Adding Cash Reserve Goals

A Cash Reserve Goal allows you to indicate an amount that can be held in a separate cash reserve account using the return assumptions associated with the Cash asset class. Add one or more Cash Reserve Goals on the Profile > Goals screen.

Any amount above the Cash Reserve goal will be assigned to the 'Taxable Investment' account, which will use the investment assumptions associated with the Asset Allocation for that plan. If the total Taxable investment is less than the Cash Reserve goal, we will assign the entire amount to the Cash Reserve account.

Viewing Cash Reserve in Cash Flows

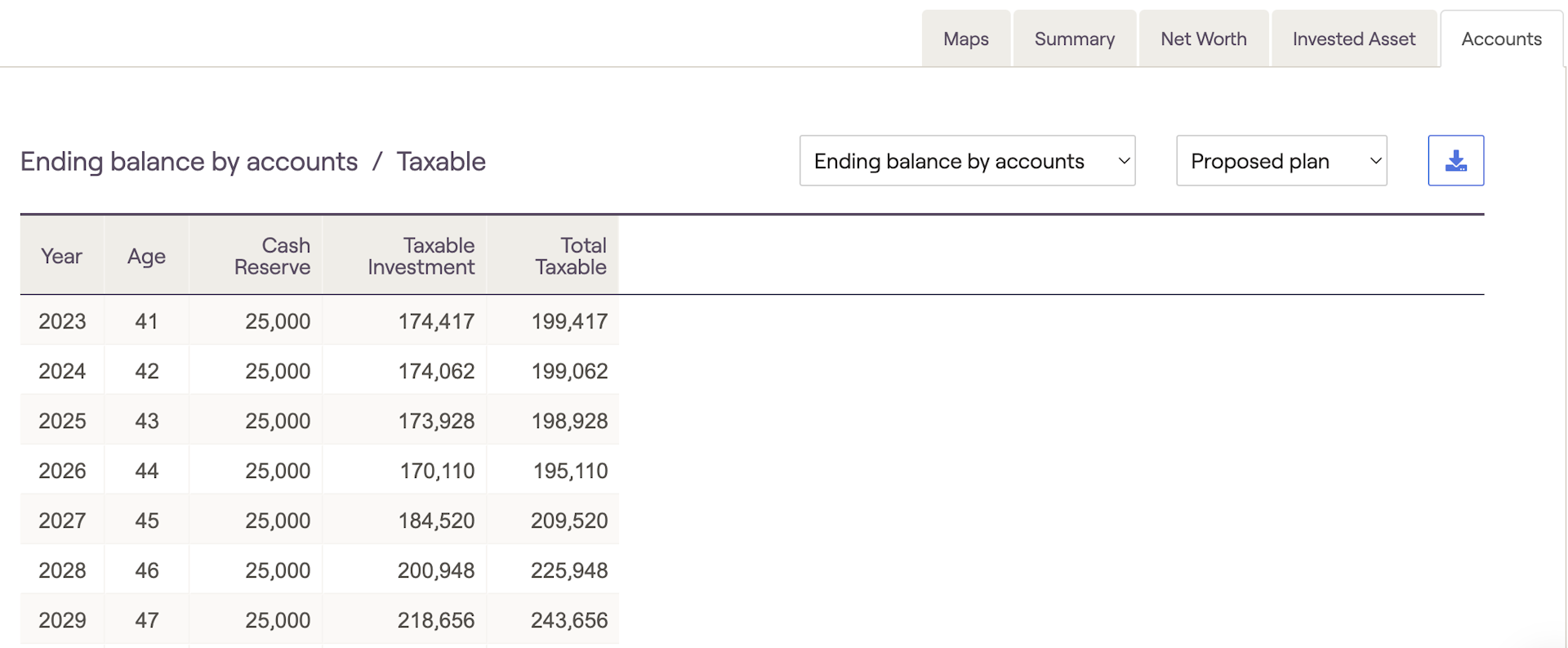

On the Retirement > Cash Flows page, on the 'Account' tab, you can see the breakdown between the Cash Reserve value and the Taxable Investment value by clicking the 'Taxable' column header. The total taxable amount is split between Cash Reserve (growing at cash rate) and Taxable Investment (growing at asset allocation rate).

Additions / Withdrawals from Cash Reserve

If a Cash Reserve goal ends, we will allocate the amount of the Cash Reserve goal from the Cash Reserve account to the Taxable Investment account.

Each Cash Reserve goal is a static amount that does not automatically increase with inflation. If the Cash Reserve goal is fully funded, any growth will automatically be moved into the Taxable Investment account.

Negative cash flows will be automatically funded first from the Taxable category. Money will be withdrawn from the Taxable Investment account first; if the Taxable Investment account is fully depleted, money will be then be withdrawn from the Cash Reserve account. If you wish to have negative cash flows come from other investment categories before the Taxable Investment and/or Cash Reserve accounts, you can add Distribution cards on the Profile > Income screen.

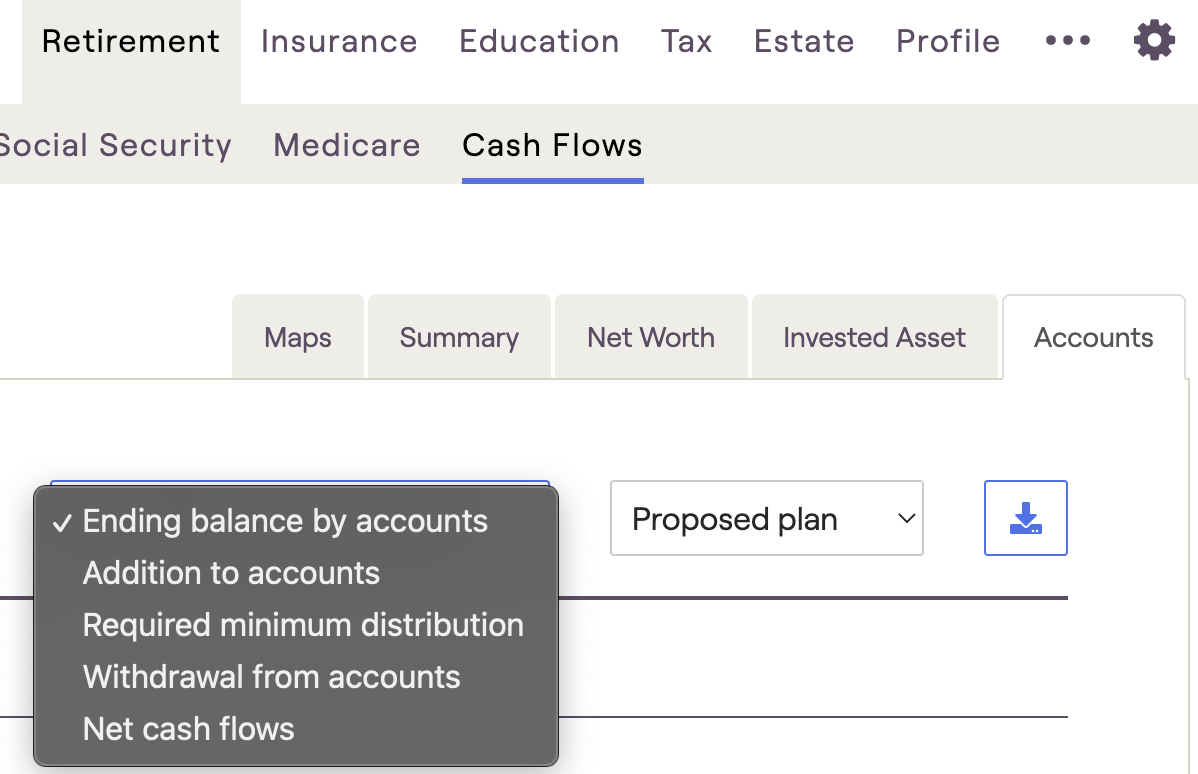

You can see total additions, withdrawals, and net cash flows from the Cash Reserve and Taxable Investment accounts by using the left-hand drop-down box.

Proposing Changes to Cash Reserves

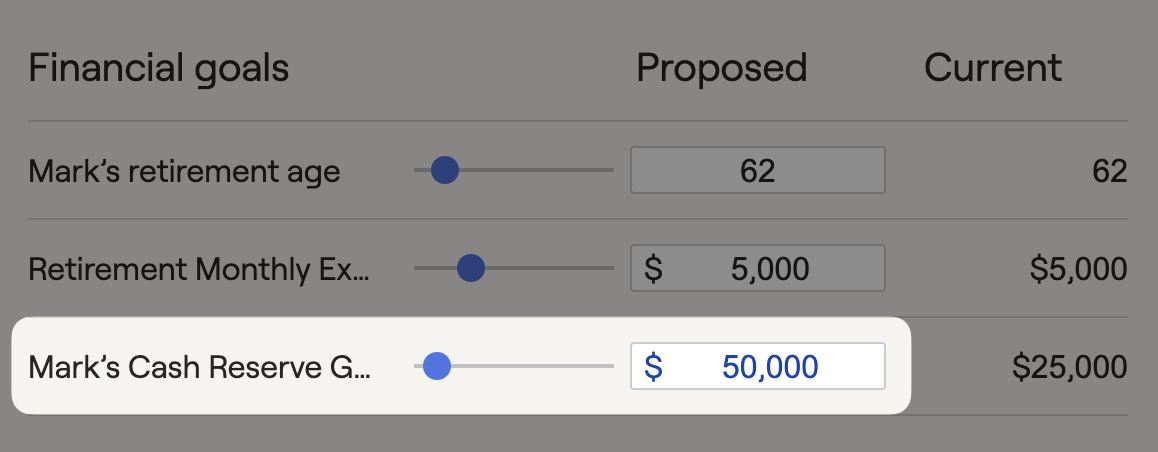

You can illustrate changes to the Cash Reserve goal on the Retirement > Analysis screen under the Action Items section.

First, add the current Cash Reserve goal on the Profile > Goals screen.

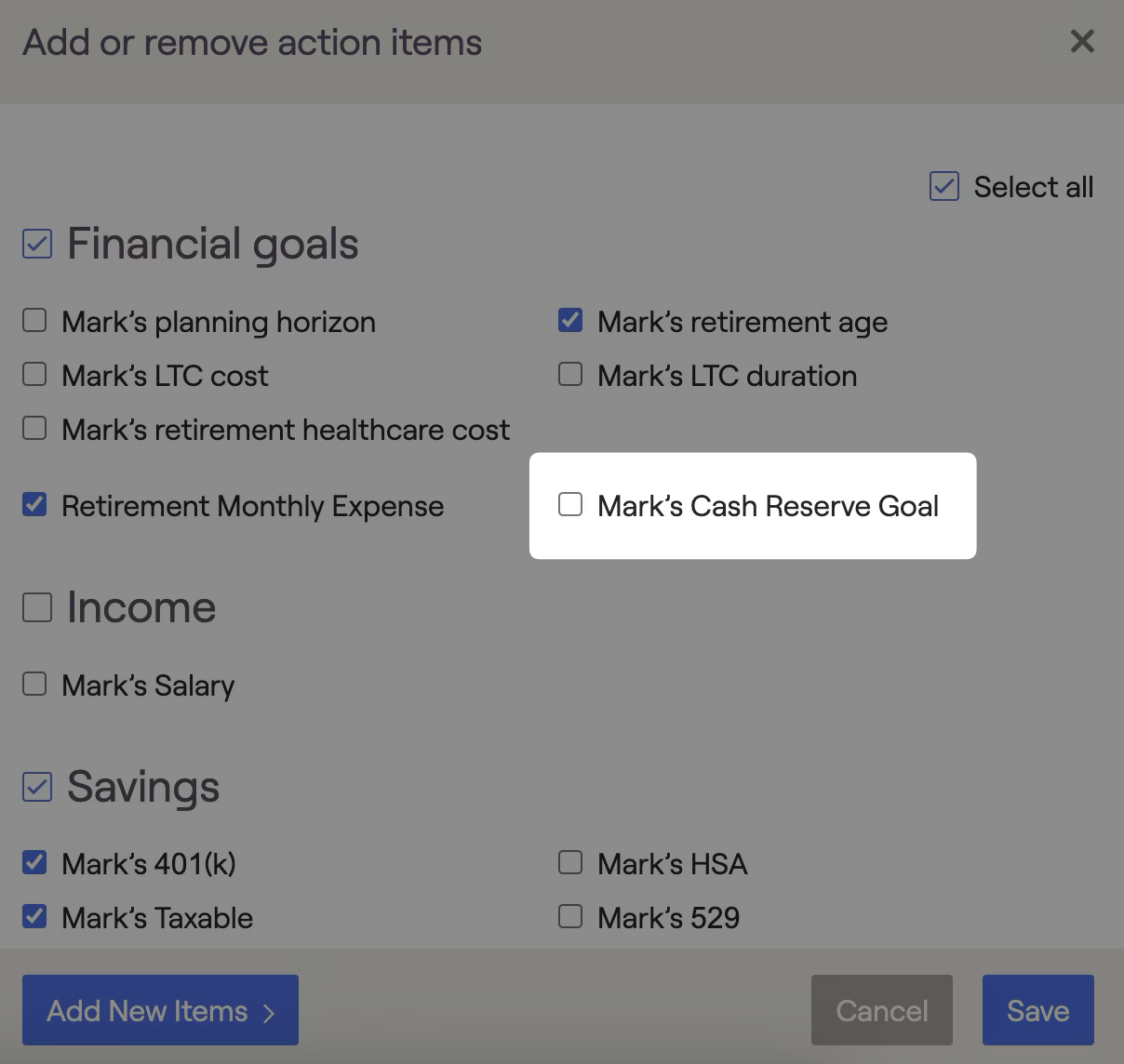

Second, go to the Retirement > Analysis section, open the 'Action Items' panel and click the 'Edit' button.

Third, find the Cash Reserve goal, check the box, and click 'Save'