Properties can be accounted for within a financial plan via the Net Worth section of the Profile, which is where all of a client's assets and liabilities are entered, along with their current balances. By default, the Net Worth is also the 4th step of the initial data entry process for newly created clients:

Primary Home

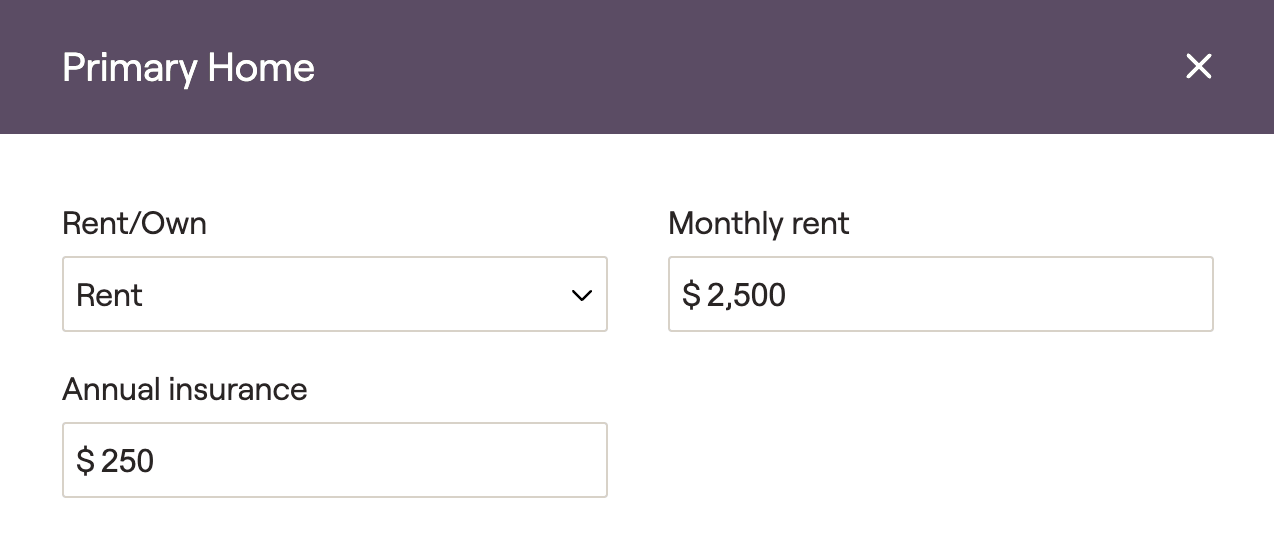

Renting Primary Home

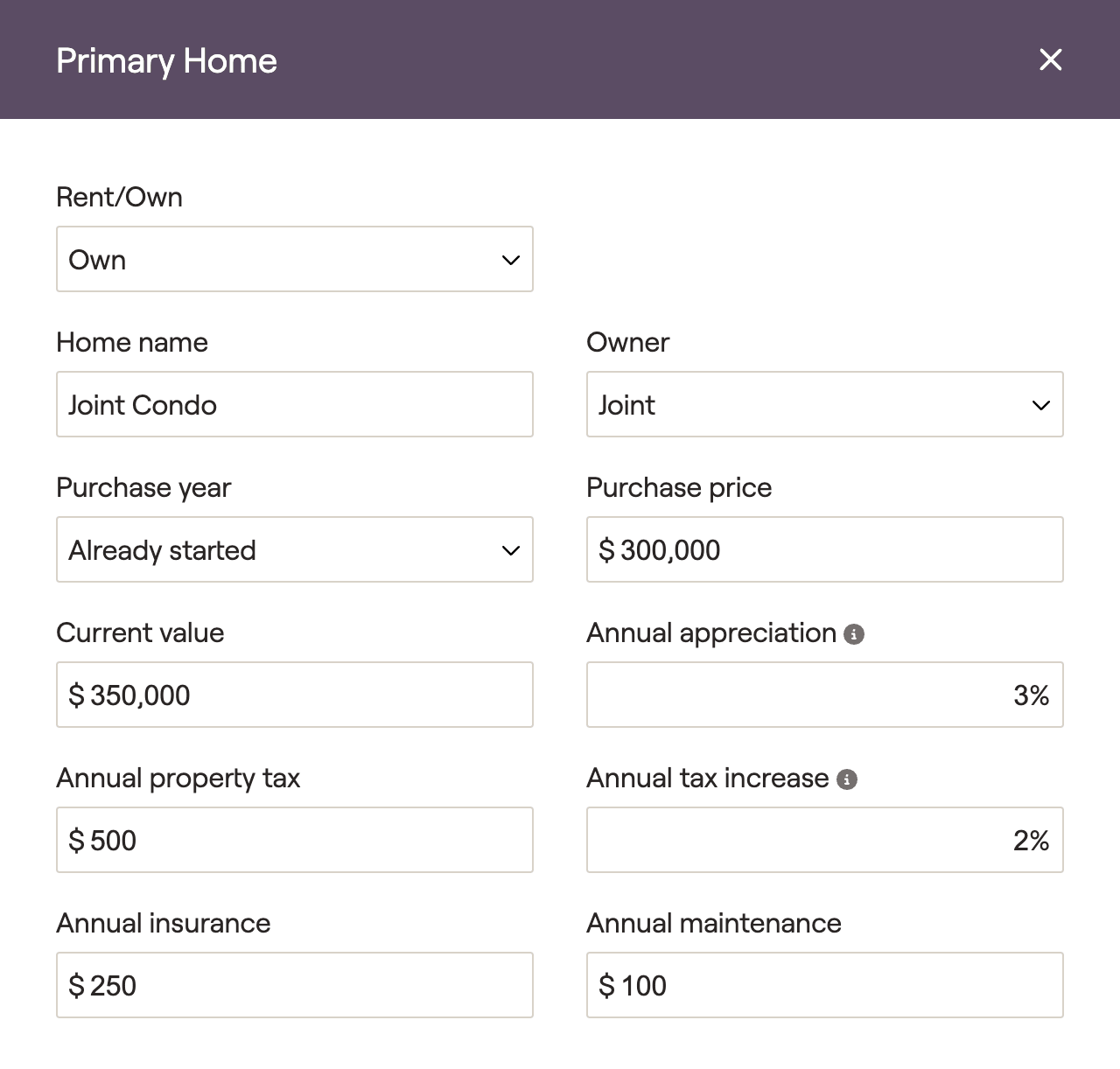

Owning Primary Home

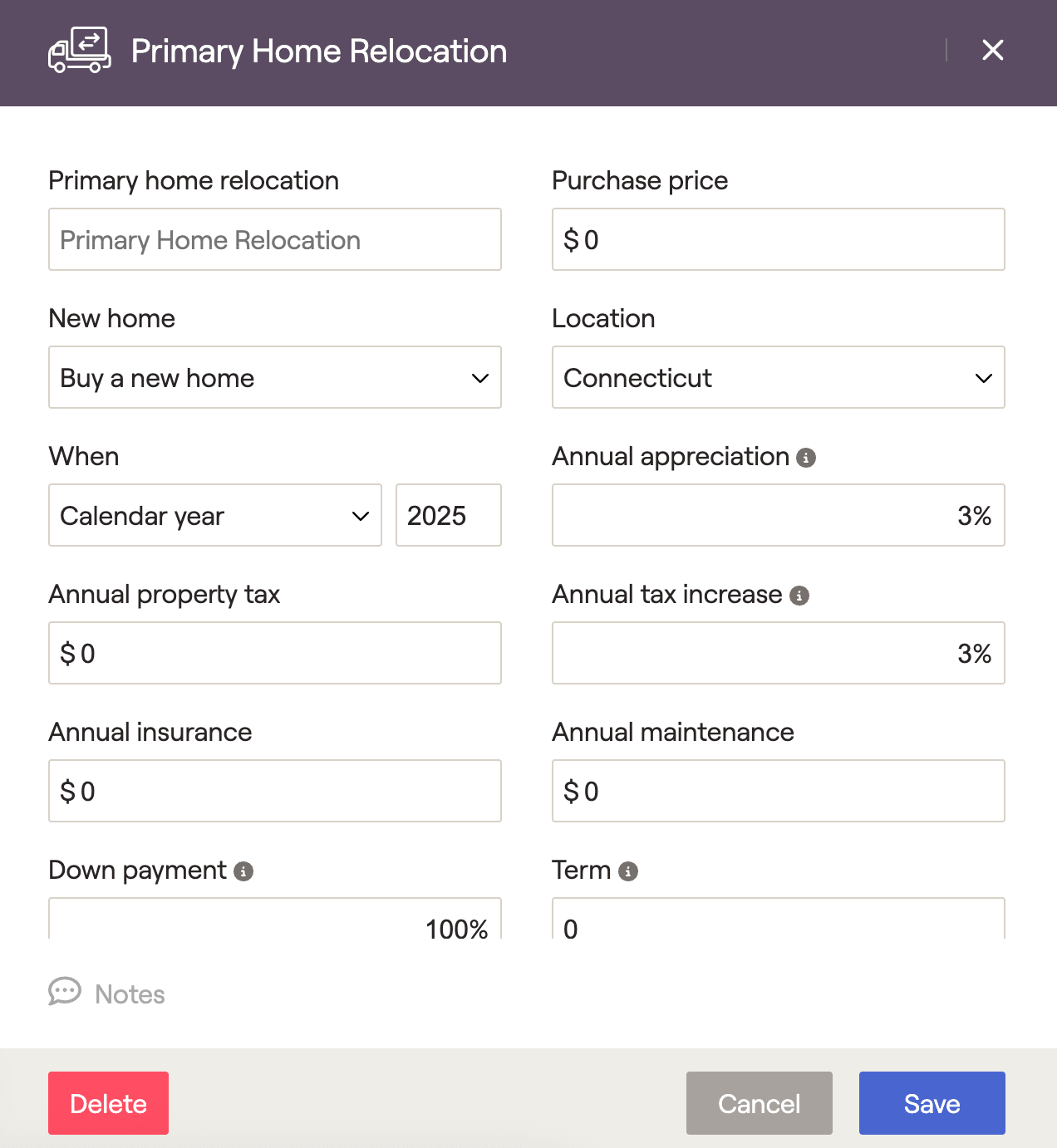

Primary Home Relocation

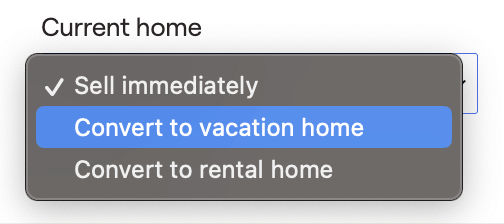

You can also specify what happens to the current primary home. The default option is 'Sell immediately', selling the existing property. Any mortgage and home equity associated with the property will be marked as paid, and the net proceeds will be added to the cash flow.

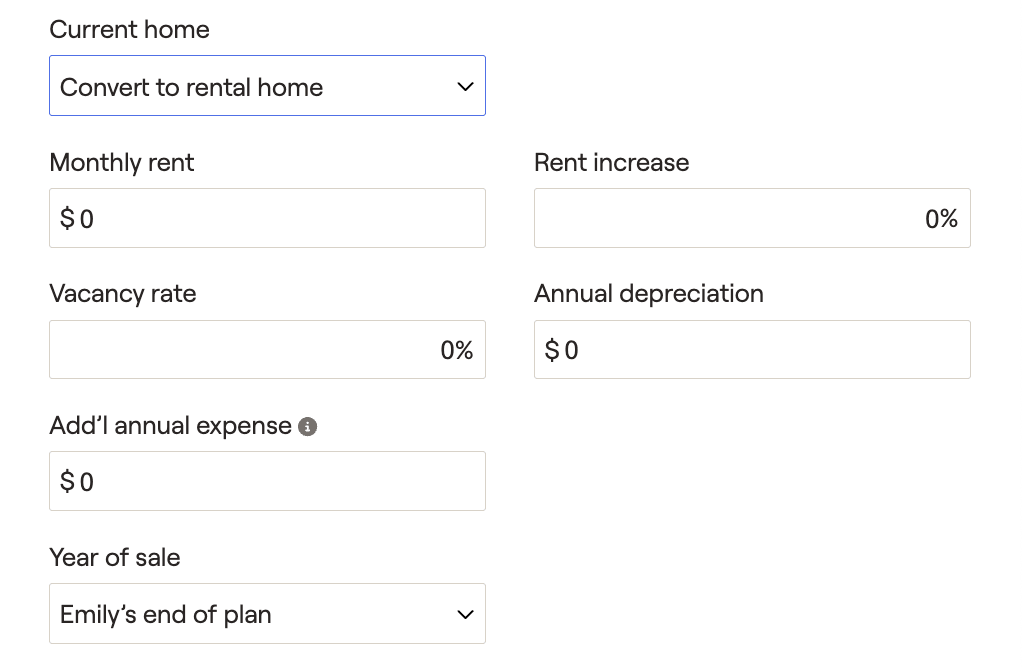

You can also convert the primary home to a vacation home or a rental home. If you convert to a rental home, you will be asked to enter information about new rental income, additional maintenance expenses, and depreciation. Additional annual maintenance expenses will be added to the annual maintenance value entered on the previous primary home.

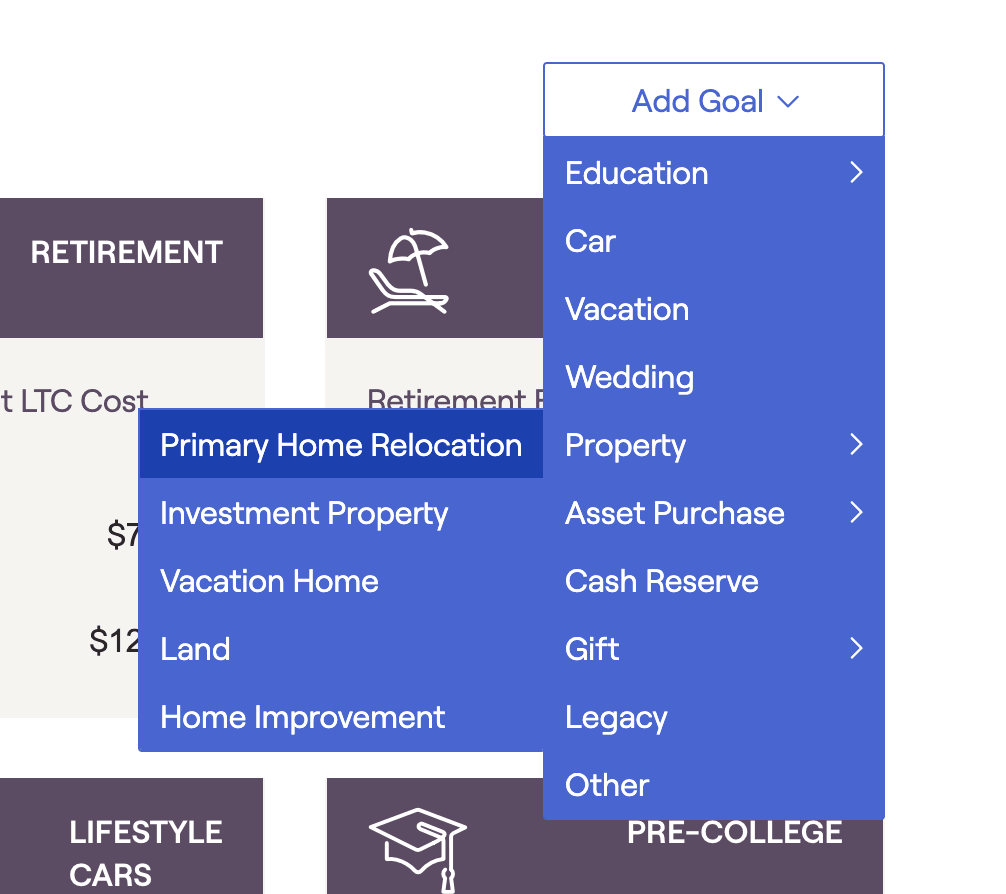

Add Additional Properties

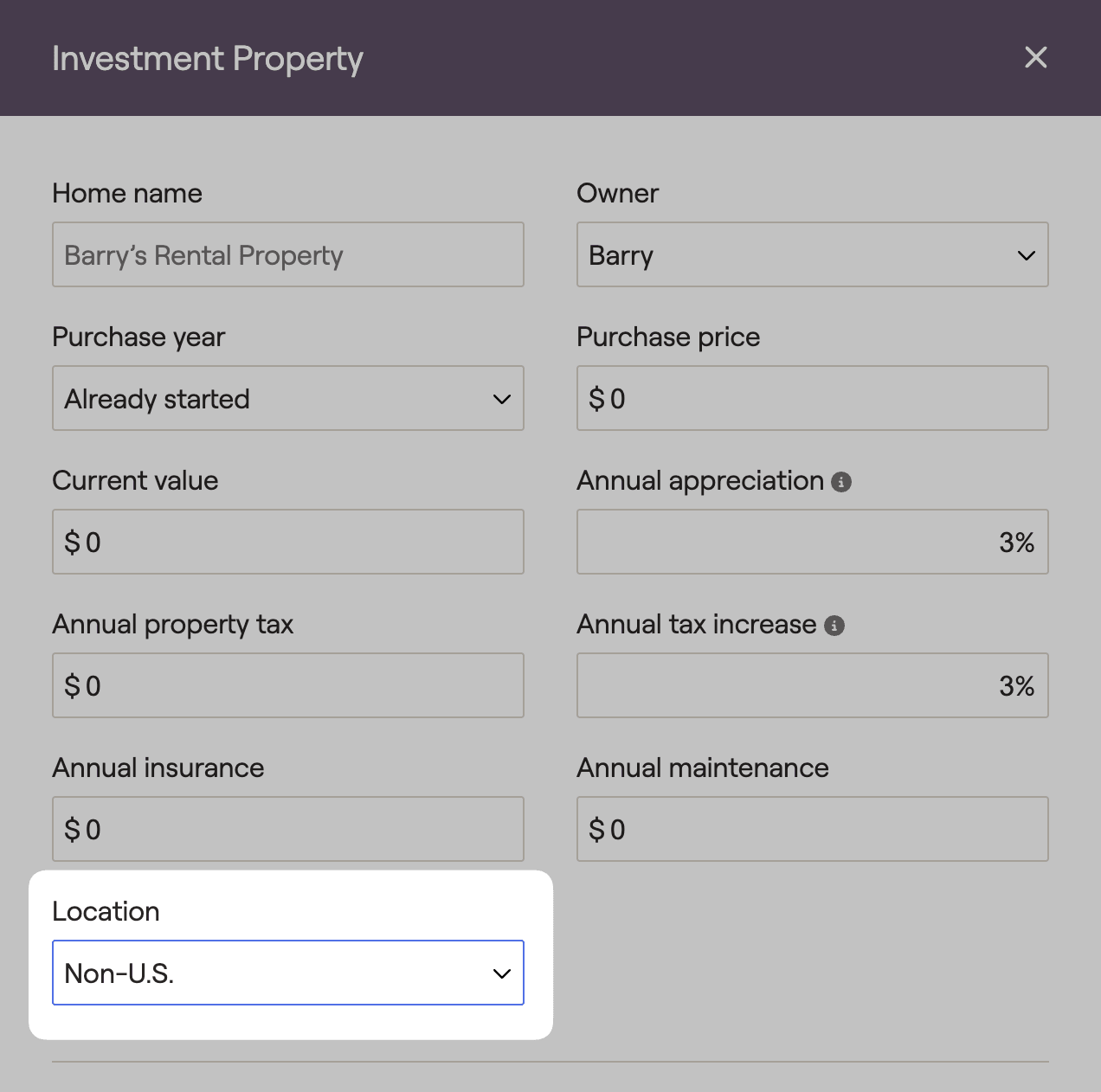

Investment Property

Investment properties added to the Net Worth allow advisors to demonstrate the value of the home as well as monthly maintenance, rental income & vacancy rates. Income flowing from investment properties will populate line 5 of Schedule 1 within Tax > Tax Estimate > Details > Schedule 1-3.

Entry | Description |

|---|---|

Home Name | Name the home. |

Owner | Specify if the home is owned by the client, the co-client, or owned jointly. |

Purchase Year | Defaults to Already Started, which assumes the client purchased the home sometime in the past. The other two options allow you to enter the specific time of purchase. Select Calendar year to specify the year the home was purchased, or select Client's age to select how old the client was when the home was purchased. |

Purchase price | The amount the client paid for the home at the time of purchase. |

Current value | An estimate of the current market value for the home. |

Annual appreciation | The rate at which the property's value will be estimated to increase or decrease moving forward. This may be taken from industry data, historical data, or some other source. This value will be used in retirement projections and tax projections. |

Annual property tax | The amount the client pays in taxes on the property. |

Annual tax increase | The property tax will increase by this percentage annually. |

Annual insurance | The amount the client pays in homeowners insurance. Be careful not to double-count insurance, as the property may be covered by other insurance types. |

Annual maintenance | Total deductible maintenance costs for the property. |

Location | Determines the state taxes if clients relocate to the investment property. |

Rent Approach | Determines how monthly rent income and vacancy rates will be projected out into the future. The 'Simple Growth' option will allow you to enter a single monthly rent amount, annual increase, and vacancy rate to be used throughout the projections. The 'Use Detailed Schedule' option will allow you to manually enter the monthly rent income and vacancy rate for each and every year of the client plan. |

Annual Rent Increase | Available when using 'Simple Growth' as your rent approach. Determines the % increase for rent income each year. |

Monthly Rent Income | The rental income being generated by the property, as a monthly figure. This amount will feed into the retirement projections as a cash inflow. |

Vacancy Rate | The assumed rate of vacancy each year. The percentage entered here will directly reduce the rental income generated by the property. |

Total Tax Basis | The total cost basis of the property, excluding any non-depreciable portion (such as land). Typically the purchase price, but can increase based on improvements. This value acts as the total amount we're able to depreciate over the course of the plan, and is referenced when calculating capital gains taxes on the sale of the property. |

Accumulated & Annual Depreciation | Depreciation allows the client to spread the tax deduction for the property purchase over time. Residential real estate has a max of 27.5 years of depreciation. RightCapital will calculate the cap up to the 'Total Tax Basis' based on the 'Accumulated Depreciation' and the 'Annual Depreciation'. The annual depreciation will be reflected in line 5 of Schedule 1 to the 1040. (This will adjust the rental income that you see on line 5). |

Passive Loss Carryover | This occurs when the client does not have enough passive income by which to offset the losses in a given tax year. The client can carry over these losses until they sell the property or realize enough passive gains. Losses will show on Schedule 1 line 5 of the sample 1040 (This will adjust the rental income that you see on line 5). An individual can deduct up to $25,000 depending on their Modified AGI. |

Year of Sale | Select the year of sale for the property. |

The net sale proceeds are calculated as the sale price minus any outstanding loan balance and any expenses. Net proceeds will be included in that year's cash flow. If the client setting uses Traditional Cash Flow, any positive cash flow generated will be invested in the taxable account based on the current or proposed asset allocation.

If your client owns property outside of the US, select 'Non-U.S.' for location - this will turn off tax calculations on the rental income and capital gains tax will not be applied upon selling this property.

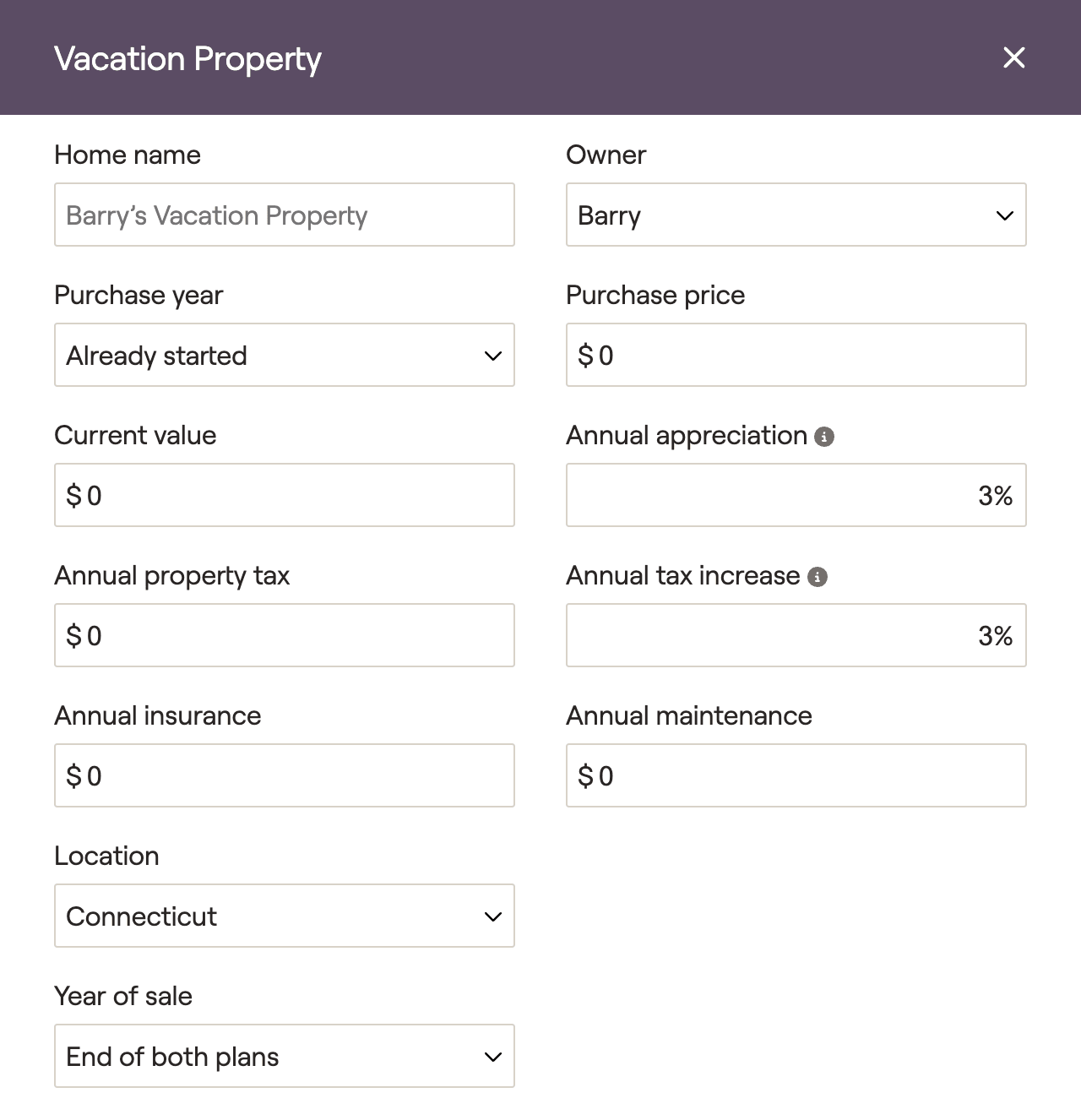

Vacation Property

Vacation properties entered into the Net Worth allow advisors to demonstrate the value of the home as well as expenses like property tax and insurance. This home can be sold to fund cash flow needs by adjusting the year of sale.

Entry | Description |

|---|---|

Home Name | Name the home. |

Owner | Specify if the home is owned by the client, the co-client, or owned jointly. |

Purchase Year | Purchase Year: Defaults to Already Started, which simply assumes the client purchased the home sometime in the past. The other two options allow you to enter the specific time of purchase. Select Calendar year to specify the year the home was purchased, or select Client's age to select how old the client was when the home was purchased. |

Purchase price | The amount the client paid for the home at the time of purchase. |

Current value | An estimate of the current market value for the home. |

Annual appreciation | The rate at which the property's value will be estimated to increase or decrease moving forward. This may be taken from industry data, historical data, or some other source. This value will be used in retirement projections and tax projections. |

Annual maintenance | Annual maintenance costs for the property. |

Location | Determines the state taxes if the client relocates to the vacation home. |

Annual property tax | The amount the client pays in taxes on the property. |

Annual tax increase | The property tax will increase by this percentage annually. |

Annual insurance | The amount the client pays in homeowners insurance. Be careful not to double-count insurance, as the property may be covered by other insurance types. Can also include HOA payments. |

Year of Sale | Select the year of sale for the property. |