For clients with HSAs, you can enter ongoing contributions within the Savings section of the Profile (or the Savings step of the initial data entry process). These savings cards can be added by clicking Add Saving in the upper right, and selecting HSA:

HSA Savings Data Entry

Click on this card to open a data entry drawer on the right side of your screen, allowing you to input the contribution information:

Start by choosing the client or co-client as the Owner. Depending on your chosen Target option, enter the client's Contribution as an annual dollar amount, percentage of income, or the maximum contribution. Lastly, dial in the Saving starts and Saving ends dates to determine the duration of the contributions.

If you have 'Annual dollar amount' chosen as your target you can enter an optional Annual Increase, which will be applied to the contribution amount each year within the cash flow projections. The Flat dollar match field can be used to reflect an employer match.

What does "Self-employed" do?

Checking the Self-employed box will cause this card to calculate contributions based on the client's Self-employment income, rather than Salary income.

Additional Information

Contribution Limits and Taxation

Employee contributions are capped at the IRS limits for a single individual ($4,400 for 2026, plus $1,000 catch-up for age 55+) and for a family ($8,750 for 2026, plus $1,000 catch-up for age 55+).

Employee contributions are pre-tax and are treated as Adjustments to Income (Line 13 of the Schedule 1, Line 10 of the 1040) for tax purposes, reducing a client's AGI.

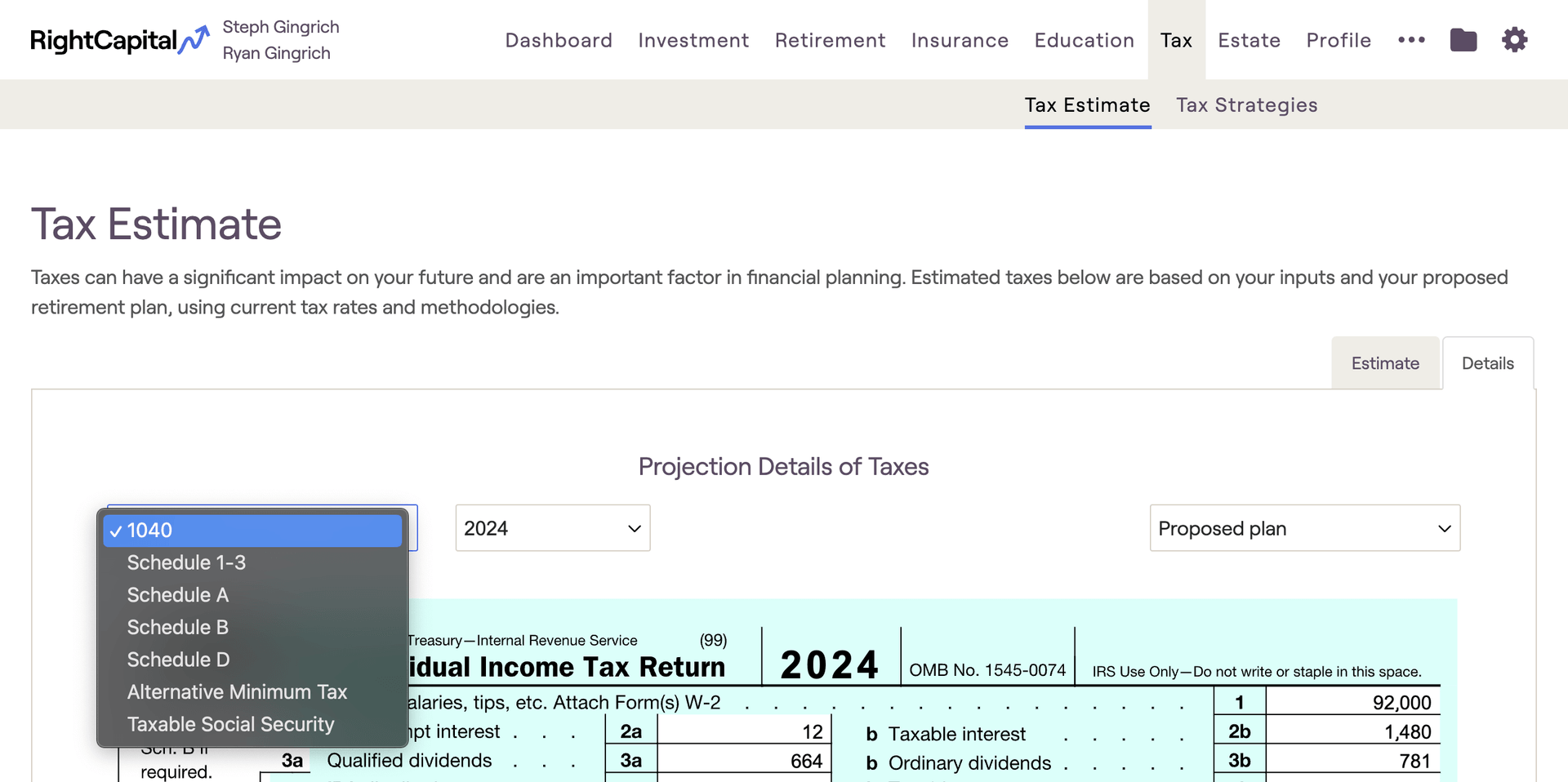

Sample tax forms can be viewed in the Tax > Tax Estimate > Details tab:

Cash Flow Location & Details

Client contributions can be tracked in two locations within the Retirement > Cash Flows:

- The Summary tab > Planned Savings column

- The Invested Asset tab > Planned Savings column

Employer contributions can be found in the Invested Asset tab > Employer Match & Other column.

Contributions to HSA plans will always occur within the cash flow projections, even in years with cash flow deficits.