Return scenarios are RightCapital's way of giving you granular control over sequence of return within your client plans. By utilizing return scenarios, you can view and analyze each client plan within the context of virtually any possible market scenario.

Default Return Scenarios

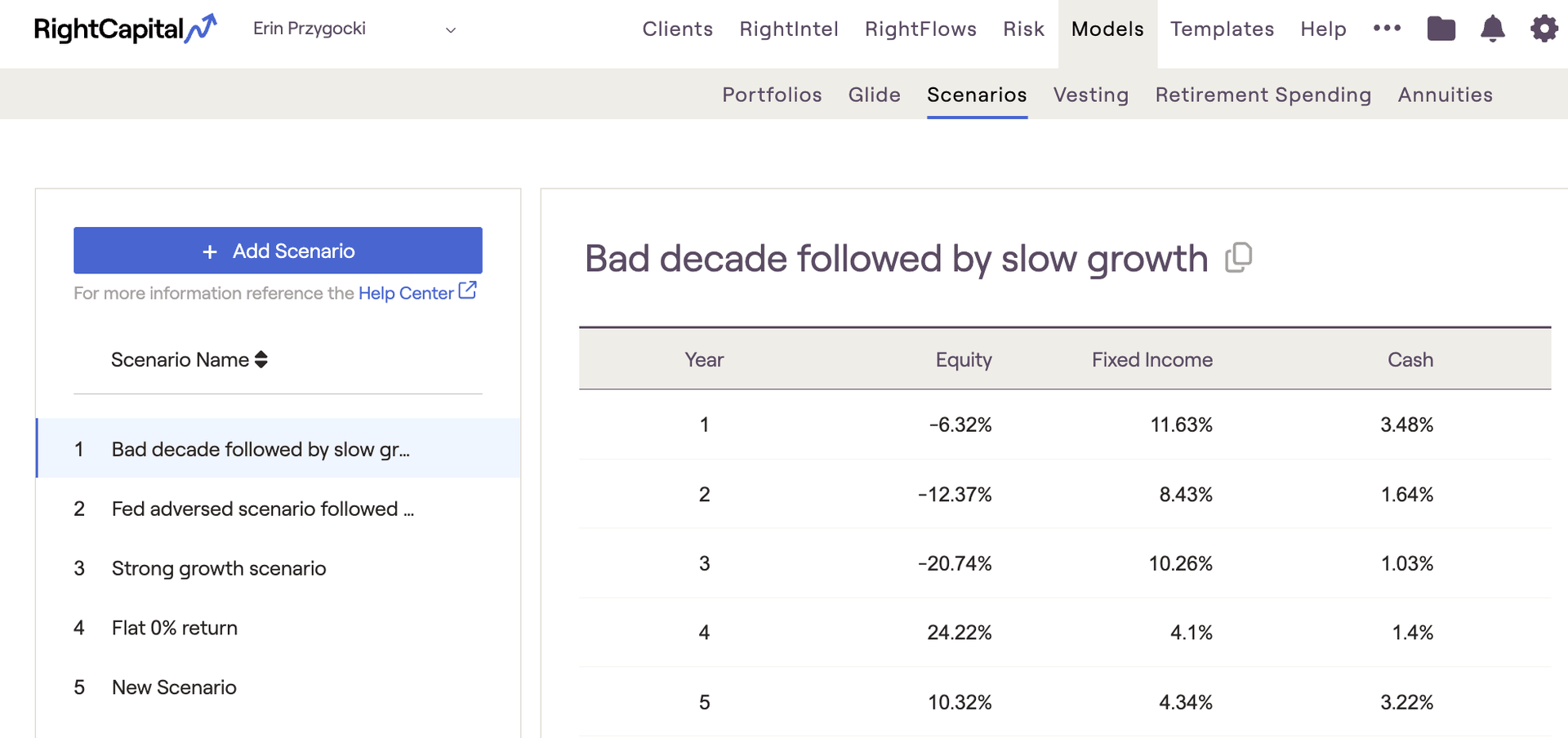

RightCapital includes four default return scenarios, which are pre-built into every advisor account. By clicking on the name of each scenario, the exact values of each asset category in each year are displayed:

A bad decade of volatile performance, leveling off to reflect slow growth for the remainder of the scenario.

Years 1-10 of the scenario are modeled after the S&P 500 index (equity) and Bloomberg Aggregate Bond Index (fixed income) from the year 2000 through 2009.

Years 11+ reflect 2% equity, 1% fixed income, and 0.25% cash returns (slow growth)

A four year hypothetical recession, leveling off to reflect modest growth for the remainder of the scenario.

Years 1-4 of the scenario are loosely modeled after the type of stress tests released by the Federal Reserve each year, to test the solvency of large financial institutions.

Years 5+ reflect 4% equity, 2% fixed income, and 0.5% cash returns (modest growth)

A good decade of mostly positive performance, leveling off to reflect strong growth for the remainder of the scenario.

Years 1-10 of the scenario are modeled to reflect positive market performance with fluctuating year-to-year returns. This is an original scenario developed by RightCapital.

Years 11+ reflect 8% equity, 4% fixed income, and 1% cash returns (strong growth)

Eliminates equity, fixed income, and cash returns for the duration of the scenario.

Adding New Return Scenarios

After a scenario has projected returns for all 50 years, asset growth will continue at the rates specified in the final year of the scenario chart.

Quick Fill

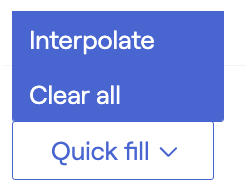

When creating a custom return scenario, the Quick Fill button allows advisors to populate or clear information much more easily.

- Interpolate will automatically populate all 0% inputs between beginning and ending values listed. This feature saves time and helps to populate values more quickly.

- Clear all will reset all return scenario inputs to 0%.

Re-order Return Scenarios

Delete Return Scenarios

Where to Use Return Scenarios

Return scenarios are able to be applied in several places within a client plan:

- When comparing two plans in the Retirement > Analysis > Comparisons tab

- When analyzing retirement details for a proposal, in the Retirement > Analysis > Retirement Details tab

- When curating a stock plan proposal in the "..." More Menu > Stock Plans > Analysis tab