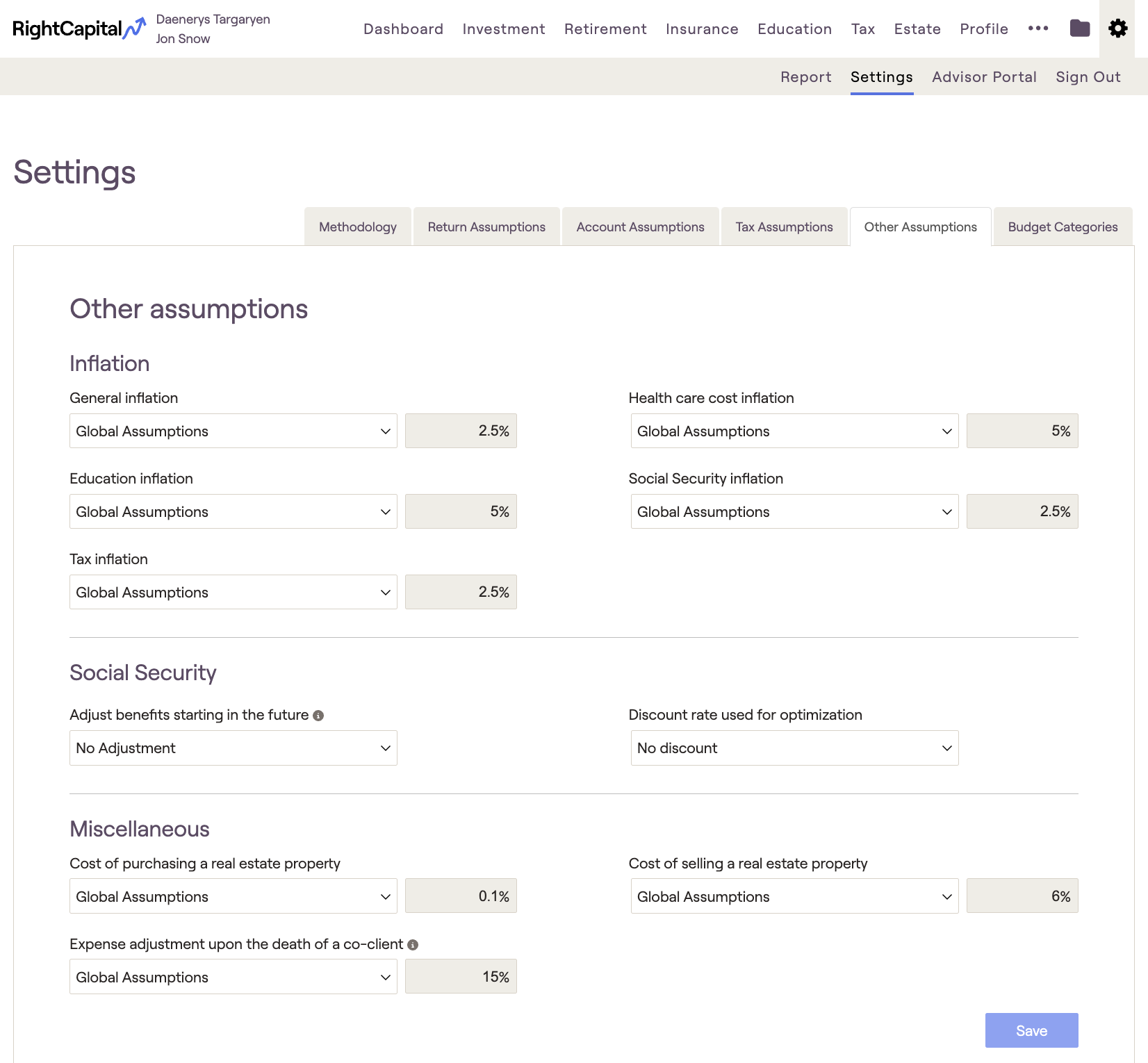

Inflation

RightCapital projects goals and expenses using five different inflation assumptions. These inflation assumptions are set globally in the Assumptions tab of the Advisor Portal, but you can choose to change the inflation assumptions at the client-level within each plan. Making changes to inflation assumptions here will not impact your global assumptions or any of your other financial plans.

Default Inflation Assumptions

Default inflation settings are derived from studies and planning tools used by leading financial institutions and industry experts. The default assumptions are as follows:

General Inflation: 2.5%

Health Care Cost Inflation: 5%

Education Cost Inflation: 5%

Social Security Inflation: 2.5%

Tax Inflation: 2.5%

Custom Inflation Assumptions

To customize inflation rates at the client level, use the dropdown menu to switch "global assumptions" to "customized assumptions". When adjusting the inflation settings, a financial plan is impacted in the following ways:

For more information on inflation assumptions in RightCapital, please see the article linked below:

Social Security

Adjust Benefits Starting in the Future

For clients who may be concerned about the sustainability of the Social Security Program, the ‘Adjust benefits starting in the future’ setting can be utilized to bake in a specific percentage reduction to all Social Security benefits starting in the future:

Adjustments to this setting will impact both the Monte Carlo analysis, as well as the future cash flow projection. This only applies to benefits that are being filed for in the future; it does not apply to any client who is already receiving benefits (or to any SS benefits entered via an Other Income card).

Example: If a client’s future social security benefit in 2030 is $20,000, and you enter a ‘Reduce By’ percentage of 2.5%, their benefit in 2030 will be reduced to $19,500.

Discount Rate Used for Optimization

For more details on this setting, please see the article linked below:

Miscellaneous

There are three Miscellaneous Assumptions that are able to be adjusted. These misc. assumptions are set globally in the Assumptions tab of the Advisor Portal, but you can choose to change the misc. assumptions at the client-level within each plan:

- Cost of purchasing a real estate property: Represents costs associated with purchasing a property. This assumption will impact property purchases and primary home relocations.

- Cost of selling a real estate property: Represents typical real estate agent fees associated with selling a property. This assumption will impact property sales and primary home relocations.

- Expense adjustment upon the death of a co-client: Represents the reduction in living expenses associated with the death of a client or co-client. This expense adjustment will impact pre-retirement and retirement living expenses for the surviving client, and will only occur within joint plans.

RightCapital uses the following default values for each of the miscellaneous assumptions: