The client's Dashboard provides excellent overviews of important areas of financial viability, and this article dives into the client's liquidity. The liquidity tool allows a client to set up an emergency fund to cover expenses in the case of loss or hardship.

This tool powerfully visualizes the importance of reserving cash funds in case of unforeseen setbacks, emergency situations, or spontaneous spending opportunities.

Include a thoughtful conversation around liquidity in a client meeting to continue to elevate both your insight and your genuine care for the client's best interest.

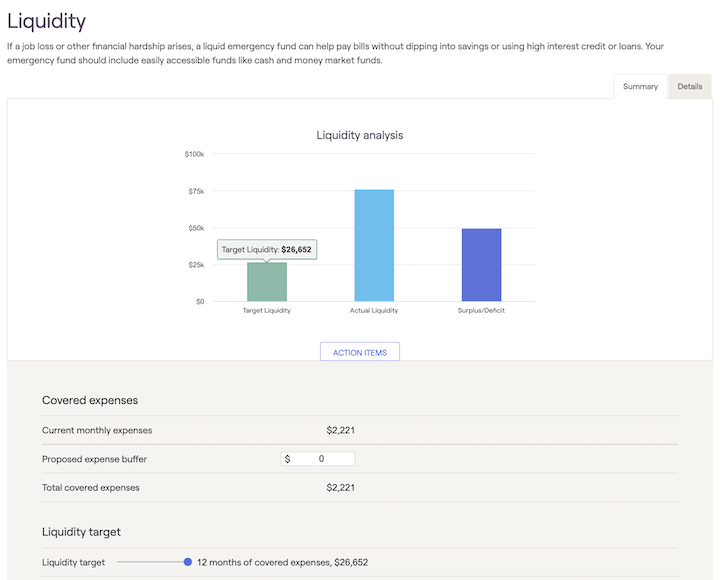

The Liquidity screen displays a target value for the client's emergency fund, their liquid assets, and the surplus or deficit between the two.

Determining Expenses

This calculation will exclude any goals and credit card payments listed in the profile tab. Retirement living expenses are also excluded from the client's target liquidity calculation.

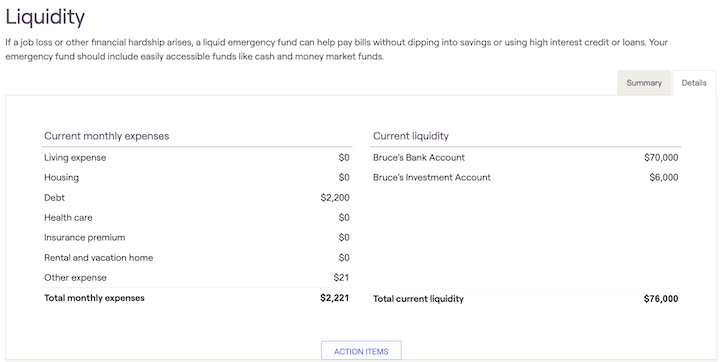

Determining Liquid Assets

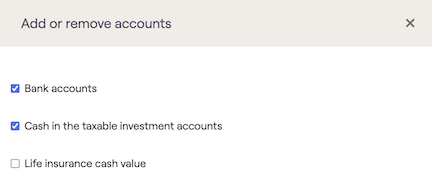

The Actual Liquidity can be customized to reflect the value of all accounts set up as "Bank" accounts on the Net Worth screen, the value of cash "asset class allocations" for taxable investment accounts, and the cash value associated with life insurance policies. To customize how RightCapital calculates the available liquid assets, click the edit button at the bottom of the action items.

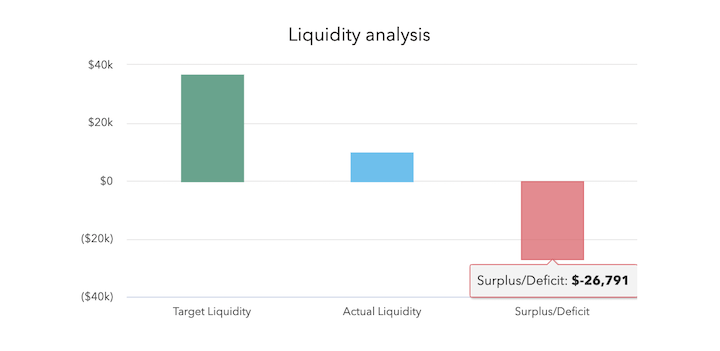

The Surplus/Deficit bar will drop below the positive axis and show a negative amount if there is insufficient liquidity to match the target liquidity.

Mouse over the bars in the chart to see the actual values for each of the bars