After popular demand, RightCapital is excited to launch the tax status Married Filing Separately! We hope you are as excited as we are! Please check out this article to see all enhancements added to our planning modules. With our new tax filing status option, you can show the client the difference between Married Filing Jointly and Married Filing Separately.

All tax calculations, such as tax brackets, deductions, and Medicare IRMAA premiums have been updated for this filing status.

Select Filing Status

To change the filing status, navigate to Profile > Expenses > Tax and Fees card.

Tax Estimate

Navigate to the Tax > Tax Estimate tab to see the following graphs for the client and co-client:

Effective tax rate

Federal Income tax bracket

Federal Capital gain tax bracket

Navigate to the Tax Estimate > Details tab to see a breakdown of the detailed tax projections for the client and co-client.

Tax Distributions

Advisors can now see the key tax components that make up the taxable income during each year of the financial plan for the client and the co-client. In the Actions Items, the conversion target will allow users to choose from three separate conversion scenarios for the client and co-client. To specify the starting and ending dates for conversions, please click into the "Edit" field to update for the client and co-client.

For more details on each client's Roth conversion, navigate to the Details tab, where you can click into the table headers to view each individual's conversions.

Please note: The Medicare premium tax bracket will account for higher Medicare premiums for individuals that are married filing separately. For more information on our Distribution and Conversion Tool, please reference this article.

Tax Assumptions

In the Gear Icon > Settings > Tax Assumptions, specify the following tax variables for the cleint and co-client:

Misc itemized deductable

Capital loss carryover

Charitable giving carryover for cash and appreciated assets

AMT credit carryforward

Prior year's MAGI

Retirement Cash Flows

When viewing the Cash Flow summary page, click on the Tax Payment header to see a detailed overview of the client and co-client tax payments. RightCapital will show the Federal, State, and FICA individually.

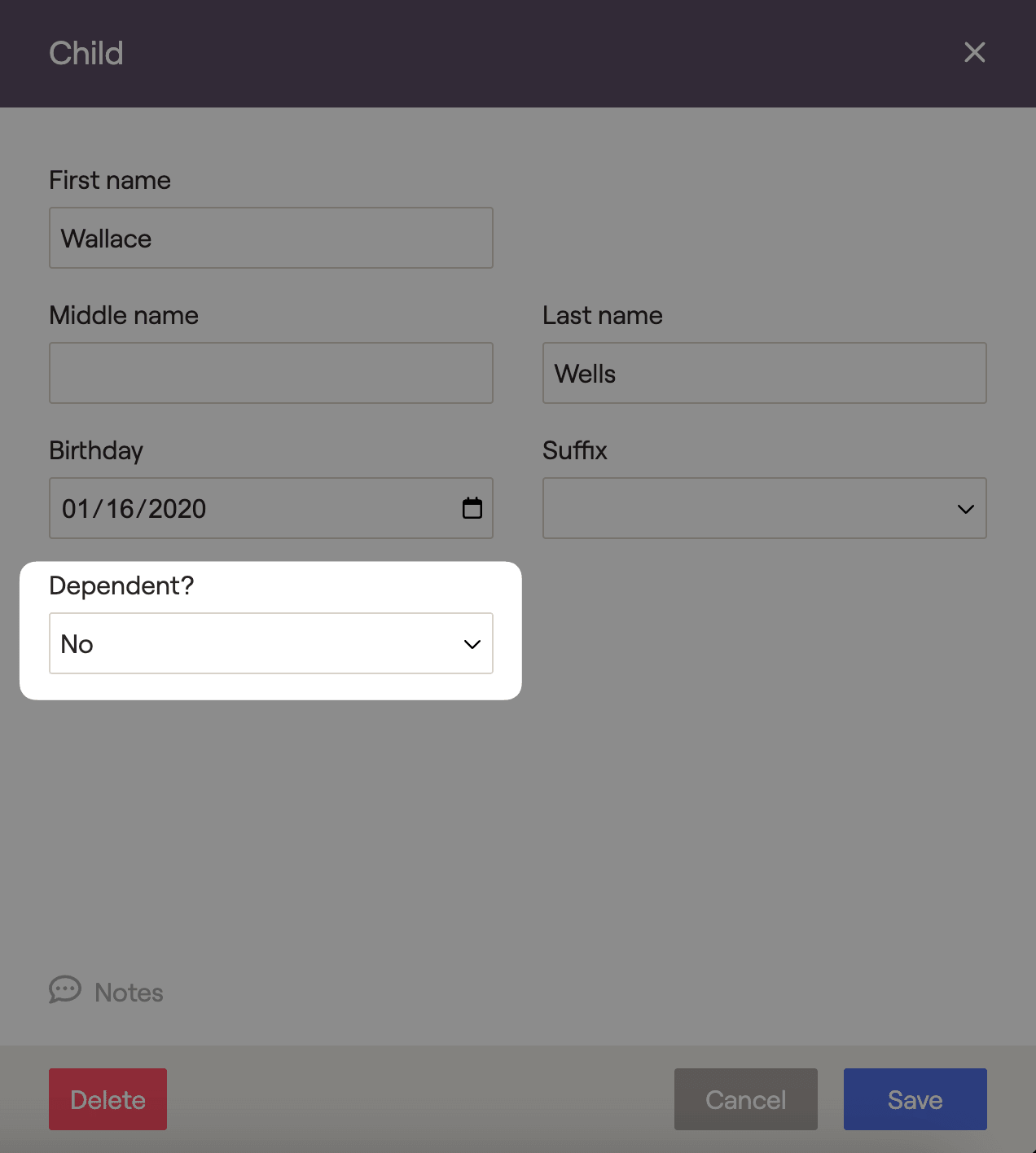

Adding Dependent Information

We have added the ability to specify who claims the dependent in the plan. Navigate to the Profile > Family > Child card and select the dependent from the dropdown.

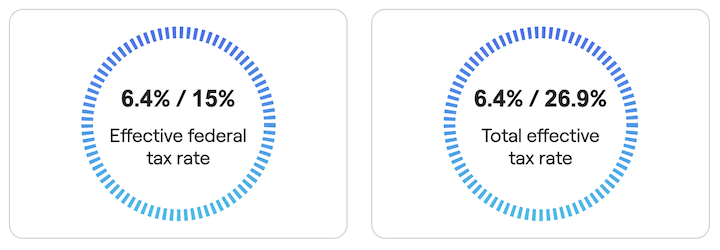

Snapshot Key Metrics

In the Snapshot module, the Tax Estimate metrics will reflect the effective federal and the total effective tax rate for the client and the co-client.

Update to Reports

When generating a report of the Tax details, the report will include a page for the client and the co-client.