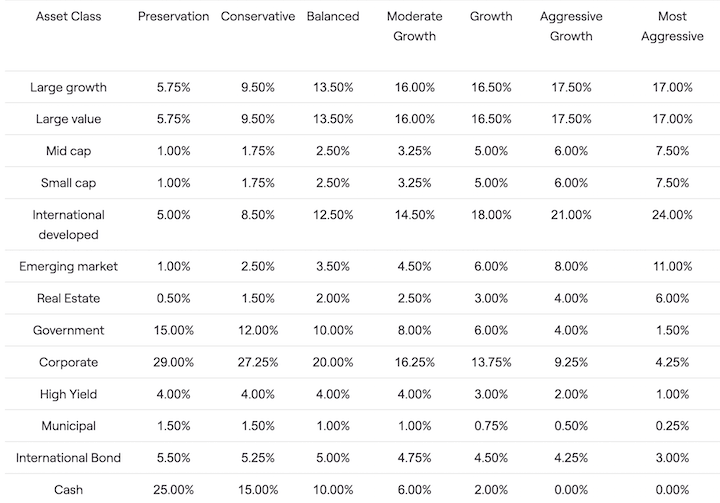

RightCapital’s proprietary Asset Allocation Portfolios utilize Asset Classes determined by Morningstar. They were developed based on public data at Morningstar.com from leading investment management firms, including Fidelity, Vanguard, T. Rowe Price, Charles Schwab, Principal, and American Funds.

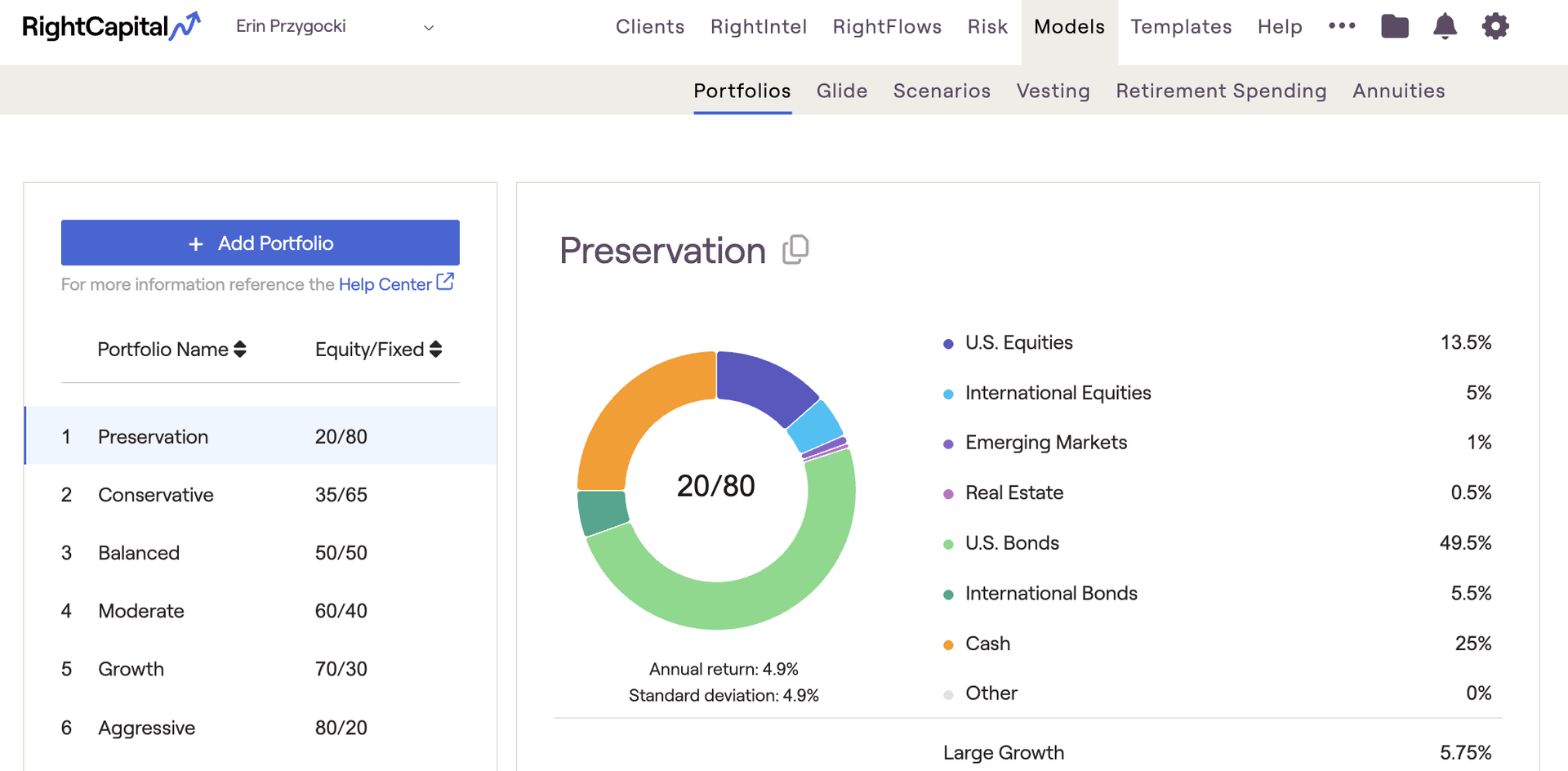

Default Model Portfolios

RightCapital includes seven default model portfolios, which are pre-built into every advisor account. We plan to review the data on an annual basis. The Asset Allocation Portfolio allocations are as follows:

Adding New Model Portfolios

Asset Class Based

To create a model portfolio by asset class, use the model type dropdown menu to select "asset class based". Scroll down to enter the percentage of each asset class that makes up the portfolio. Values must equal 100% to save:

Holdings Based

If you want to create a model portfolio based on holdings, select the "holdings based" model type. The portfolio will default to 100% of the 'Other' asset class. Use the "Edit Holding" button on the right to input your specified holdings.

Use the drawer to enter ticker symbols, from Morningstar's database, along with their corresponding weighting. Values must equal 100% to save. When viewing the new portfolio within a client's plan, only the associated asset classes will be visible.

Re-order Model Portfolios

When viewing the list of your model portfolios, RightCapital allows you to change the order they are displayed. Within the list of models on the left, you can click on the title of one of the models and then drag it to the desired location.

Delete Model Portfolios

Custom models can be deleted by hovering your mouse over a particular model and then clicking the 'x' icon that appears to the right:

Where to Use Model Portfolios

Model portfolios can be applied in several places within a client plan:

- When allocating a client's investments in the Profile > Net Worth tab

- When selecting a target portfolio in the Investment module

- When proposing a new asset allocation in the Retirement > Analysis > Action Items