Explore Debt Management in RightCapital

Debt Overview

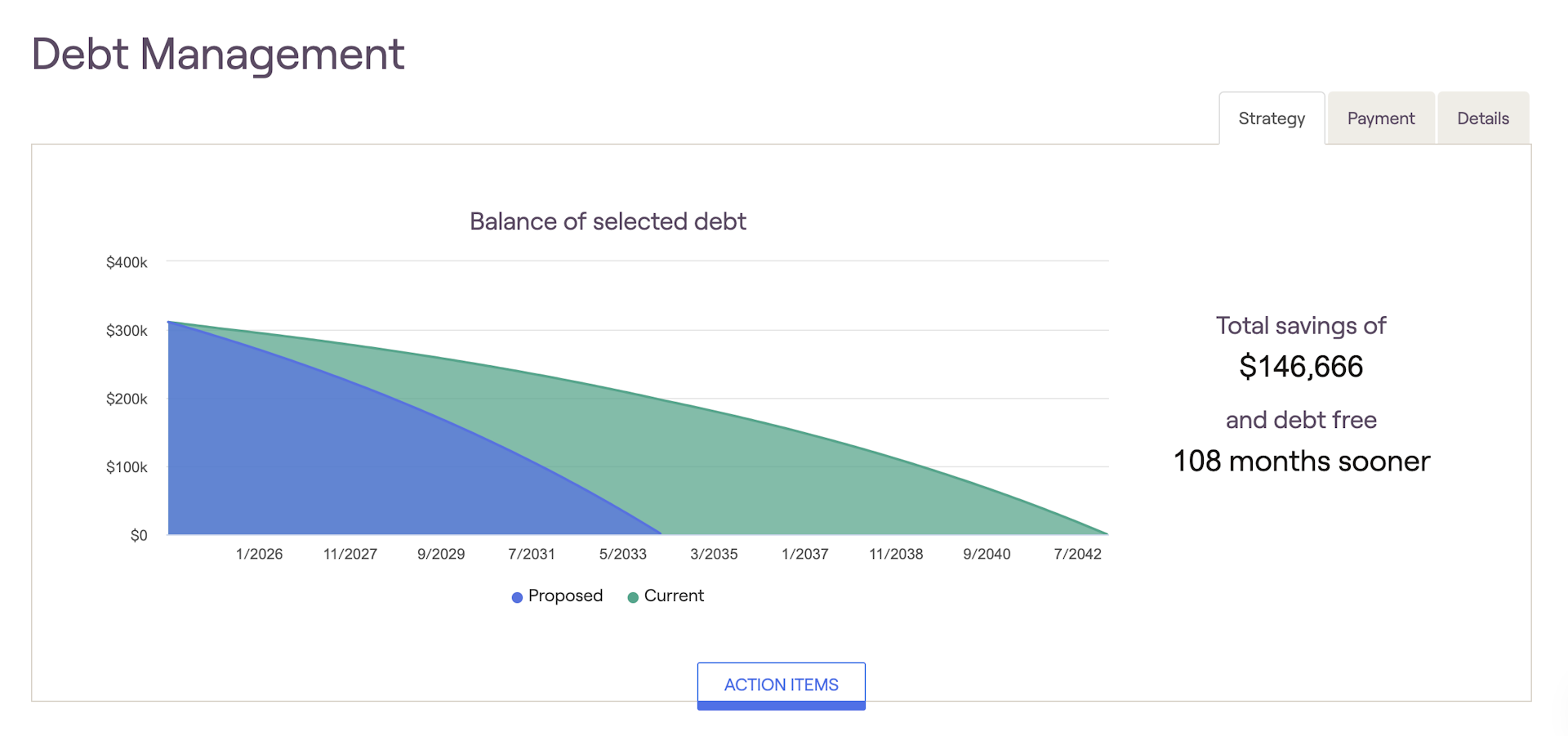

RightCapital advisors can easily demonstrate the value of eliminating debt in a financial plan using specific debt reduction strategies. Before implementing these strategies advisors can view all the necessary information regarding account balances, minimum payments, and annual percentage rate (APR). This allows the adviser to view all debts in one location and determine the best approach for each client's needs.

Debt management plays a key role in holistic financial planning. Some types of borrowing are necessary and bring value to the client's life with assets that appreciate over time. Other forms of debt are a burden within financial plans since they don't produce additional net worth or income.

Strategy Tab

Debt Reduction Strategies

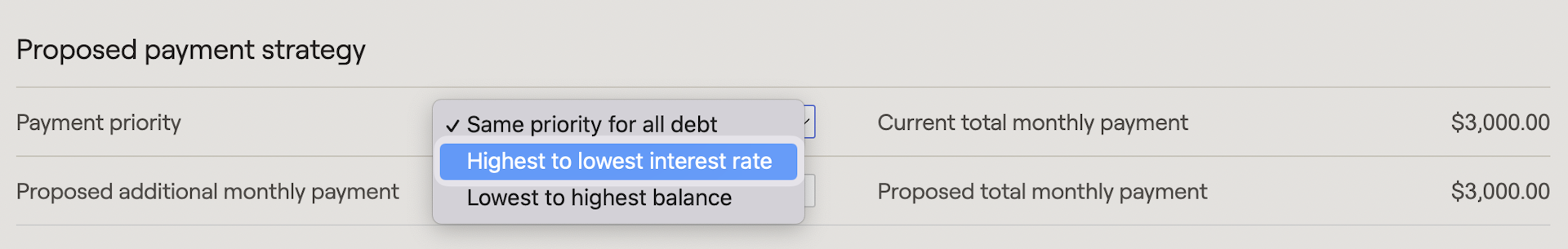

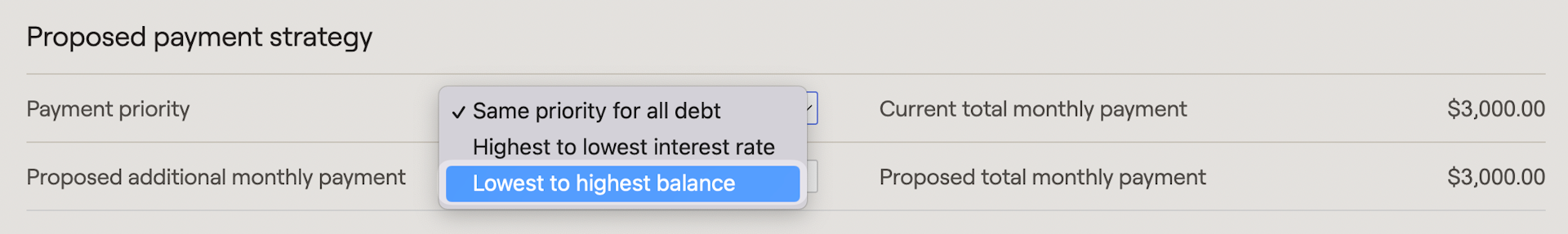

Common debt reduction methods prioritize debt payments using a "snowball" or "avalanche" technique which can be modeled in the Debt Management tool. In each strategy, the minimum payments are met but the total monthly debt payments do not decrease as the debt is paid off. Instead, as each liability is eliminated, the previous payment gets rolled into the next prioritized debt. RightCapital allows users to choose from the following strategies:

Prioritizing debt payments from the highest to the lowest interest rate is known as the "debt avalanche" strategy. This saves money on interest payments by quickly paying down the principal balance on high-interest debt. This method reduces the interest accruing on debts which can heavily impact total costs.

Prioritizing debt payments from lowest to highest balance is known as the "debt snowball strategy". This strategy allows clients to gain momentum by paying off multiple debts in a short period of time. Although this strategy saves less on interest when compared to the "debt avalanche" method, it can offer encouragement for clients who are overwhelmed with multiple debt payments.

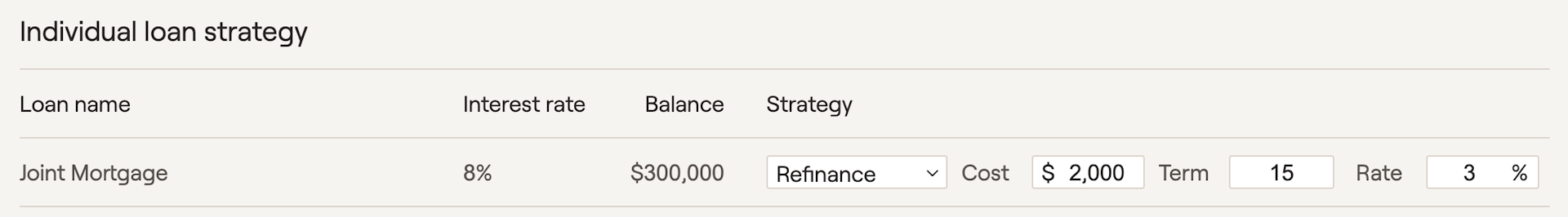

Refinancing

Borrowers can seek to refinance their debt in order to make favorable changes in their credit agreements. In this scenario, the original contract is replaced with new terms that offer updated payment schedules, lower interest rates, and reduced monthly payments. Typically borrowers will refinance mortgages, car loans, or student loans as interest rates fall in response to changing economic conditions.

Adjusted rate mortgages, Interest only mortgages, Home equity lines of credit, and Reverse mortgages are not included in the proposed payment strategies due to the complex calculations involved.

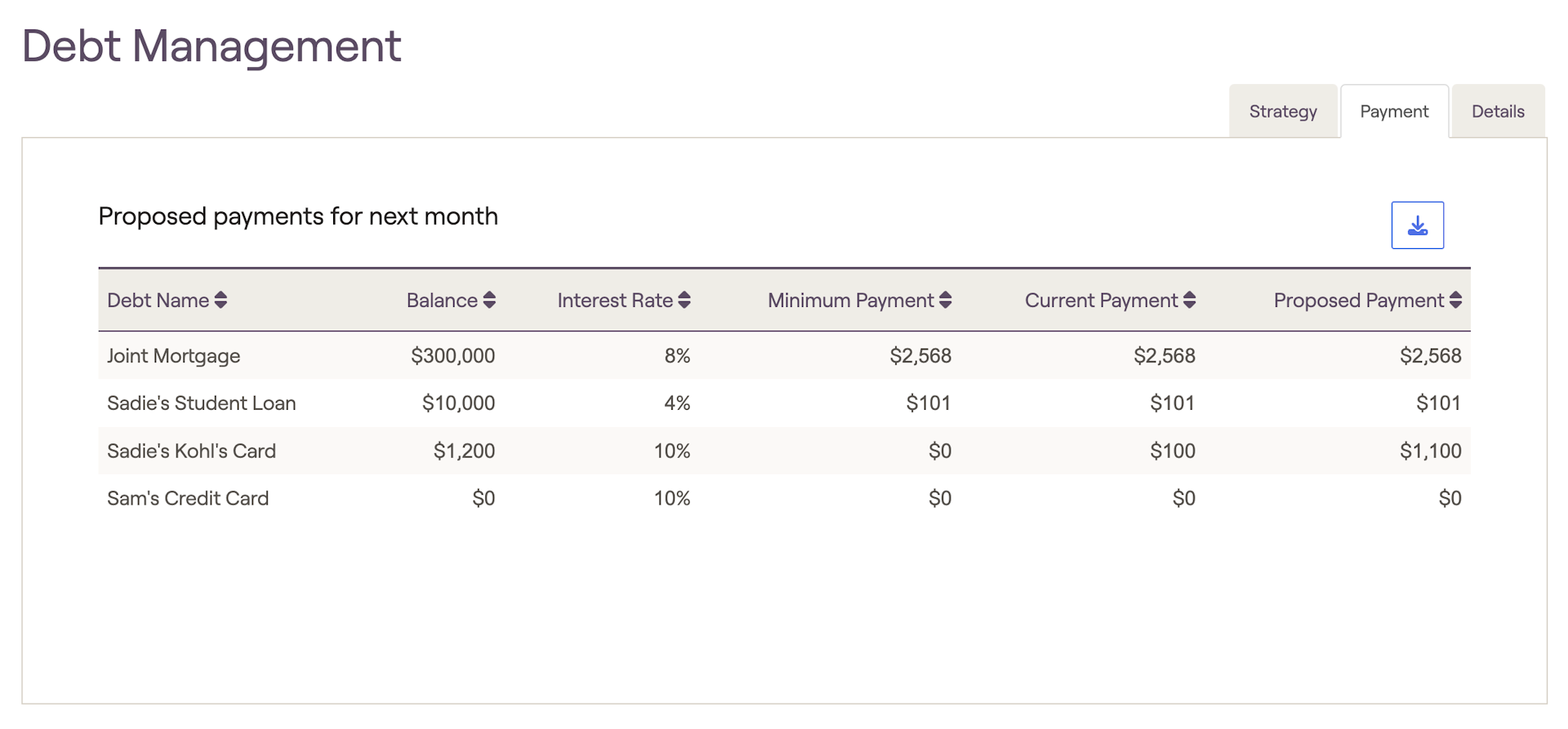

Payment Tab

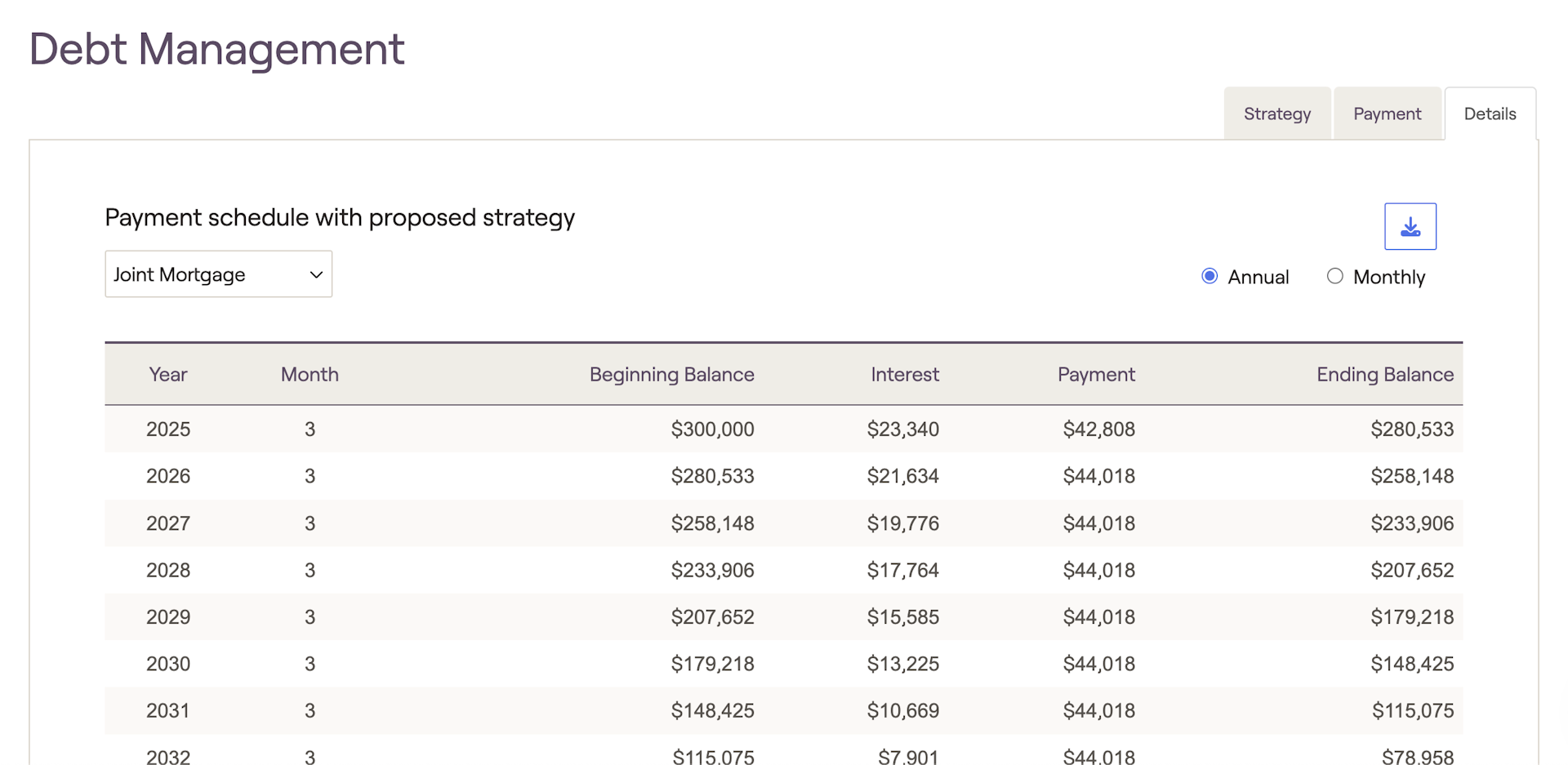

Details Tab

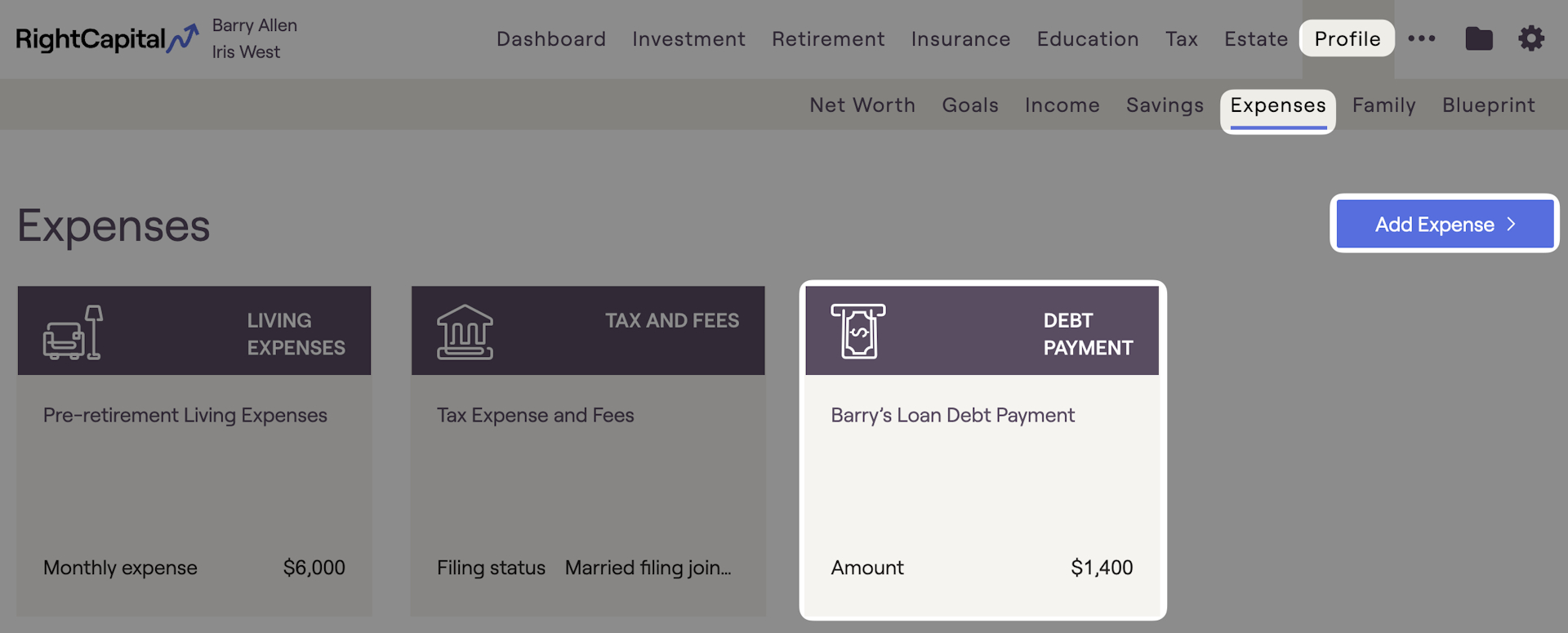

Principle Only Payments in RightCapital

Outside of the Debt Management planning module, advisors can illustrate the benefits of principal-only payments being applied to a client's loan by using the "Extra Debt Payment" expense. Within the Profile > Expenses tab, an 'Extra Debt Payment' card can be added if there is a loan or credit card added to the plan. The one-time or recurring payments will be used to pay down the principal portion of the applicable loan.

Interaction with Student Loans

In addition, no changes to the Student Loan planning module will impact what is reflected on the Debt screen or vice versa.