Modeling Disability Scenarios

RightCapital includes a suite of tools highlighting the retirement risks of being underinsured. According to the Social Security Administration, the chance of becoming disabled before you retire is 1 in 4 - and for most people, disability will result in a lower living standard due to the loss of income. The Disability Insurance module demonstrates the exposure of financial loss to a disabling condition and enables a proposal to cover the shortage.

Visualize potential loss of income from a disability scenario

Determine and propose additional disability insurance coverage

Overview

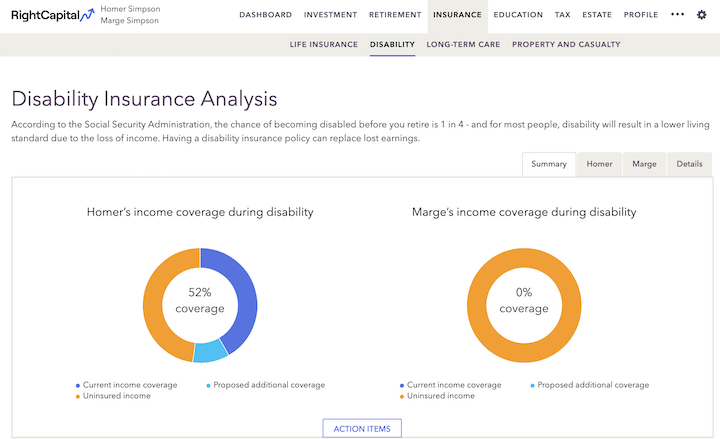

Summary Tab

The percent coverage at the center of the chart represents the total (current & proposed) insured income percentage covered over the specified disability period. Mouse over the charts to show percentages of current coverage, proposed coverage, and uninsured income.

Client/ Co-client Tabs

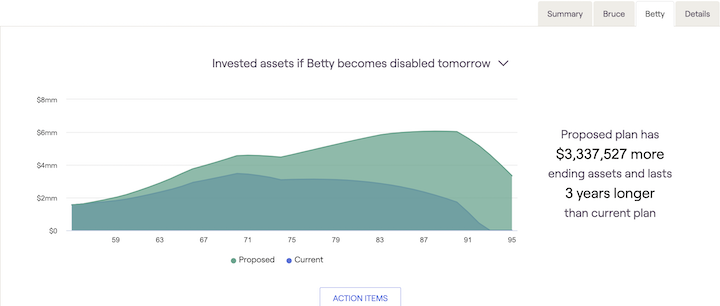

You will also see two tabs on the insurance screen with the names of the client and co-client. The tab labeled with the client's name illustrates the scenario in which the client becomes disabled tomorrow; the tab labeled with the co-client's name illustrates the scenario in which the co-client becomes disabled tomorrow. In each tab, users can choose between two graphs by changing the dropdown menu on the right.

- The income coverage bar graph reflects the annual, covered, and uninsured income by year for each scenario. Uninsured income is listed in orange, and the total percentage of insured income is displayed to the right of the chart. This projection includes any current and proposed additional insurance indicated in the Action Items section.

- The invested assets graph illustrates the impact on investments after a disability scenario arises. The chart displayed in blue shows the projection before including any proposed additional insurance; the chart in green shows the projection including the proposed additional insurance.

Action Items

In the Action Items, users can customize the disability scenario for each client. As a default, the disability scenario begins tomorrow and lasts through retirement. Users can propose additional disability coverage for each client scenario by adjusting the following variables:

- Disability lasts: Allows users to choose how long the disability scenario will last.

- Proposed monthly coverage: Allows users to specify the amount of proposed additional income coverage. This amount is added to any existing coverage.

- Proposed benefit period: The number of years or age which the insurance will pay disability benefits through.

- Proposed elimination period: The amount of time a client must pay out of pocket before coverage begins.

- Proposed inflation adjustment: The inflation amount that the disability benefit will be adjusted annually.

- Proposed inflation type: Users can choose whether the inflation adjustment to the proposed additional benefit is compound or simple.

- Proposed annual premium: The annual premium associated with proposed additional income coverage.

When users propose additional disability coverage and click refresh, the pie chart above will illustrate the proposed additional income for each client in light blue and any remaining uninsured income in orange. The total income percentage at the center of the graph will also display a new percentage of income that is covered over the specified disability period.

Additional Action Item Adjustments

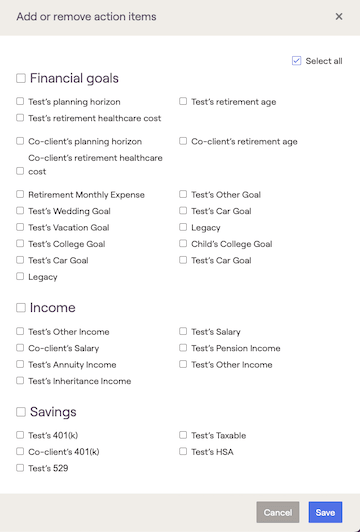

Users can also use the Action Items section to illustrate the impact of changes to plan inputs on the disability insurance calculation. You can do so by clicking the 'Edit' button at the bottom right-hand corner of the Action Items section.

When you click on the 'Edit' button, you will see a screen illustrating various goals, expenses, savings, and strategies that you can change to see the impact on the insurance projection. These mirror the options under the Retirement Analysis action items.

You can check off the boxes in front of any action items you wish to include to add them to the action items section and click Save to return to the action items screen to make any changes. There is also a “Select all” checkbook on the top-right-hand side if you wish to have all the action items included in your action items list.

Note: Changes made under the Disability Insurance action items only impact the insurance projection. They do not impact the current or proposed plans in the Retirement Analysis section or any other screen within RightCapital.

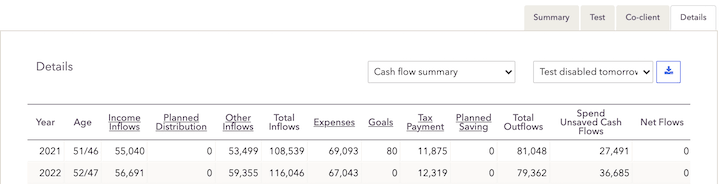

Details Tab

The details tab illustrates cash flow information associated with the projections on the summary and client tabs. Users can change the drop-down menus on the right to switch between client and co-client scenarios and between the cash flow summary and ending account balances.

The details tab functions in the same manner as the Retirement Cash Flows.