As tuition costs continue to rise across the US, some clients may find themselves wondering if they'll be able to fully fund the education goals within their plans. RightCapital's Education Funding Analysis allows you to do just that, pulling in education costs for all members of the client household and allowing you to individual tailor an education funding strategy for each one.

"Student" Tabs

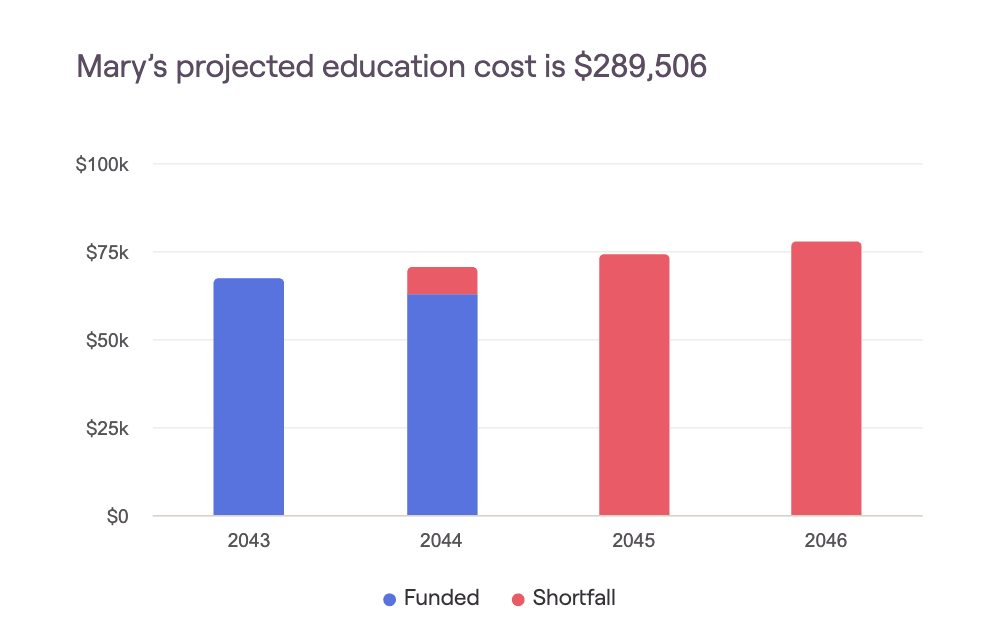

The bar chart on the left will highlight the annual education costs for each student. As a reminder, education costs increase on an annual basis using your Education Cost Inflation rate. The pie chart to the right highlights the overall goal coverage percentage, as well as any funding shortfall.

If there are multiple education goals entered for a single individual, each of those goals will be included in the analysis for that student. For example, a pre-college goal from age 14-17, followed by a college goal from age 18-21:

Projected Education Costs

The charts within the Education Analysis will illustrate the education costs reflected in the Goals section of the Profile, within any Pre-college or College Goal data cards:

Projected Goal Coverage

You may see that a percentage of a student's education goal is already being funded (shown in blue), even prior to dialing in a funding strategy using the Action Items. This may occur if there are existing 529 assets within the plan, including:

- 529 accounts, entered within the Profile > Net Worth section.

- 529 savings, entered within the Profile > Savings section.

Action Items

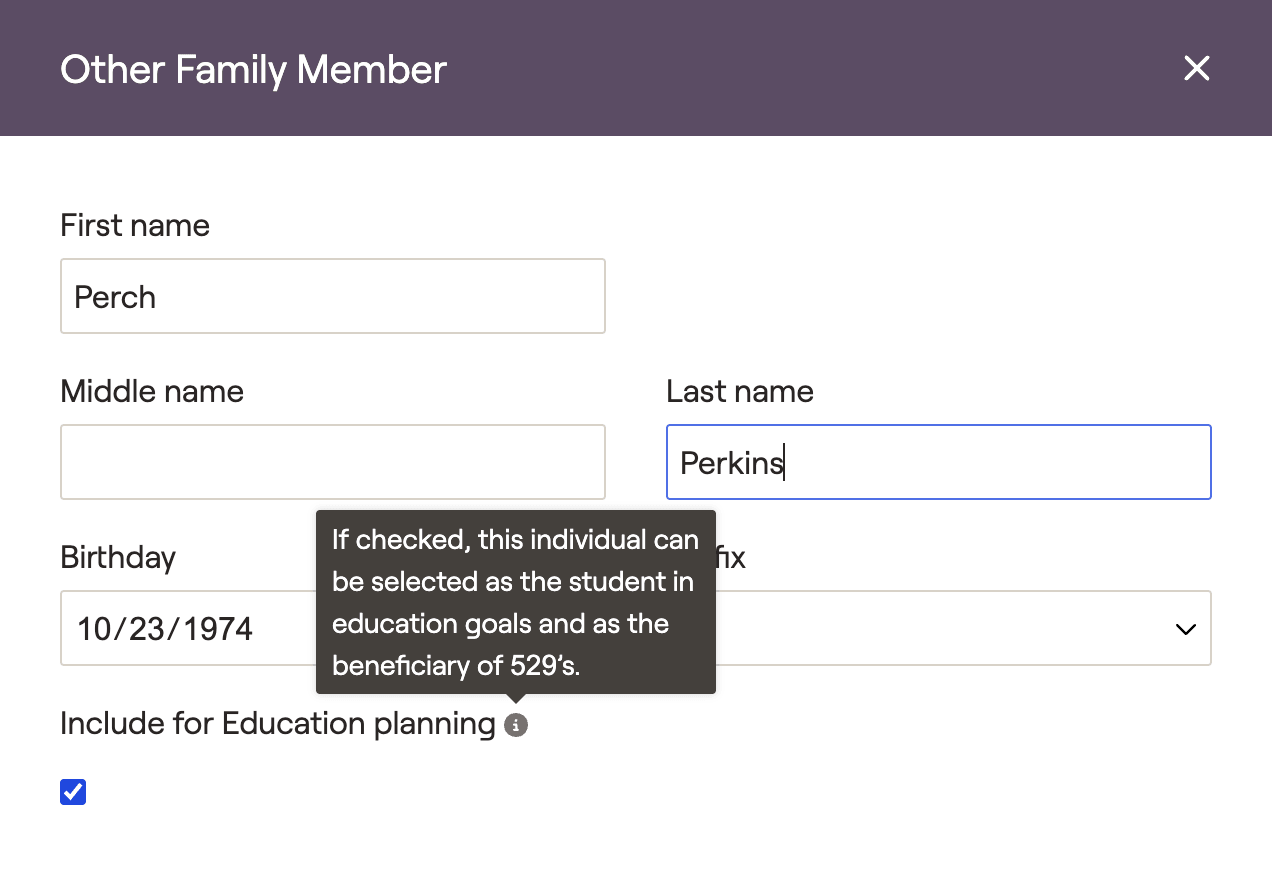

Education Goals

529 Balance / Savings

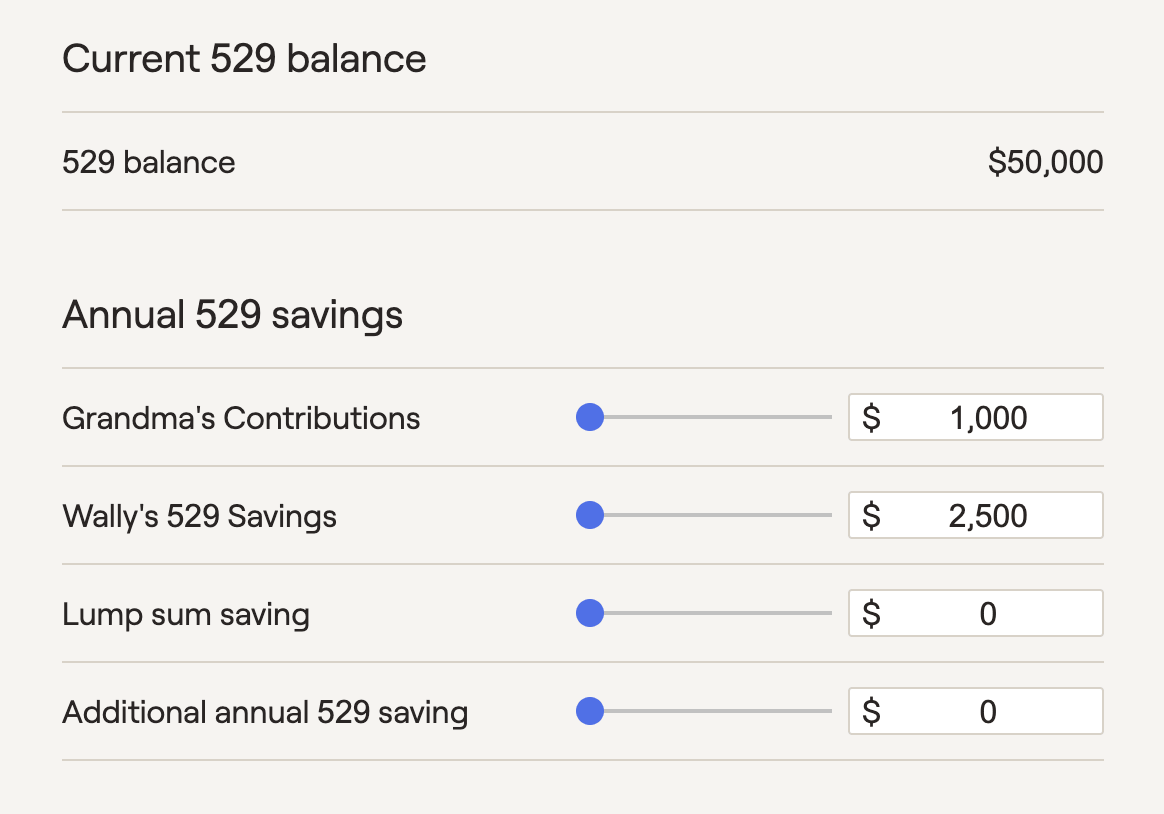

Beneath the education goals, you will see information regarding the 529 assets in the plan for that student:

- The Current 529 balance will reflect the total value of all education savings accounts entered within the Profile > Net Worth area, with the student listed as the beneficiary.

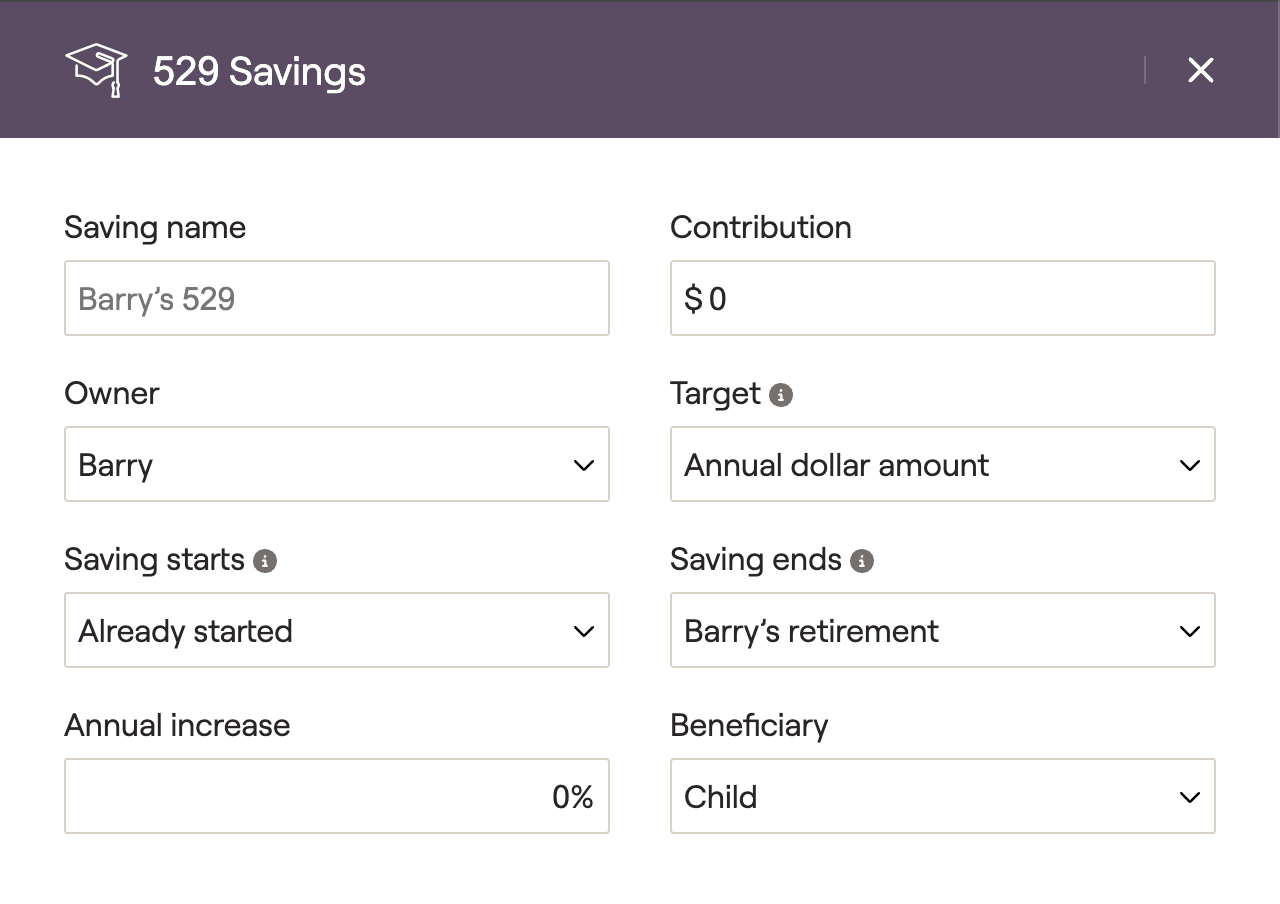

- The Annual 529 savings section will list the value associated with any 529 savings cards entered within the Profile > Savings area, where the student is set as the beneficiary. If there are multiple cards for that student, you will see them all listed as separate items. The values entered within these data cards will flow through into the Education analysis:

By manipulating existing 529 contributions and modeling additional 529 savings, you can fine-tune a student's education funding proposal to achieve the exact amount of goal coverage that your clients are looking for (a certain number of years, a specific goal coverage percentage, etc):

As a reminder, the Education module is based on comprehensive cash flow data from the Proposed Plan in the Retirement Analysis. If you're making changes to the 529 savings and not seeing an impact, it may be due to cash flow deficits that are occurring within the proposed plan.

Strategy

If 'Current allocation' is used:

We will use the asset allocation associated with all 529 accounts in the client's Profile, where the student is the beneficiary.

If there are no 529 accounts where the student is the beneficiary, we will use the Asset Allocation for the Proposed Plan in the Retirement Analysis module.

- 529 only - only assets and savings in 529 accounts will be used. If there are not sufficient 529 assets, remaining education costs will not be funded.

- 529 and taxable - we will first look to fund education costs using 529 accounts. If those assets are fully depleted, we will look to fund goals from available cash flows and any taxable investment accounts within the plan. If those assets are insufficient, remaining education costs will not be funded.

- 529, taxable and Roth - we will first look to fund education costs using 529 accounts, available cash flows and taxable investments (same as 529 and taxable). If those assets are insufficient, we will withdraw assets from any Roth IRA accounts within the plan. Withdrawals from Roth accounts will be penalty-free. If Roth assets are insufficient, remaining education costs will not be funded.

- All resources except 529 - 529 assets will be excluded from education funding. Costs will be funded using available cash flow, followed by investment withdrawals according to your Withdrawal Sequence setting.

- All resources - we will first look to fund education costs using 529 accounts. If those assets are fully depleted, we will look to fund costs using available cash flow, followed by investment withdrawals according to your Withdrawal Sequence setting.

Details Tab

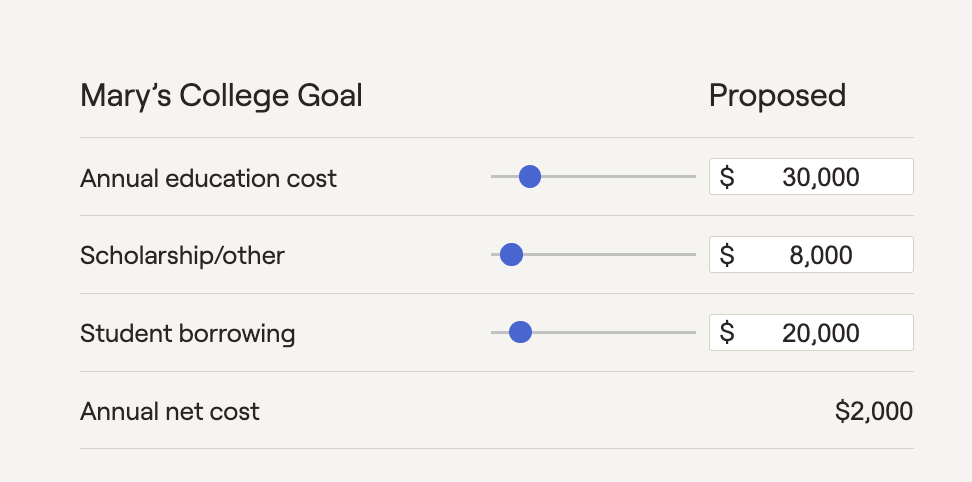

The impact of scholarships & student borrowing on a student's education costs.

How much of a student's education is funded with 529 assets vs other sources.

Any shortfalls that may occur if the selected funding sources are insufficient.

Highlight the impact of a change in 529 asset allocation on the portfolio return.

Visualize lump sum and additional annual 529 savings that have been entered via the Action Items.

Identify if a student's 529 accounts are being under or overfunded within the projections.

If a student's 529 account is overfunded in RightCapital, the leftover funds will be used on the next youngest student once the beneficiary has finished school within the plan. However, if there are no more education costs in the rest of the plan, excess funds in a 529 can grow endlessly and skew your plan output. Be mindful not to overfund 529 accounts for the youngest student in the plan!

Applying Your Proposal in the Retirement Analysis

After dialing in your education funding proposal within the Education module, you can then choose to instantly reflect this strategy within the broader context of a client's retirement projections. To apply an education proposal, visit the Retirement Analysis module and access the action items at the bottom of the screen. On the right side of the action items, isolate the 'Education Strategy' dropdown, and choose the 'Education Proposal' option. Once you click Refresh in the lower right, details from the Education module will flow into the Proposed plan:

A few things to note when importing education funding proposals into the Retirement Analysis:

When using the "Current Strategy" option (which is selected by default), nothing entered into the Education module will impact the retirement projections. The Current Strategy will attempt to fund education goals in the same way as the 'All Resources' funding strategy (529s first, then available cash flow, then investment withdrawals according to your Withdrawal Sequence setting).

If you enable an "Education Proposal" that is funding less than 100% of a student's education goal, the remainder of the goal that is unfunded will be omitted from the retirement projections. This can be done intentionally (for example, parents who plan to pay for only a portion of a child's college education).

Additional Information