Customize Global Inflation Rates in RightCapital

Default Inflation Assumptions

RightCapital uses five different inflation assumptions to project goals and expenses. The default inflation assumptions were derived by referencing studies and planning tools from leading financial institutions and industry experts. We plan to review the data on an annual basis. The default inflation assumptions are as follows:

Inflation Type | Default Value |

|---|---|

General inflation: | 2.5% |

Health care cost inflation: | 5% |

Education cost inflation: | 5% |

Social Security inflation: | 2.5% |

Tax inflation: | 2.5% |

General Inflation

The five Retirement Spending Strategies, within the Profile > Goals > Retirement Expense card

The Today's Dollars toggle in the Retirement > Analysis tab

The Discount Rate used for Optimization setting, in the Gear Icon > Settings > Other Assumptions tab

Any Expenses or Goals with an Annual Increase field that is set to "General Inflation"

Health Care Cost Inflation

The Retirement Health Care Cost goal card

The Annual Retirement LTC Cost goal card

Any Expenses or Goals with an Annual Increase field that is set to "Health Inflation"

Education Cost Inflation

The College and Pre-College goal cards

Any Expenses or Goals with an Annual Increase field that is set to "Education Inflation"

Social Security Inflation

Social Security payments every year, both prior to filing and for those who have already started receiving benefits

PIA bend points, earnings test (AET) exempt amounts, and other variables needed to calculate social security benefits

The Social Security salary base (also known as the taxable wage base) every year for the purpose of calculating the maximum Social Security benefit

Tax Inflation

Yearly contribution limits for retirement accounts (employer-sponsored plans and IRAs)

Ordinary income, capital gains, and medicare premium (IRMAA) tax bracket thresholds

Estate tax exemption thresholds (federal and state)

Inflation Timing For Future Items

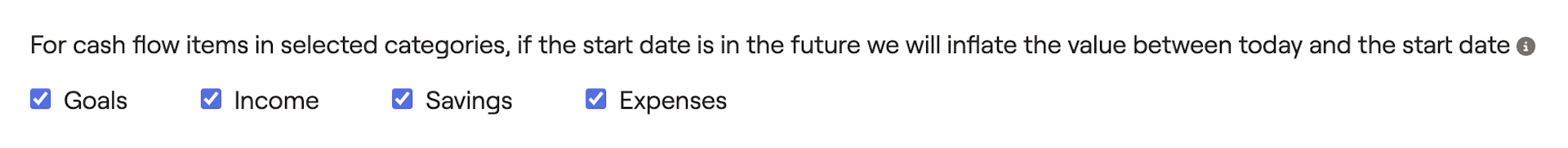

Underneath the five inflation rates, advisors have the ability to specify whether the values entered for cash flow items such as goals, income, savings, or expenses will inflate between now and the start date of the item:

If the box is checked, items with a future start date will be adjusted for inflation beginning today. This will not impact pension income, annuity income, loan income, business income, real estate income, or asset/property purchase goals. This is exclusively a global setting, and cannot be adjusted on a client-by-client basis.

Client-Specific Inflation Assumptions