Adding Property Goals

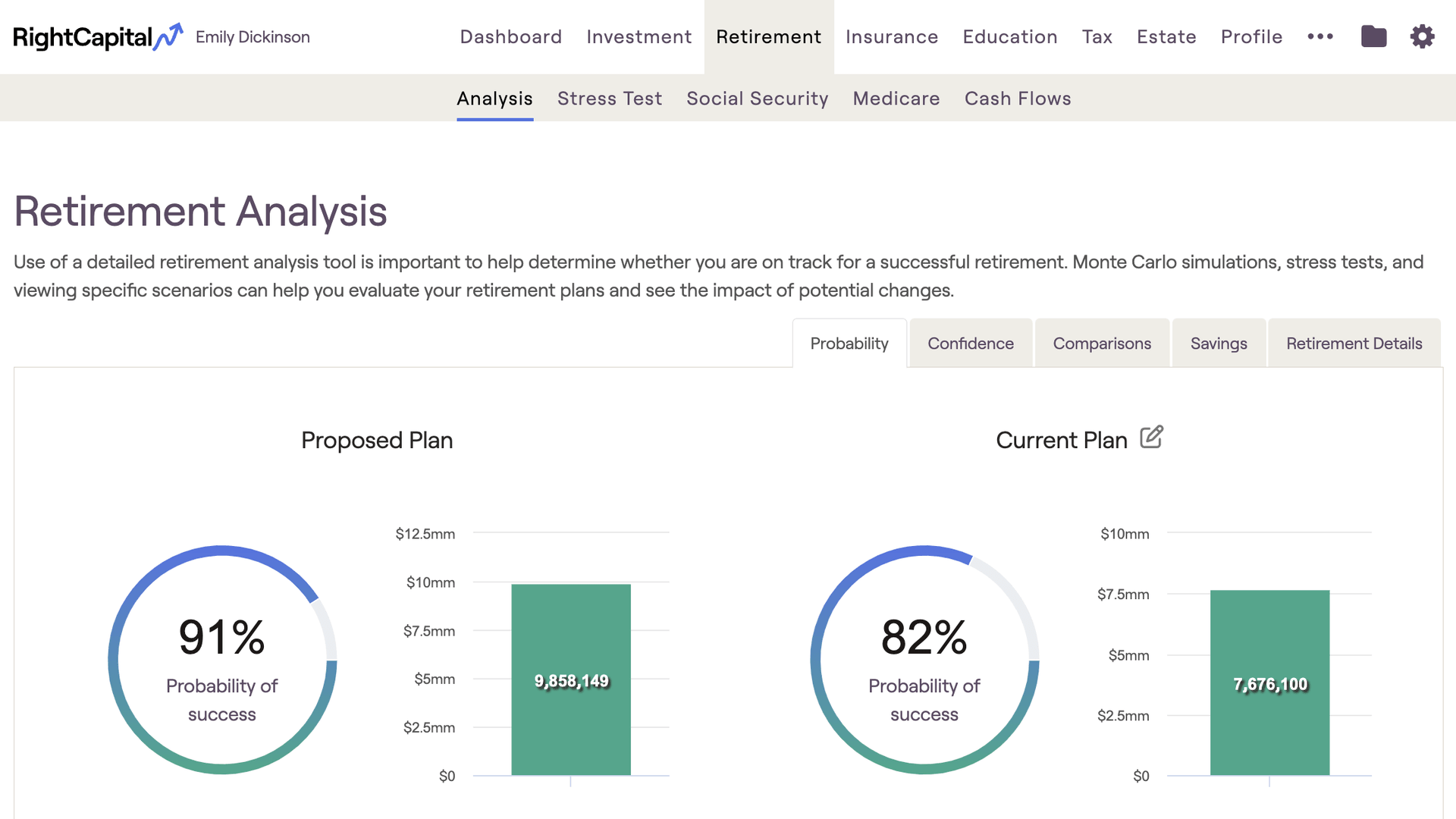

Additionally, property goals can be added directly to a proposed plan within the Retirement > Analysis module. This allows for an easy comparison of scenarios with different financial goals. For more information on adding financial goals to the Retirement > Analysis module, click here.

Primary Home Relocation

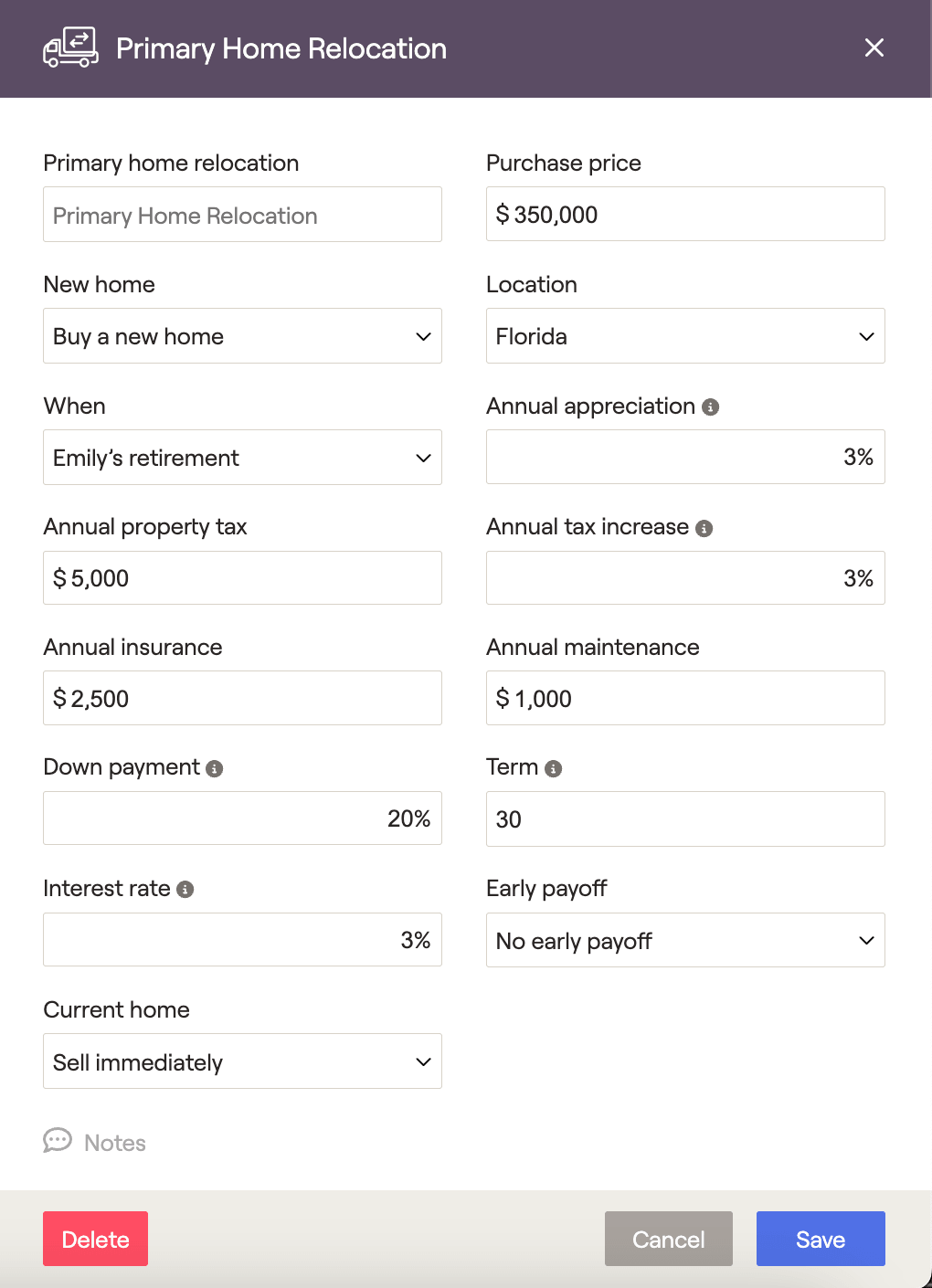

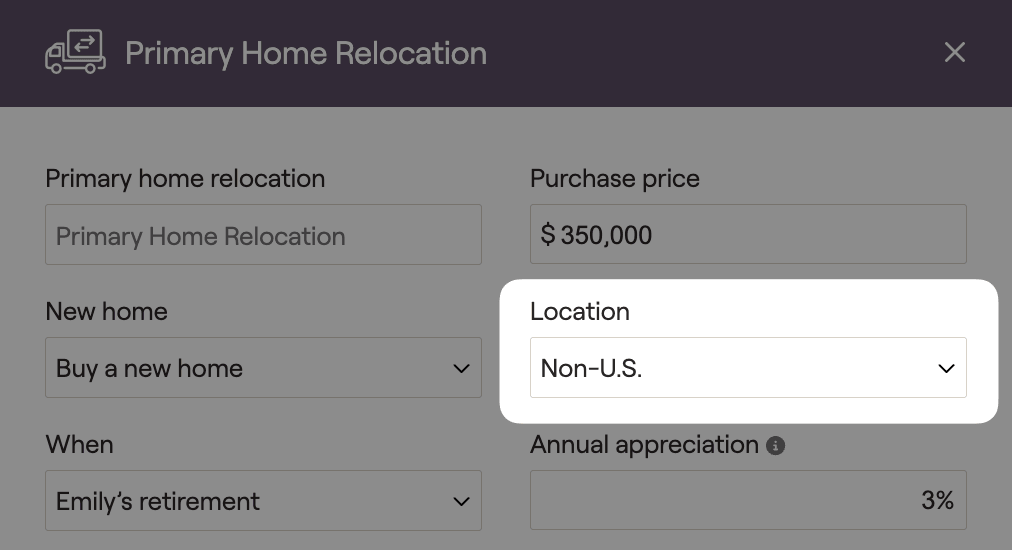

The Primary Home Relocation goal allows you to change the client's primary residence in the future. You can have the client move into a new or existing property. For new properties, you can enter the state of residence (which will generate updated state taxes), year of relocation, and details about the home and financing. You can enter multiple Relocation goals to change the primary residence at different times.

You can also specify what should happen to the existing primary home at the time of sale.

Fields include:

The default option is 'Sell immediately', selling the existing property. Any mortgage and home equity associated with the property will be marked as paid, and the net proceeds will be added to the cash flow.

You can also select to convert the primary home to a vacation home or an investment/rental property. If you convert to a rental home, you will be asked to enter information about rental income, expenses, and depreciation. Additional annual maintenance expenses will be added to the annual maintenance value entered on the previous primary home.

If the New home is set to "Inherit Property"

If the New home is set to "Buy a new home"

If the New home is set to "Move into existing home"

You will see a drop-down box that includes all existing properties' names; select the property that the client will be moving into. Existing information from the property, such as mortgage, property tax, and insurance will be continued.

Primary Home Relocation can be used to reflect many different scenarios, including:

A client who is renting but looking to purchase a home in the future

Client who is looking to move to a bigger house in a few years

A client who is looking to downsize / relocate at retirement

A client who plans to move into their vacation or rental home

A client who is looking to convert their current home into a rental property

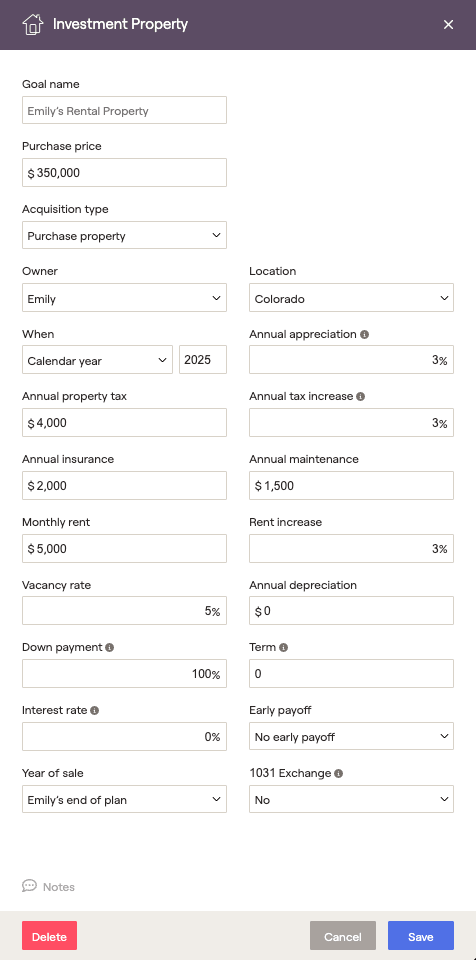

Investment Property Purchase

An Investment Property Purchase can be used to purchase a property that will be used to generate income in the future.

In addition to the fields discussed above under the Primary Home Relocation goal, under the Investment Property, you can enter the following information:

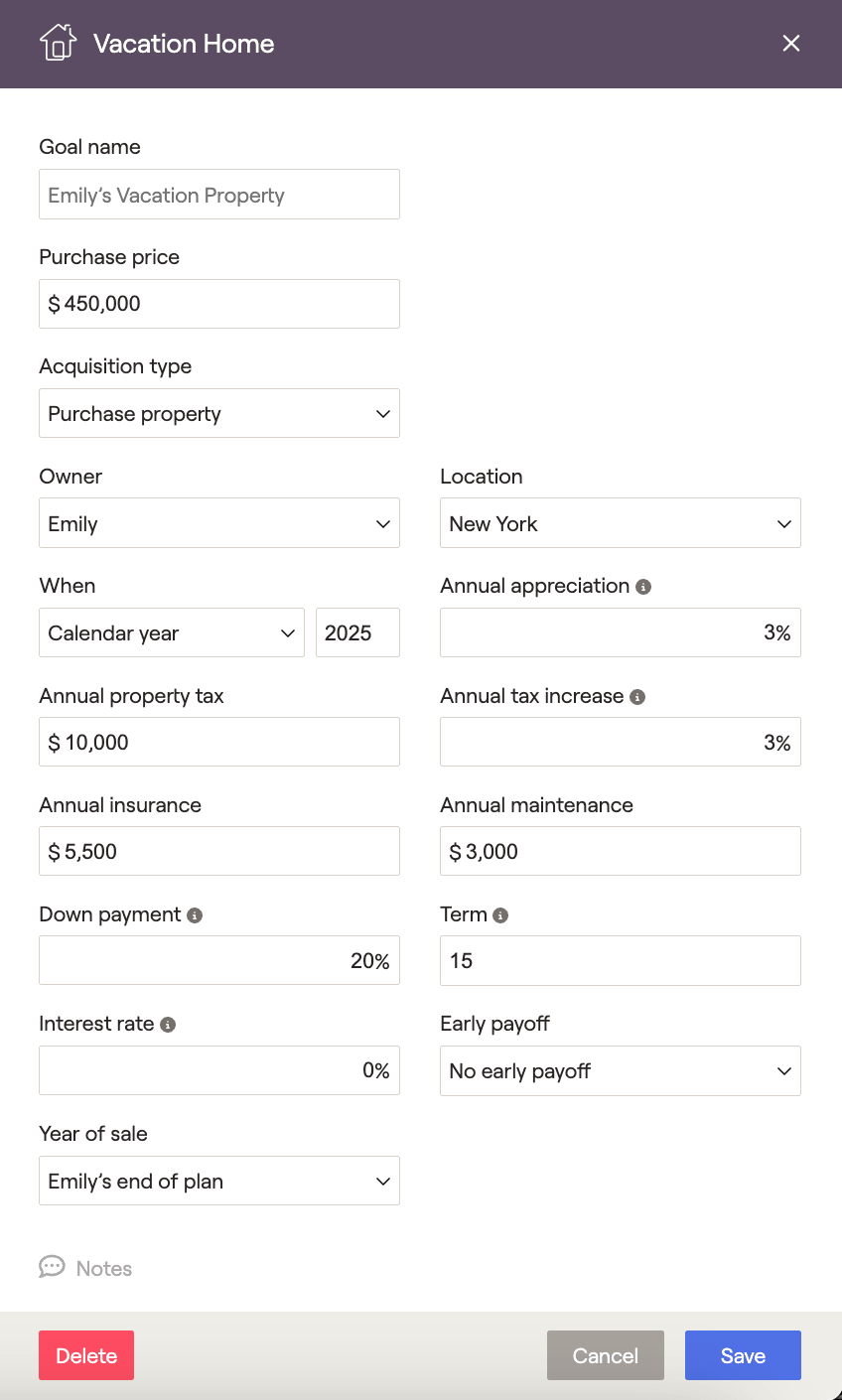

Vacation Home Purchase

A Vacation Home Purchase goal can be used to purchase a vacation home, 2nd home, or any other property that is not expected to generate income for the owner.

For more information about any fields on the Vacation Home Purchase goal, see the discussions above under Primary Home Relocation and Investment Property Purchase.

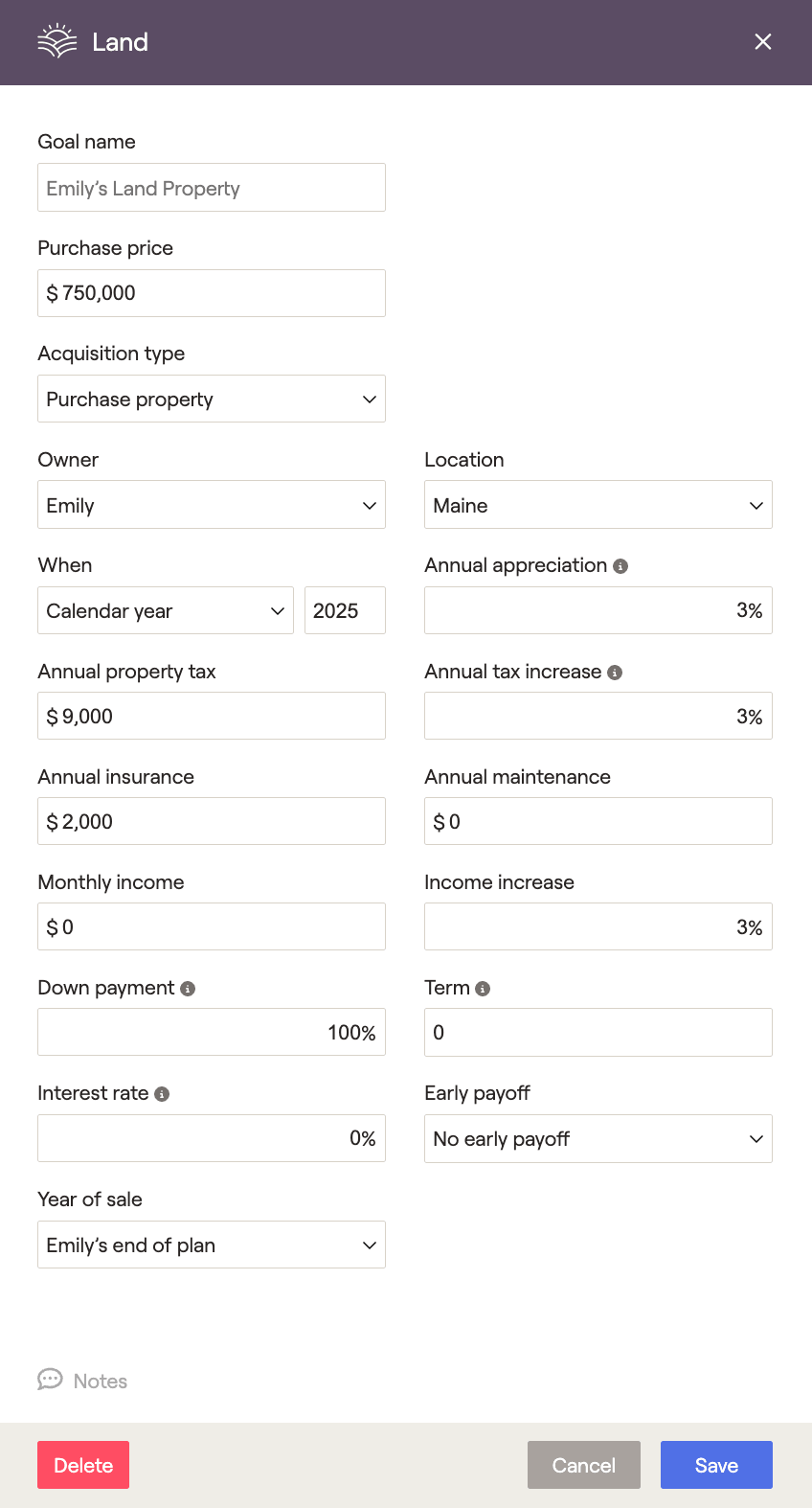

Land Purchase

A Land Purchase goal can be used to purchase land at a future date within the financial plan. Users can indicate expenses and income associated with the property, similar to an investment property. The land will be included with investment properties in the Retirement > Cash Flows. Expenses, taxation, etc., will be treated similarly to an investment property, with the distinction that land does not allow for depreciation.

Home Improvement Goal

This goal simulates future home improvement costs that can increase the value on a linked house. The goal amount is deducted from cash flows in the specified year, while the "added value percentage" of the goal amount increases the linked property's value. The "added value percentage" allows the property value to increase by a different amount than the home improvement cost.

The home improvement goal will also increase the cost basis, used to calculate capital gains when the property is sold, by the goal costs. Using the three additional fields at the bottom of the card, you can reflect any expected increases to property taxes, insurance, and maintenance fees as a result of the home improvement goal.

Using Additional Loan Types

Future property purchase goals allow you to input the down payment amount, interest rate, and term for a standard loan within each data card. Simply enter 100% in the down payment field to pay outright for a property purchase. To use other loan types to fund the purchase, enter 100% in the down payment field, then visit Profile > Income > Add Income> Other Income > New Loan Income. The new data card will allow you to enter and link the new loan type to any future property purchase goal.

Illustrating Changes to Property Goals

You can illustrate changes to the purchase year of any Investment Property Purchase or Vacation Home Purchase goal under the Action Items section on the Retirement / Analysis screen. The goals will automatically display under the "Property and asset purchases":

You can change the year of purchase to any specific year or either client's retirement year. If you want to show a plan where the property purchase is not included, set the purchase year "Never".