As a robust picture of a client's profile emerges, be sure to add all the appropriate forms of insurance coverage associated with the client, co-client, and any children. Permanent Life Insurance Information can be entered on the Net Worth screen by using the Add Account > Insurance dropdown menu.

This information can be used within the client's plan and the various screens under the Insurance section. All insurance premiums will be added to the client's expenses in the cash flow section. Cash value of life insurance policies can also be tracked in the cash flow section under the account tab. Cash Value is considered part of the tax-free assets in the Investment > Tax Allocation screen.

Adding Cash Value Life Insurance to a financial plan

In the Profile > Net Worth Area, use the Add Account > Insurance dropdown menu to select one of the Permanent Life Insurance options.

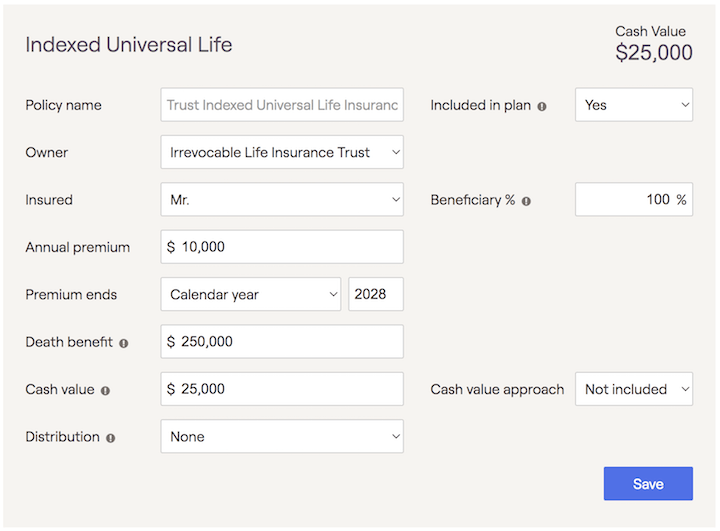

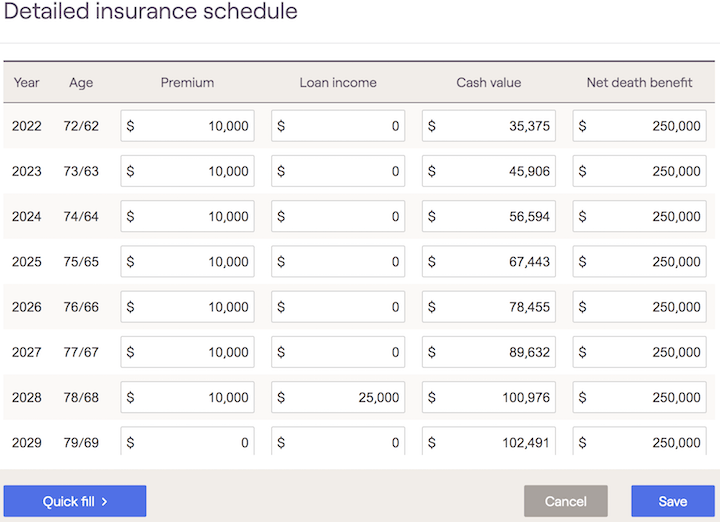

Users can then fill out the necessary details to show death benefits, premiums, fees and cash value distributions within the future cash flows.

Key Terms

- Tax Free Loan: Loan taken against a permanent life insurance policy's cash value which can be paid back or subtracted from the death benefit.

- Full Surrender: The amount of money an insurer will pay to the policyholder if the insurance contract is voluntarily terminated before it reaches maturity. When Full surrender is selected you will see a new field appear to enter cost basis for the policy. The cost basis will be added to premiums that take place before the starting year to determine the total basis. This total basis will be used to calculate the taxation of income inflows associated with surrendering the policy.

Cash Value Approach

There are three different options for projecting cash value insurance, which can be chosen in the “Cash value approach” drop-down box within the card:

Premiums increase the cash value by the amount of the premium

Cash value grows at a rate of (Crediting rate – Annual fee) each year

Loans are treated as income and a loan balance is tracked

The loan balance increases each year by the Loan rate

The net death benefit paid is reduced by the loan balance

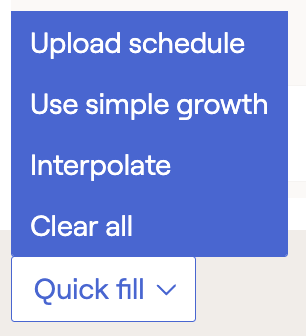

- Upload Schedule allows you to upload an excel file containing the insurance illustration. More information on this process can be found here.

- Use simple growth will populate the cash value with a simple growth projection based on the cash value, crediting rate, and annual fee % entered when using the ‘Simple growth’ cash value approach.

- Interpolate will automatically populate all $0 inputs between beginning and ending values listed in the detailed schedule. This feature saves time and helps to populate insurance premiums, loan income, cash value & death benefit.For example, if users enter $100,000 in year 2020 and $200,000 in year 2030, the system will set the 2021 value to $110,000, the 2022 value to $120,000, etc. until all inputs are filled through 2030.

- Clear all will reset all detailed schedule values to $0.

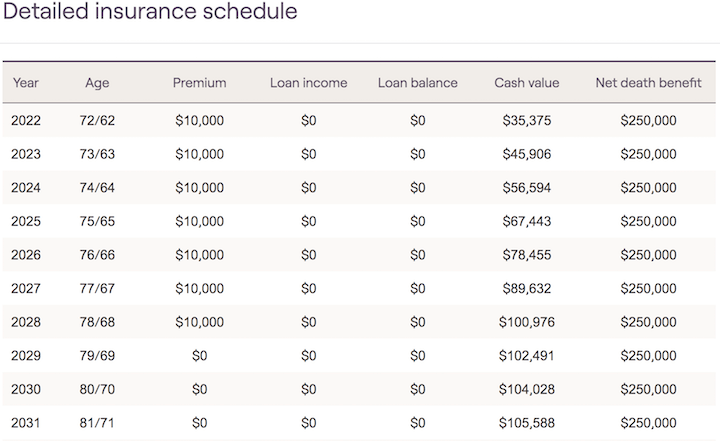

The customized rules for calculating cash value and death benefits allow users to match client’s in-force illustration. The exact values entered in the system will be used in the projection.

The two options can be combined by first generating a ‘Simple growth’ projection, and then switching to ‘Use illustration’ to manually adjust some of the numbers generated by the projection.

Upload Insurance Schedule

Streamline data entry for manually added insurance schedules by uploading via a .CSV file. Drag and drop a .CSV file, browse your local drive, or paste the data directly into the Upload Schedule section. To get started:

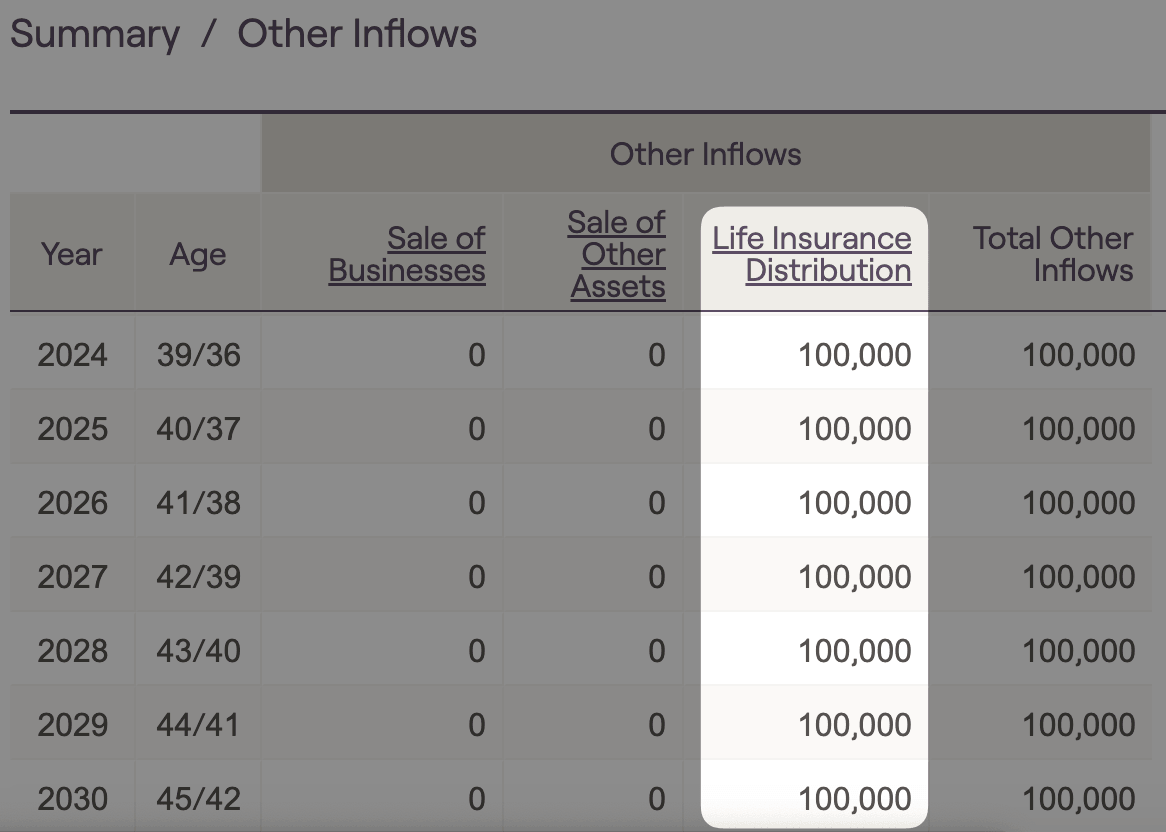

Tracking Distributions and Cash Value in Cash Flows

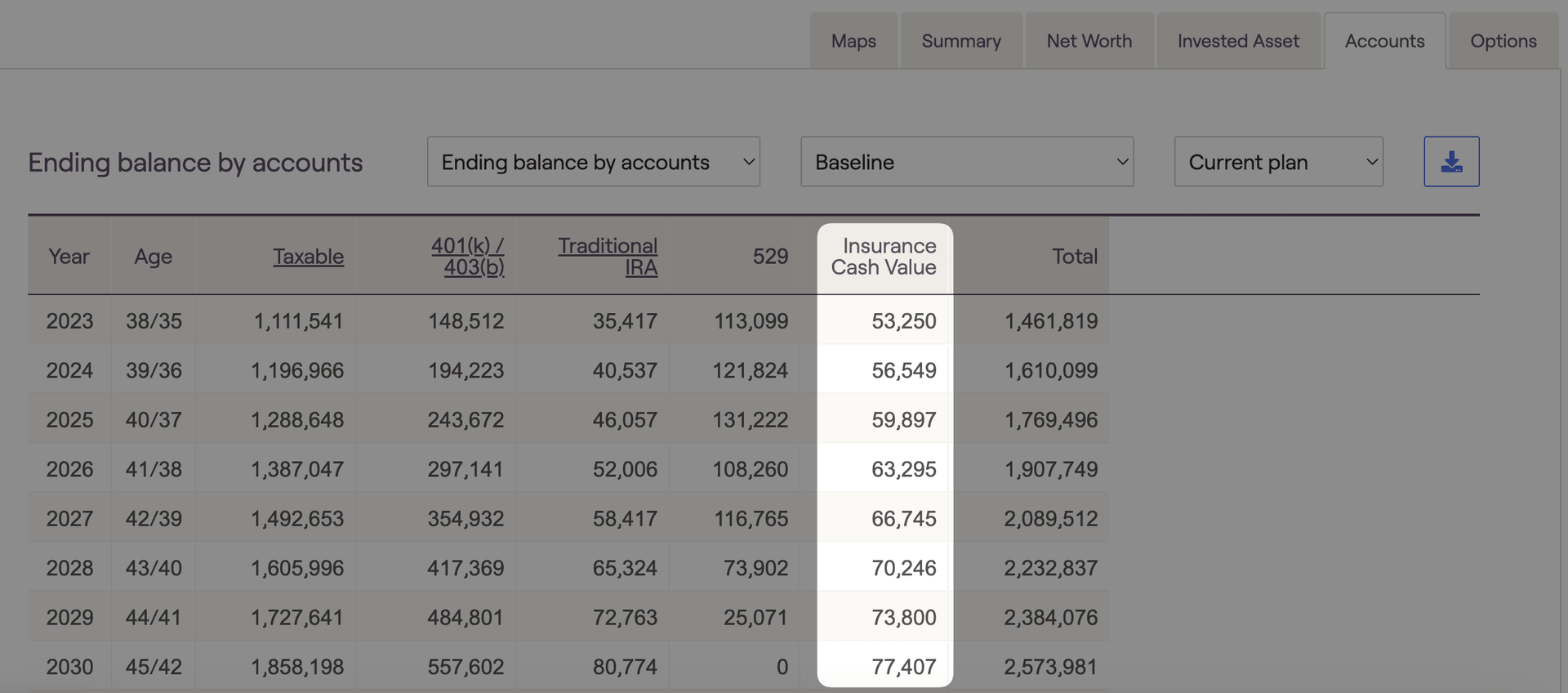

The Insurance Cash Value amount can be tracked in the Retirement> Cash Flows> Accounts Tab. The "ending balance by account" dropdown selection will allow the user to see the cash value in each calendar year as seen in the screenshot below.