The Life insurance screen will work differently depending on whether there are two or a single client.

Overview - Joint Life Insurance

The Life Insurance screen illustrates two projections of the surviving client's income and assets in the case that one was to die a year after the current date. It also calculates the amount of insurance that would ensure the surviving client would not run out of income in the Cash Flow projection. The Life Insurance planning module reflects details from the current plan.

The Insurance projection is best used with the Cash Flow and Modified Cash Flow calculation methods (not Goal-based).

The projection includes everything that goes into the retirement projection with the following adjustments:

Any existing insurance that would be paid out is included

Any income, savings, expenses, or goals associated with the deceased are removed

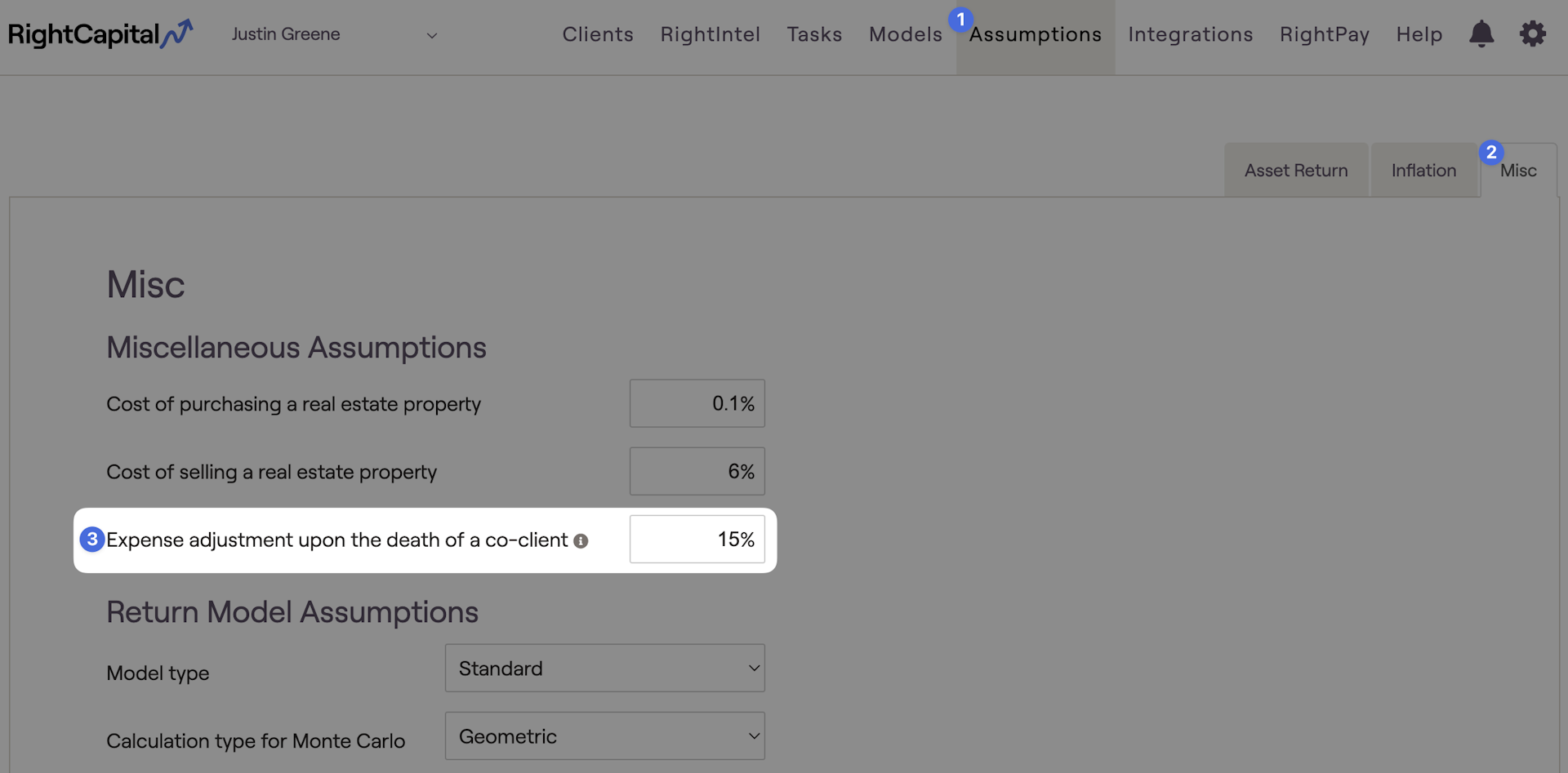

Joint expenses are reduced by 15%

Any insurance amount received will be assumed to be invested with the same proposed asset allocation as their other investment assets.

Summary Tab

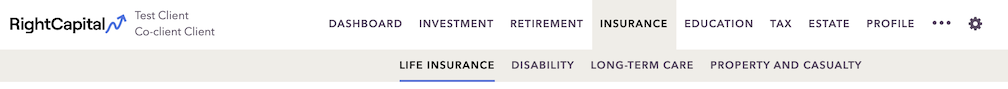

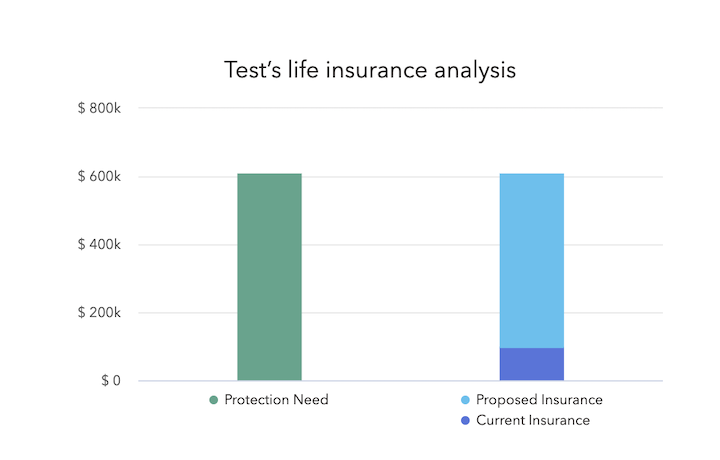

The Summary tab allows you to compare the estimated protection need to current and proposed insurance coverage.

Client / Co-client Tabs

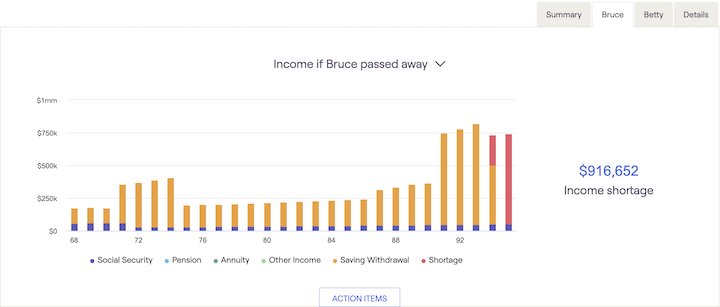

You will also see two tabs on the Insurance screen with the names of the client and co-client. The tab labeled with the client's name illustrates the scenario in which the client passes away in one year and the co-client survives; the tab labeled with the co-client's name illustrates the scenario in which the co-client passes away in one year and the client survives.

The income chart reflects the projected income in retirement for each scenario shown on the Summary tab, broken down by type of income. Any shortage is shown in red, and the total shortage is displayed to the right of the chart. If the total of the client's current and proposed insurance exceeds the insurance need, you will see no income shortage. This projection includes any proposed additional insurance indicated in the Action Items section.

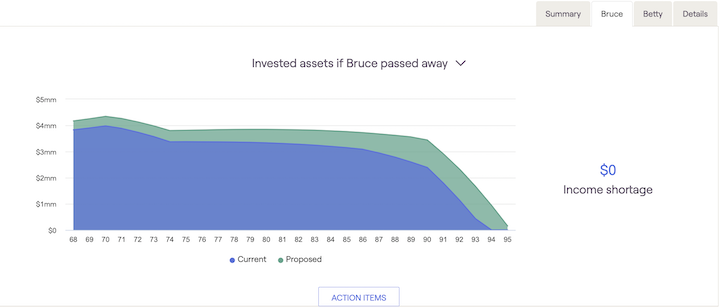

You can also use the drop-down box to display a chart showing the surviving client's projected invested assets through retirement. The chart displayed in green shows the projection before including any proposed additional insurance; the chart in blue shows the projection including the proposed additional insurance.

Only the chart from the Income tab will be included in the PDF report.

Action Items

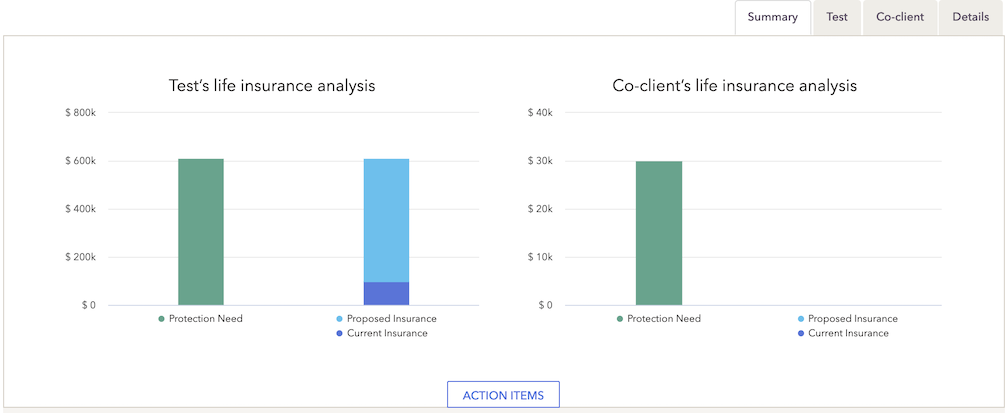

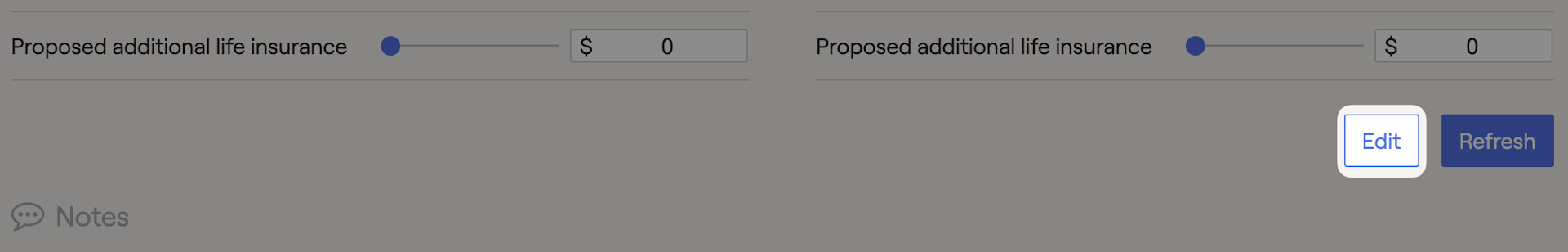

You can also use the Action Items section to illustrate the impact of changes to plan inputs on the insurance need. You can do so by clicking the 'Edit' button at the bottom right-hand corner of the Action Items section.

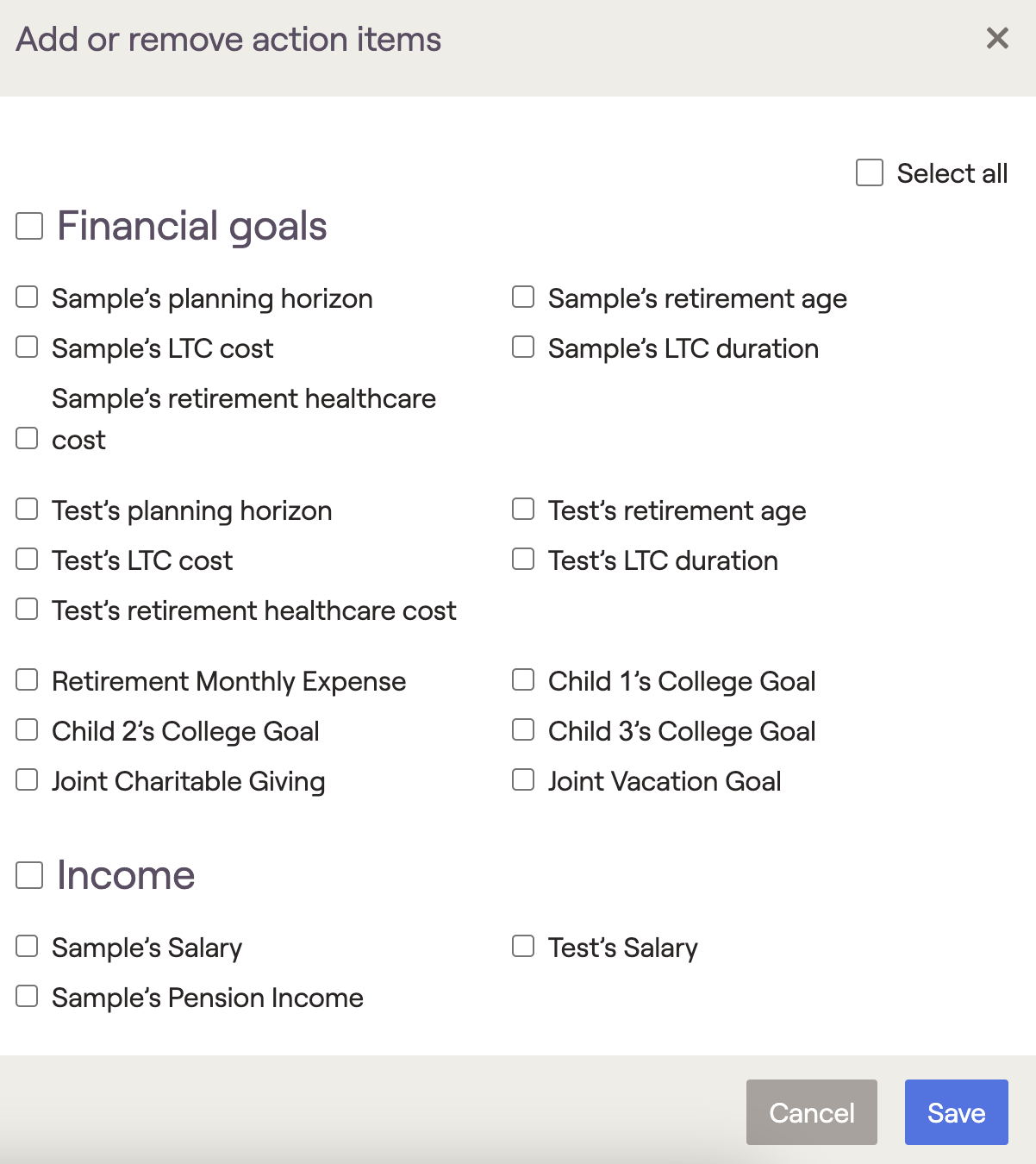

When you click on the 'Edit' button, you will see a screen illustrating various goals, income, expenses, savings, and strategies you can change to see the impact on the insurance projection. These mirror the options under the Retirement Analysis action items.

You can check off the boxes in front of any action items you wish to include in the action items section, or you can check the “Select all” checkbook on the top-right-hand side if you wish to have all the action items included in your action items list. Make sure to click Save to return to the action items screen to make any changes.

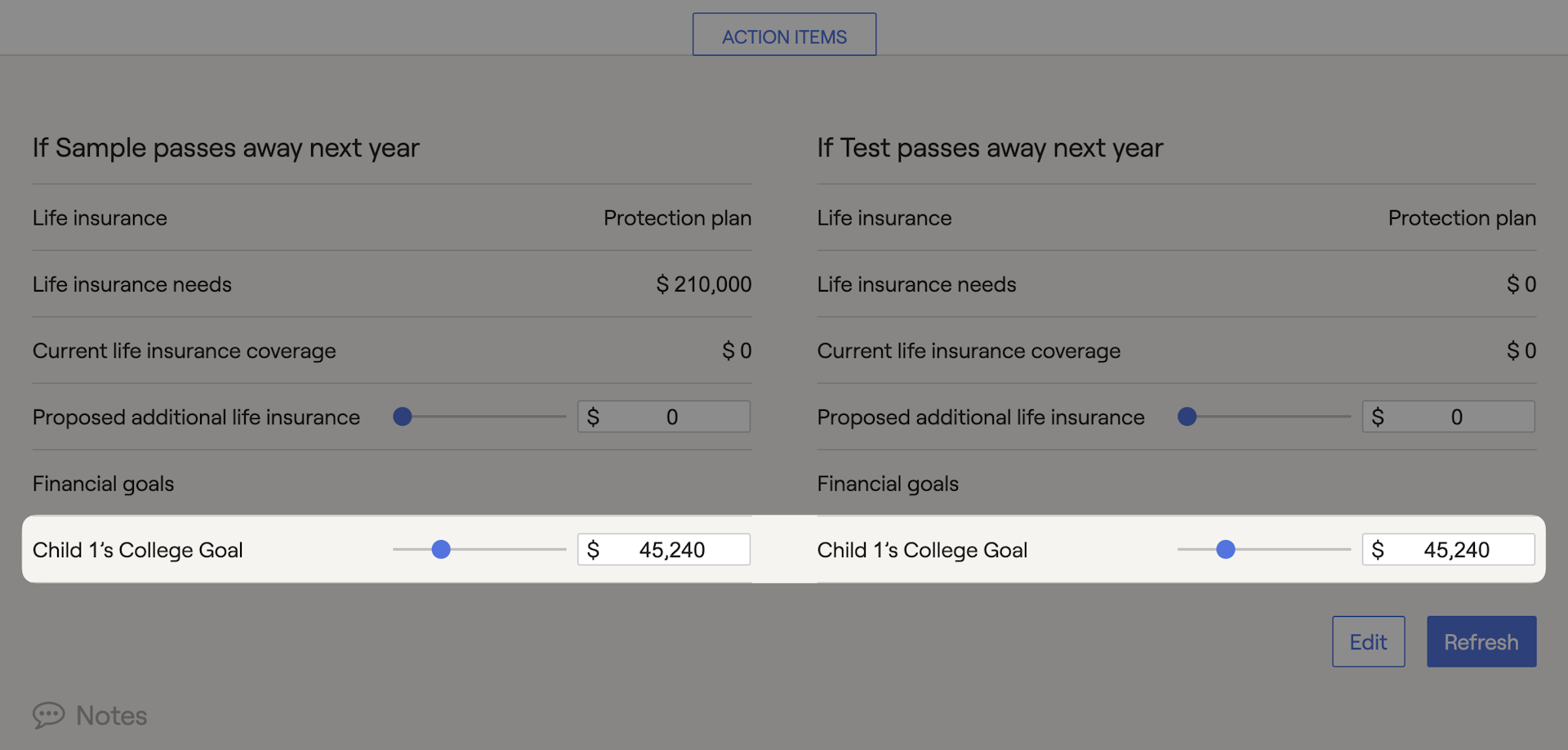

For example, if you want to illustrate that a surviving spouse would no longer pay for a child's college in the event of premature death, you can select the child's college goal and once you click 'Save', you will be able to adjust the college goal in either scenario to see the impact:

Note: Changes made under the Life Insurance action items only impact the insurance projection. They do not impact the current or proposed plans in the Retirement Analysis section or any other screen within RightCapital.

Details tab

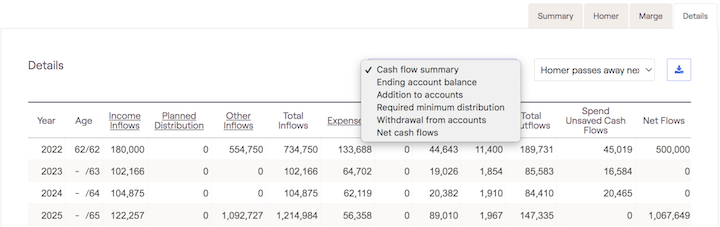

The details tab illustrates the cash flow details associated with the projections shown on the Summary and income tabs.

The details tab functions in the same manner as the Retirement Cash Flows. You can use the drop-down box in the upper-right-hand corner to switch between the projection showing the client passing away and the co-client passing away. You can switch between the projections showing the client and co-client passing away, indicated by the dash in the age column. There are several available sections in the details area, including; Cash flow summary, Ending account balance, Addition to accounts, Required Minimum Distribution, Withdrawal from accounts, and Net cash flows.

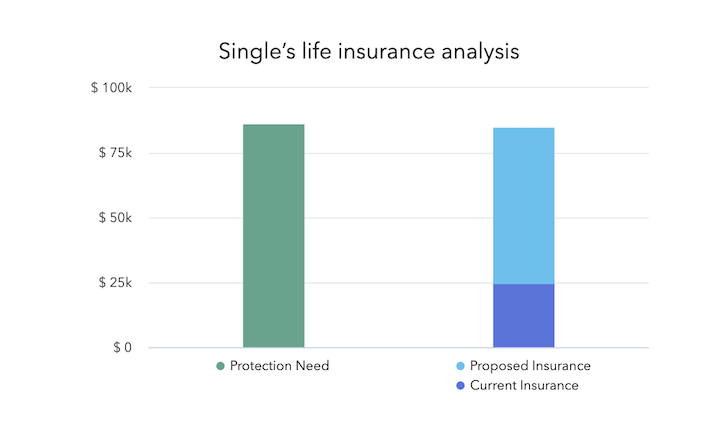

Single Life Insurance

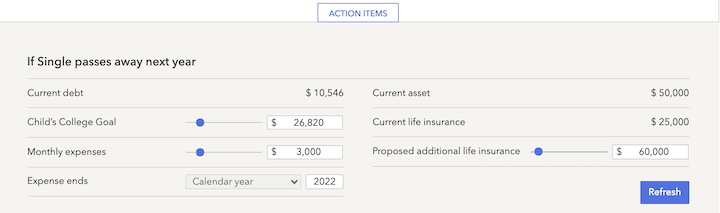

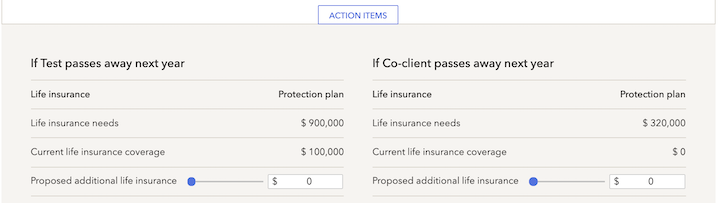

If there is only one client, since there is no surviving client, we will calculate a protection need based on specific goals and/or expenses.

The protection need will factor in any college goals, plus a monthly expense number you can indicate for a specific amount and timing. It will also factor in how their current assets can meet those needs. This will then be compared to their current and proposed insurance amounts.