Adding Inherited IRA's to Net Worth

To add an existing inherited IRA account users can visit the net worth area of a financial plan. Inherited IRA accounts can be added manually, using the green 'Add Account' button, or linked through integration and aggregation using the green 'Link Account' button. Account Aggregation is only available to Premium & Platinum subscribers.

Visit the Profile > Net Worth (or step four of the initial data entry).

Click Green 'Add Account' button then choose 'Investment'.

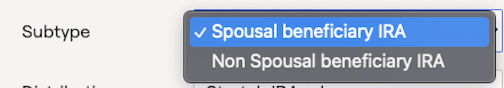

Label the investment account with name and owner. Then change account type to Inherited Traditional IRA or Inherited Roth IRA.

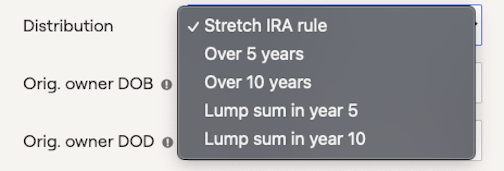

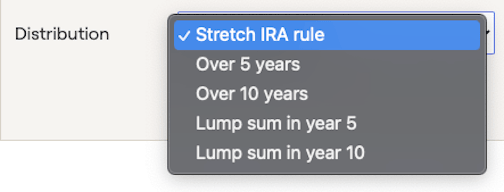

- Stretch IRA rule (default value): This option stretches payments over the life of the new or original owner.

For Spousal beneficiaries, the distribution amount is recalculated each year based on the new owner's life expectancy.

For Non-Spousal beneficiaries, the amount is based on life expectancy as of the original owner’s date of death, which is reduced by 1 for each subsequent year.

- Over 5 years: This option allows for equal distributions in each of the first 5 years after the year of the original date of death.

- Over 10 years (only available for non-spouse): This option allows for equal distributions in each of the first 10 years after the year of the original date of death.

- Lump sum in year 5: No distributions will be made until the entire value is distributed 5 years after the year of the original date of death.

- Lump sum in year 10 (only available for non-spouse): No distributions will be made until the entire value is distributed 10 years after the year of the original date of death.

Designate the original owner's date of birth and date of death

- Original owner Date of Birth (DOB): This is for the date of birth of the original IRA owner, which is used to calculate life expectancy for stretching payments for non-spouse beneficiaries.

- Original owner Date of Death (DOD): This is for the date of death of the original IRA owner, which is used to determine timing of payments for 5- and 10- year options as well as when original life expectancy is calculated for non-spouse beneficiaries.

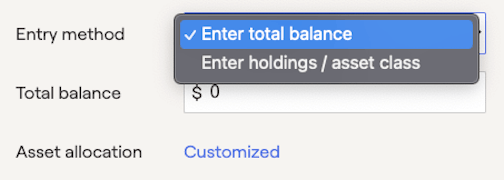

Aggregated and Integrated accounts values will automatically update and there will be no option to enter total balance.

- When using "Enter total balance" method users can simply enter the total account balance.

- When using "Enter holdings / asset classes" method there are two ways of indicating the account’s value:

- Use Add Holding to enter in specific tickers for stocks or mutual funds — in which case Morningstar data will be used to update price information on a daily basis.

- Use Add Asset Class to provide a broad allocation mix — either Equity/Fixed Income or broken out using Morningstar asset classes.

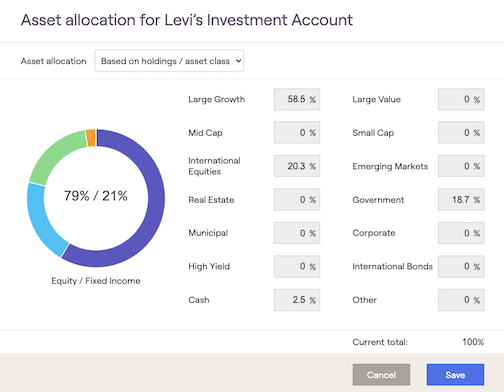

Assigning an Asset Allocation

Each entry method used to assign value will provide options to specify an asset allocation. This asset allocation is used to determine growth and standard deviation in the Monte Carlo simulations and Cash Flow projections.

- Customized: Allows the user to specify the asset allocation by entering in percentages for each asset class. In this scenario the customized asset allocation will be used to assign growth and standard deviation used in Monte Carlo analysis. When choosing a "customized" asset allocation the default breakdown is 100% ‘Other’. In order to apply the customized asset allocation users must click "save" on the bottom right. Current total must equal 100% in order to save the information.

- Based on model portfolio:** Allows the user to select any model portfolio available to them. If this option is chosen, the asset allocation for the account will be set to the asset allocation of the selected portfolio. In this scenario the total balance will be used to assign the current dollar value while the model portfolio will be used to assign growth and standard deviation used in Monte Carlo analysis.

- Based on holdings / asset class: Only available when the Entry method is set to “Enter holdings / asset class”. In this case RightCapital will calculate the asset allocation based on the holdings or asset classes that are entered or linked to the account.

- Customized: Allows the user to specify the asset allocation by entering in percentages for each asset class. In this scenario the entered holdings and asset classes will be used to assign the current dollar value while the customized asset allocation will be used to assign growth and standard deviation used in Monte Carlo analysis. When choosing a "customized" asset allocation the default breakdown is 100% ‘Other’. In order to apply the customized asset allocation users must click "save" on the bottom right. Current total must equal 100% in order to save the information.

- Based on model portfolio: Allows the user to select any model portfolio available to them. If this option is chosen, the asset allocation for the account will be set to the asset allocation of the selected portfolio. In this scenario the entered holdings and asset classes will be used to assign the current dollar value while the model portfolio will be used to assign growth and standard deviation used in Monte Carlo analysis.

Adding an IRA as future Inheritance

IRA's can be added as a future inheritance through the following process:

If an inherited “401(k) and traditional IRA” or “Roth 401(k) and Roth IRA” is added as income we will ask for the original owner DOB and Distribution type. We assume any such inherited assets are from a non-spouse, and all distributions will work the same as for inherited IRA assets.

Inherited IRA accounts, added as income, will assume the averaged asset allocation from other investments in the Net Worth

Visit the Profile > Net Worth > Income tab > click Blue 'Add Income' button > select inheritance

Fill in amount, start year & owner then select, Traditional IRA or Roth IRA from 'Inherited asset' dropdown

Designate the original owner's date of birth.

- Original owner Date of Birth (DOB): This is for the date of birth of the original IRA owner, which is used to calculate life expectancy for stretching payments for non-spouse beneficiaries.

- Stretch IRA rule (default value): This option stretches payments over the life of the new or original owner.

For Non-Spousal beneficiaries, the amount is based on life expectancy as of the original owner’s date of death, which is reduced by 1 for each subsequent year.

- Over 5 years: This option allows for equal distributions in each of the first 5 years after the year of the original date of death.

- Over 10 years (only available for non-spouse): This option allows for equal distributions in each of the first 10 years after the year of the original date of death.

- Lump sum in year 5: No distributions will be made until the entire value is distributed 5 years after the year of the original date of death.

- Lump sum in year 10 (only available for non-spouse): No distributions will be made until the entire value is distributed 10 years after the year of the original date of death

Users can track a future inheritance in the Retirement > Cash Flows > Summary > Other Income column. The Inherited IRA account balance can also be tracked in the Retirement > Cash Flows > Accounts Tab.