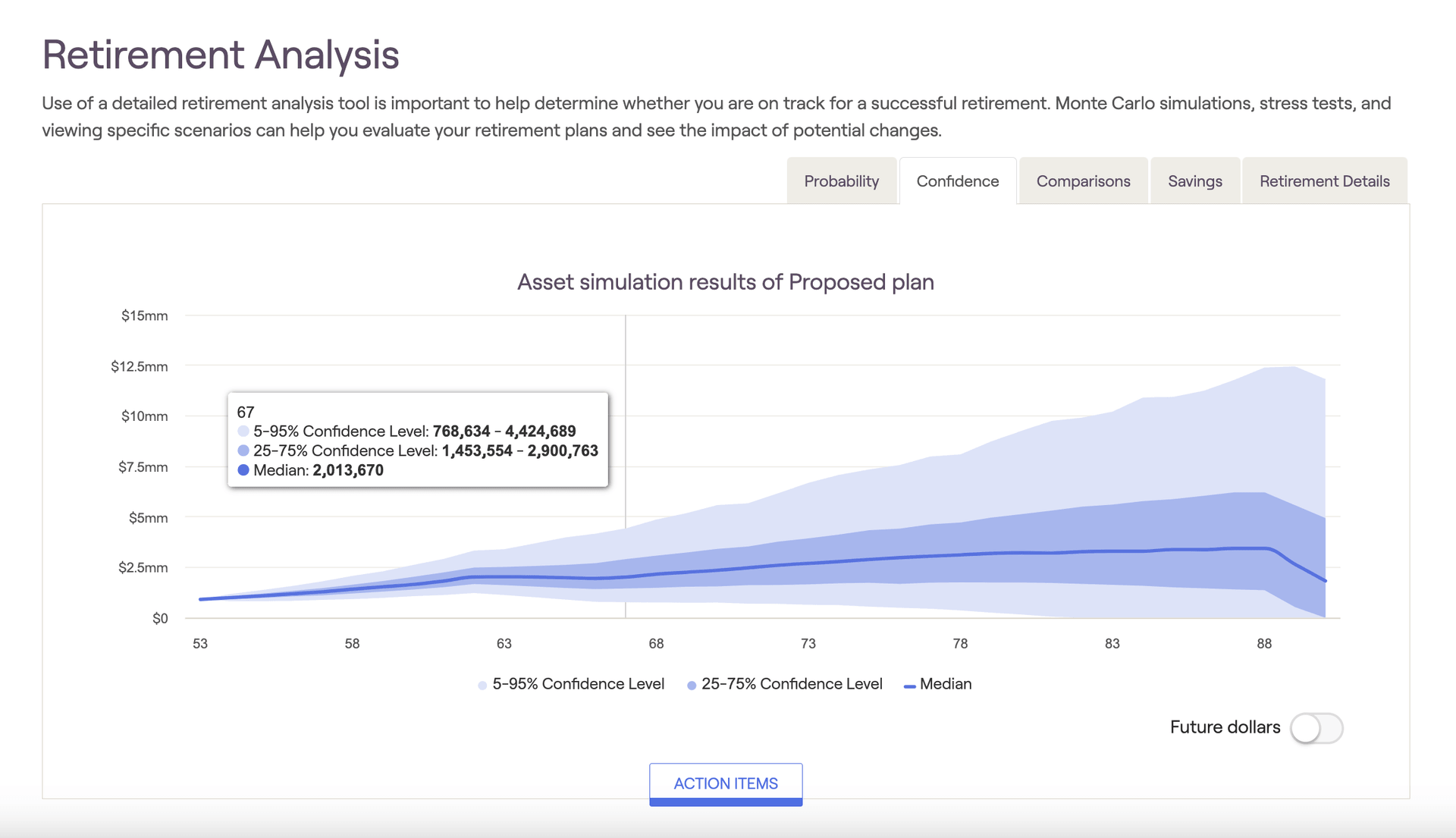

At each age (reflected on the x-axis), the 1,000 Monte Carlo trials are ordered by asset value. For the 5-95% Confidence Level, only the highest and lowest 5% of the values are excluded. So, the results of trials 51 - 950 (in asset value order) are reflected within the light blue shaded area in the confidence chart. This means that 90% of the time, a client's assets will fall somewhere between the upper and lower boundary of the light blue area. The 25-75% confidence range reflects trials 251 - 750, and the Median reflects "trial 500".

Many clients often latch onto the median value as their expected retirement value at any given point. However, at best, this only has a 1/1,000 chance of being exactly true! Some successful advisors carefully disclose both the reality of a simulation ("we can't know the future until we're there") and the reality of probable range over exact value.

Using the legend underneath the chart, you can toggle the displayed values and zero in on a specific confidence interval. As a reminder, the dollar value for the median trial in the final year of the plan is the Median Ending Invested Asset value- this will align with the value displayed within the green bar graph in the Probability tab.

Using the display settings menu to the lower right of the chart, you can choose to swap client age with calendar year on the x-axis of the chart(s):