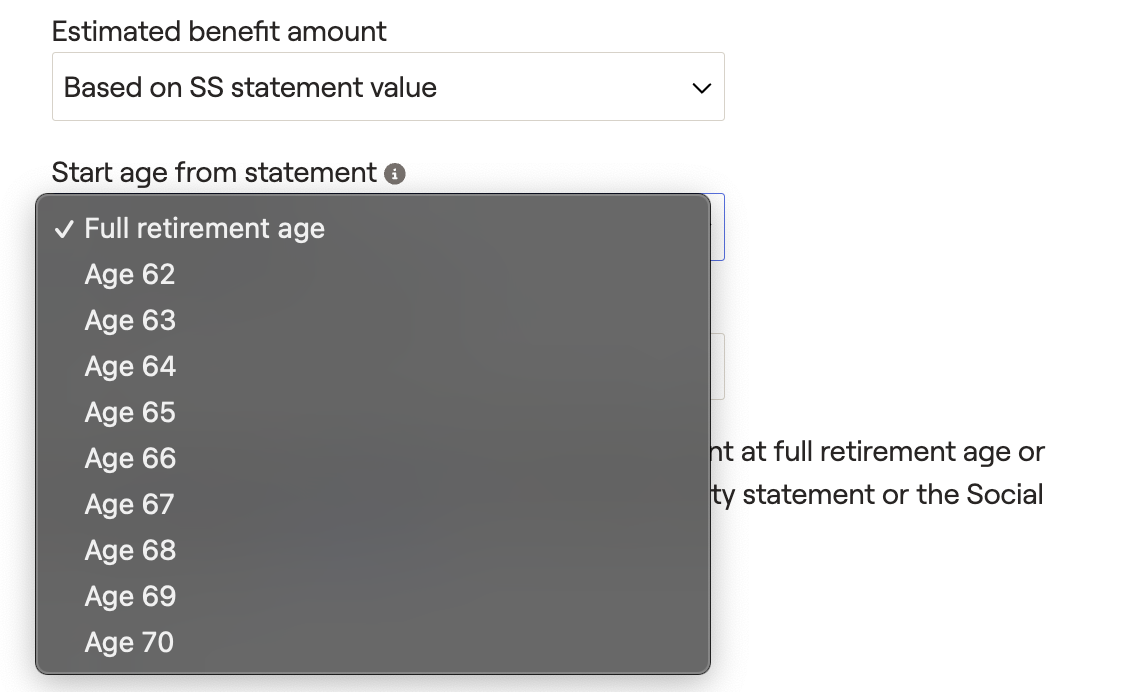

In addition to the client’s PIA at full retirement age, alternative start ages between 62 and 70 can also be entered when filling out a Social Security Income card by adjusting the ‘Start Age From Statement’.

How PIA is Calculated

When estimating a Social Security benefit in RightCapital, the client's birthday, earnings, and family profile will be used to estimate a PIA value for the plan. This PIA value is then adjusted for filing age and other adjustments.

The Social Security PIA value is based on each eligible client's averaged monthly earnings, adjusted for wage growth. The average indexed monthly earnings (AIME) are separated into three amounts, or "bend points". These amounts change based on when a client reaches age 62. Each amount is multiplied by a specific factor, and the sum of all three amounts will equal the client's PIA value which can be increased or decreased depending on other variables. Here are links that illustrate PIA bend points, and PIA Formula.

The first bend point of the AIME is $1,174. Therefore all earnings up to this amount are multiplied by 90%.

- The second bend point represents AIME between $1,174 and $7,078 which is multiplied by 32%.

- While any remaining AIME above $7,078 is multiplied by 15%.

PIA Recomputation

If a client receives large amounts of income into their 60s, the issued PIA value can be increased due to recomputation. For example, if a client decides to work until age 70; not only can they get delay credits on their retirement benefit, but their PIA can increase because their earnings between ages 60 to 70 are high enough to impact the highest 35 years of earnings used when calculating PIA.

RightCapital will only factor in recomputation when the client's estimated benefit is calculated using the "simple estimate" or the "historical covered earnings" approach. If a client is entering their assigned PIA value using the “SS statement value” option, RightCapital will not automatically factor in recomputation.

Retirement Benefit

The full retirement age (FRA) is the age when clients will be able to collect their full retirement benefit amount. The FRA is 66 if clients were born from 1943 to 1954. FRA increases gradually if they were born from 1955 to 1960 until it reaches 67. For anyone born in 1960 or later, full retirement benefits are payable at age 67. You can find a client's full retirement age by birth year in the full retirement age chart.

Clients can collect Social Security benefits as early as age 62. However, their benefit is reduced if they start collecting benefits before full retirement age. Advisors can use the following link to determine how claiming retirement benefits early will affect the benefit amount. The early withdrawal penalty when filing for Social Security benefits before the full retirement age ranges from 5% to 6.7% per year for every year before FRA, depending on the client’s birthday.

When clients delay filing for Social Security beyond their full retirement age, the benefit amount will continue to increase until age 70. Advisors can use the following link to determine how delaying Social Security will affect the benefit amount. The delay credits applied to Social Security benefits range from 5.5% to 8% each year, depending on the client’s birthday.

Spousal Benefit

Starting at age 62, spousal benefits are available to clients even if they never worked towards Social Security credits. If a client's spouse qualifies for Social Security the spousal benefit can provide 50% of the spouse's Primary Insurance Amount. The current plan's strategy will automatically include spousal benefits when appropriate.

Survivor Benefit

If a client receiving a retirement benefit passes away, the surviving spouse is eligible to receive a survivor benefit. The maximum monthly survivor benefit is 82.5% of the deceased spouse's benefit amount. The spouse can then take the greater of their retirement benefit, or the deceased client's retirement benefit.

An early withdrawal penalty of 4% to 6% per year is applied if the benefit is taken before the surviving spouse's full retirement age. No delay credits are available on survivor benefits. Financial plans in RightCapital will default to a strategy that includes survival benefits when appropriate.

Former Spouse Social Security

The Spouse Social Security card should only be used when a single client needs to document spousal/survivor benefits from a previous relationship.

If a client is divorced, they may be eligible to receive benefits based on their ex-spouse’s record. A divorced client can receive up to 50% of their ex-spouse’s full retirement benefit (PIA) starting as early as age 62, as long as the marriage lasted at least 10 years, the divorce occurred more than 2 years prior, and the client is unmarried.

If a client is a widow or widower, they may be eligible to receive a survivor benefit based on the earnings record of their deceased spouse. The amount the client will receive is based on the benefit amount the ex-spouse was receiving, or the ex-spouse’s Primary Insurance Amount (PIA) value if they had not started to receive benefits. If that amount exceeds the client’s own retirement benefit, the client will receive the difference as a survivor benefit.

Child Benefit

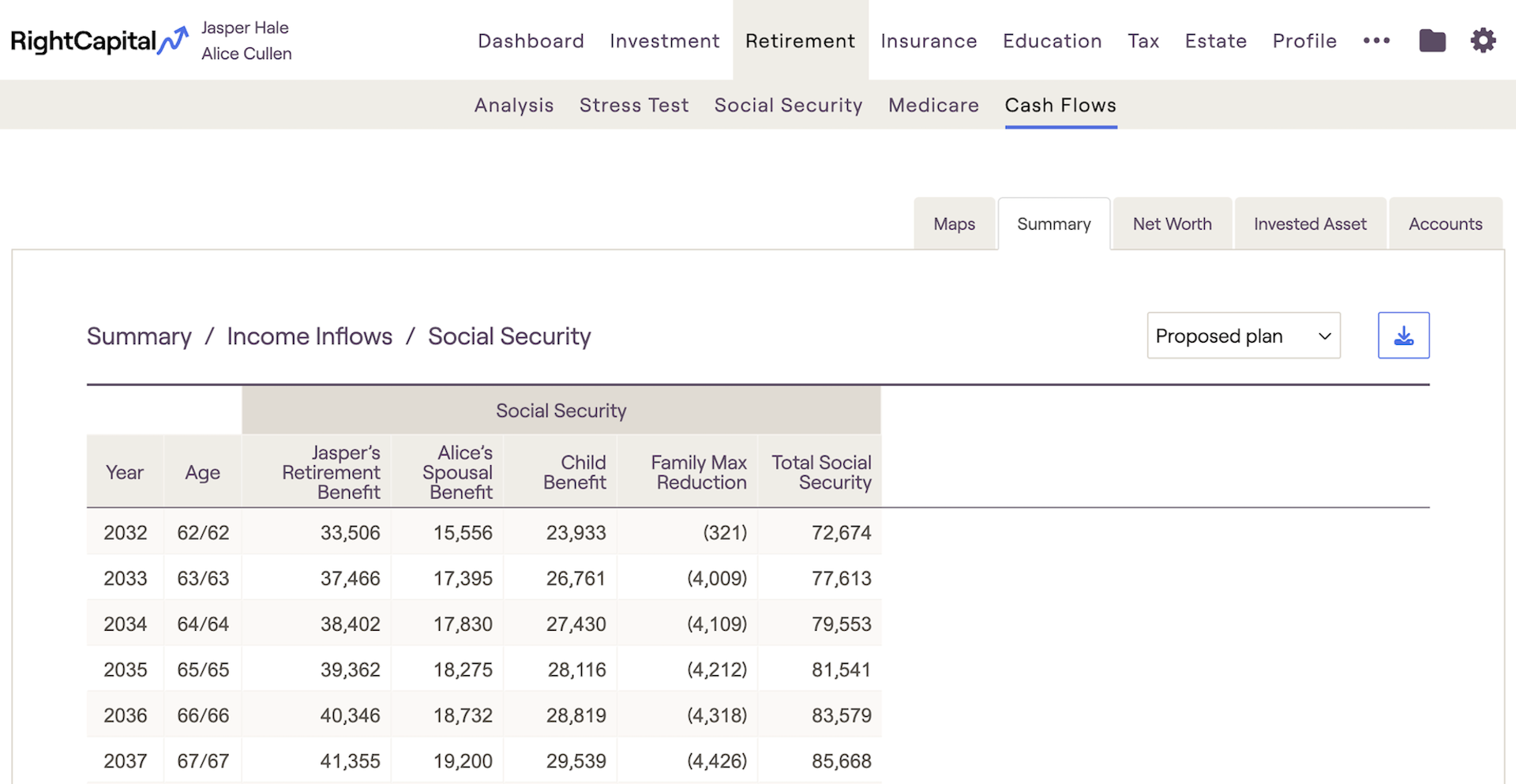

In RightCapital, child benefits are automatically calculated and applied when there is a minor dependant child included in the Profile > Family area.

When a client files for Social Security benefits while listing a minor child as a dependent, there is an opportunity to receive additional benefits. The child can be biological, adopted, or a stepchild in the household. Within a family, a child can receive up to half of the parent’s PIA at full retirement age. Child benefits stop once the child reaches age 18.

When a client passes away with a minor dependant child in the plan, the child is eligible for a survivor benefit up to 75% of the deceased parent’s PIA. This can occur even prior to the client filing for benefits, and will stop once the child reaches age 18.

Condition to receive Child Benefit | Child Benefit Amount |

|---|---|

Client receives Retirement Benefit, and has a child under age 18 | 50% of Client PIA |

Client receives Survivor Benefit, and has a child under age 18 | 75% of deceased spouse's PIA |

Family Max Benefit

In RightCapital, there is a maximum Social Security benefit each family can receive. When adding up retirement benefits, spousal benefits, child benefits & survivor benefits, RightCapital will follow the rules to cap the total benefit at the family's maximum amount. Retirement benefits will not be reduced by the family max benefit; instead, other benefit amounts will be reduced pro-rata. For information on how the family max benefit is calculated view this link.

The formula used to compute the family maximum is similar to that used to compute the Primary Insurance Amount (PIA). The formula sums four separate percentages of portions of the worker's PIA. For 2024 these portions are the first $1,500, the amount between $1,500 and $2,166, the amount between $2,166 and $2,825, and the amount over $2,825. These dollar amounts are the "bend points" of the family-maximum formula. Thus, the family-maximum bend points for 2024 are $1,500, $2,166, and $2,825. See the table showing bend points for years beginning with 1979 (the table also shows PIA formula bend points).

For the family of a worker who becomes age 62 or dies in 2024 before attaining age 62, the total amount of benefits payable will be computed so that it does not exceed:

(b) 272% of the worker's PIA over $1,500 through $2,166, plus

(c) 134% of the worker's PIA over $2,166 through $2,825, plus

(d) 175% of the worker's PIA over $2,825.

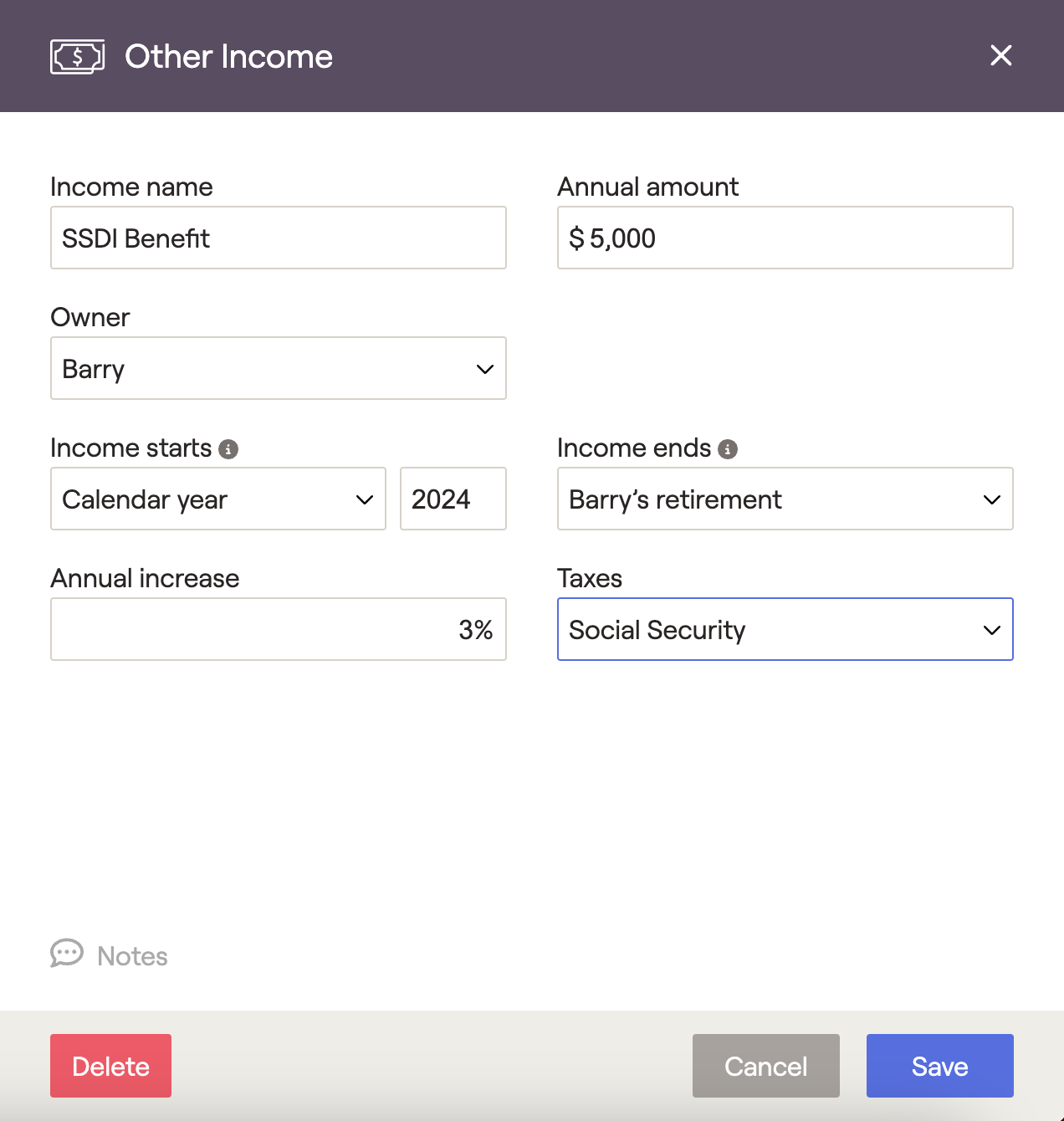

Disability Benefit (SSDI)

An Other Income card can also be used to enter social security retirement, spousal, or survivor benefits manually, rather than having RightCapital automatically calculate these benefits. To prevent automatic retirement / spousal / survivor benefit calculations from occurring, advisors can navigate to Profile > Income > Social Security, and set the Estimated Benefit Amount to “No Social Security”.

Annual Earnings Test Adjustment

The client retires at age 62.

The client starts Social Security retirement benefit at age 62, with a benefit equal to $1,000 a month.

The client works a part-time job at age 63, earning $24,000 a year.

The client's social security benefit might be reduced by $70 a month, to $930 per month.

In the month that the client reaches their FRA, the social security benefit goes back to $1,000 a month.

In each subsequent year, the client will receive an increased benefit based on the total amount withheld due to the earnings test adjustment. Over a typical lifespan, most individuals will recoup most or all of their benefits withheld before FRA.

Government Pension Offset (GPO)

Windfall Elimination Provision (WEP)

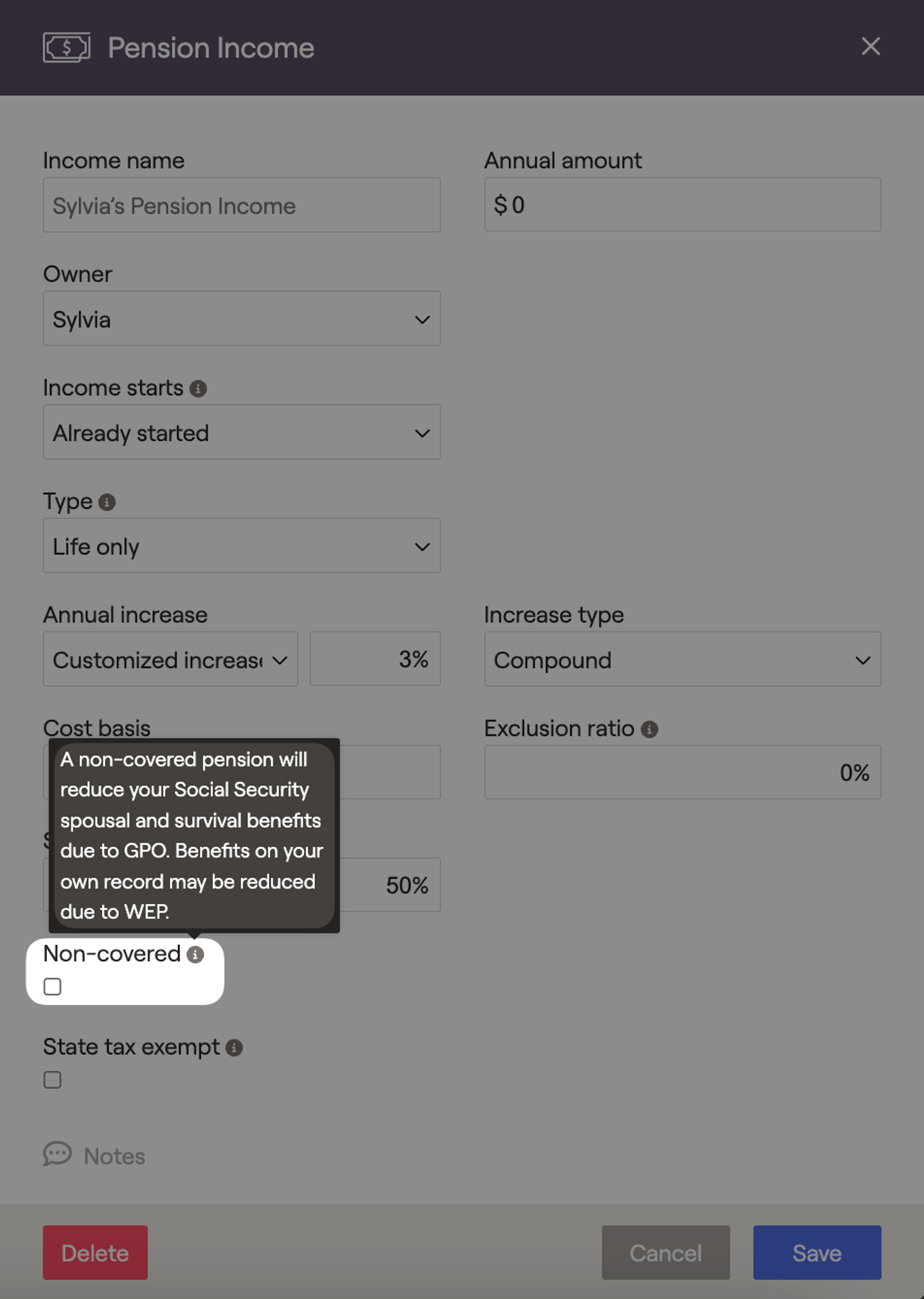

RightCapital will apply the WEP reduction to Social Security benefits when there is a non-covered pension income card entered. If clients are subject to the Windfall Elimination Provision that reduces Social Security retirement benefits, check the Non-covered box on the Pension income card (see above screenshot). This calculation will not impact Social Security income that is already being received, nor will it affect Social Security estimates when using “Based on SS statement value” as your estimated benefit amount. The WEP reduction will impact estimated SS benefits using the "simple estimate" or from "historical covered earnings". WEP can affect monthly SS benefits, spousal benefits, child benefits, family maximum benefits, and annual earnings test calculations within a financial plan. Survivor benefits will not be impacted by the Windfall Elimination Provision. RightCapital will also apply the WEP guarantee that restricts SS benefit reduction to half of the client's pension income.

For additional information on the Windfall Elimination Provision, please refer to the SSA Website.

Restricted Application

If a client's spouse was born before January 2, 1954, and has already reached full retirement age, they can choose to receive only the spouse's benefit and delay receiving their own retirement benefit until a later date. This strategy is included in the optimal Social Security analysis in RightCapital.

If the spouse’s birthday is January 2, 1954, or later, the option to take only one benefit at full retirement age no longer exists. If the spouse files for one benefit, they will be effectively filing for all retirement or spousal benefits.

This strategy has been officially phased out as of January 2nd, 2024, as all individuals eligible for restricted application are now over age 70.

Tax on Social Security Income

Federal Tax

When a client's combined Income is higher than the threshold listed below, the social security benefit is taxable in RightCapital. Combined income is defined as the client's AGI plus non-taxable interest plus 50% of Social Security benefit.

Client's Combined Income | Single filer |

|---|---|

Combined income < $25,000 | Social Security benefit not taxable |

$25,000 < Combined income < $34,000 | 50% of Social Security is taxable |

Combined Income > $34,000 | 85% of Social Security is taxable |

Client's Combined Income | Married filing Jointly filer |

|---|---|

Combined income < $32,000 | Social Security benefit not taxable |

$32,000 < Combined income < $44,000 | 50% of Social Security is taxable |

Combined Income > $44,000 | 85% of Social Security is taxable |

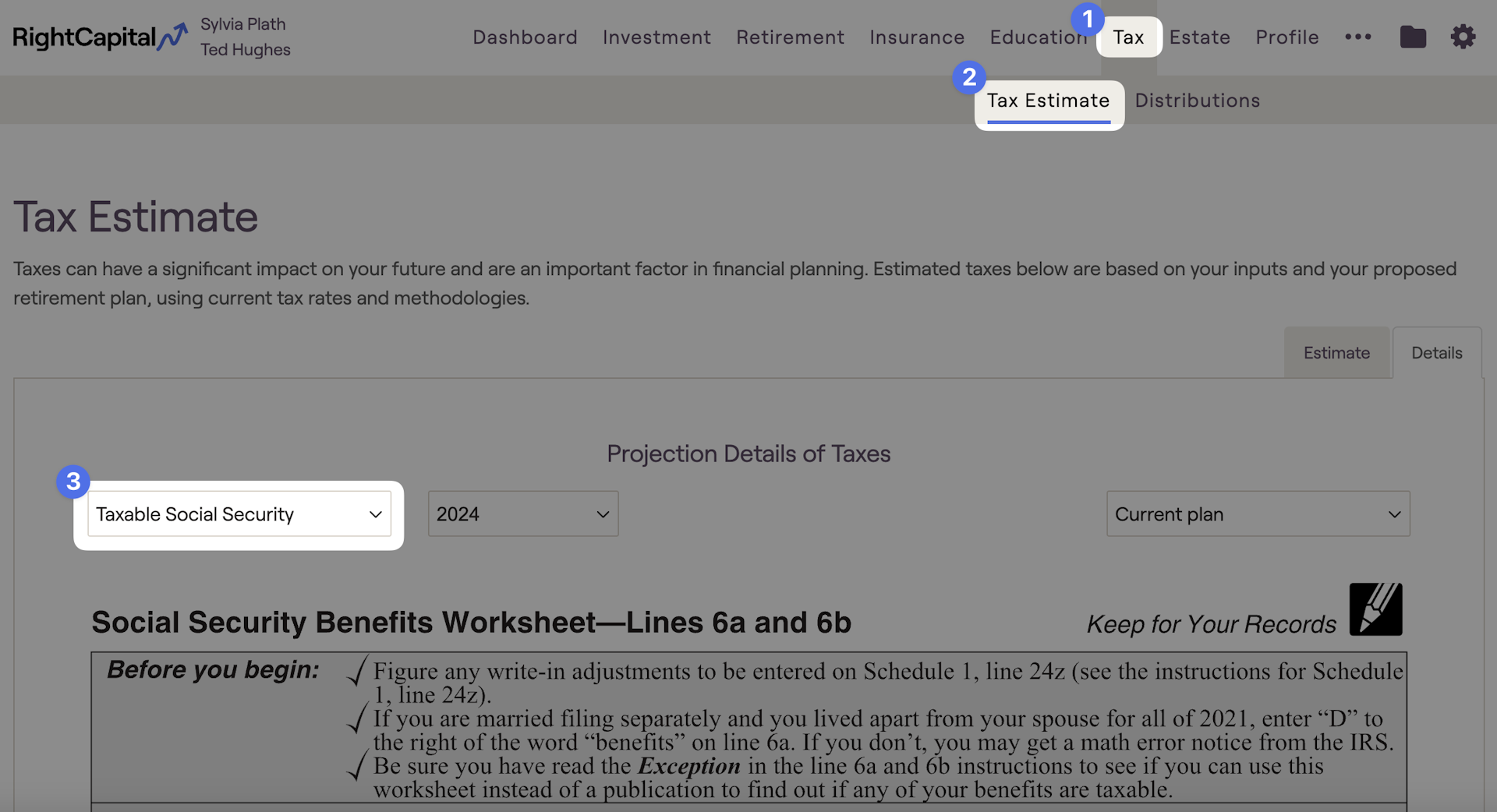

Taxable Social Security Worksheet

State tax

State | Taxable Social Security Benefit |

|---|---|

Colorado | Yes |

Connecticut | Yes |

Kansas | Yes |

Minnesota | Yes |

Montana | Yes |

New Mexico | Yes |

Rhode Island | Yes |

Utah | Yes |

Vermont | Yes |

West Virginia | Yes |