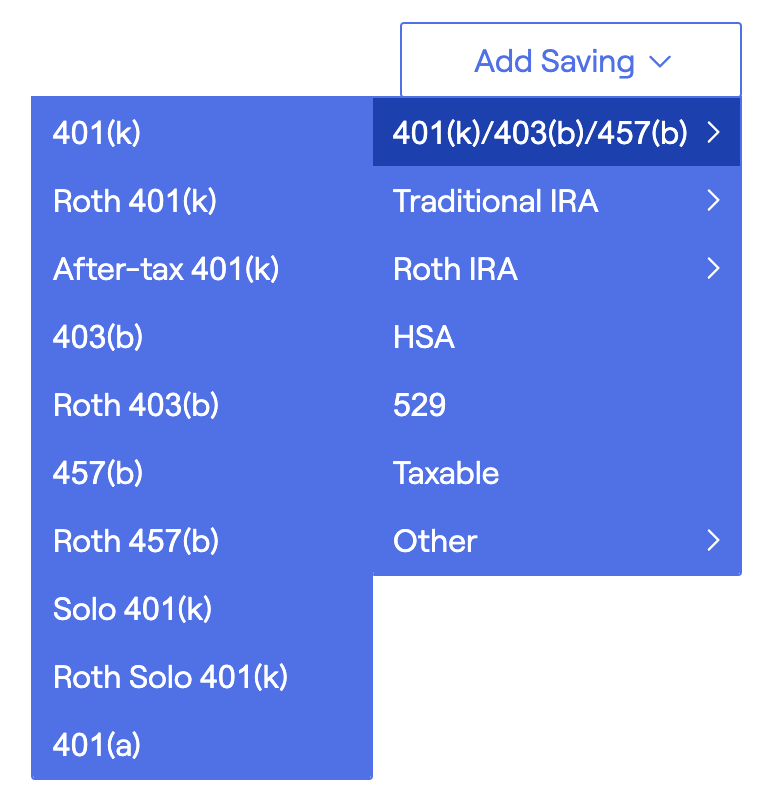

Employer Retirement Plans 401(k)/403(b)/457(b)

Total employee contributions across these accounts will be capped at the IRS maximum value ($23,000 for 2024, plus an additional $7,500 'catch up' for those 50 and over).

Total contributions to all defined contribution plans (employee plus employer) will be capped at the IRS maximum value ($69,000 for 2024, plus an additional $7,500 'catch up' for those 50 and over).

401(k) and 403(b) contributions are treated as W2 deductions and will reduce the client's income before being reflected in wages on box 7 of the projected 1040 on the Tax / Details screen.

Total employee contributions across these accounts will be capped at the IRS maximum value ($23,000 for 2024, plus an additional $7,500 'catch up' for those 50 and over).

Total contributions to all defined contribution plans (employee plus employer) will be capped at the IRS maximum value ($69,000 for 2024, plus an additional $7,500 'catch up' for those 50 and over).

457(b) contributions are treated as W2 deductions and will reduce the client's income before being reflected in wages on box 7 of the projected 1040 on the Tax / Details screen.

See our separate article on illustrating after-tax 401(k) savings.

Solo 401(k) contributions are for self-employed clients with their 401(k) plan. Total contributions to all defined contribution plans (employee plus employer) will be capped at the IRS maximum value ($69,000 for 2024, plus an additional $7,500 'catch up' for those 50 and over).

Roth Solo 401(k) contributions are for self-employed clients with their own 401(k) plan. Total contributions to all defined contribution plans (employee plus employer) will be capped at the IRS maximum value ($69,000 for 2024, plus an additional $7,500 'catch up' for those 50 and over).

Typically 401(a) retirement savings plans are used in governmental and non-profit organizations. Total contributions to all defined contribution plans (employee plus employer) will be capped at the IRS maximum value ($69,000 for 2024, plus an additional $7,500 'catch up' for those 50 and over).

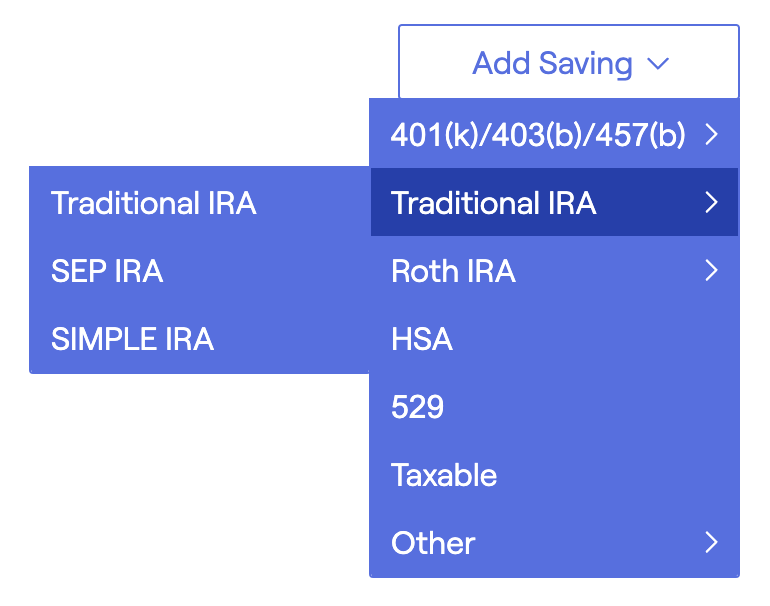

Traditional IRA

Contributions are capped at the IRS limit ($7,000 for 2024 + $1,000 catch-up for those 50 and over). Cap includes both traditional IRA and Roth IRA contributions.

Contributions less than the income limit will be considered deductible. In 2024, deductibility phases out between $77,000 and $87,000 of AGI for single; between $123,000 and $143,000 for joint. Over those thresholds, the total contribution will be considered nondeductible.

You can control whether IRA savings are funded if there are insufficient cash flows in the client Settings.

All contributions are employer contributions. Total contributions to defined contribution plans will be capped at the lesser of 25% of compensation or $69,000 for 2024.

Employee contributions are capped at the IRS limit ($16,000 for 2024 + $3,500 catch-up for those 50 and over).

Roth IRA

Contributions are capped at the IRS limit ($7,000 for 2024 + $1,000 catch-up for those 50 and over). Cap includes both traditional IRA and Roth IRA contributions. Roth IRA contributions are only included if the household is below AGI limits. In 2024 the contribution limit phases out between $146,000 and $161,000 of MAGI for single; between $230,000 and $240,000 for joint.

You can control whether Roth IRA savings are funded if there are insufficient cash flows in the client Settings.

'Backdoor' Roth IRA contributions reflect a nondeductible contribution to a traditional IRA that is then converted to a Roth IRA. RightCapital allows you to illustrate Roth IRA savings even if the client is over the Roth IRA contribution limits. The contribution amount is still capped at the IRS limit. We assume that all backdoor Roth IRA contributions are not taxable.

All contributions are employer contributions. Total contributions to defined contribution plans will be capped at the lesser of 25% of compensation or $69,000 for 2024.

Employee contributions are capped at the IRS limit ($16,000 for 2024 + $3,500 catch-up for those 50 and over).

Health Savings Accounts (HSA)

Employee contributions are capped at the IRS limit ($4,150 + $1,000 catch-up for those 55 and over and single, and $8,300 + $1,000 catch-up for age 55+ for a family in 2024). You can enter employer contributions to an HSA in the 'Flat dollar match' field.

Contributions to HSA accounts will always be included in the projection for the year, even if there is insufficient cash flow to fund the contributions once all inflows and outflows are considered. You can control when HSA contributions fund medical expenses in the client Settings.

HSA contributions are treated as W2 deductions and will reduce the client's income before being reflected in wages on line 7 of the projected 1040 on the Tax / Details screen.

529

When entering 529 Savings, you can choose the beneficiary of the 529 plan. The beneficiary can be the client, co-client, child, or 'Unassigned'. If assigned to an individual, the account can be used to illustrate college funding on the Education screen. If they are 'Unassigned' they will not appear on the Education screen but will be used to fund any college goals in the retirement projections.

There are no limits in the system on contributions to 529 plans.

You can control whether 529 savings are funded if there are insufficient cash flows, as well as whether 529s will fund pre-college goals, in the client Settings.

Taxable

Taxable savings cards are only available if you use the Modified Cash Flow or Goals based planning methods; if you use the Cash Flow planning method, we will calculate the taxable savings automatically.

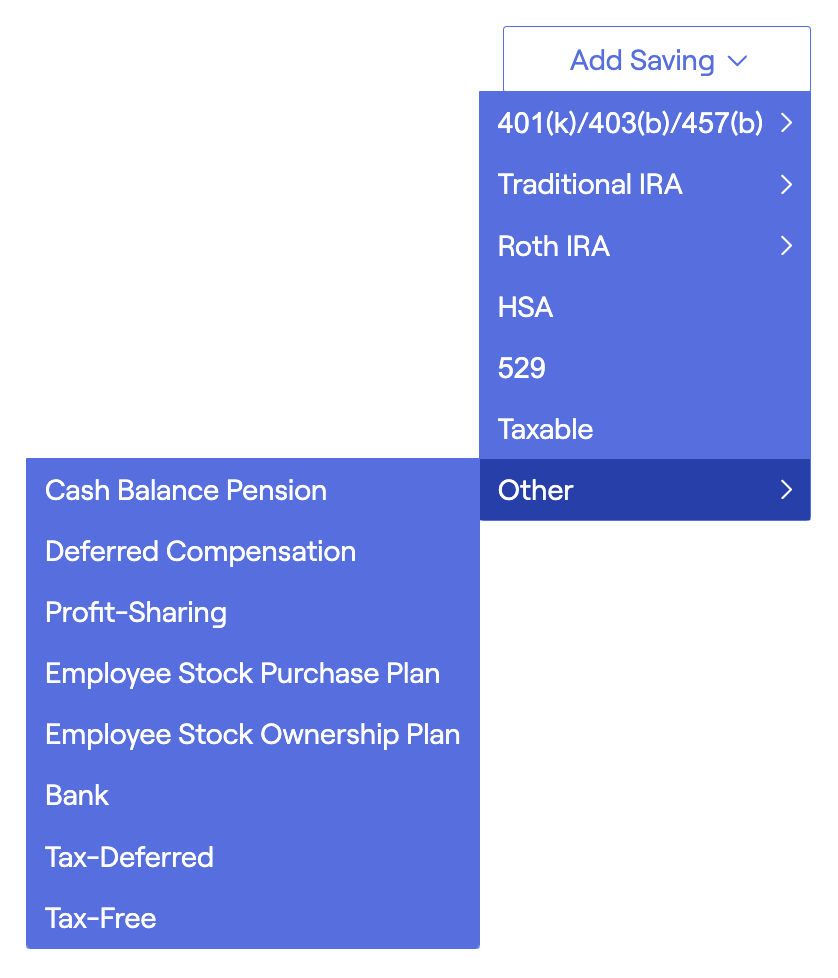

Other

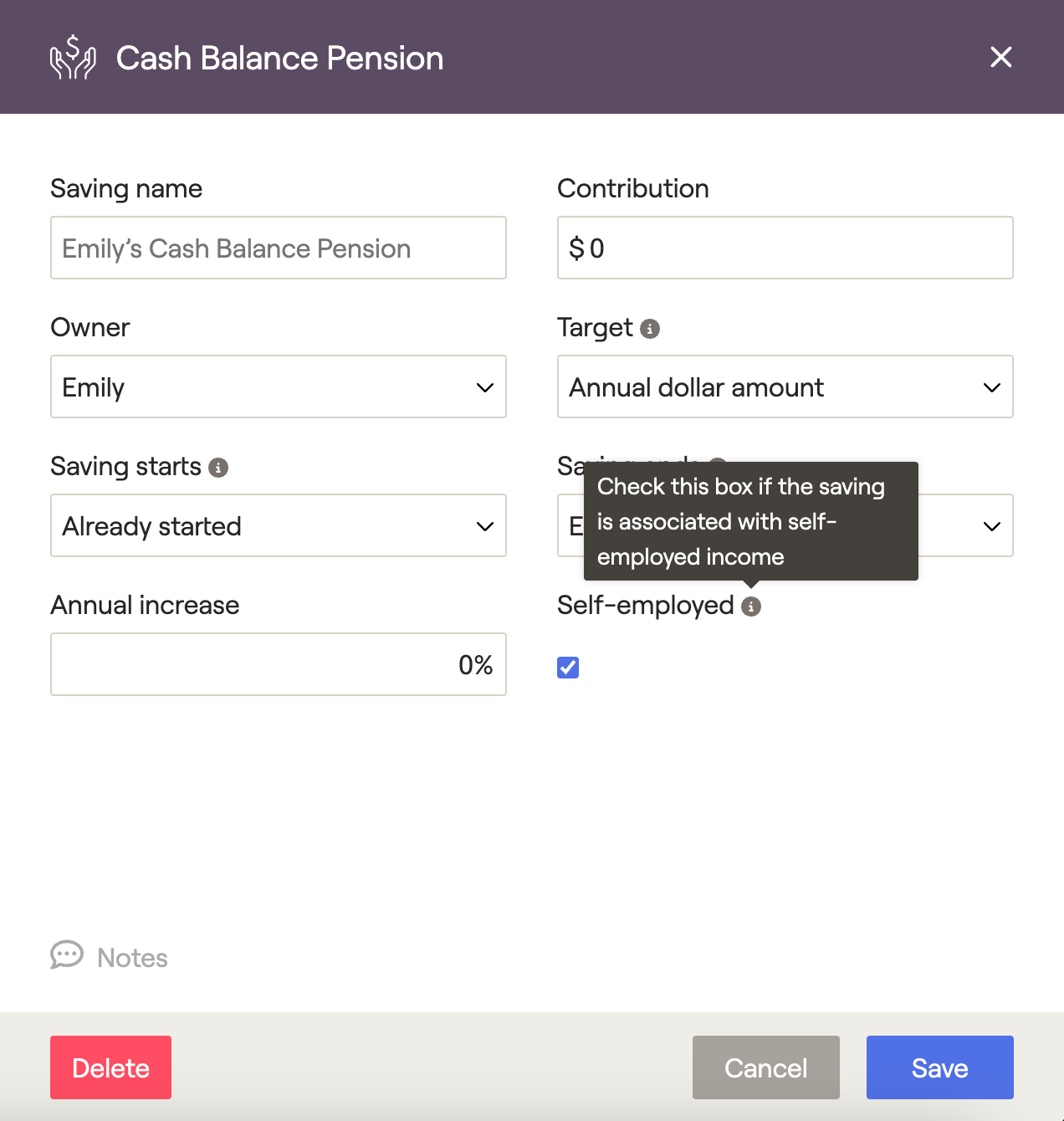

Cash Balance Pension

This card can be used to reflect outside contributions to a pension account. The Cash Balance Pension savings card will be shown as an employer contribution and be reflected in the 'Qualified Pension' column in the accounts tab of the cash flows.

Deferred Compensation

This card can reflect employee or employer contributions to a non-qualified pension account. Anything entered in the "contribution" field of a Deferred Compensation savings card will be shown under the Planned Savings column of the cash flows. Values entered in the "flat percentage match" or "flat dollar match" fields will be reflected as an employer match in the cash flows. Both employer and employee contributions will be added to the 'Non-Qualified Pension' column in the Accounts tab of the cash flows.

Profit-Sharing

This card can be used to reflect employer contributions to a profit-sharing plan. These contributions will be reflected in the '401(k)/403(b)' column in the Accounts tab of the cash flows.

Contributions to profit-sharing plans are limited to 25% of the client's salary or self-employment income. Total contributions to all defined contribution plans (employee plus employer) will be capped at the IRS maximum value ($69,000 for 2024, plus an additional $7,500 'catch up' for those 50 and over).

Employee Stock Purchase Plan (ESPP)

Employee Stock Purchase Plan savings allows you to reflect the purchase of shares in an ESPP. If the ESPP allows for the purchase of shares at a discount, you can enter the percentage discount as part of the savings card.

ESPP savings will flow through to the taxable account. You will see the value in the Net Flows section of the summary page of the cash flows, just like Taxable savings. The incremental value provided by the discount will be shown as an employer contribution.

ESPP contributions will be taxed like any other taxable assets; we do not factor in short-term capital gain rates for withdrawals within a year.

Employee Stock Ownership Plan (ESOP)

This card can be used to reflect employer contributions to a profit-sharing plan. These contributions will be reflected in the '401(k)/403(b)' column in the Accounts tab of the cash flows.

Contributions to profit-sharing plans are limited to 25% of the client's salary or self-employment income. Total contributions to all defined contribution plans (employee plus employer) will be capped at the IRS maximum value ($69,000 for 2024, plus an additional $7,500 'catch up' for those 50 and over).

Bank

This card includes cash savings in the client's bank account. These funds will grow at the rate of return associated with Cash in the return assumptions area. The bank account savings card will only be visible when the "Cash Management method" is set to "Treat bank account as cash, spend cash before taxable" or "Treat bank account as cash, spend cash after taxable".

Bank account savings will only display when using modified cash flow planning method.

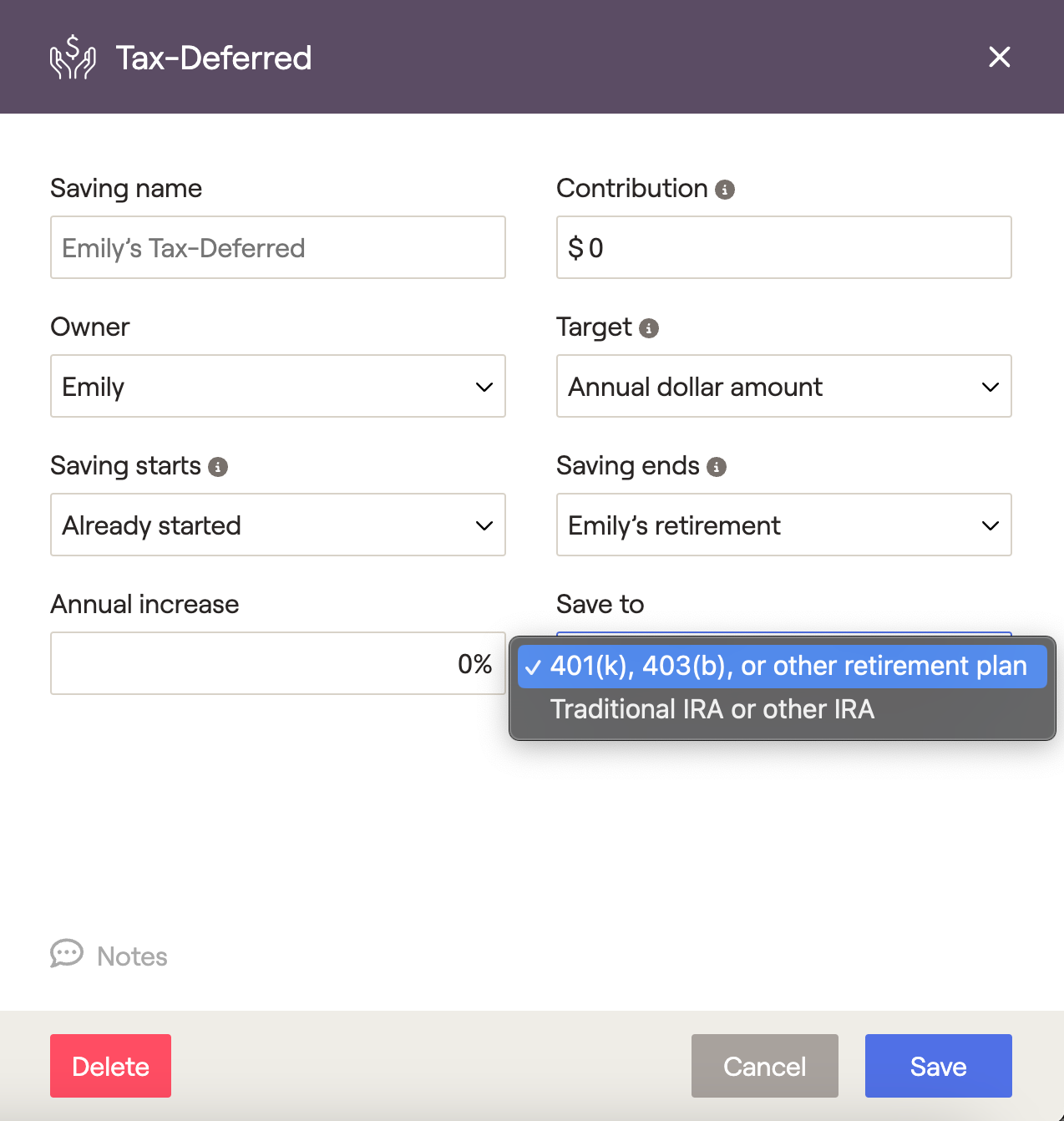

Tax-Deferred

This card can be used to reflect outside contributions to a tax-deferred account. Anything entered as part of a Tax-Deferred savings card will be shown as an employer contribution and be reflected in the '401(k) / 403(b)' column in the accounts tab of the cash flows.

There will be an additional variable in each card that allows the user to select the account type the savings will flow to. The options for tax-deferred savings are:

401(k), 403(b), or other retirement plan

Traditional IRA or other IRA

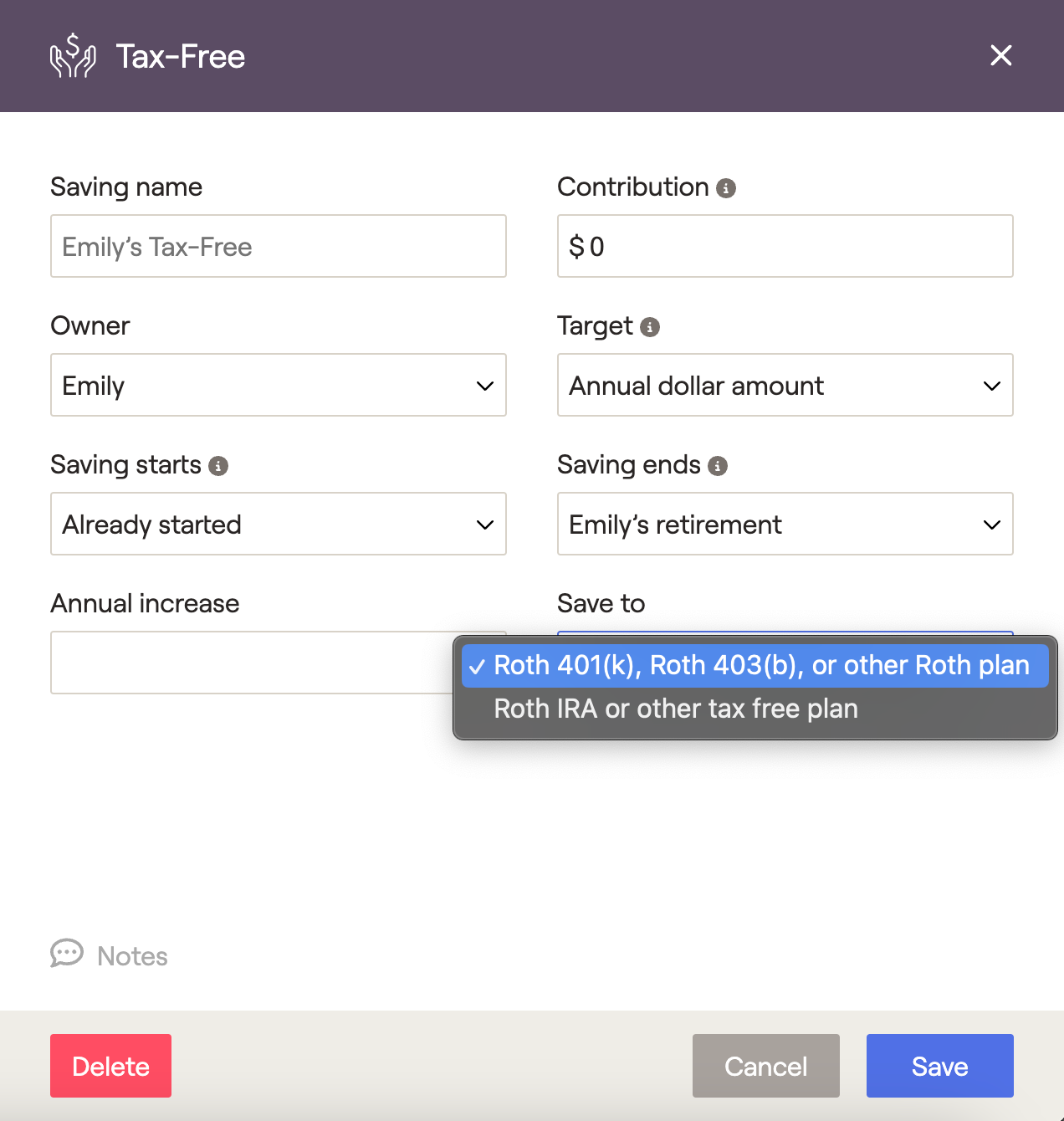

Tax-Free

This card can be used to reflect outside contributions to a tax-free account. Anything entered as part of a Tax-Free savings card will be shown as an employer contribution and be reflected in the 'Roth 401(k) / 403(b)' column in the accounts tab of the cash flows. The options for tax-free savings are:

Roth 401(k), Roth 403(b), or other Roth plan

Roth IRA or other tax-free plan