Tax Cuts and Jobs Act (TCJA)

Effective January 15th, 2018, RightCapital has been updated to reflect changes associated with the Tax Cuts and Jobs Act (TCJA). All existing client accounts have been set to reflect the TCJA changes, including the sunset of provisions that expire in 2025.

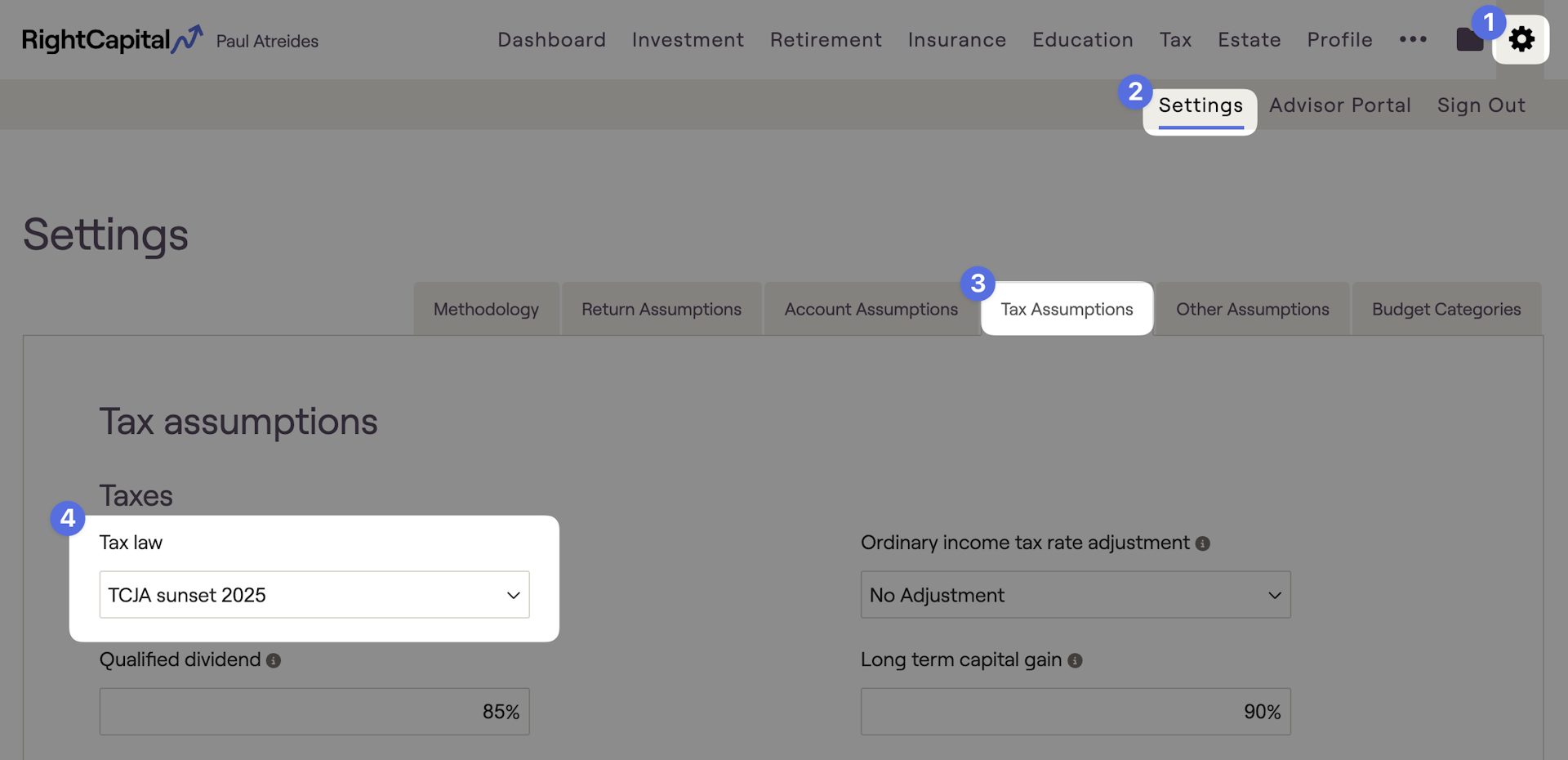

There is now the flexibility to illustrate client plans under three different tax law frameworks.

- TCJA sunset 2025: reflects all updated provisions related to TCJA, including the sunsetting of most individual income tax provisions in 2025

- TCJA no sunset: reflects all updated provisions related to TCJA for the entire duration of the plan (ignores the sunset provisions).

- 2017 tax law: reflects all tax provisions before the enactment of TCJA, as would be used in clients' 2017 tax calculations.

Details of Changes

The following updates to the system have been made to reflect tax law changes associated with the Tax Cuts and Jobs Act of 2017 (TCJA). For more details about what has and has not changed, we suggest this article by Michael Kitces ↗️.

New Tax Brackets

Tax Brackets have been updated to the new 10%, 12%, 22%, 24%, 32%, and 35% brackets with associated income thresholds.

The Standard Deduction, Exemptions, Credits

The 2025 standard deductions under TCJA have been updated to:

Single & Married Filing Separately: $15,000

Married Filing Jointly: $30,000

Head of Household: $22,500

Qualified Business Income

The new deduction for qualified business income has been incorporated. This provides a 20% deduction for business income from an LLC, partnership, or S corporation.

Deductions on any income indicated from a business type of LLC, partnership, or S Corp, as well as any 'Self-employment income' will automatically be included. The deduction is 20% of business income, capped at 20% of taxable income (pre-deduction).

The deduction is phased out based on income limits for 'specified services businesses'. By default we assume that any business is a 'specified services' business; modify this assumption by un-checking the 'Service business' box found on the business or self-employment income card.

For business income coming from a 'Service business', in 2025 the deduction phases out:

Filing Joint: phase-out begins at $394,600 of taxable income (pre-deduction), and is fully phased out by $494,600 (2024 values: $383,900 - $483,900).

Filing Single: phase-out begins at $197,300 and is fully phased out at $247,300 (2024 values: $191,950 - $241,950).

The phase-out reduces the deduction by 1% of business income per $1,000 of taxable income for couples and 2% of business income per $1,000 of taxable income for single.

At this time we do not consider the limitation on deductions associated with the number of wages paid to employees.

The $10,000 cap on state & local Income tax and property tax deductions has been included.

Any expense indicated as a miscellaneous itemized deduction will no longer be reflected as a deduction on Schedule A.

The AMT exemption amounts and phaseouts have been updated under TCJA. For 2025:

Single/Head of Household: $88,100 - $626,350

Married filing separately: $68,500 - $626,350

Married filing jointly: $137,000 - $1,252,700

Additional Impacts

If the tax law is set to TCJA with the sunset provision, the current tax brackets will be utilized through 2025 and then revert to the 2017 tax brackets. This is referenced on the screen by listing the respective tax rates associated with the brackets; e.g. the '12%/15% tax bracket' illustrates the current 12% bracket through 2025 and then reverts to the prior 15% bracket.

When using Roth conversions to 'fill up' the tax bracket, the same approach will be used - the amount needed to fill the current 12% bracket through 2025 will be calculated and then the old 15% bracket thereafter. For more details about the Tax Strategies tool, click here.