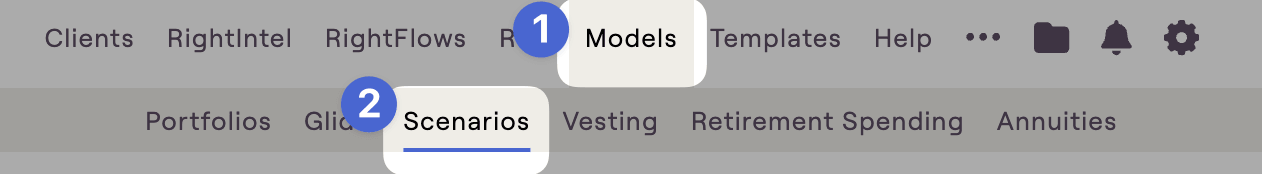

Return scenarios are RightCapital's way of giving you granular control over sequence of return within your client plans. Advisors can create their own custom return scenarios in the Models > Scenarios tab of the Advisor Portal:

To create a new scenario, click Add Scenario on the left. After being created, the new scenario can be renamed by clicking the "..." icon next to the name:

You can also make a copy of an existing model by hovering over a model, and clicking the copy icon to the right of the model name:

After adding the new scenario, use the detailed schedule on the right to adjust the Equity, Fixed Income, and Cash returns for all 50 years of the scenario. Scroll down to the bottom of the page and click Save to preserve the new scenario.

What happens after year 50?

After a scenario has projected returns for all 50 years, asset growth will continue at the rates specified in the final year of the scenario chart.

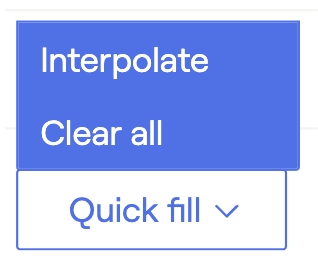

When creating a custom return scenario, the Quick Fill button allows advisors to populate or clear information much more easily.

- Interpolate will automatically populate all 0% inputs between beginning and ending values listed. This feature saves time and helps to populate values more quickly.

- Clear all will reset all return scenario inputs to 0%.

Return scenarios are able to be applied in several places within a client plan:

- When comparing two plans in the Retirement > Analysis > Comparisons tab

- When analyzing retirement details for a proposal, in the Retirement > Analysis > Retirement Details tab

- When curating a stock plan proposal in the "..." More Menu > Stock Plans > Analysis tab

- Optionally, return scenarios can be turned on within the Retirement > Cash Flows, by navigating to the Gear Icon > Settings > Methodology page, and checking the 'Allow display of scenario-specific cash flows' setting.