Frequently Asked Questions

Need assistance? RightCapital is here to help! Please use the common questions and answers below to assist you in generating financial plans. For additional assistance, use the link to our support team at the bottom of the article.

This is due to the planning method you have set within the client settings. When the "Goals based" planning method is selected, RightCapital mostly ignores income and expenses and instead looks to goals, savings, and account information in retirement. This will remove the Add Expense" button, and only pension and annuity income will appear within the "Add Income" menu.

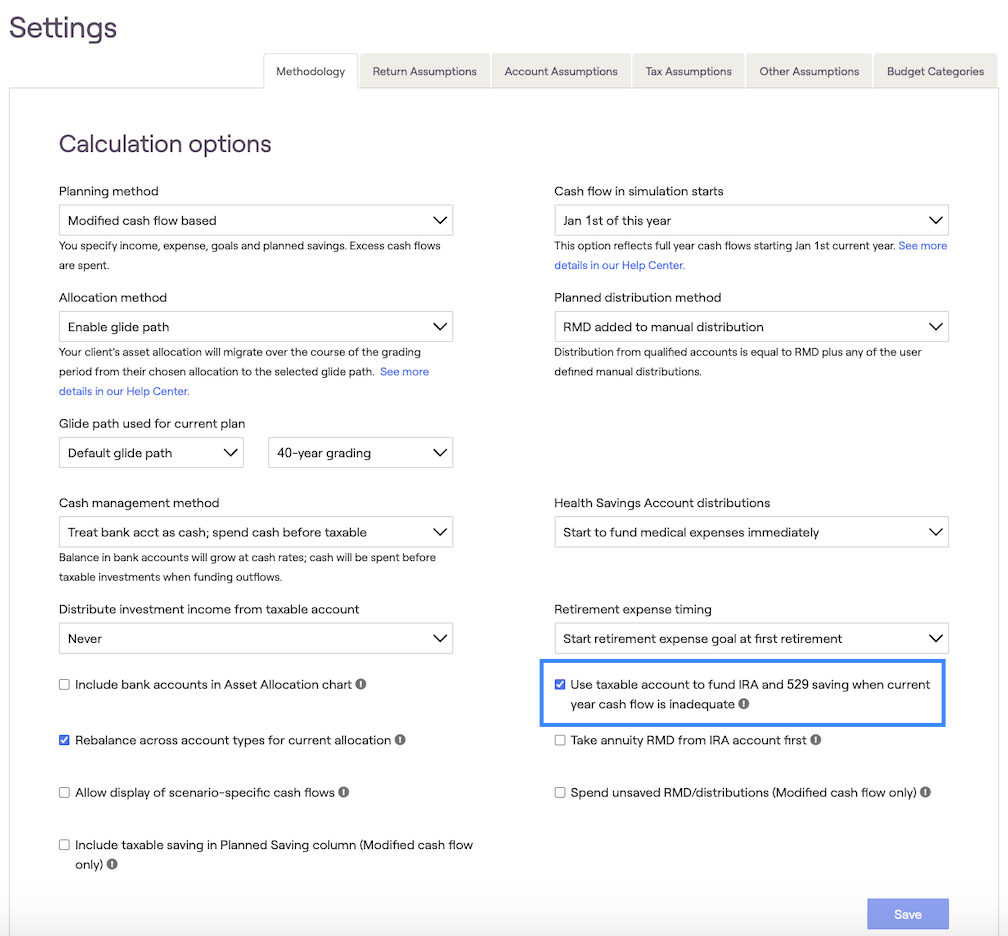

To change the Planning Method to "Cash Flow" or "Modified Cash Flow" this can be changed in the Gear icon > Settings > Methodology tab within the client plan. To learn more about the planning methods that RightCapital offers, please click here.

RightCapital will only fund contributions to IRA, Roth IRA, and 529 accounts from cash flows. If there are insufficient cash flows in any year, RightCapital will not reflect the contributions in that year.

If you wish to reduce taxable investment accounts to fund IRA and 529 savings, check the "Use taxable account to fund IRA and 529 saving when current year cash flow is inadequate" box in the Client Plan > Gear Icon > Settings > Methodology tab.

After completing the six initial steps of data entry, it is helpful to review the Retirement > Cash Flows > Summary report to review income and expense totals. This is a quick way to identify the total income inflows and expense outflows during every year of the financial plan.

For a more in-depth overview of information, click on an underlined column header (ex. Expenses) to see a breakdown of information. For more information on the cash flows, please click here.

You can also update the client default residence state for all new clients that you create going forward, visit the Advisor Portal > Client Settings > Client Presets tab.

We have multiple ways to contact our top-notch Support Team. We also invite you to join our weekly recurring webinars focussed on creating plans, presenting plans, and deep dives into specific planning modules. Click here to learn more!