Adding Trust-Owned Assets to Net Worth

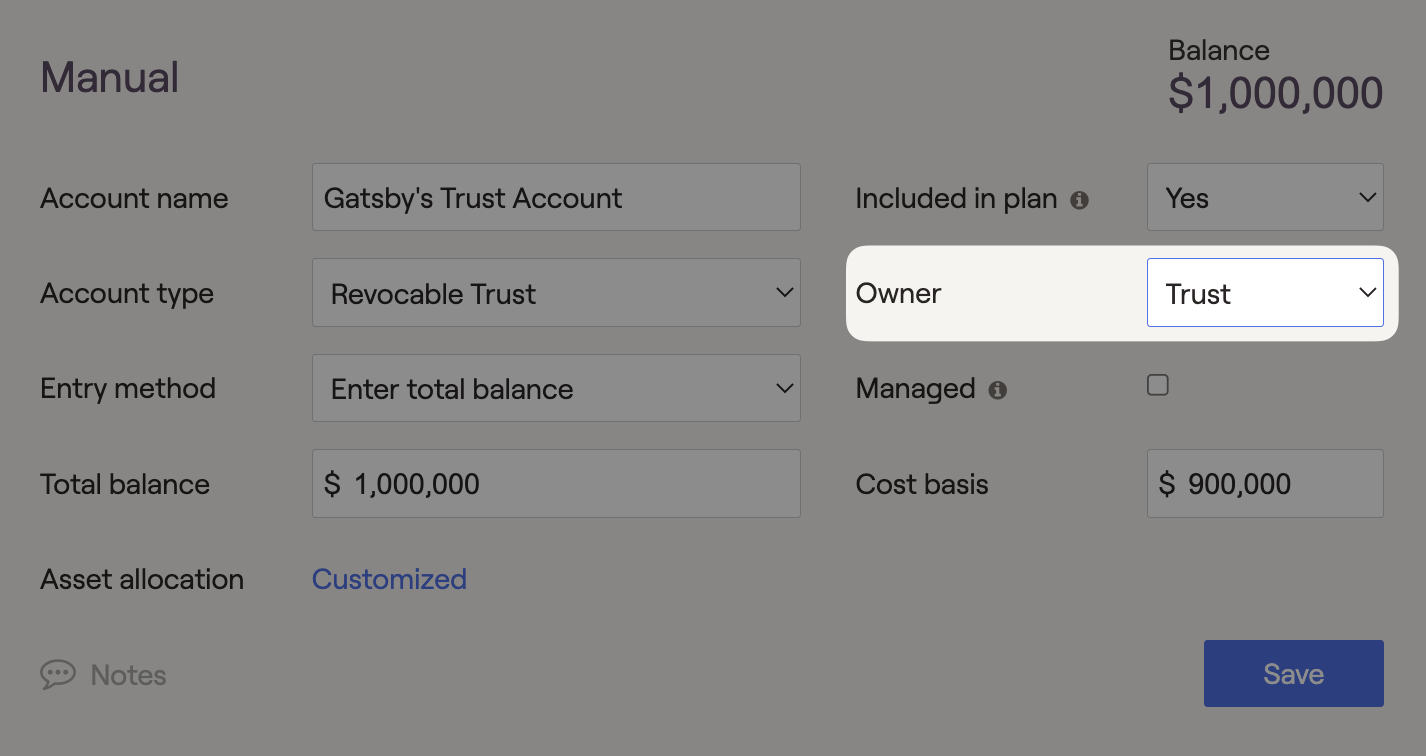

Trust Owned Investment Accounts

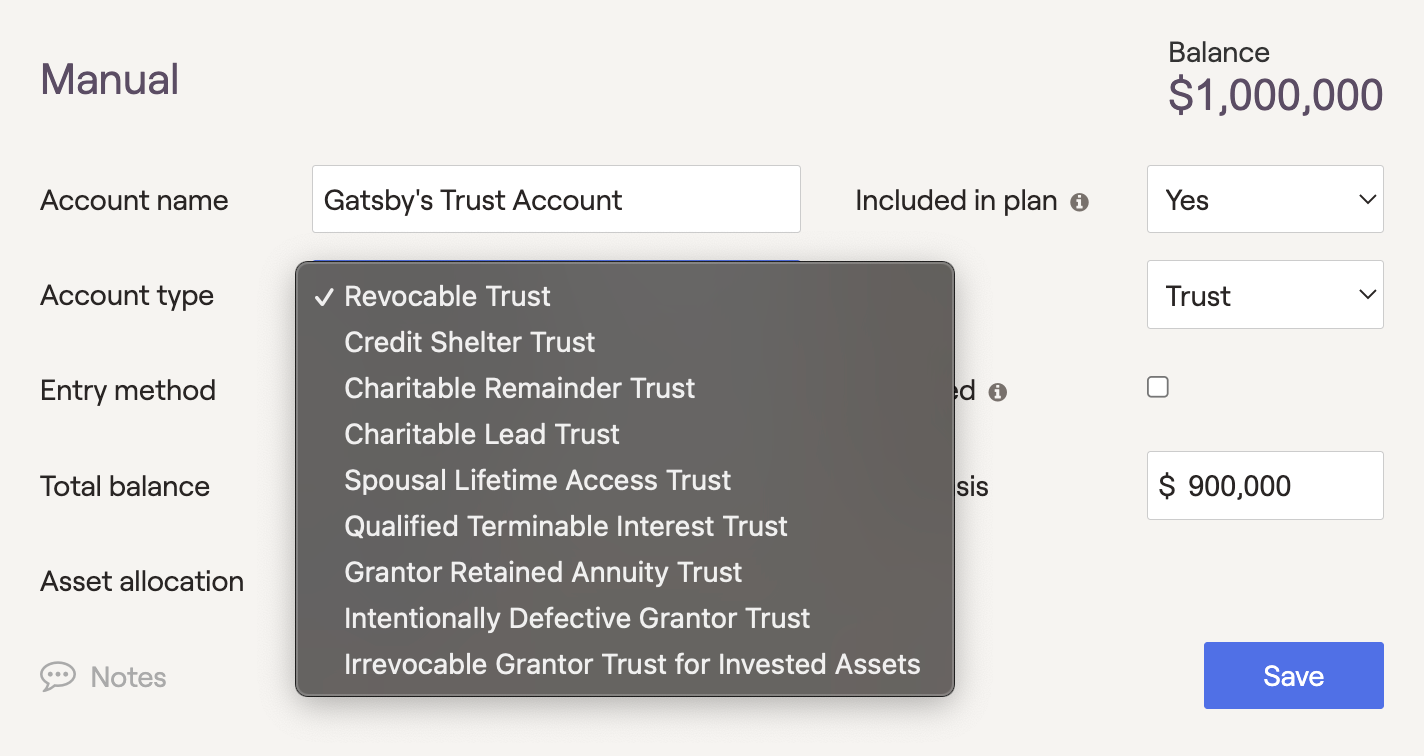

For clients with invested assets held in trust accounts, use the Profile > Net Worth area to illustrate all relevant details in the client's plan. RightCapital allows you to input the following trust types as investment account "owners":

Revocable Trusts

Credit Shelter Trusts (CST's)

Charitable Leads Trust (CLT's)

Charitable Remainder Trusts (CRT's)

Spousal Lifetime Access Trusts (SLAT's)

Qualified Terminable Interest Trusts (QTIP's)

Qualified Personal Resident Trusts (QPRT's)

Grantor Retained Annuity Trusts (GRAT's)

Intentionally Defective Grantor Trusts (IDGT's)

Irrevocable Grantor Trust (IGT'S)

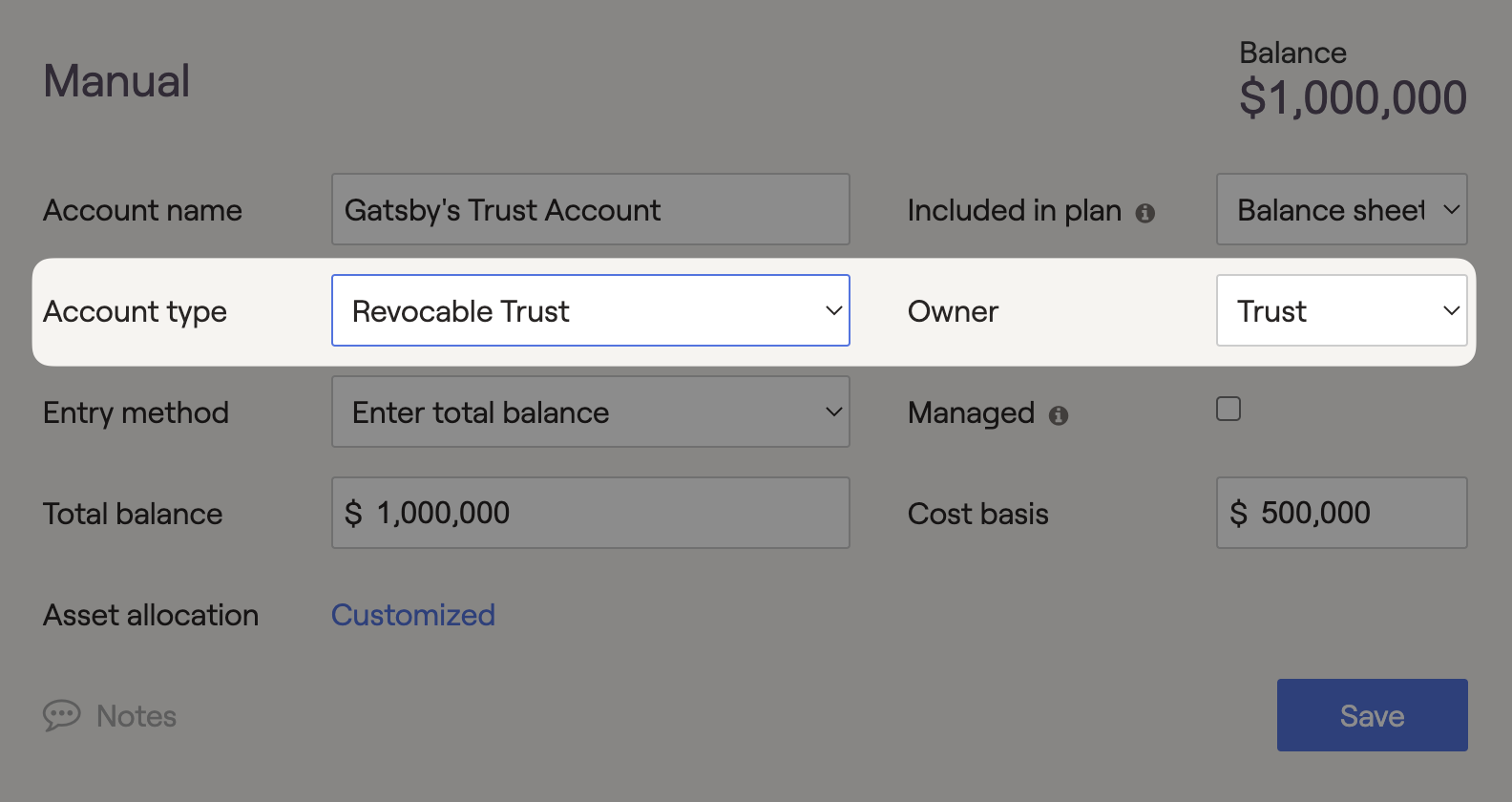

Revocable Trusts

Irrevocable Trusts

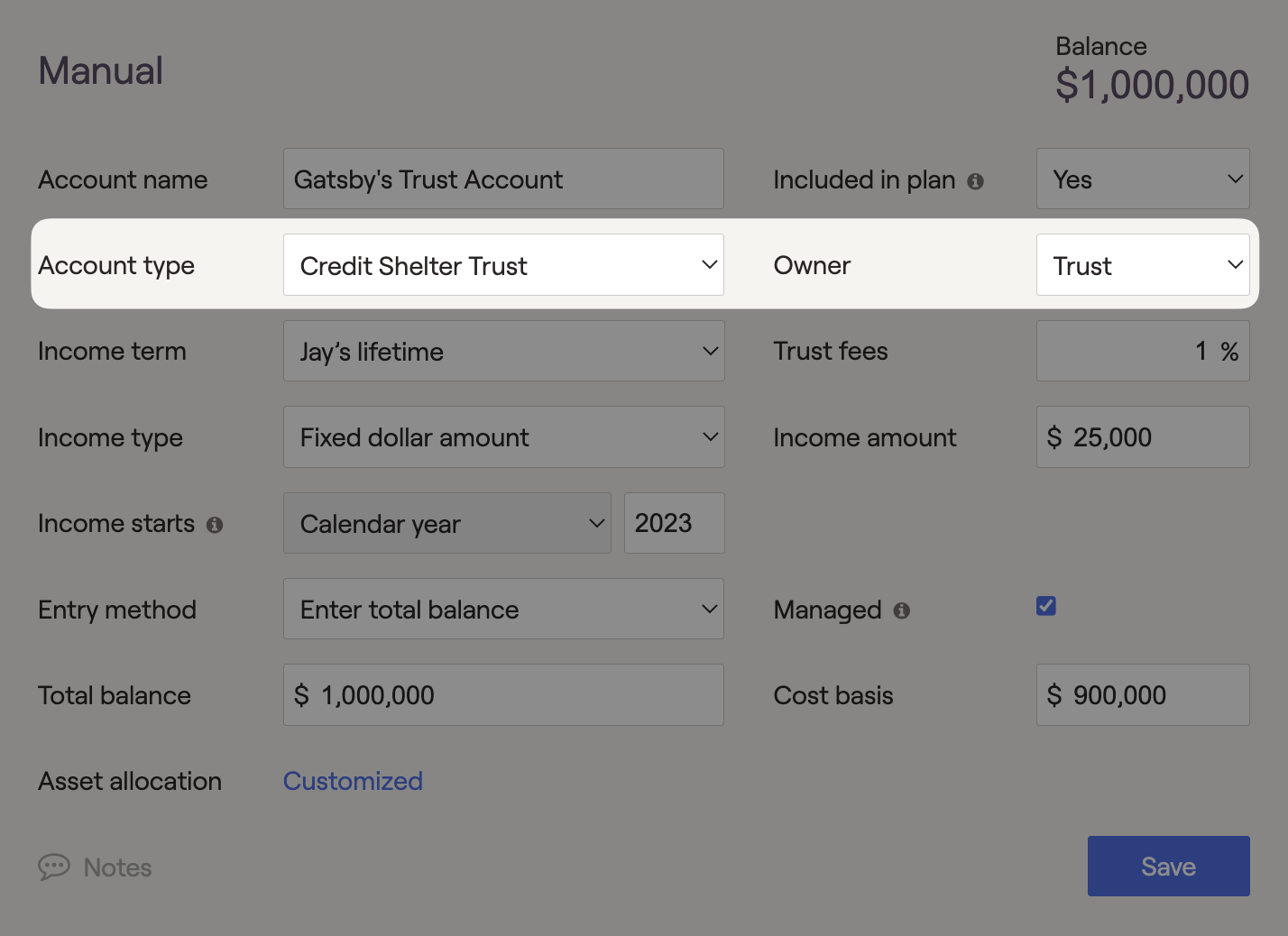

Credit Shelter Trusts (CST's)

Once Credit Shelter Trusts are entered into the Net Worth, they will be listed in the trust column on the client's Balance Sheet. Assets in the CST are held outside the estate and will reduce federal estate taxes when applicable.

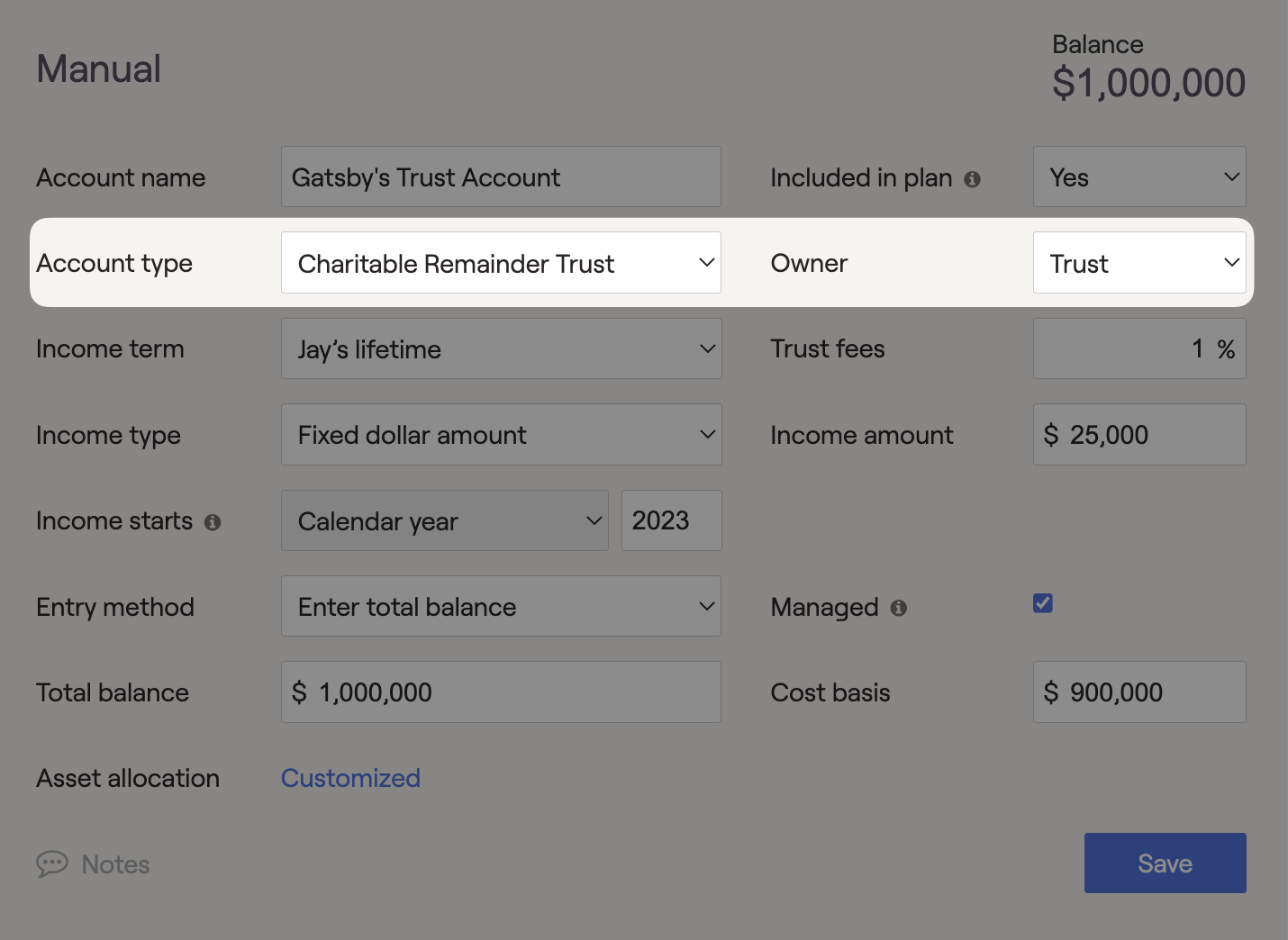

Charitable Remainder Trusts (CRT's)

Once Charitable Remainder Trusts are assigned as the owner of any investment account in a financial plan, it produces income for the beneficiary over a period of time before the remainder is donated to charity.

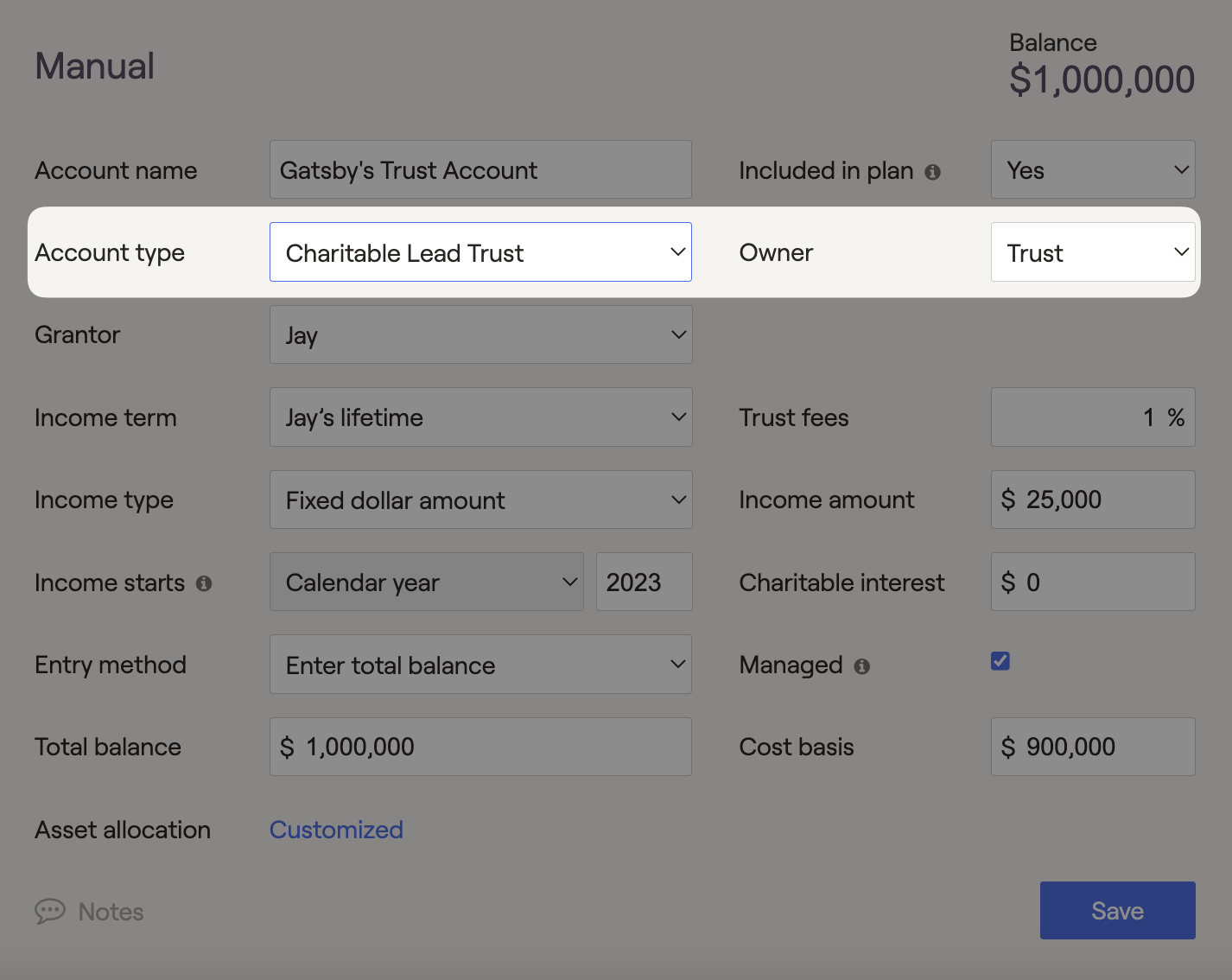

Charitable Leads Trust (CLT's)

Once the Charitable Leads Trust is assigned as the owner of an investment account, it offers income distributions to a charity before being allocated to non-charitable beneficiaries. This trust type can be viewed as a grantor trust or non-grantor trust by changing the Grantor field from client to none.

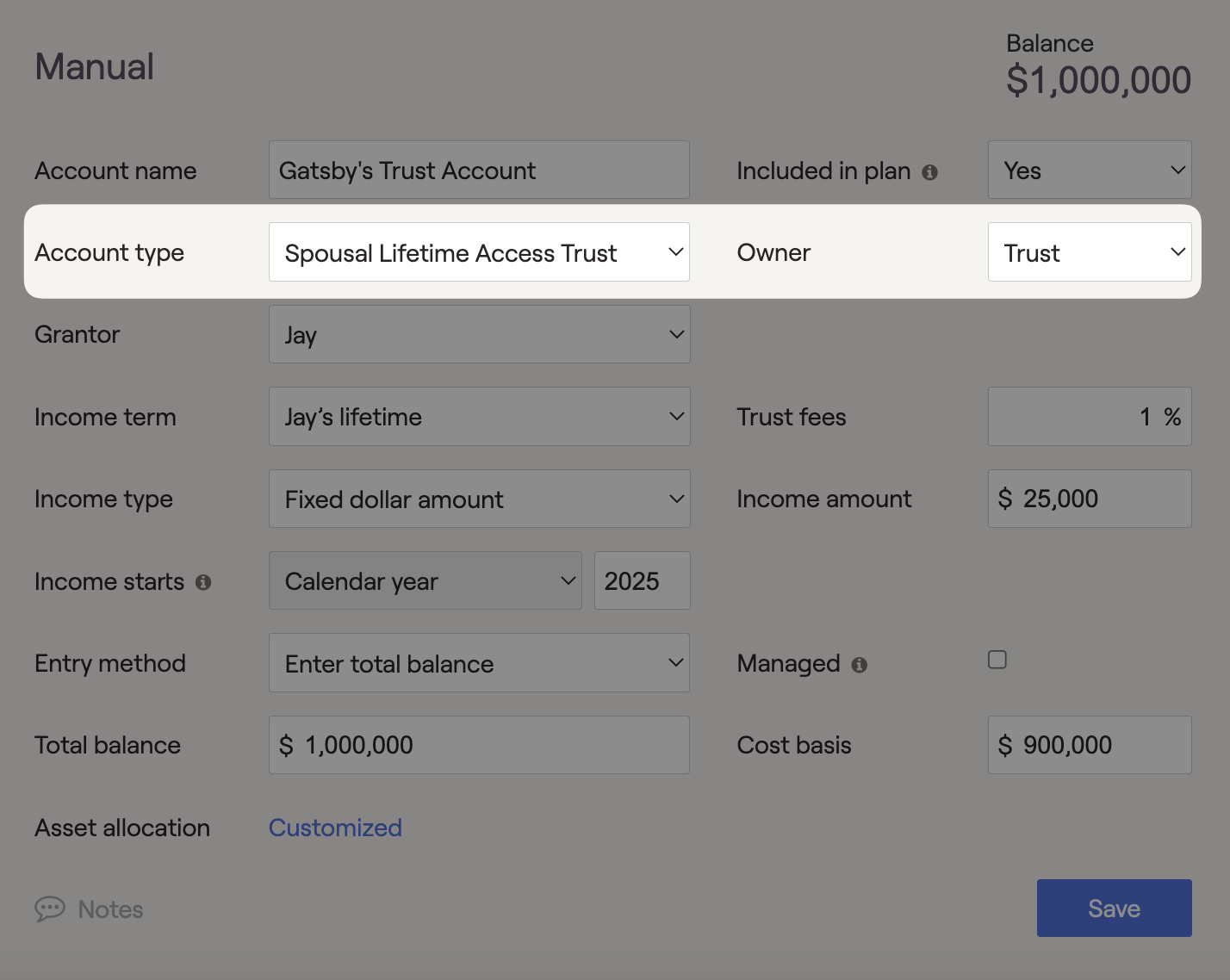

Spousal Lifetime Access Trusts (SLAT's)

Once entered into the client's Net Worth, SLAT's allow for the transfer of assets from one spouse to another, including income before or after the original grantor’s death. Since the Grantor is responsible for taxes on income generated by the trust, you must indicate details within the "Grantor" dropdown menu.

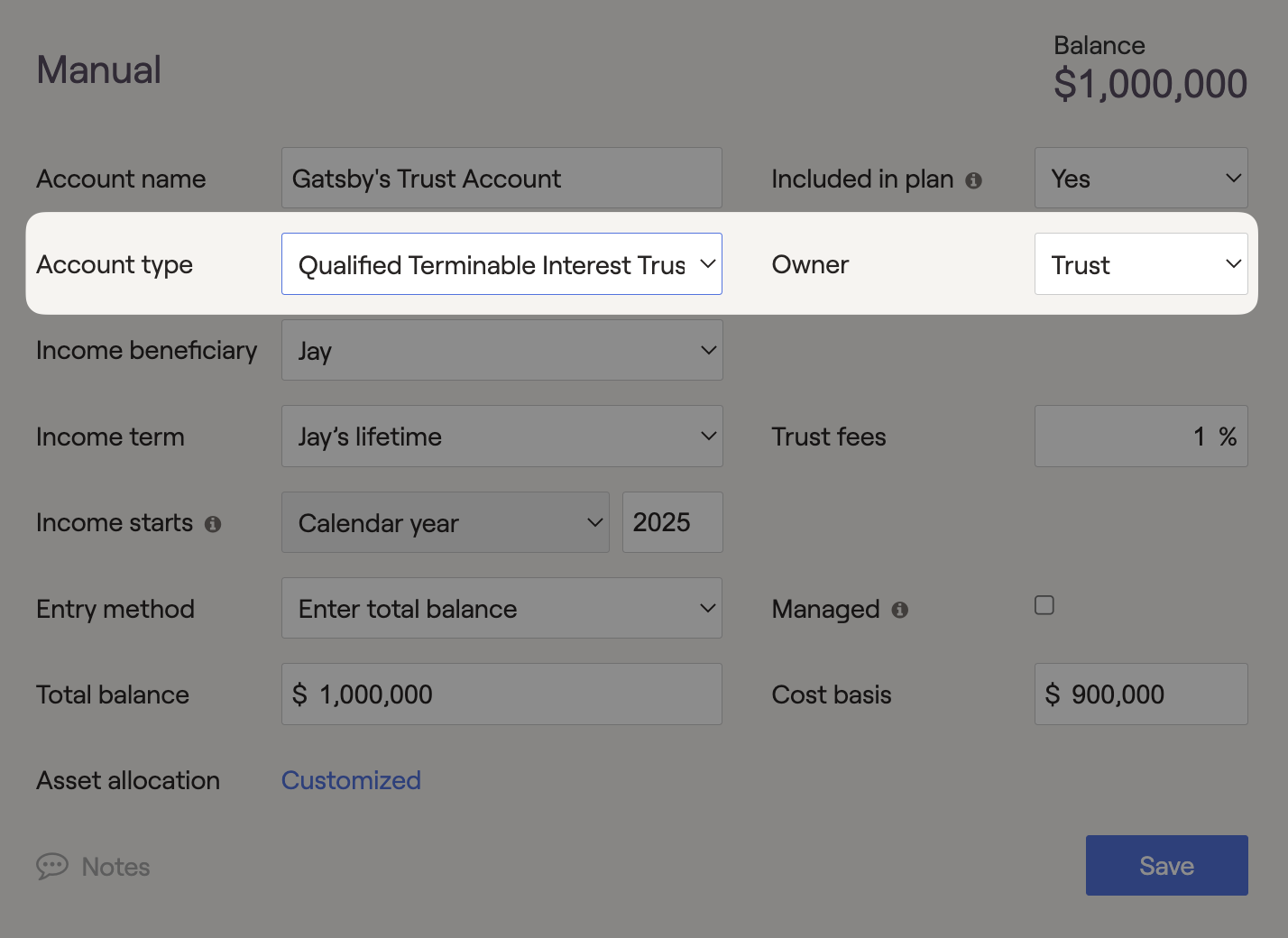

Qualified Terminable Interest Trusts (QTIP's)

Once entered into the client's Net Worth, QTIP Trusts provide income for a surviving spouse while the remaining assets are transferred to specific heirs. The client will be taxed on the income generated within the trust account. RightCapital will automatically calculate the income amount that enters the cash flows as interest plus dividends. The QTIP Trust's value will be included in the taxable estate at the end of the planning horizon.

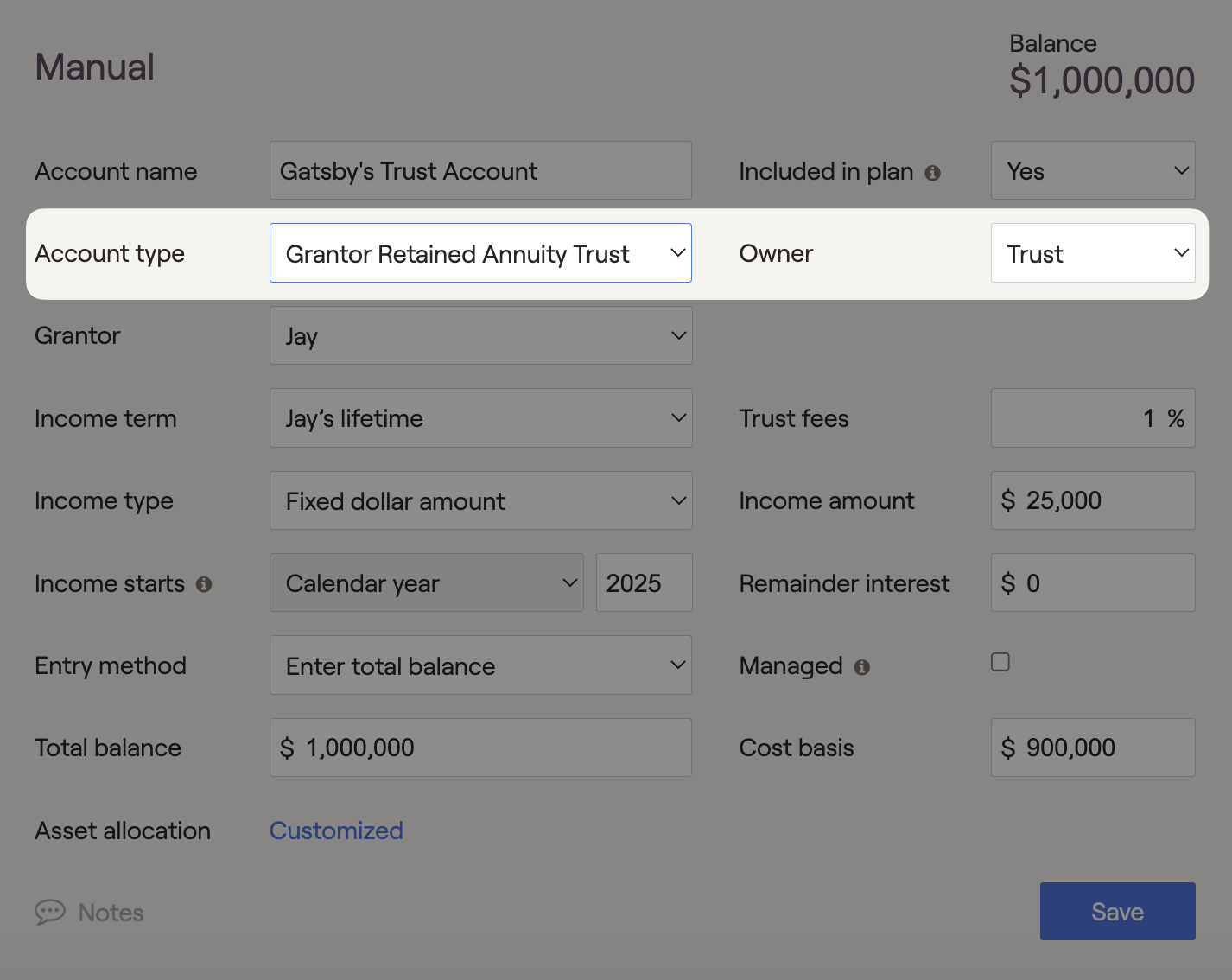

Grantor Retained Annuity Trusts (GRAT's)

Once entered into the client's Net Worth, GRAT's provide income to the grantor while the remaining value is passed to beneficiaries without incurring gift taxes. Since the Grantor is responsible for taxes on interest, dividends, and gains generated by the trust, you must indicate details within the "Grantor" dropdown menu. The annuity income stream is not taxed as it enters the client's plan.

If the grantor dies within the GRAT term (Income term) of the trust, the remaining value is added back into the plan as income. If the client outlives the GRAT, the appreciation assets are passed to beneficiaries tax-free.

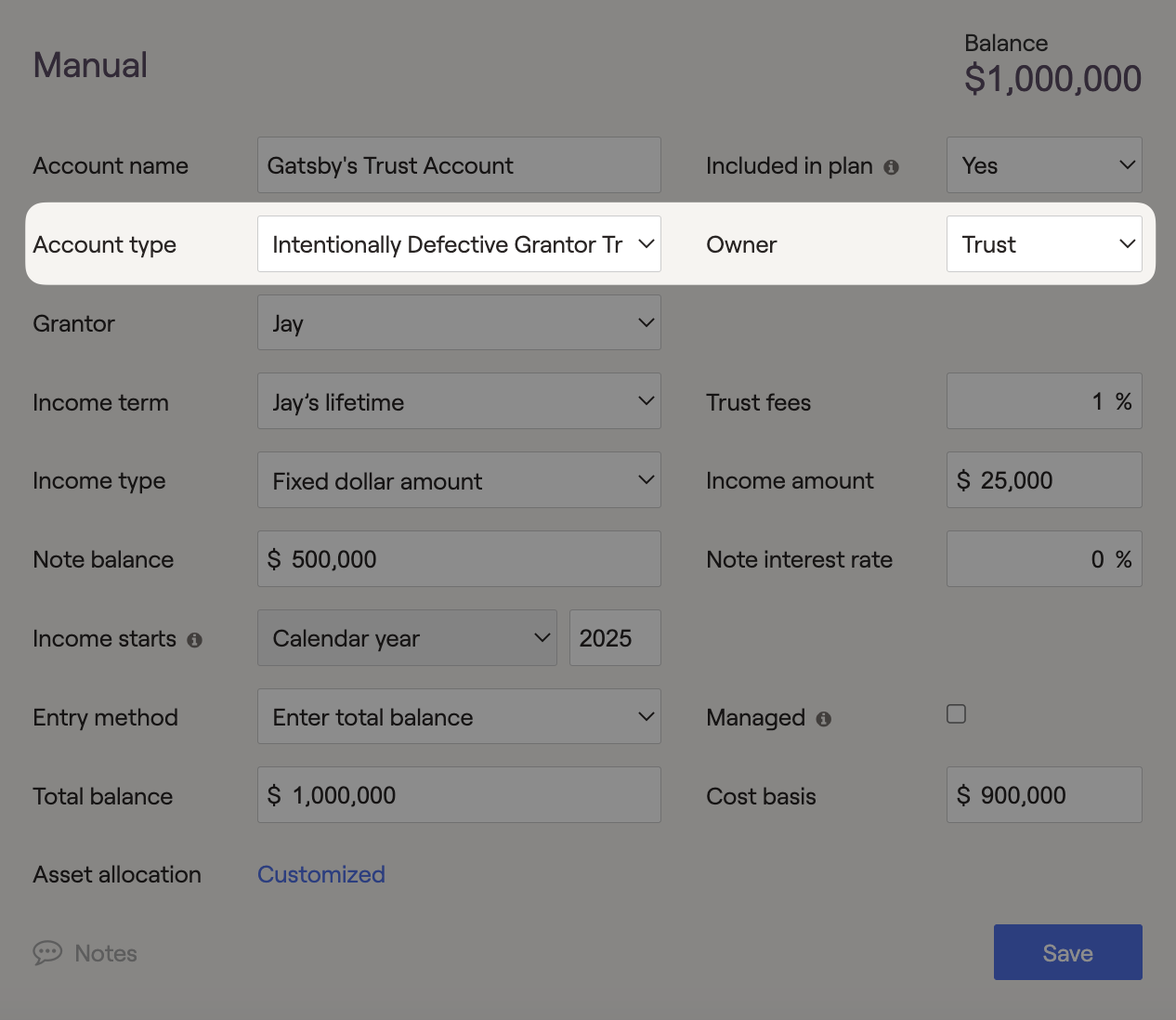

Intentionally Defective Grantor Trusts (IDGT's)

Once entered into the client's Net Worth, IDGT's provide income to the grantor while the remaining value is passed to beneficiaries without incurring taxes. Since the Grantor is responsible for taxes on interest, dividends, and gains generated by the trust, you must indicate details within the "Grantor" dropdown menu. The annuity income stream is not taxed as it enters the client's plan.

When created, assets are sold to the trust instead of gifted to avoid gift taxes. Therefore, instead of an income stream annuity, the assets can be sold for a note receivable. Indicate the Income amount, the Note balance, and the Interest rate for the trust. RightCapital will take whatever is left in the note balance at the end of the income term and add it as a balloon payment to the financial plan.

If the grantor dies within the IDGT term (Income term) of the trust, the remaining value is added back into the plan as income. If the client outlives the IDGT, the appreciation assets are passed to beneficiaries tax-free.

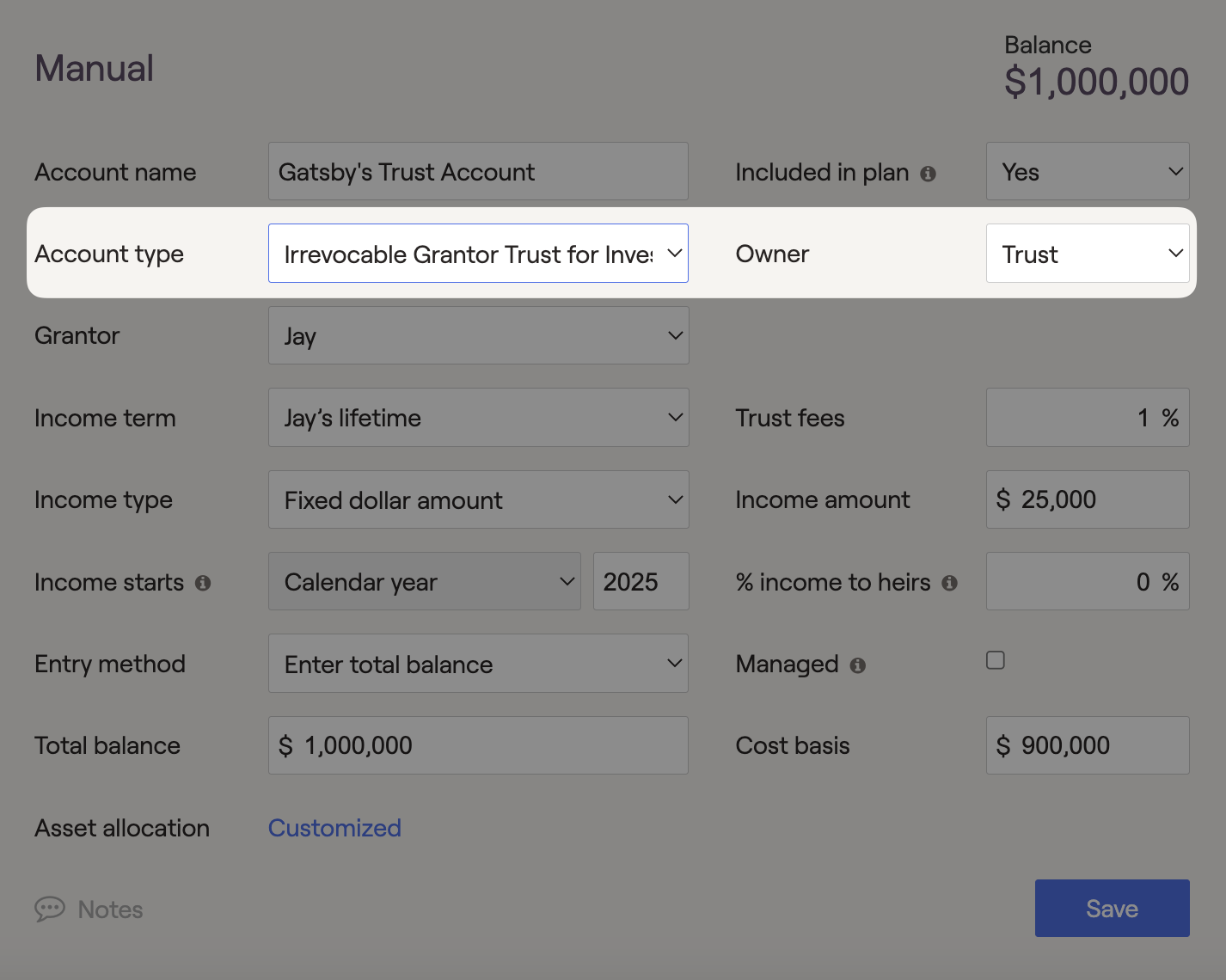

Irrevocable Grantor Trust

Once the Irrevocable Grantor Trust is entered into the client's net worth, the assets will be placed outside of the client's taxable estate. Assets in this trust will not be subject to probate costs or estate taxes in the financial plan. Income can impact the client's cash flows or be sent to individuals outside the plan. In a Grantor trust, the client is responsible for any taxes on income generated within the trust. This type of trust can be used to model the important details of various irrevocable grantor trusts.

Trust Owned Properties

Investment properties cannot be owned by Qualified Personal Residence Trust