Enabling Custom Asset Classes

RightCapital offers access to use customized asset classes in addition to the standard asset classes shown.

Custom Asset Class functionality includes the ability to:

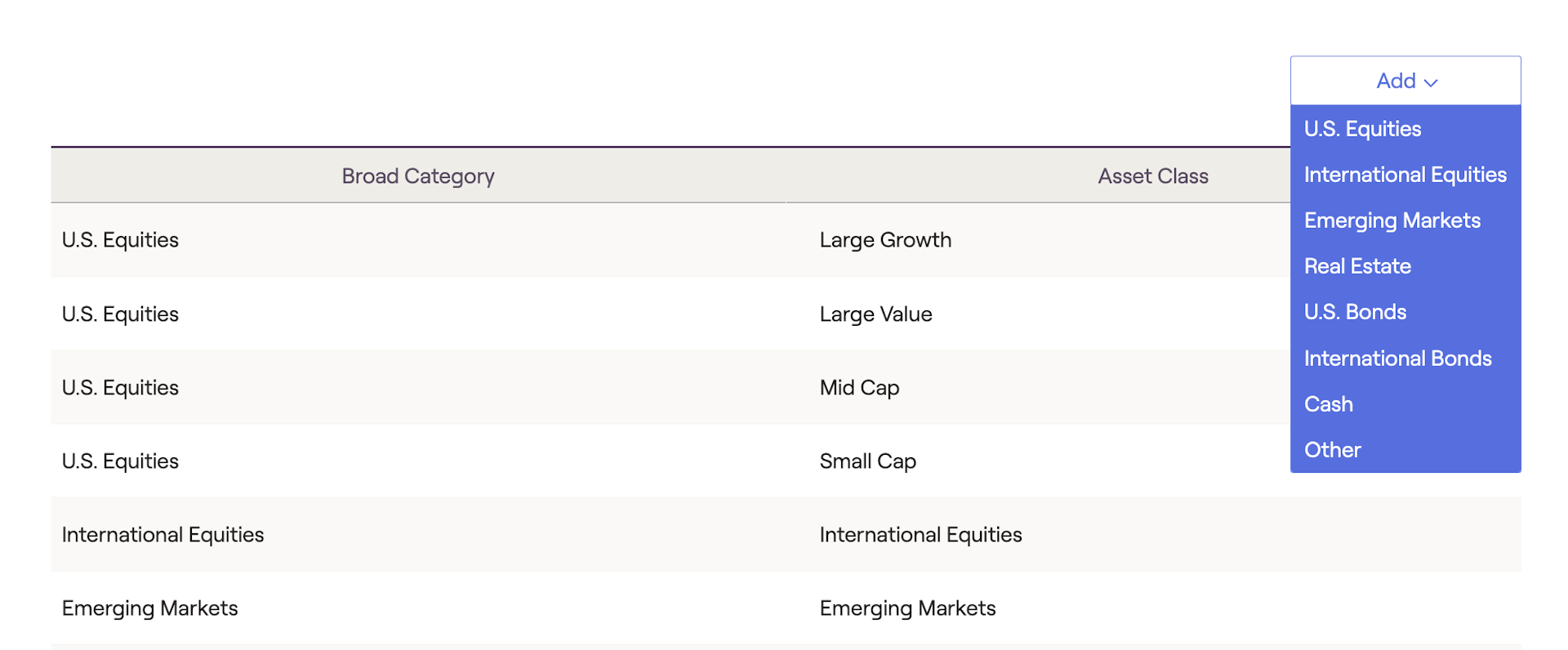

Add additional asset classes under existing asset categories

Add additional asset classes under the 'Other' category to reflect specific models/investments

Customize correlations between asset categories, including the 'Other' category

Adjust volatility assumptions for existing and custom asset classes

- Once Custom Asset Classes are enabled they are unable to be turned off.

- Advisors who enable Custom Asset Classes are unable to downgrade their subscription at a later date.

Please ensure that Custom Asset Class functionality will meet your needs prior to requesting that it be enabled. If you would like to review whether Custom Asset Classes will work for you please email sales@rightcapital.com.

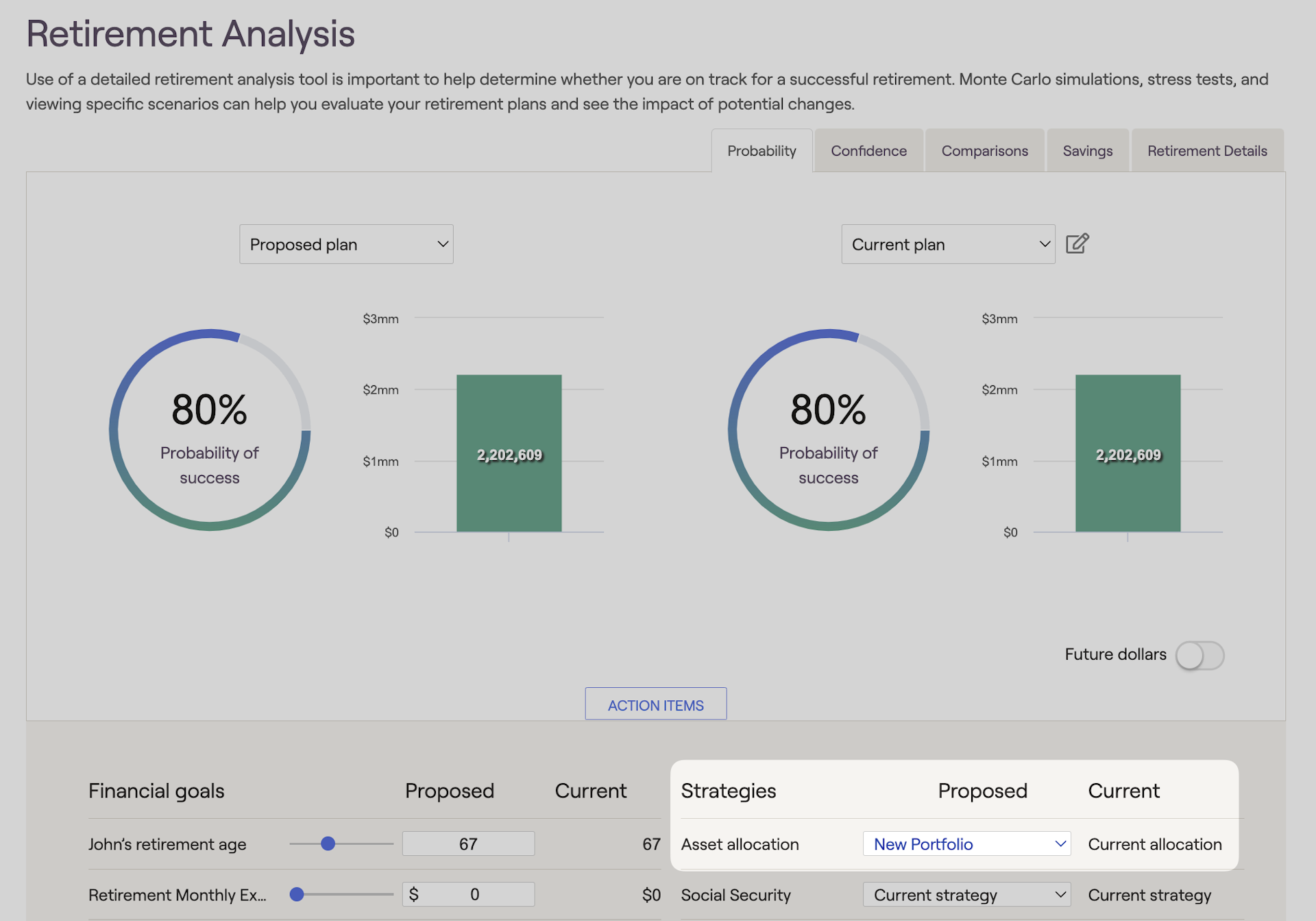

Impact on Monte Carlo Simulations

When Custom Asset Classes are enabled, we use a different model to generate Monte Carlo scenarios. This is to account for the flexibility provided for updating volatility and correlation assumptions. This granular approach utilizes a standard log-normal distribution model. If you enable Custom Asset Classes, you may see different results for existing plans.

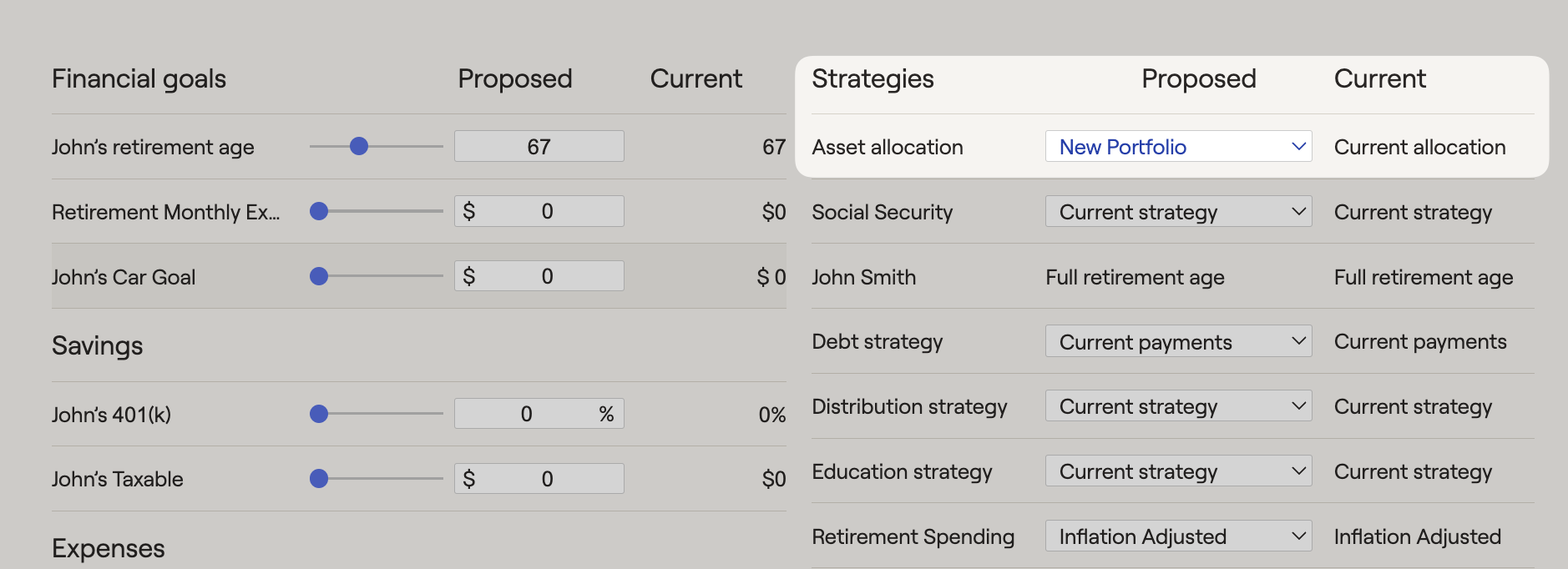

How to set up custom asset classes

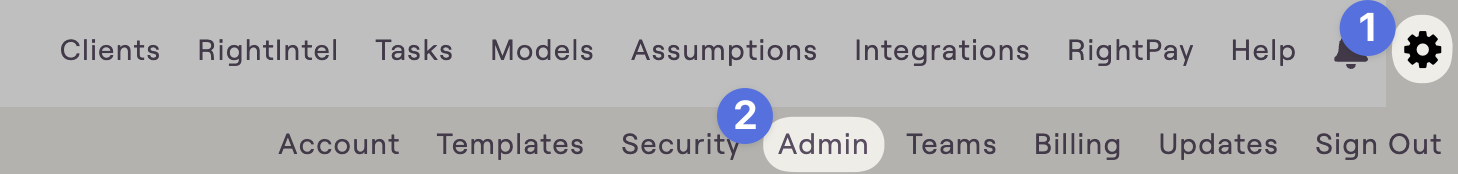

Navigate to the Gear Icon > Admin tab.

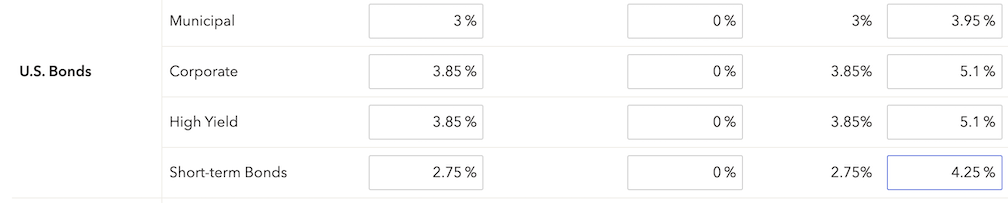

Once the asset class has been added for your firm, select the Assumptions > Asset Return tab to update the return and volatility assumptions associated with that (or any other) asset class:

With custom asset classes enabled, you can create a general cryptocurrency asset class, or even dedicated asset classes for specific cryptocurrencies like Bitcoin and Ether.

Using Custom Asset Classes to reflect additional asset classes within models

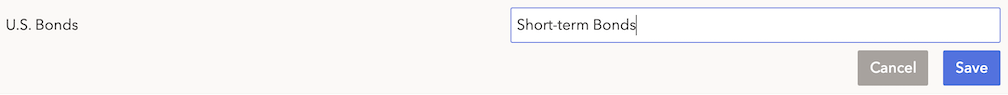

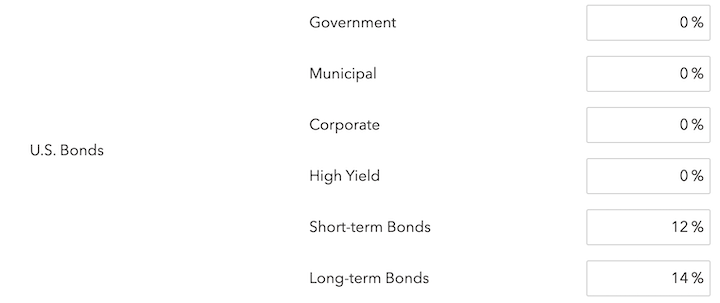

Use the Custom Asset Class functionality to reflect different asset classes in the asset allocation models used in RightCapital. For example, if you differentiate bonds by duration rather than the sector in your models, add asset classes to reflect categories such as 'Short-term Bonds' and 'Long-term Bonds', and you can update the return/volatility assumptions for those asset classes. Use this to reflect more granular investment classes or alternative asset classes.

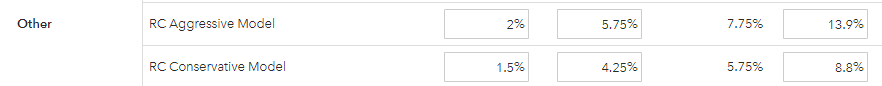

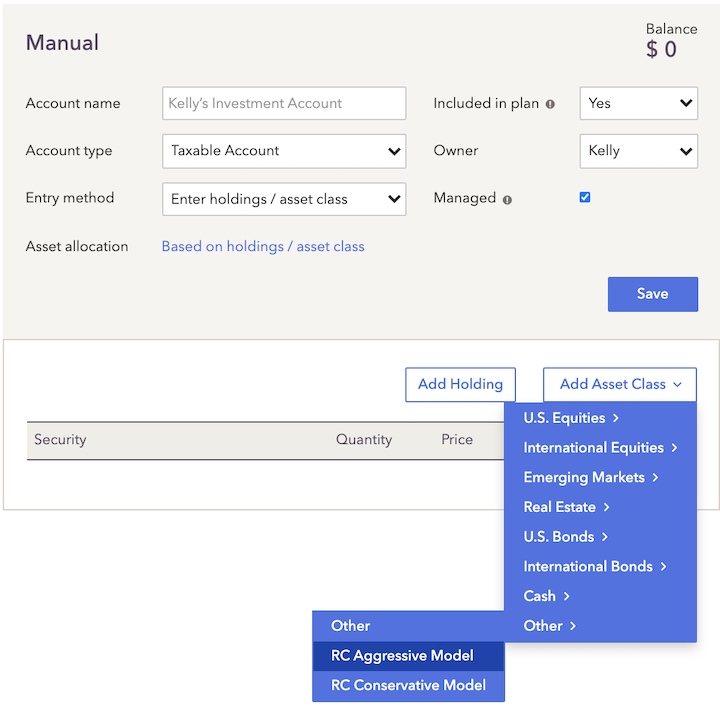

Using Custom Asset Classes for tactical models or custom investment strategies

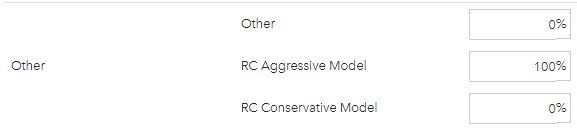

Differentiate yourself from the competition using the Custom Asset Class functionality to illustrate the client's investments in a tactical or dynamic model that may change over time. Add additional 'asset classes' under the 'Other' category to reflect the strategies used, along with associated returns and volatility numbers:

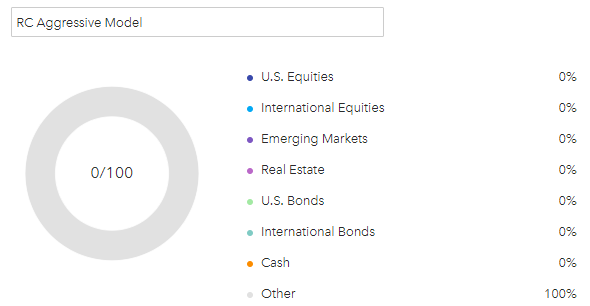

Reflect client's current investment in your custom strategy.

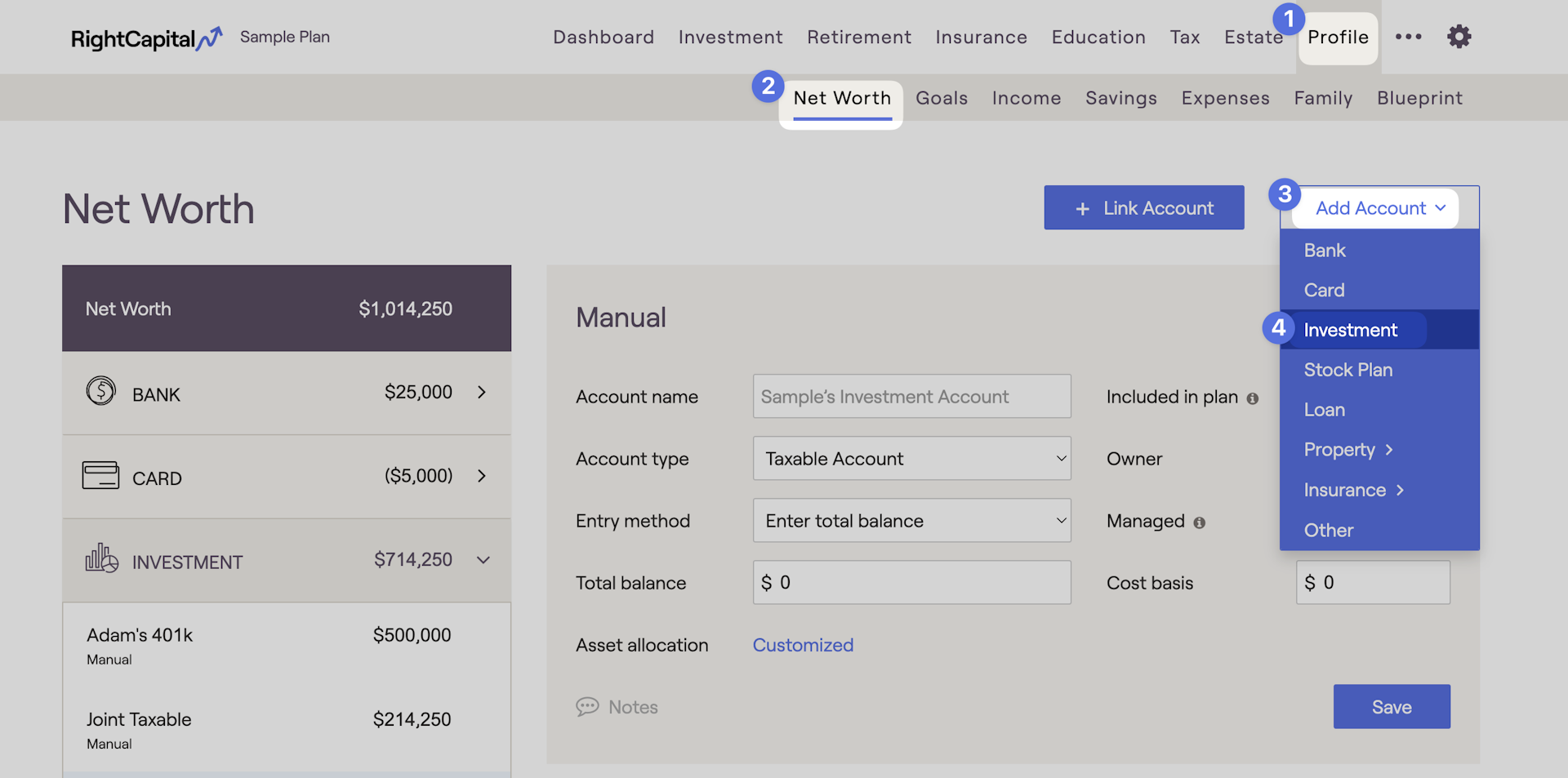

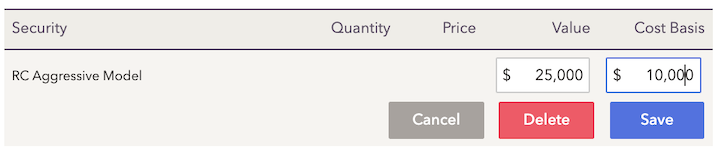

For clients currently invested in your strategy, allocate their investments to that strategy by adding a manual investment account and assigning the value to that asset class:

Investment Mapping

Funds that are mapped will not be mapped to any custom asset classes - they will only be mapped to the default asset classes. This includes tickers entered directly, accounts linked via integration or account aggregation, or model portfolios linked from Nitrogen.