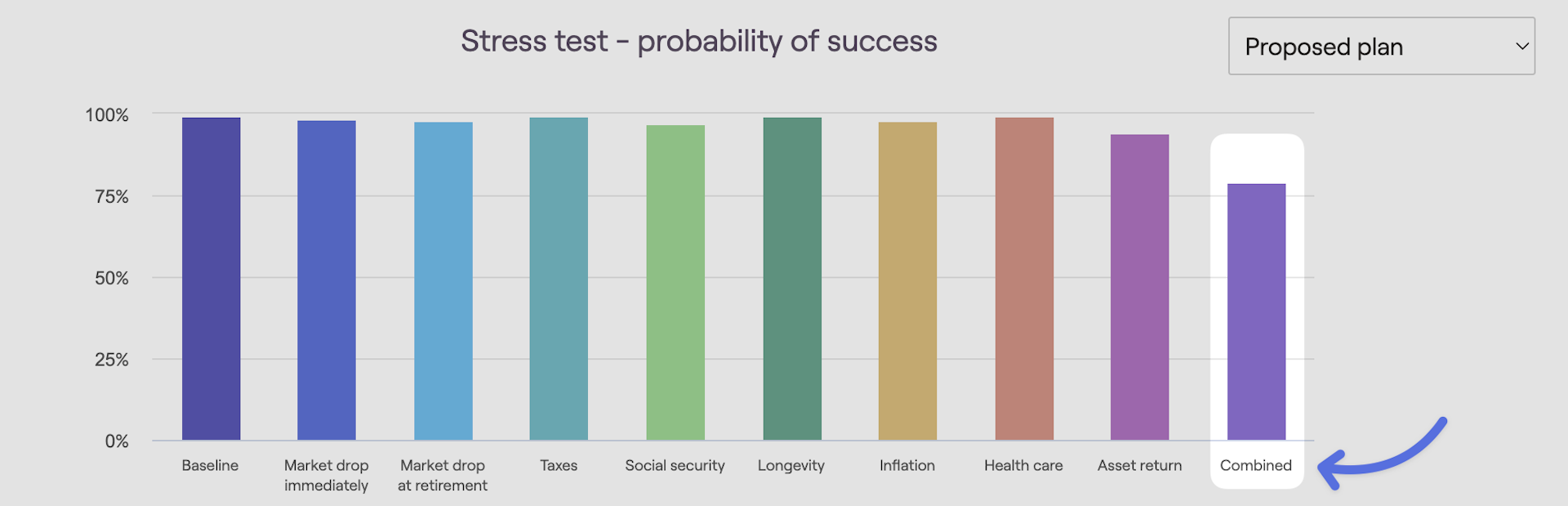

Building a successful retirement proposal for a client is wonderful, but what happens if uncontrollable factors experience more dire realities than the projection currently includes? RightCapital has built the Stress Test tool to answer this exact question.

Using Stress Tests

There are many uncontrollable factors in the future. RightCapital has identified several common factors which often contribute to a diminished retirement lifestyle and has modeled a stress test to determine a client's financial resilience to fluctuations in these categories.

The Stress Test tool can be an effective element in building a case for shifting a client's investment allocation.

The Stress Test can be viewed as a simplified sensitivity analysis, and help to identify areas of potential weakness in a client's current financial plan.

For example, if a client (like the screenshot above) demonstrates strong resilience to a market crash, but low resilience to tax increases, consider a proposal which shifts more assets into tax-sheltered accounts and fewer assets in equity accounts. This may create an overall more resilient portfolio. This is, of course, just one tool among many when making complex financial decisions and is not advice.

As another example, if a client is resistant to purchasing LTC insurance, show the impact of increased health care costs in this stress test and then build a proposal which includes LTC insurance and show the client this graph again, with increased resilience to increased health care costs.

To choose which stress test items you wish to display on the screen, click the 'Edit' button to check or uncheck various stresses:

Stress Test Details

Category | Description |

|---|---|

Equity markets drop immediately by | Assumes an immediate drop in the equity portion of the client's investments by the percentage indicated. Subsequently, investments are assumed to grow as they would have in the Baseline plan, one year after the market drop. |

Equity markets drop at retirement by | Assumes a drop in the equity portion of the client's investments, at retirement, by the percentage indicated. Subsequently, investments are assumed to grow as they would have in the Baseline plan, one year after the market drop. |

Asset return will be lower by | Reduces variable investment returns by the percentage indicated across the board. |

Inflation will be higher by | Increases all inflation rates by the percentage indicated. For example, if general inflation is 2.5% and you indicate that inflation will be 1% higher, we will use 3.5% as the general inflation rate. |

Tax expense will be higher by | Assumes an increase in the total taxes paid by the percentage indicated. For example, if the client is paying $20,000/yr in taxes, a 20% higher tax stress will increase the tax expense to $24,000. |

Social Security will be reduced by | Assumes a reduction in total Social Security benefits paid by the percentage indicated. For example, if the client is receiving $50,000/yr in Social Security, a 40% reduction in Social Security will reduce the benefits to $30,000/yr. |

Health care cost will be higher by | Assumes an increase in the total health care costs by the percentage indicated. This applies to costs specified in the Annual Retirement Health Cost and Annual Retirement LTC Cost cards. |

You (and your spouse) will live | Extends both the client and co-client's planning horizon by the number of years specified. |

Combined | The combined stress test reflects the cumulative impact of all of the other stress tests displayed in the graph. This allows you to select specific stressors and indicate their combined impact on the probability of success. |

Creating and testing multiple Plans

As you create multiple proposed plans for clients, the Stress Test can be an excellent way to compare the resiliency of those proposed plans in a variety of environments. You can determine which plan to stress by using the drop-down box in the upper right-hand corner of the Stress Test screen.