Explore Required Minimum Distributions in RightCapital

RightCapital enables advisors to capture every element of a client's financial landscape — even comprehensive components like required minimum distributions (RMDs).

This article is designed to provide an overview of required minimum distributions and the accounts that they affect in RightCapital.

The information in this article assumes the advisor has the Planned Distribution method selected, where the software will automatically calculate the RMDs. For more information on settings that impact RMDs in a client's profile, click this link.

RightCapital RMD Overview

Required minimum distributions (RMDs) represent the minimum amount clients must distribute from qualified accounts annually to avoid tax consequences. For clients who reached age 73 on or after January 1st, 2023, the required minimum distribution start age is 73. Clients who reach age 72 before January 1st, 2023, must begin RMDs at age 72. As a default, RightCapital will distribute RMDs at the appropriate age, based on the client's birthday. Users can customize RMD settings within the client methodology area of the financial plan.

Accounts Subject to RMDs

The following accounts will be subject to the required minimum distribution rules when entered into a client's financial plan. For more information on adding investment accounts to a client's plan, please use this link.

401(k) plans

403(b) plans

457(b) plans

Traditional IRA's

SEP IRA's

SIMPLE IRA's

Inherited Roth IRAs

Inherited Traditional IRAs

Qualified Annuities

Qualified Pensions

Profit Sharing Plan

Employee Stock Ownership Plans

Employee Stock Purchase Plans

Generating RMDs

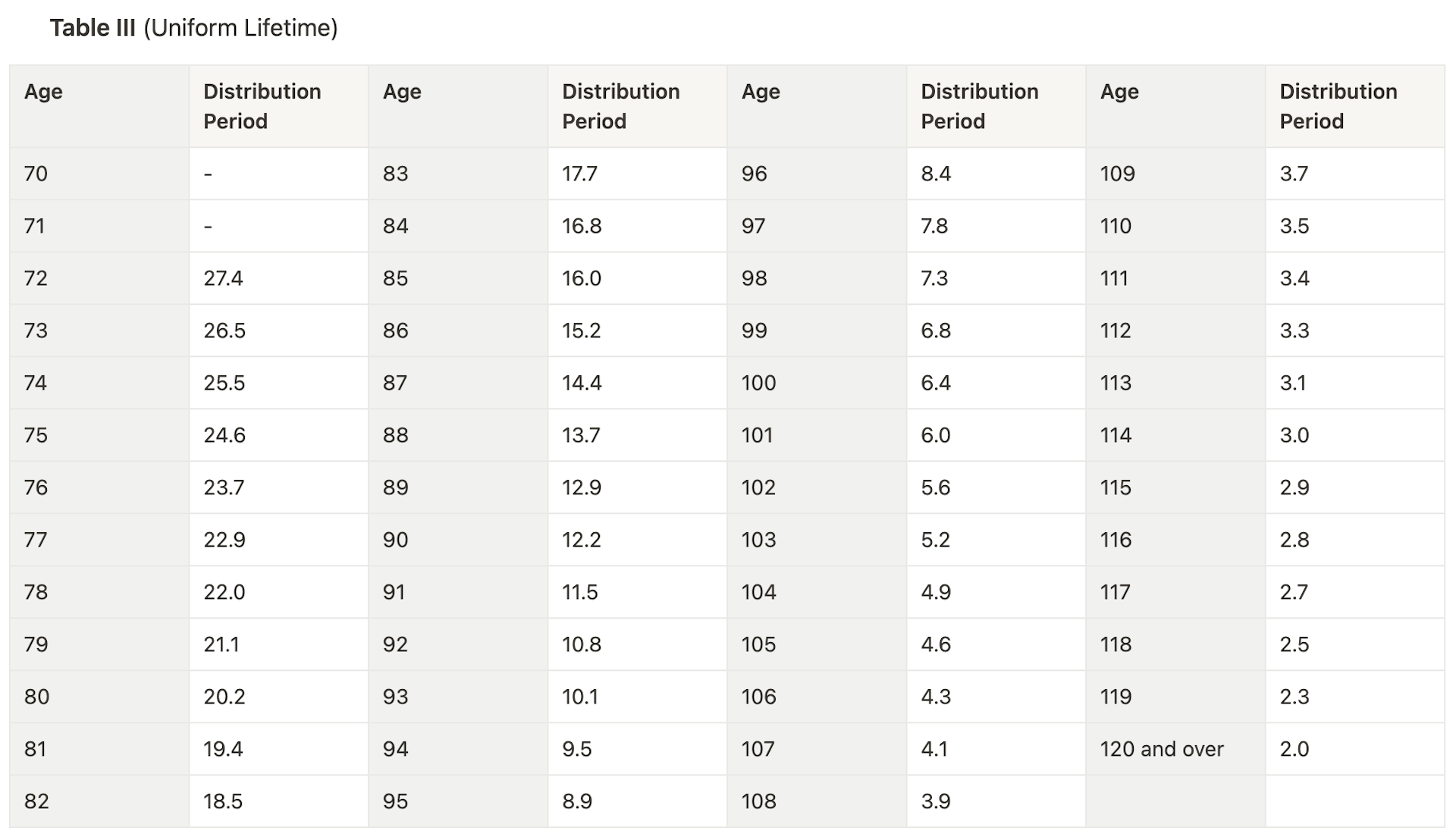

When generating required minimum distributions (RMDs) for qualified accounts, RightCapital divides the year-end account balance by the appropriate RMD factor from the Uniform Lifetime Table to determine the appropriate distribution. The RMD factors we use are based on the client's age and can be found in the chart below. The only caveat to this calculation occurs when the co-client has an age difference of ten years or more.

If a client is 73 years old and owns an IRA worth $100,000 at the end of last year, RightCapital would run the following calculation to determine the IRA RMD.

$100,000 (IRA year-end balance) / 26.5 (RMD Factor) = $3773.58 (Scheduled RMD)

RMD Generation when Clients Have 10+ Year Age Gap

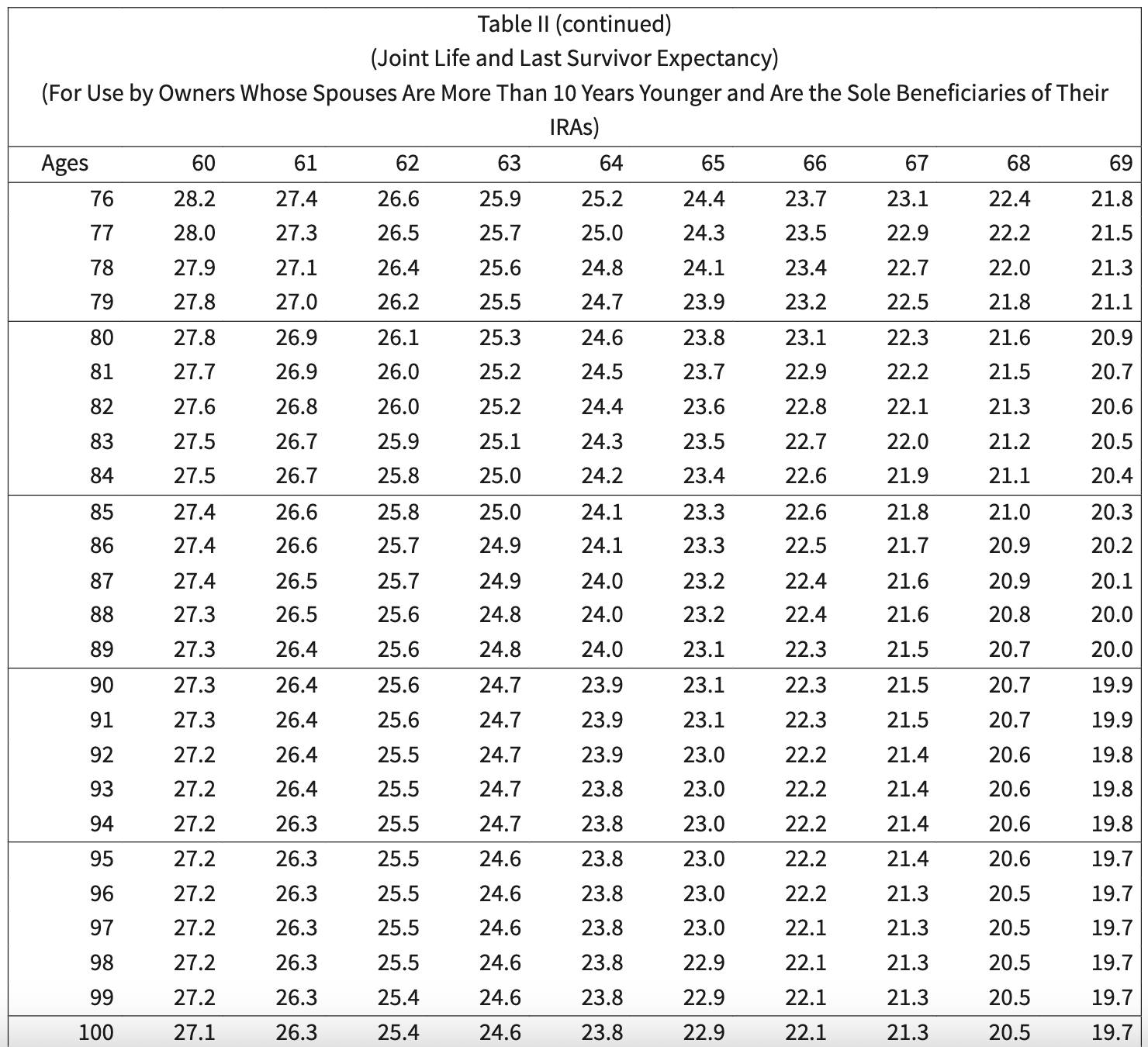

When the client and co-client have an age difference of ten years or more, RightCapital will adjust the RMD calculation to use factors from the IRS joint life expectancy table. This typically results in a lower RMD amount.

When the client and co-client have a large age difference, RMDs are calculated based on factors from Table II (joint life expectancy table) at the intersection of the client and co-client's ages. For additional information on calculating RMDs when the client and co-client have an age difference of ten years or more, please refer to this IRS worksheet. An example of the RMD factors we use in this scenario can be found in the chart below.

RMDs After Client Passes Away

When a client passes away within a financial plan, RightCapital will assume a spousal rollover rather than an Inherited IRA for accounts subject to RMDs. The rollover account will then calculate RMDs based on the year-ending account balance and the surviving spouse's uniform life table factors.

Inherited IRA's RMDs"s

If a client owns an Inherited IRA or Inherited Roth IRA, RightCapital will automatically generate the required minimum distributions regardless of the owner's age. Custom distributions to satisfy the 10-year distribution rule, applicable to non-spousal beneficiaries, can be detailed within the Profile > Net Worth > Inherited IRA data card.

Spousal beneficiaries of Inherited IRA or Roth IRA accounts not subject to the inherited IRA will have two methods of calculating RMDs:

If the original owner died before starting RMDs, RightCapital would use the surviving spouse's age and factors from their Uniform Lifetime table to calculate Inherited IRA RMDs.

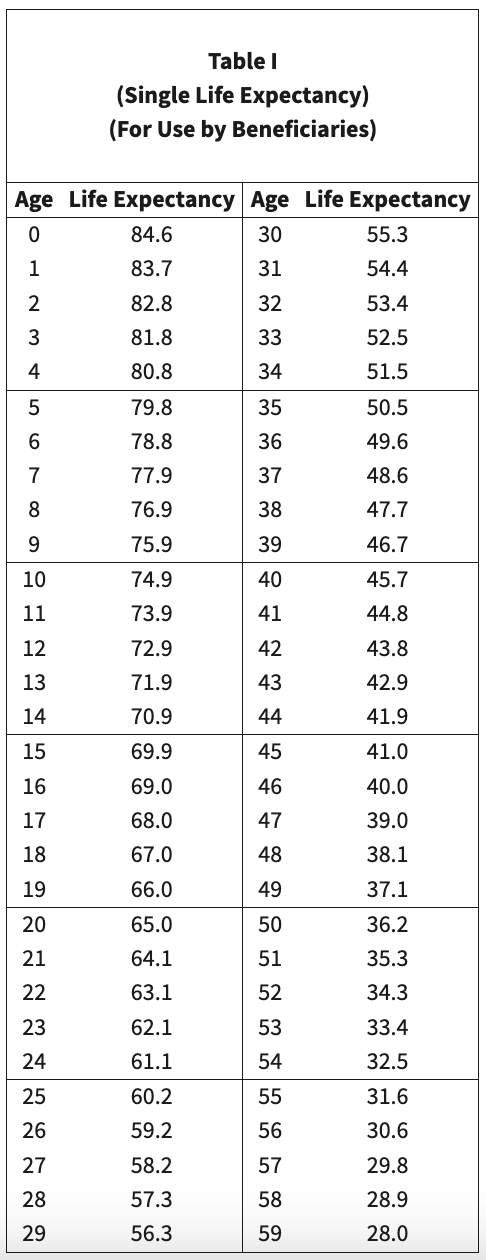

If the original owner dies on or after RMDs begin, RightCapital will use factors from the single life expectancy table 1 associated with the younger of, the surviving spouse's current age, or the original owner's age at death. The factor is then used to generate an RMD for the inherited account.

Qualified Annuity RMDs

If the client owns a Qualified Annuity, RightCapital will generate RMDs based on the owner's age and factors from their uniform life table. Each Qualified Annuity entered will allow the user to customize income distributions that may or may not fully satisfy RMD requirements. If the RMD requirements are not satisfied through income distributions, RightCapital will begin distributing additional income from the qualified accounts at the appropriate RMD start age.

Qualified Charitable Distribution(QCD)

The qualified charitable distribution (QCD) rule allows owners of traditional IRAs to exclude required minimum distributions (RMDs) from their AGI when the funds are donated to a qualified charitable organization. QCDs can satisfy part or all of the client's RMDs from their IRA.

If your 2018 RMD was $10,000, and you made a $5,000 qualified charitable distribution for 2018, you would have had to withdraw another $5,000 to satisfy your 2018 required minimum distribution.

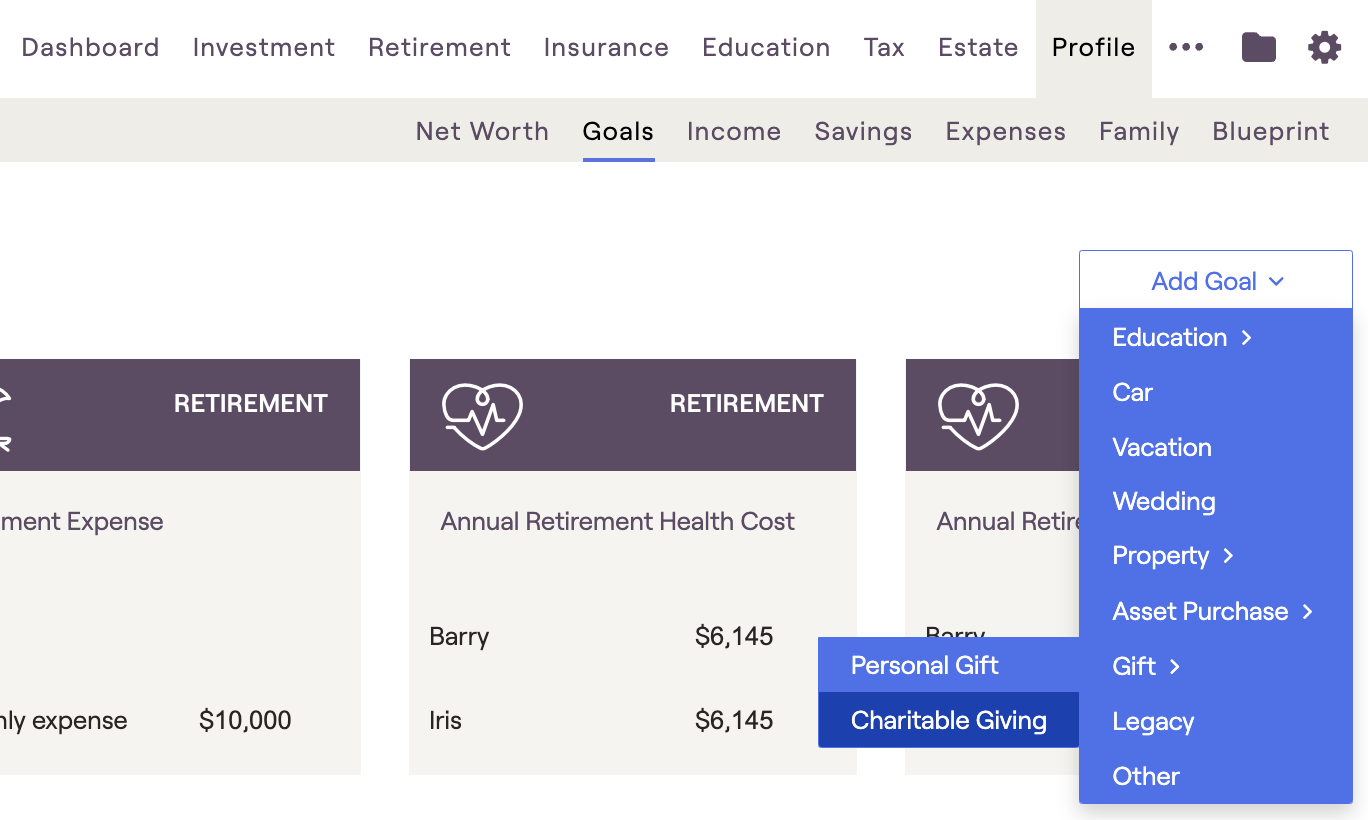

RightCapital allows for three types of qualified charitable distributions. These can be added to the client's financial plan through the Profile > Goals > Add Goal > Gift > Charitable Giving data card.

- IRA (Qualified charitable distribution): This allows individuals over 70 ½ to donate funds from an IRA directly to a charity tax-free. QCDs will also count toward their required minimum distribution for that year. When selected, users will see a Planned Distribution in the Retirement > Cash Flows and a goal to reflect the contribution to charity.

- Inherited IRA (Qualified charitable distribution): This allows individuals over 70 ½ to donate funds from an Inherited IRA directly to a charity tax-free. QCDs will also count toward their required minimum distribution for that year. When selected, users will see a Planned Distribution in the Retirement > Cash Flows and a goal to reflect the contribution to charity.

- IRA annuity (Qualified charitable distribution): This allows individuals over 70 ½ to donate funds from a qualified annuity to a charity tax-free QCDs will also count towards their required minimum distribution for that year. This is only available if the distribution setting for the annuity is ‘Regular withdrawals’. When selected, users will see a Planned Distribution in the Retirement > Cash Flows and goal to reflect the contribution to charity.

For QCDs to offset RMDs in RightCapital, users must use the appropriate "planned distributions method" setting. When the "Greater of RMD and manual distribution" is selected, QCDs entered as a charitable giving goal will offset the automatically scheduled RMD within the financial plan. See settings that impact RMDs below for additional information.

Settings that Impact RMDs

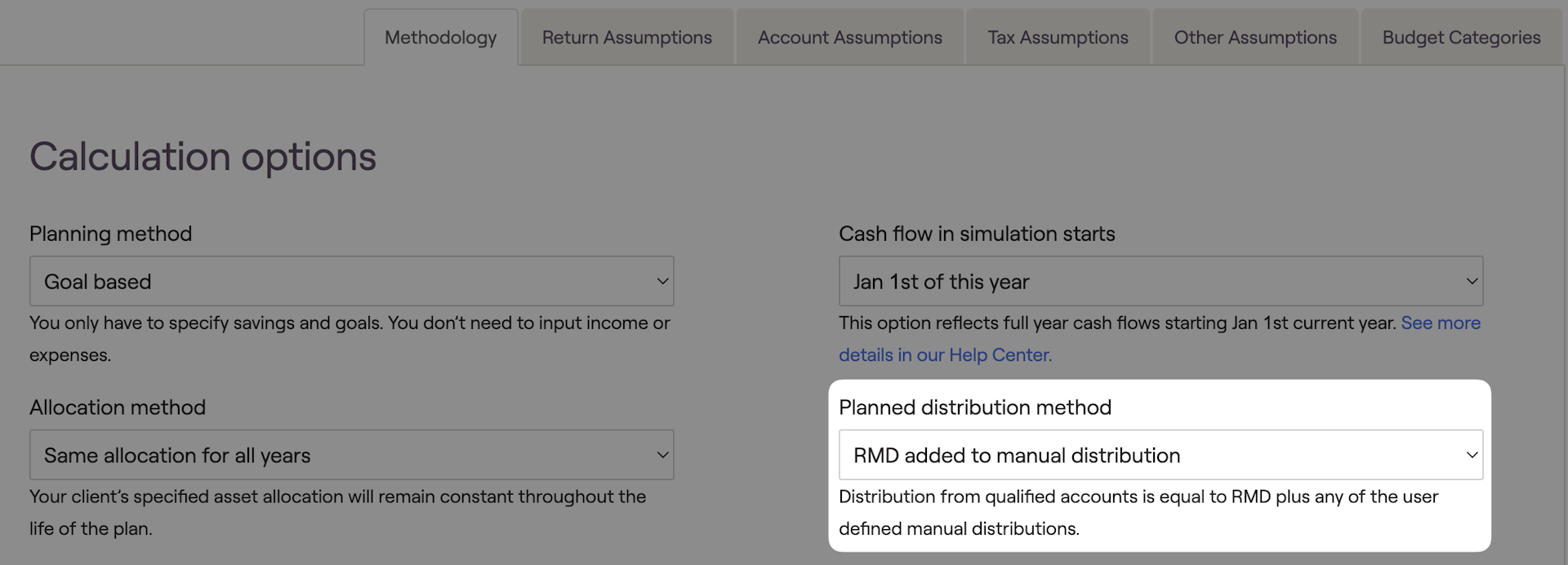

Each client plan can be customized to produce outcomes that mirror the advisor's unique philosophy. There are two settings in each plan that will have an impact on the client's Required Minimum Distributions. To access these settings, advisors can open the client plan > Gear icon > Settings > Methodology area. Here advisors can customize the Planned Distribution Method and choose to take annuity RMDs from IRA accounts First. These settings can be adjusted globally for all new clients in the Advisor Portal > Gear Icon > Account > Client Presets Tab.

Planned Distribution Method

This setting determines how manual distributions interact with Required Minimum Distributions (RMDs) calculated automatically by the system. Options include having the manual distributions added to the RMDs, having the system calculate the greater of the manual distributions and RMDs, or overriding the system's RMD calculation to just use the manual distributions. This setting applies across all account types.

For more, see the article on income distributions.

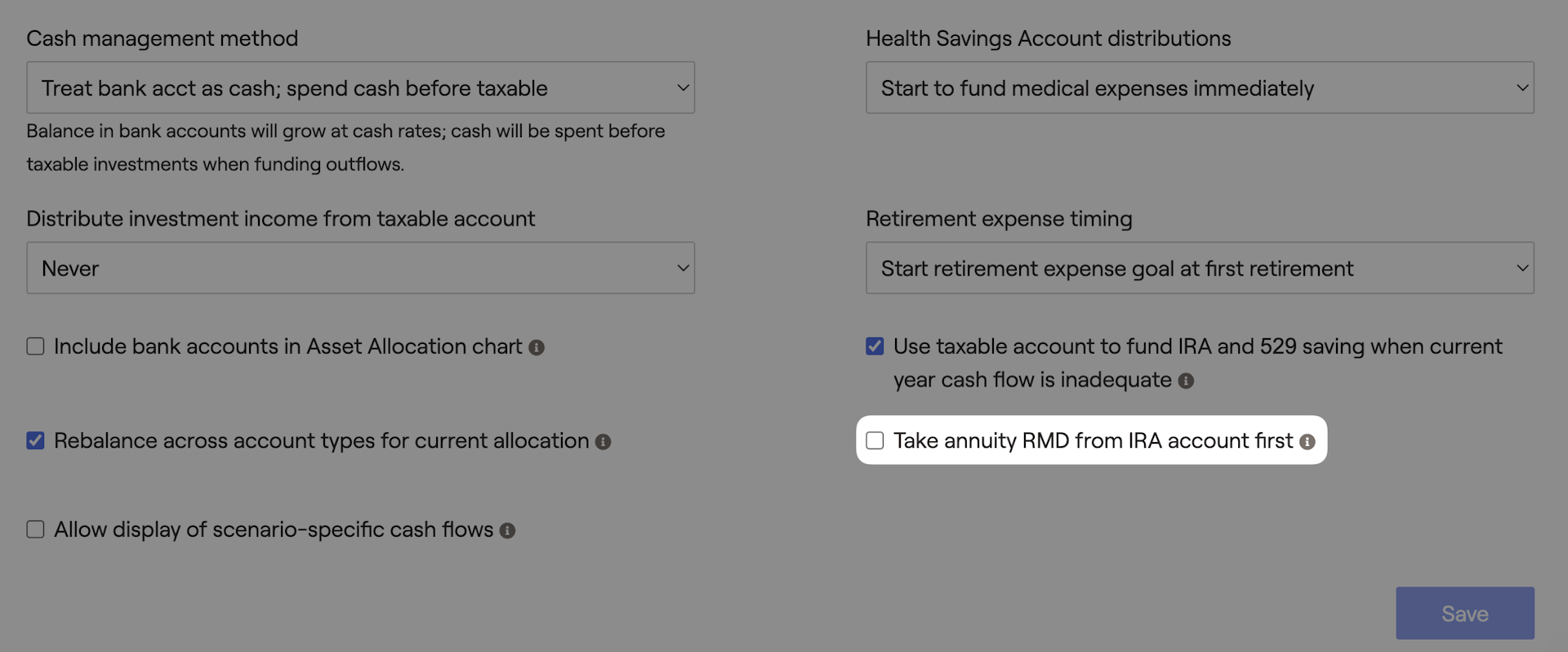

Take Annuity RMD from IRA accounts first

Taking annuity RMDs from IRA accounts first allows advisors to adjust how RMDs affect qualified annuities built into the financial plan.

If the setting is unchecked, we will calculate the RMD for lifetime income annuities each year starting in the year the client turns 70 1/2 and will distribute the greater of the RMD or the client's lifetime income amount in that year.

Also, if this setting is checked, once the client has started taking lifetime income withdrawals, if the client's RMD exceeds the lifetime income amount, we will take the excess from the client's IRA or other qualified annuities.

Only use this setting if your client has sufficient funds in their IRA or other qualified annuities to cover the additional RMDs. If there are insufficient funds in their IRA or qualified annuity to cover the additional RMDs, the client's RMDs will be understated as we will not take the balance from the annuity.

Whether the setting is checked or not, once lifetime income withdrawals begin, those withdrawals will count towards the total RMD required across your clients' IRA and qualified annuity accounts. If the lifetime income amount exceeds the RMD calculated for the lifetime annuity, we will reduce the RMD from the client's traditional IRA by the excess amount.